Stocks rally to record highs: Weekly Market Recap

By Gerald Wong, CFA • 27 Jul 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

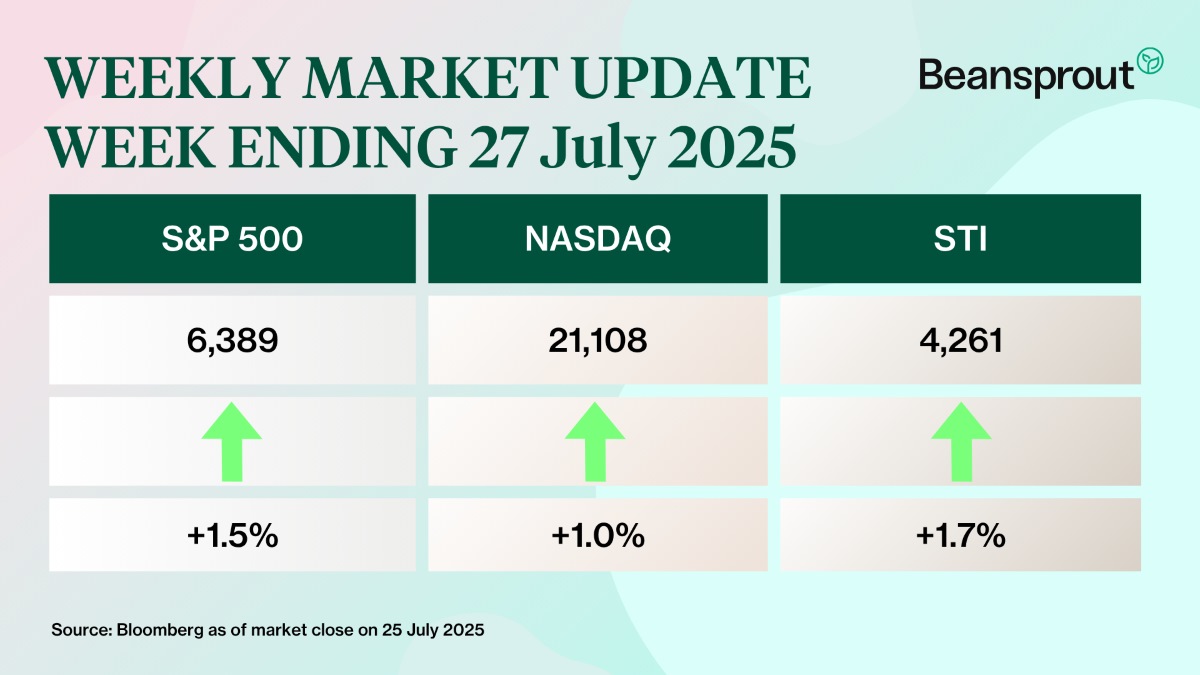

US and Singapore stocks reached new record highs, while the T-bill yield declined

What does a comfortable retirement really mean?

It’s a question that often comes up in our conversations with readers, and one I’ve been thinking more about myself lately.

Whether you’re nearing the official retirement age or aiming to achieve financial independence earlier, the idea of a “comfortable retirement” is becoming more top of mind for many in Singapore.

For most of us, savings is where it starts. But in today’s environment of persistent inflation and economic uncertainty, savings alone may not be enough.

That’s why we’ve often shared how building multiple income streams can help us prepare more confidently for the future.

This week, the 1-year T-bill yield fell to just 1.68%. With short-term interest rates coming down, the upcoming 6-month T-bill auction is likely to see continued pressure on yields too.

In comparison, the latest Singapore Savings Bond (SSB) offers a 10-year average return of 2.29%, potentially more attractive for those looking to lock in longer-term returns while keeping flexibility.

Beyond bonds, the Singapore stock market remains a valuable source of passive income. This week, the Straits Times Index (STI) reached a fresh all-time high, boosted by news that MAS has appointed the first batch of fund managers to deploy S$1.1 billion under the Equity Market Development Program (EQDP).

We dive deeper into why the Singapore stock market may deserve a closer look, especially for income-focused investors.

At the same time, it’s worth reflecting on what “retirement” means to each of us. For some, it’s about financial security. For others, it’s about freedom on your own terms.

Whichever version resonates with you, the good news is that there are more options than ever to help you get there.

Gerald, Founder of Beansprout

⏰ This Week In Markets

🚀 Stocks rally on increased optimism

What happened?

The U.S. finalised new trade agreements with Japan, Indonesia, and the Philippines this week, helping to ease concerns about global trade tensions.

Investor sentiment was further buoyed by reports of progress in U.S.–EU negotiations, ahead of the 1 August deadline for potential 30% tariffs.

