US stocks rally to new highs with rate cuts: Weekly Market Recap

By Gerald Wong, CFA • 21 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

US stocks reached record highs following Fed interest rate cuts

I woke up on Thursday to the news that the Fed had cut rates for the first time since December.

Rate cuts always have wide implications for the markets.

We’ve already seen fixed deposit and savings account rates come down in recent months, and the upcoming T-bill yield is likely to stay low too.

Against this backdrop, I have been exploring where income opportunities can still be found in a lower-rate environment.

As our webinar this week on the LionGlobal Short Duration Bond Fund (Active ETF SGD class), I shared that beyond headline yields, it’s also important to look at price volatility when looking at income assets.

If you’re looking for something safe that offers a higher return than the T-bill, the latest Singapore Savings Bond (SSB) provides a 10-year average return of 1.93% per annum, with the flexibility to redeem early.

We also explored whether Singapore REITs might be worth a closer look, given that their dividend yields remain above the T-bill yield.

If you missed the webinar earlier, you can still catch my sharing on Singapore’s first active bond ETF here.

As rates move lower, it's worth considering a mix of passive income options to build an income portfolio that's both resilient and rewarding.

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

🏛 Fed cuts interest rates

What happened?

The US Federal Reserve delivered its first rate cut of 2025, lowering interest rates by 0.25% as widely expected.

Looking ahead, the Fed signalled another 0.50% of cuts by year-end, in response to signs of weakness in the job market.

The Fed also projects more rate cuts through 2026 and 2027.

What does this mean?

The Fed’s decision to lower borrowing costs came against the backdrop of a softer labour market.

In their post-meeting statement, officials noted that “job gains have slowed” and that “downside risks to employment have risen.”

Why should I care?

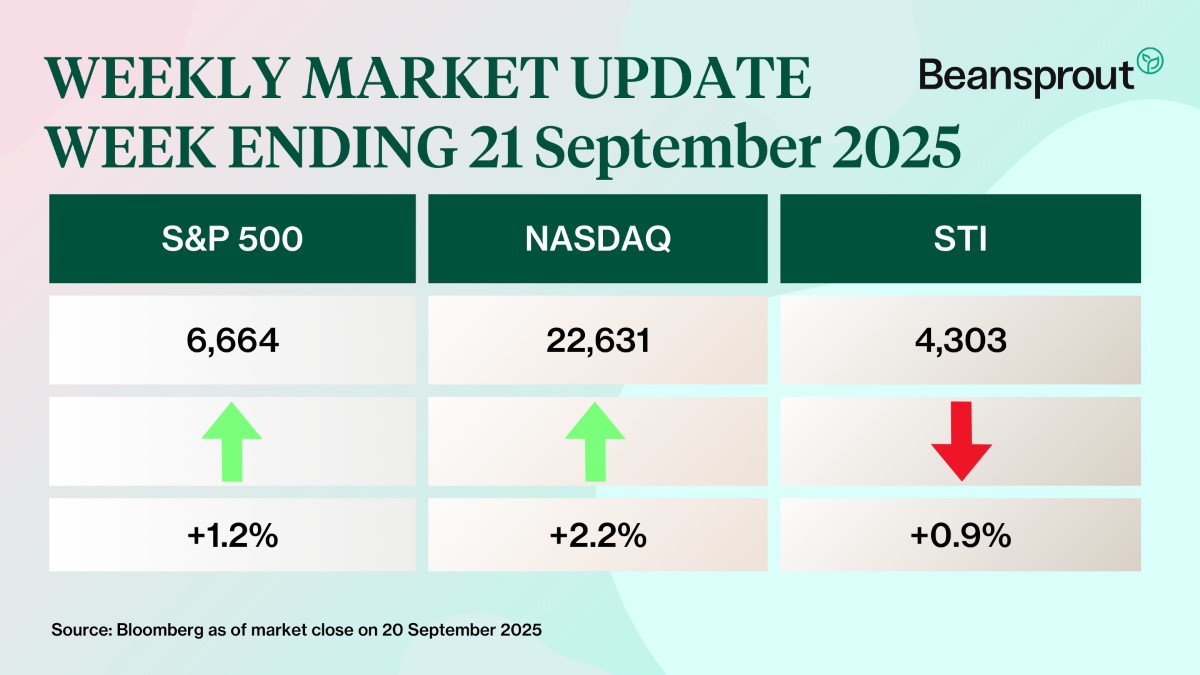

Major US indices climbed to fresh record highs, buoyed by improved sentiment at the back of the rate cut.

In Hong Kong, the Hang Seng Tech Index reached its highest level in nearly four years, lifted by growing optimism over China’s AI boom.

Back home, Singapore’s Straits Times Index (STI Index) pulled back after strong gains the week before.

🚗 Moving This Week

- Hongkong Land will sell its Singapore and Malaysian property arm MCL Land to Malaysia’s Sunway Group in a S$738.7 million cash deal. The transaction is Sunway’s largest deal to date, lifting the conglomerate’s Singapore investment to more than S$1.2 billion since July. Read more here.

- SGX will be launching an index that tracks listed companies that are not constituents of the Straits Times Index (STI), as part of efforts to showcase its broader equity market. STI, the benchmark index for Singapore’s stock market, is made up of the 30 largest companies by market capitalisation. Read more here.

- Seatrium announced that its appeal in the Singapore court to block a US$126.6 million standby letter of credit payment related to a rig contract with a customer has been dismissed. It added that provisions had already been made in its accounts for the full amount payable under the letter of credit. Read more here.

- Cybersecurity company AvePoint listed on the mainboard of the SGX on 19 September, becoming the first B2B SaaS stock to be listed on the SGX. Learn more about AvePoint here.

- Singapore REITs rebounded strongly in the third quarter to date, with the iEdge S-Reit index delivering total returns of 10.3 per cent since end-June, amid ongoing expectations for US interest-rate cuts. Learn more about Singapore REITs here.

- Nvidia agreed to invest US$5 billion in Intel and said the two will co-develop chips for PCs and data centres. Intel will use Nvidia’s graphics technology in upcoming PC chips and also provide its processors for data centre products built around Nvidia hardware.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

Interest rates are falling. Can Singapore REITs offer higher dividend yields?

Lower interest rates have sparked a rally in Singapore REITs. We explore if REITs can offer higher dividend yields compared to T-bills.

🤓 What we're looking out for next week

- Thursday, 25 September 2025: Singapore 6-month T-Bill Auction, US Final GDP data, Singapore Savings Bond application closing date

- Friday, 26 September 2025: US Core PCE Data

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments