3 Top-Performing Singapore Blue-Chip REITs in 2025. Are their dividends still attractive?

REITs

By Gerald Wong, CFA • 28 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We look at the top 3 Singapore Blue-Chip REITs with the best year-to-date performance in 2025 and find out if their dividend yields are still attractive.

What happened?

The Singapore REIT sector has rebounded this year.

With interest rates easing in 2025, we have seen some of the REITs reporting higher dividends once again.

Over the course of the year, we have been sharing Singapore REITs with dividend yields of above 5%.

As the year comes to a close, we reviewed the wider S-REIT market to find out which are the top performing Singapore blue chip REITs by year-to-date performance.

In this article, we highlight three well-established names with strong year-to-date price gains, and outperforming the Straits Times Index. We also assess whether their dividend yields are still attractive for income investors.

3 Top-Performing Singapore Blue-Chip REITs in 2025

#1 - Suntec Real Estate Investment Trust (SGX: T82U)

Suntec REIT owns a portfolio of prime commercial and retail properties in Suntec City, Marina Bay, and the Central Business District of Singapore.

It also holds interests in commercial assets in Australia and the United Kingdom.

The REIT’s unit price has increased 23.08% year-to-date to S$1.43 as of 24 December 2025.

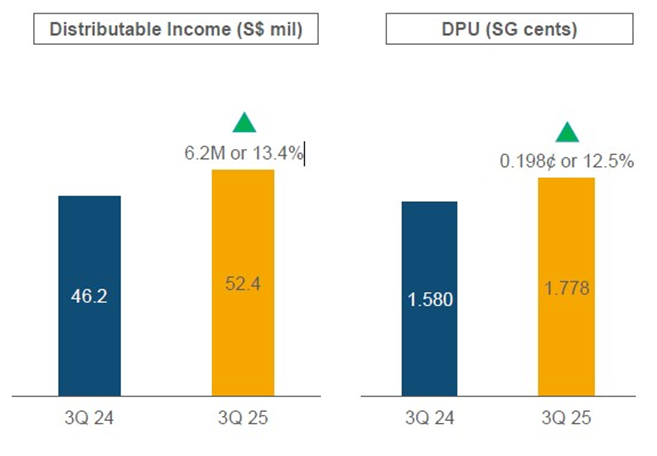

In its 3Q 2025 Business Updates, Suntec REIT reported a significant improvement in distributable income, which rose 13.4% YoY to S$52.4 million.

Consequently, DPU for the quarter climbed 12.5% YoY to 1.778 cents.

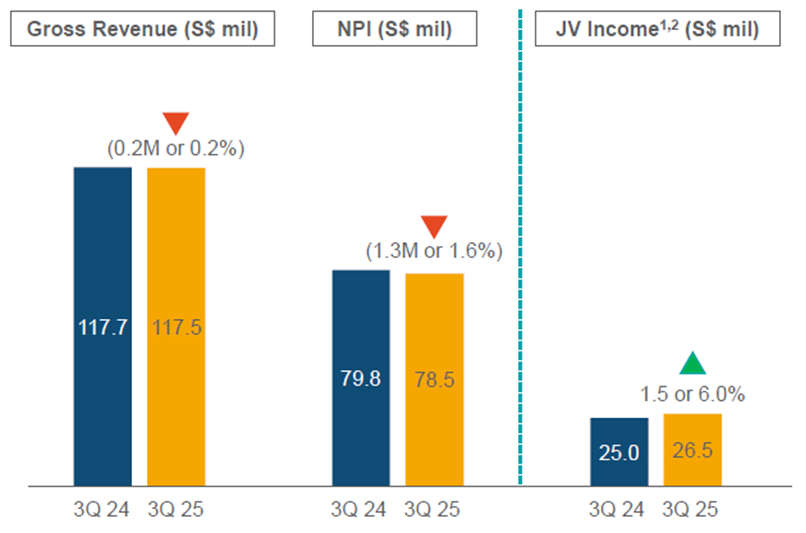

While NPI fell slightly by 1.6% to S$78.5 million due to vacancies in Australia and the UK, the DPU growth was driven by non-operational factors, specifically lower financing costs and a reversal of withholding tax provisions.

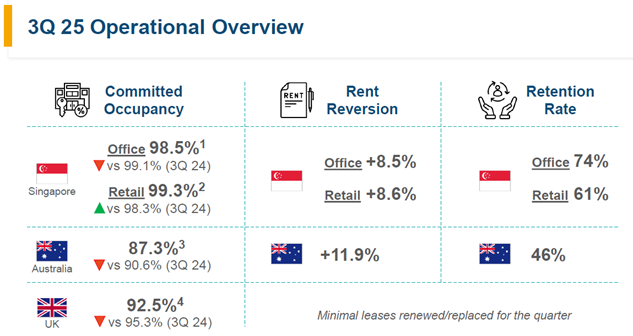

Operational metrics in Singapore remain robust, with the Singapore office portfolio achieving 98.5% occupancy and rent reversion of +8.5%.

Based on the annualised year-to-date DPU of 4.933 cents and unit price of S$1.45 as at 24 December 2025, Suntec REIT offers a forward dividend yield of approximately 4.9%.

Related Links:

- Suntec REIT share price history and share price target

- Suntec REIT dividend history and dividend forecasts

#2 - CapitaLand Integrated Commercial Trust (SGX: C38U)

CapitaLand Integrated Commercial Trust (CICT) is the first and largest REIT listed on the Singapore Exchange.

It holds a diversified portfolio of retail, office, and integrated developments primarily located in Singapore, with a presence in Germany and Australia.

Key assets include Raffles City Singapore, Bugis Junction, and Plaza Singapura.

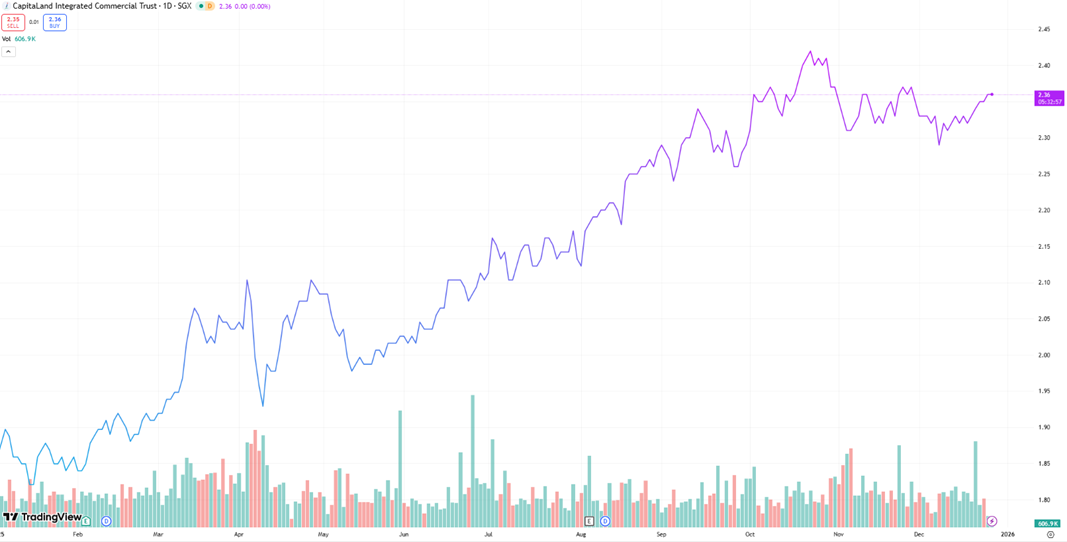

The REIT’s unit price has run up 21.65% year-to-date to S$2.36 as of 24 December 2025.

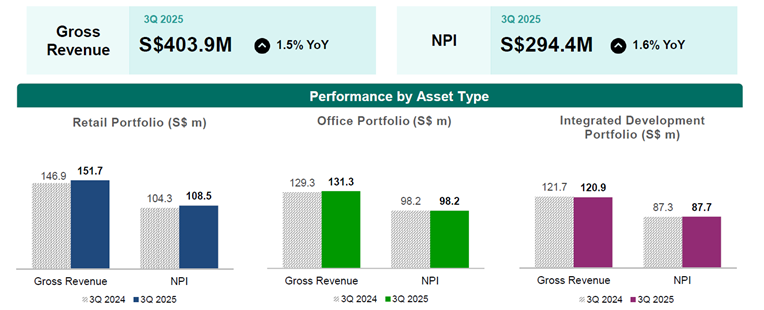

In 3Q 2025, CICT reported a resilient performance.

Gross revenue for the quarter rose 1.5% year-on-year (YoY) to S$403.9 million, while Net Property Income (NPI) increased 1.6% YoY to S$294.4 million.

This growth was supported by the retail segment, where tenant sales surged 19.2% YoY, largely due to the contribution from ION Orchard. Excluding ION Orchard, tenant sales still grew by a healthy 1.0%.

CICT has also completed the acquisition of the 55.0% interest in CapitaSpring office for S$1,045.0 million on 26 Aug 2025.

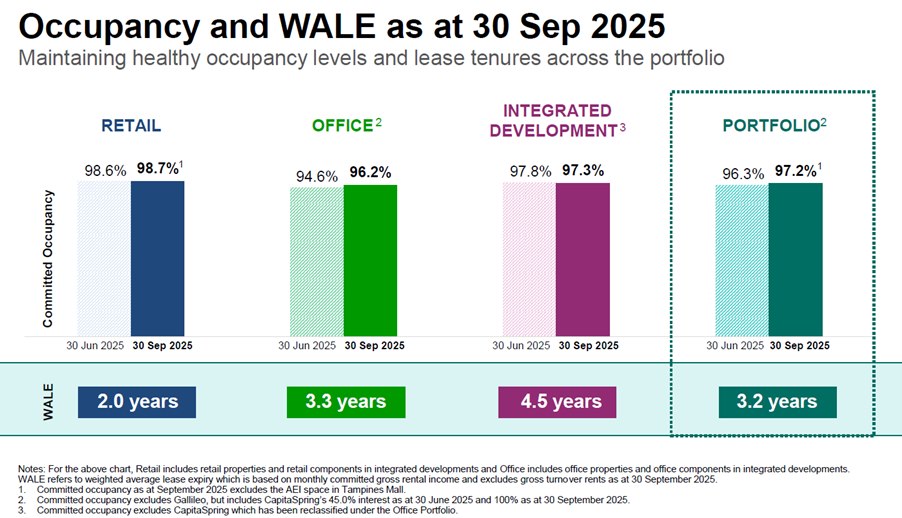

The portfolio’s committed occupancy remained high at 97.2%, with positive rent reversion of 7.8% for retail and 6.5% for office leases year-to-date.

However, aggregate leverage rose slightly to 39.2% as of 30 September 2025.

Based on its 1H 2025 DPU of 5.62 cents and a unit price of S$2.36 (as of 24 December 2025), CICT offers an annualised dividend yield of approximately 4.7%.

Related links:

- CapitaLand Integrated Commercial Trust (SGX: C38U) share price history and share price target

- CapitaLand Integrated Commercial Trust (SGX: C38U) dividend forecast and dividend yield

#3- Mapletree Pan Asia Commercial Trust (SGX: N2IU)

Mapletree Pan Asia Commercial Trust (MPACT) is a flagship commercial REIT with properties across five key gateway markets in Asia: Singapore, Hong Kong, China, Japan, and South Korea.

Its portfolio is anchored by substantial assets like VivoCity and Mapletree Business City in Singapore.

MPACTs unit price has climbed 18.89% year-to-date to S$1.45 as of 24 December 2025, making it one of the best performing blue chip REITs in 2025.

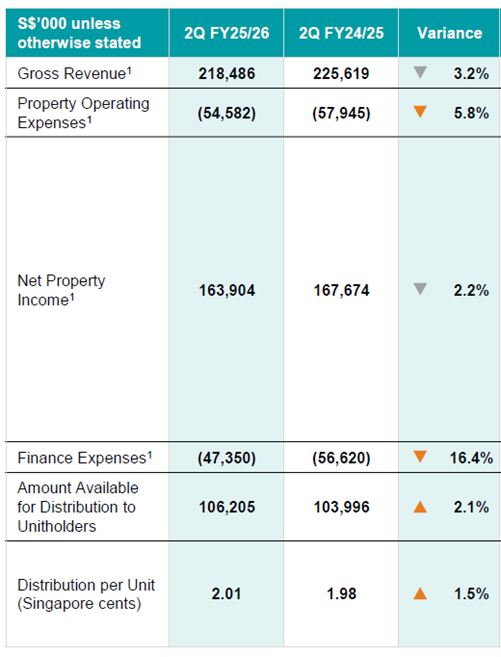

For the second quarter of FY25/26 (ended 30 September 2025), MPACT reported a 3.2% YoY decline in gross revenue to S$218.5 million and a 2.2% dip in NPI to S$163.9 million.

The decline was attributed to the divestment of Mapletree Anson and weaker overseas contributions due to currency headwinds.

Despite the lower topline, Distribution Per Unit (DPU) for the quarter grew 1.5% YoY to 2.01 Singapore cents.

This was achieved through cost savings in property operating expenses and lower finance costs resulting from debt repayment using divestment proceeds.

Singapore remains the stronghold, with VivoCity delivering a 7.7% NPI growth quarter-on-quarter.

MPACT’s annualised dividend yield stands at approximately 5.5%, based on its 1H FY25/26 DPU of 4.02 cents and the unit price of S$1.45 as at 24 December 2025.

Related links:

- Mapletree Pan Asia Commercial Trust (SGX: N2IU) share price history and share price target

- Mapletree Pan Asia Commercial Trust (SGX: N2IU) dividend history and dividend forecasts

What would Beansprout do?

All three REITs had experienced a rebound in 2025, delivering double-digit year-to-date price gains.

This was supported by growth in their distributions per unit, as their net property income (NPI) stabilised and financing costs came down.

Across the 3 REITs, Mapletree Pan Asia Commercial Trust is expected to offer the highest dividend yield of 5.5%.

This is followed by Suntec REIT offers a dividend yield of about 4.9%, while CapitaLand Integrated Commercial Trust is expected to offer a dividend yield of around 4.7%.

Looking ahead into 2026, we expect Singapore REITs are likely to benefit from falling interest rates.

However, we expect the divergence in the performance of Singapore REITs to persist, with returns continuing to depend on factors such as sub-sector exposure, geographical mix, and the extent of debt that has been hedged at fixed rates.

Within the sector, we favour REITs that can sustain and grow distributions through active portfolio management, such as asset enhancements, selective acquisitions, or rental reversion opportunities.

To screen for Singapore REITs with lowest price-to-book valuation or highest dividend yield, check out our best Singapore REIT screener.

You can find out what may drive further potential upside in Singapore stocks here.

If you are new to investing in Singapore REITs, you can start to learn more about Singapore REITs here.

If you prefer diversification without picking individual REITs, you can also gain exposure through Singapore REIT ETFs.

Lastly, you can also check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in REITs.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments