Citigold Singapore Review: Is Citigold priority banking worth it?

Private Wealth

By Beansprout • 05 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Discover if Citigold Priority Banking in Singapore is worth it. Explore its benefits, requirements, fees, and exclusive perks to see if it fits your wealth goals.

What happened?

If you're seeking a personalised and premium banking experience, Citigold is an option to consider.

Citigold is Citi's premium banking service for high-net-worth individuals.

It requires a minimum Assets Under Management (AUM) balance of S$250K to enjoy benefits like up to 7.51% p.a. interest on savings, dedicated client advisor, global wealth services, preferential rates and exclusive tools.

Let’s explore what Citigold has to offer and how it could support your long-term financial goals.

What is Citigold?

Citigold is Citi's premium banking service aimed at high-net-worth clients looking to grow their wealth more actively.

With a minimum AUM of S$250K required to qualify, Citigold offers a suite of personalised services and exclusive rates to help accelerate your financial plans.

Here are some highlights of being a Citigold client:

- Earn up to 7.51% p.a. interest on Citi Wealth First Account

- Dedicated client advisor and team of wealth experts

- Preferential rates on loans, deposits and investments

- Wealth management tools like Citigold Total Wealth Advisor

- Enjoy zero foreign currency conversion fees with Citibank Global Wallet when you pay with your Citigold Debit Mastercard for overseas and online spends

- Enjoy 6-month commission-free buy trades online for U.S. and Hong Kong markets when you open a new Citibank Brokerage account. T&Cs apply.

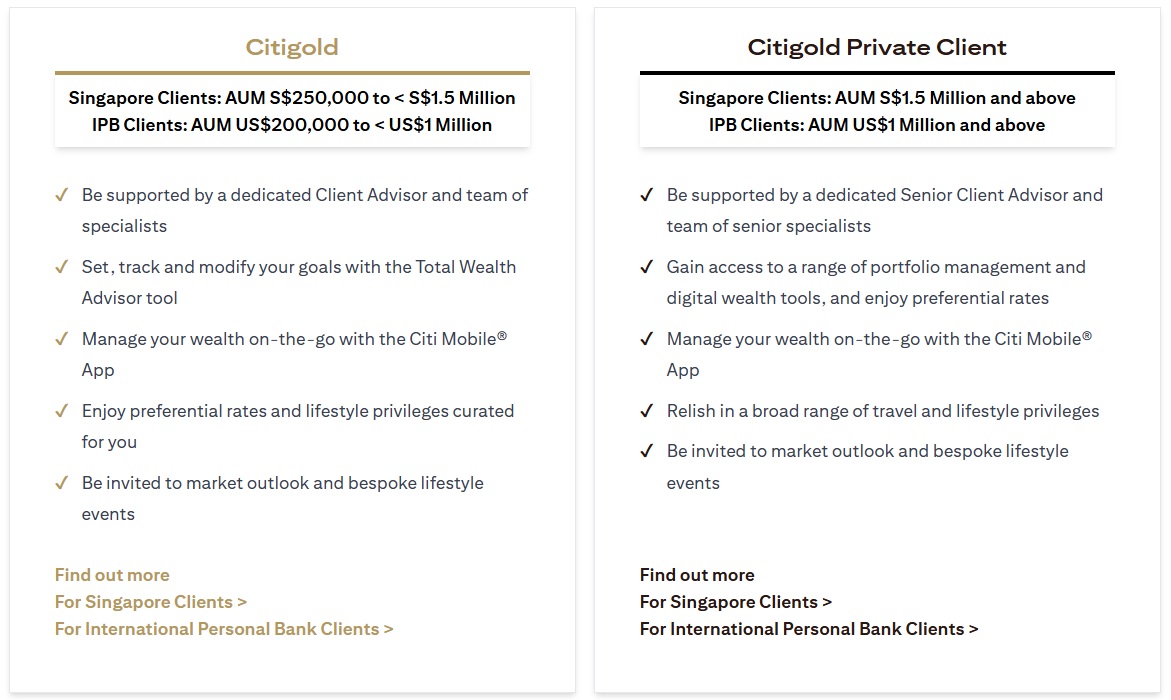

What is the difference between Citigold and Citigold Private Client?

Citigold focuses on growing your wealth holistically through wealth advice by a dedicated Client Advisor, preferential rates, and global services.

While Citigold is tailored for clients with over S$250K in investible assets, Citigold Private Client is tailored for clients with at least S$1.5 million in investible or liquid assets.

In addition to what Citigold clients can enjoy, Citigold Private Client customers enjoy a dedicated Senior Client Advisor who is supported by a team of highly experienced wealth experts as well as luxury lifestyle benefits such as complimentary airport lounge access, hotel privileges and exclusive dining benefits.

Citigold and Citigold Private Client Differences

What are some key benefits of Citigold?

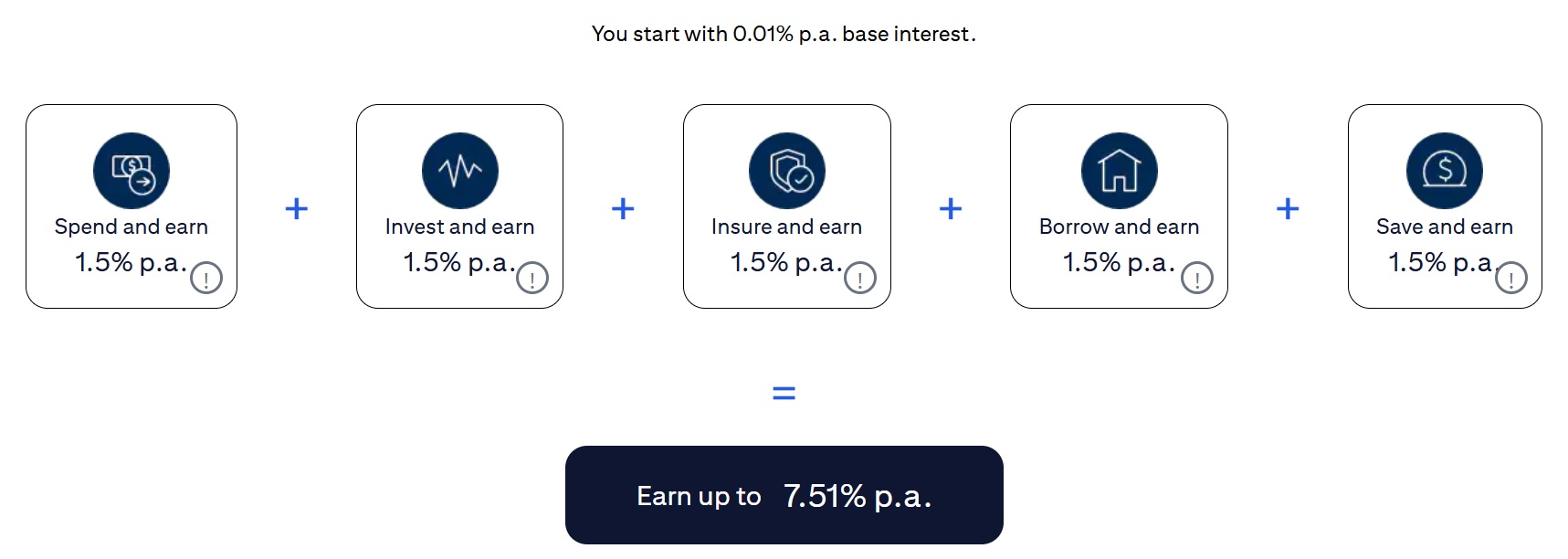

#1 – Get up to 7.51% p.a. of interest with Citi Wealth First account

Citigold clients get access to Citi's Wealth First Account, which allows you to earn an attractive 7.51% p.a interest rate by meeting criteria in categories like monthly spend, investments and loans.

This is one of the highest savings interest rates available.

| Criteria | Interest Earned |

| 1.5% p.a. |

| 1.5% p.a. |

| 1.5% p.a. |

| 1.5% p.a. |

| 1.5% p.a. |

| Source: Citigold Website as of 5 December 2025 | |

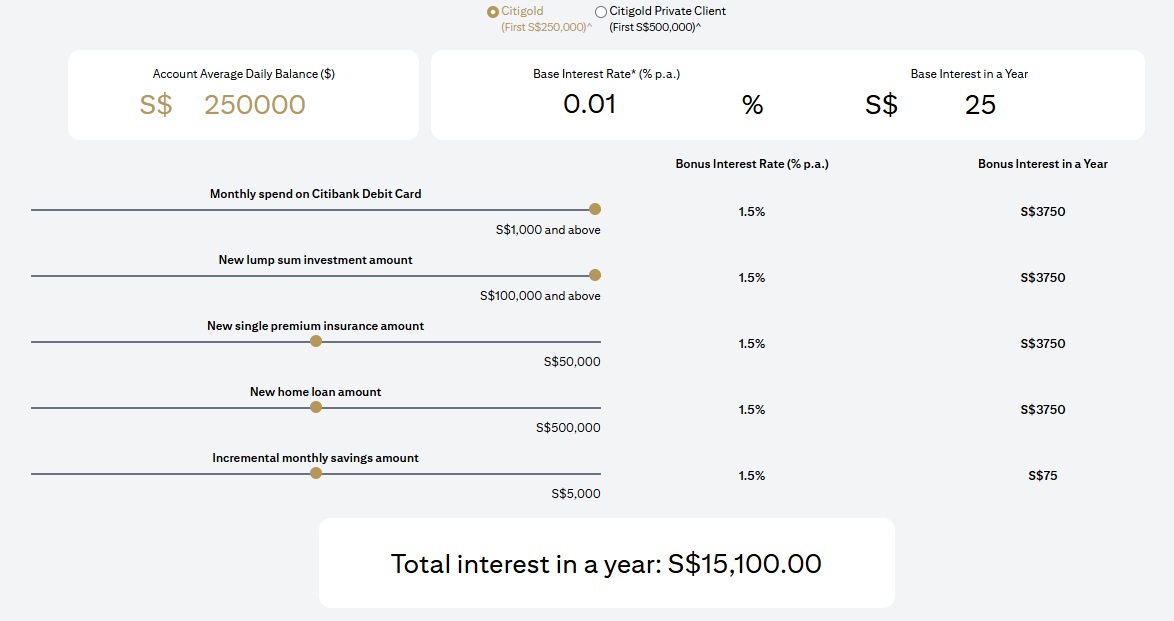

For example, having S$250K average balance in your account, with a monthly spend of S$1K, S$100K lump sum investment amount, S$50K single premium insurance, S$500K home loan and S$5K incremental monthly savings amount would get you S$15,100 annual interest from the account.

#2 – Personalised wealth planning backed by Citi’s expert team

Citigold provides clients an entire team of experts for advice to grow your wealth, unlike regular banking.

Your personal team includes a Client Advisor, Investment Counsellor, Mortgage Specialist, Insurance Specialist and Treasury Specialist.

You also get access to insights and opportunities from over 350+ Citi research analysts globally.

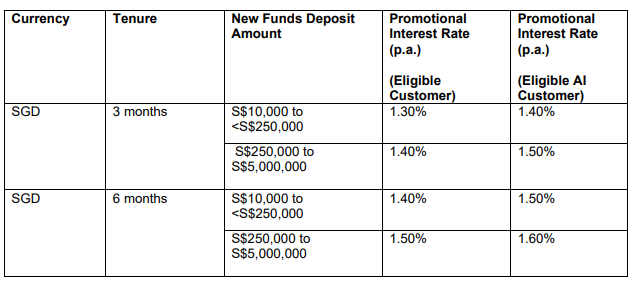

#3 – Enjoy preferential rates as a Citigold client

Citigold grants access to exclusive products not available to regular customers.

This includes bespoke investments, preferential home loan rates, market-leading deposit rates, commission-free US/HK trades and annual fee waivers on credit cards.

Existing Citigold clients can enjoy a promotional fixed deposit rate of up to 1.40% per annum and 1.50% per annum on their respective 3-month and 6-month SGD Time Deposit for new funds. T&C apply.

Additionally, under the SGD Time Deposit Investment Bundle Promotion, existing Citigold clients can receive up to 2.50% p.a. rates for 2-months with a minimum placement of S$50K if they also invest in eligible Citi distributed investment products. T&C apply.

Find out more about the latest Citigold’s exclusive time deposits promotions here.

For the promotional time deposit mentioned above, you would need to apply through a Relationship Manager as they are not available through Citibank Online or the Citi Mobile App.

Do note that Citibank’s interest rates and promotional offers may change and can vary monthly.

#4 – Access to bespoke wealth management tools

Citigold clients get access to a suite of exclusive wealth management tools to simplify managing their finances.

The key tool offered is the Citigold Total Wealth Advisor, a goal-based wealth advisory tool which helps you plan, monitor and manage your portfolio in one place.

After setting your wealth goals with your client advisor, you can also review your portfolio against the Citigold Diversification Index and Citi’s Model Portfolios and make adjustments to stay on course.

In addition, Citigold clients also get privileged access to Citi's extensive global research and analytics capabilities.

#5 – Exclusive in-person wealth consultations at Citi Wealth Hub and Wealth Centres

For those of us who prefer face-to-face financial advisory, Citigold and Citigold Private Client customers can visit the Citi Wealth Hub at 268 Orchard Road, or the Citi Wealth Centres at One Holland Village and Parkway Parade, for a more personalised and holistic wealth management experience with private pods, expert support and curated events.

#6 – Enjoy world-class experiences and exclusive lifestyle privileges

Citigold Debit Mastercard holders can enjoy complimentary access to Global Blue Airport Fast Lanes and Global Blue City VIP Lounges, among other lifestyle perks.

For 2025, Citibank clients had the chance to win a 4-day, 3-night all-inclusive trip to Munich with Category 1 match tickets to attend the UEFA Champions League Final, complete with luxury accommodations, curated dining experiences and a guided city tour of Munich.

Find out more lifestyle privileges that you can enjoy as a Citigold client here.

What are some potential drawbacks of being a Citigold client?

#1 – Complex bonus criteria & conditional rewards

Achieving the full bonus interest of up to 7.51% p.a. requires multiple actions like salary credit, investment, insurance, borrowing, etc. which makes the program more complex to maximize.

Citigold’s bonus interest is tiered with each action earning an extra ~1.5% p.a., so stacking multiple actions is essential.

Even for New-to-Bank (NTB) welcome gifts, you must meet many conditions within a tight timeframe, such as depositing fresh funds, investing, insuring, and applying for home loan.

#2 – Stringent status maintenance criteria

While Citigold offers attractive benefits and global privileges, maintaining the tier requires a substantial minimum Asset Under Management (AUM) of S$250K, which may be a barrier for emerging affluent clients.

Additionally, clients need to actively invest or insure a significant portion of their assets to fully qualify for rewards and perks, which might not suit those seeking a more passive banking relationship.

The bank also charges a monthly service fee of S$15 when your Total Relationship Balance (TRB) falls below S$15,000 at the end of each month.

The high thresholds and ongoing requirements can make it challenging for some customers to retain the status.

How to qualify for a Citigold client?

If Citigold resonates with your banking needs after reading the above, here are the eligibility criteria:

- Minimum S$250K in Assets Under Management

- Singaporean / PR / Valid Work Pass Holder

- 18 Years and above

There's no minimum income amount required. As long as you meet the above criteria, you qualify to unlock Citigold’s range of personalised services.

What are the current sign-up rewards with Citigold?

Citibank is currently offering welcome rewards for new Citigold and Citigold Private Client customers.

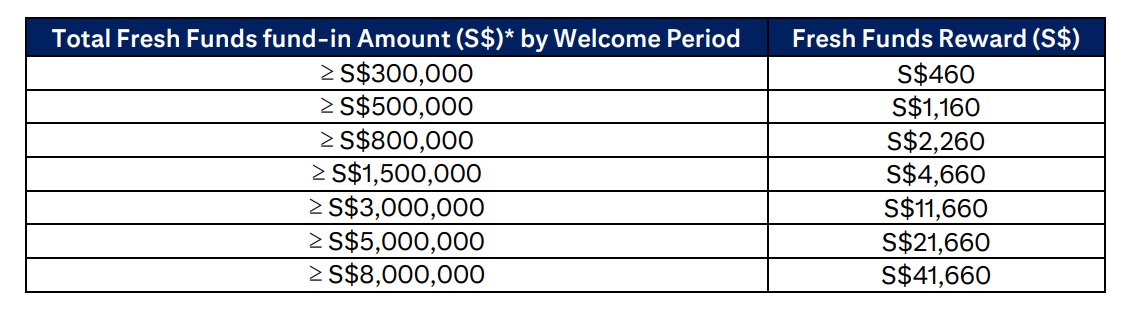

There is a tiered, step-up reward structure, meaning the more fresh funds you bring in, the higher your welcome bonus.

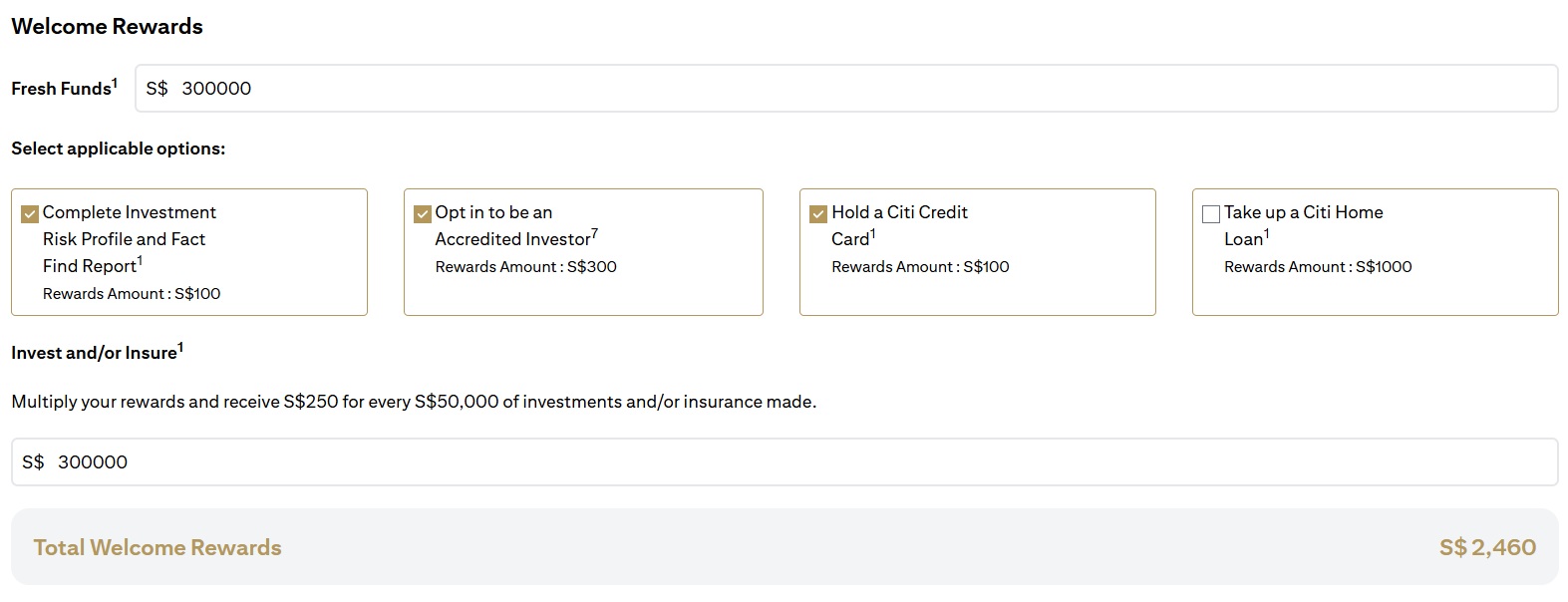

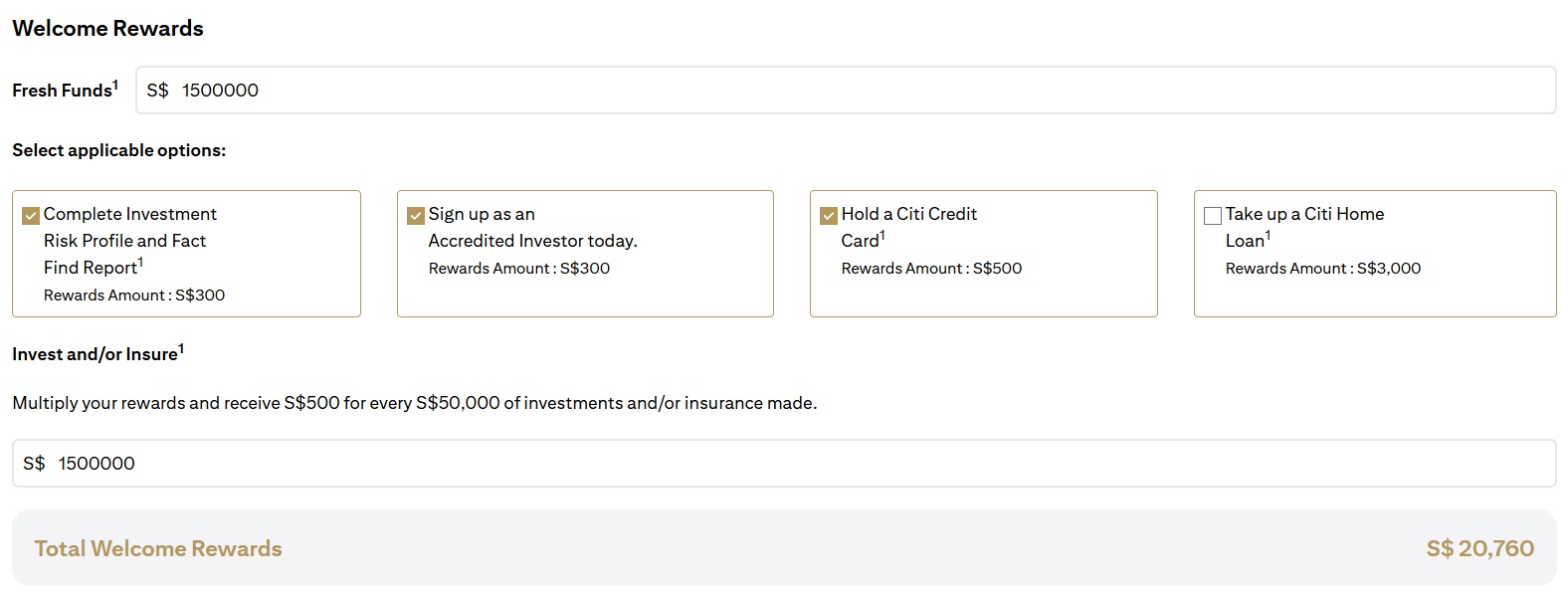

There are also further cash incentives available when you meet additional criteria like completing your Investment Risk Profile and Fact Find Report, investing in S$50,000 increments, holding a Citi credit card, and taking up a home loan.

At the base level with Citigold, you can earn up to S$2,460 in welcome rewards by establishing a relationship with S$300K in fresh funds, completing your risk profile and fact-find report, opting in as an Accredited Investor, investing and/or insuring S$300K, holding an eligible Citi credit card, and maintaining your relationship.

For those with higher capital to deploy and are interested in becoming a Citigold Private Client customer, the rewards can go up to S$20,760 when you deposit S$1.5 million in fresh funds, complete your Investment Risk Profile and Fact Find Report, opt in as an Accredited Investor, hold a Citi credit card, invest and/or insure S$1.5 million, and maintain an eligible Citi relationship.

To make the most of the sign-up rewards, you can read the terms and conditions here.

How does Citigold compare to DBS Treasures and Standard Chartered Priority

In case you’re wondering how does Citigold compares to DBS Treasures and Standard Chartered Priority, I've compiled them in the table below.

| Priority Banking Programme | Citigold | DBS Treasures | Standard Chartered Priority |

| Total Relationship Balance (TRB) | S$250K in AUM | S$350K | S$200K or at least S$1.5 million in mortgage with Standard Chartered |

| Sign-up Rewards |

|

Get additional S$1,000 if you opt in as an Accredited Investor. |

|

| Preferential Fixed Deposit Interest Rate | If you are an existing Citigold client, you can earn:

| N/A | Earn 1.20% p.a. on 6-month SGD fixed deposit (> S$25K) |

| Savings Account Preferential Interest Rate | Earn up to 7.51% p.a. interest on your Citi Wealth First Account by combining base interest with bonus rewards for spending, investing, buying insurance, taking a home loan, and growing your account balance. | N/A | Up to 1.80% p.a. interest with Wealth $aver on your first S$1.5mil deposit balance |

| Additional rewards | S$1,000 cash reward when you successfully apply for and accept an offer for a New Housing Loan of minimum S$800K from Citi. S$100 cash reward when you hold a valid primary/main card of any Citi Credit Card within the period of Enrolment Month till the end of the Welcome Period. | Get up to S$8,000 in digiPortfolio investments for the first Unit Trust trade via DBS Online Funds Investing platform | S$200 cash reward for every S$50K (or equivalent in foreign currencies) investment purchased in Eligible Unit Trust in a single day. Capped at S$6,000. S$200 cash reward for each S$100K in single premium insurance plans or every S$10K in regular premium plans purchased. Each capped at S$3,000

|

| Source: DBS Treasures, Standard Chartered Priority, Citigold, as of 5 December 2025 | |||

What would Beansprout do?

Citigold offers a comprehensive range of services, digital tools and lifestyle benefits to support your financial goals.

Whether you're saving, investing, insuring or taking up a home loan, Citigold provides an integrated platform to manage all your financial needs in one place, with competitive rewards for clients who engage across multiple services.

With a dedicated client advisor, access to market insights, preferential rates and curated lifestyle privileges, Citigold provides a convenient way to manage your wealth more effectively.

However, the S$250,000 minimum balance may be a hurdle for some, and maximising the 7.51% p.a. interest on the Citi Wealth First account requires meeting multiple conditions across spending, investing, and borrowing.

If you are still building up your assets or prefer simpler criteria to earn bonus interest, Standard Chartered Priority may offer a more accessible entry point.

Meanwhile, DBS Treasures could appeal to investors who want stronger investment support, access to exclusive products, and an integrated digital-plus-advisory platform backed by one of Singapore’s largest research and wealth management teams.

If you’re looking to access exclusive investment opportunities in private markets at a lower minimum, you can also check out ADDX.

Thinking about signing up? Visit Citigold website for full details.

You may want to compare other priority banking services to see which best aligns with your financial goals.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

0 questions