What does this mean?

Strong earnings further lifted global stock markets.

In the U.S., Google’s parent Alphabet reported solid results, with a sharp increase in capital spending on AI initiatives, highlighting its commitment to driving long-term growth in artificial intelligence.

Back home, DFI Retail Group reported a 38.9% year-on-year increase in profit for the first half of 2025 and announced a special dividend, adding to the upbeat sentiment in Singapore’s stock market.

Why should I care?

The S&P 500 and Nasdaq notched their second straight week of gains, buoyed by strong earnings and improving sentiment.

In Singapore, the Straits Times Index (STI) also continued its rally, helped by renewed investor interest after MAS announced the appointment of the first batch of fund managers to deploy S$1.1 billion under its Equity Market Development Program (EQDP).

🚗 Moving This Week

- Mapletree Logistics Trust (MLT) reported a distribution per unit (DPU) of S$0.01812 for the first quarter ended June, a decline of 12.4 per cent from the previous year. MLT attributed the lower distribution to weaker regional currencies, divestment of 12 properties and absence of divestment gains. Read more here.

- Mapletree Pan Asia Commercial Trust (MPACT) has announced the sale of two Japan office buildings to two unrelated third parties for a total consideration of about JPY8.73 billion ($78.7 million). This represents a 1.7% premium against the aggregate purchase price of JPY8.58 billion. Read more here.

- Keppel DC REIT reported distribution per unit (DPU) of S$0.05133 for its first half of the financial year ended Jun 30, a 12.8% increase from S$0.04549 in the same year-ago period. This was attributed mainly to contributions from the acquisition of data centre buildings Keppel DC Singapore 7 and 8, Tokyo Data Centre 1, and contract renewals and escalations. Read more here.

- Digital Core REIT (DCREIT) declared distribution per unit of 1.80 US cents for 1H 2025, unchanged from 1H 2024. DCREIT reported distributable income of US$23.37 million in 1H 2025, a 3.5% increase compared to 1H 2024. Read more here.

- OUE REIT reported distribution per unit of 0.98 cents for 1H 2025, 5.4% higher year-on-year. This was due improvement in performance of its Singapore office assets, as well as lower financing costs. Read more here.

- Frasers Centrepoint Trust (FCT) reported a committed occupancy of 99.9% for its retail portfolio in the third quarter ended 30 June 2025, an increase from 99.5% in the previous quarter. The manager expects government support measures, such as Community Development Council and SG60 vouchers, to boost retail spending. Read more here.

- DFI Retail Group’s underlying profit rose 38.9 per cent to US$105 million for the first half ended Jun 30, from US$75.6 million in the same period the year before. The company announced a special dividend of US$0.443 per share. This is on top of an interim dividend of US$0.035 per share, unchanged from the previous year. Read more here.

- SingPost has divested its entire freight forwarding business, Famous Holdings, for about S$177.9 million. The sale resulted in an estimated realised gain on disposal of S$10.5 million and about S$104 million in cash for the company. Read more here.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

SSB 10-year return at 2.29%. Better than fixed deposits and T-bills?

The current issuance of the Singapore Savings Bond (SSB) offers a 10-year average return of 2.29% per year. We compare this to fixed deposits and T-bills to find out if it's worth applying for the SSB.

🤓 What we're looking out for next week

Earnings Announcements

- Monday, 28 July: SIA, Mapletree Industrial Trust, Lippo Malls Indonesia Retail Trust, Great Eastern, Raffles Medical earnings

- Tuesday, 29 July: Starhill Global REIT, Keppel Pacific Oak US REIT, First REIT, ESR REIT, CapitaLand Ascott Trust earnings

- Wednesday, 30 July: Mapletree Pan Asia Commercial Trust, Keppel REIT, Far East Hospitality Trust, CDL Hospitality Trust, CapitaLand India Trust, CapitaLand China Trust

- Thursday 31 July: Seatrium, Netlink Trust, Keppel, Frasers Logistics & Commercial Trust, Elite UK REIT, AIMS APAC REIT earnings

- Friday, 1 August: OCBC Bank earnings

Key US Dates

- Wednesday, 30 July: FOMC Interest Rate Decision and Press Conference, Microsoft, Meta earnings

- Thursday, 31 July: Apple, Amazon earnings

Dividend Dates

- Monday, 28 July: SIA Engineering ex-dividend

- Wednesday, 30 July: Digital Core REIT, Mapletree Logistics Trust, OUE REIT, Sabana REIT, SATS, SingPost ex-dividend

- Thursday, 31 July: Singtel, Suntec REIT ex-dividend

- Friday, 1 August: Keppel DC REIT ex-dividend

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Join the Beansprout Telegram group and Facebook group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments