With US dollar volatility, is it time to look at SGD-denominated funds?

Mutual Funds

Powered by

By Nicole Ng • 13 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Explore four Fullerton SGD-denominated funds for Singapore-based investors amid US dollar volatility

This post was created in partnership with Fullerton Fund Management.

What happened?

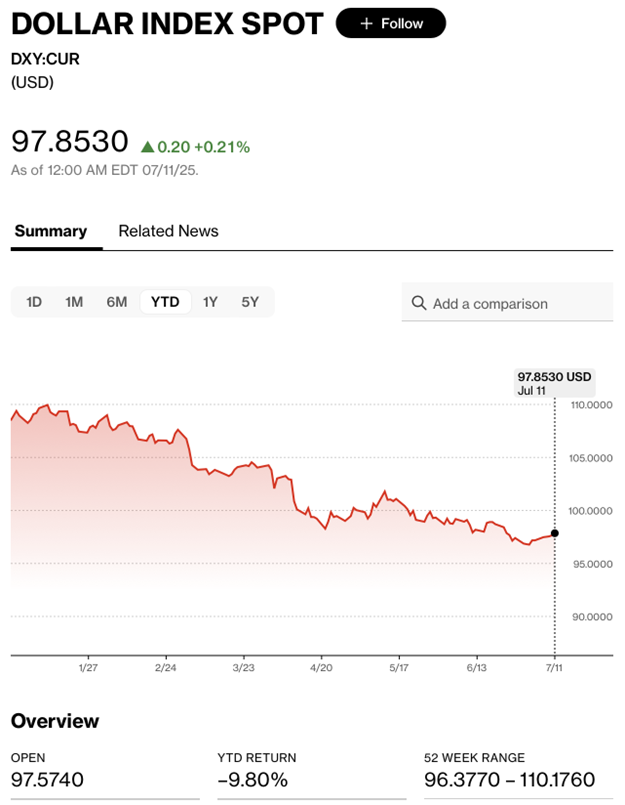

The US dollar has been volatile so far in 2025.

Since Donald Trump began his second term, a series of abrupt policy shifts, ranging from revived trade tariffs to shifting global alliances, has rattled markets.

Confidence in the USD also took a hit.

As of 11 July 2025, the Dollar Index (DXY), which tracks the value of the USD against a basket of major currencies, declined 9.8% year-to-date. This is its steepest fall in the past five years.

With this renewed volatility, I’ve found myself looking for safer, more stable investment options in my spending currency. Naturally, that’s the Singapore Dollar (SGD).

As a Singapore-based investor, it makes sense for me to hold more assets in SGD, especially since most of my expenses, liabilities, and daily transactions are in the same currency.

Add to that the recent decline in yields for short-term instruments like T-bills, SGD-denominated bond funds could be a way to earn passive income with a decent return.

One local fund manager that often comes up is Fullerton Fund Management.

Whether I’m looking for a safer place to park idle cash or seeking potentially higher passive income returns with moderate risk, Fullerton has a SGD-based fund that fits the bill.

Here, I take a closer look at four SGD-denominated funds managed by Fullerton that may suit different goals.

#1 – Fullerton SGD Cash Fund

I’ll start with the fund that often comes up in the Beansprout community: the Fullerton SGD Cash Fund.

This could be an alternative investment option1 for liquidity while earning a return that is potentially comparable to Singapore Dollar Banks Savings Deposit rates.

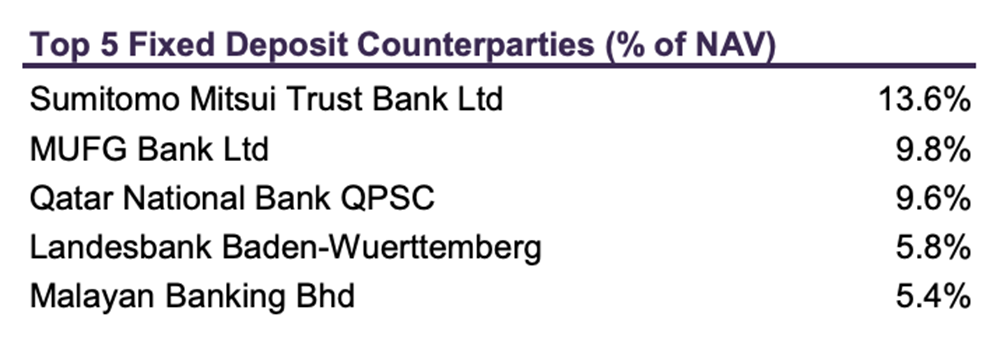

The fund is a money market fund that invests mainly in SGD fixed deposits with reputable local and foreign financial institutions.

1The Fund does not offer any performance or capital guarantee. Investors should note that investments in the Fund may expose investors to risks that are different from pure deposit products. Any investments in the Fund must not at any time be thought of as similar to a deposit in a bank.

As the fund only invests in short-term SGD instruments, there is no foreign currency risk2. However, as this is an investment, the fund is not capital guaranteed.

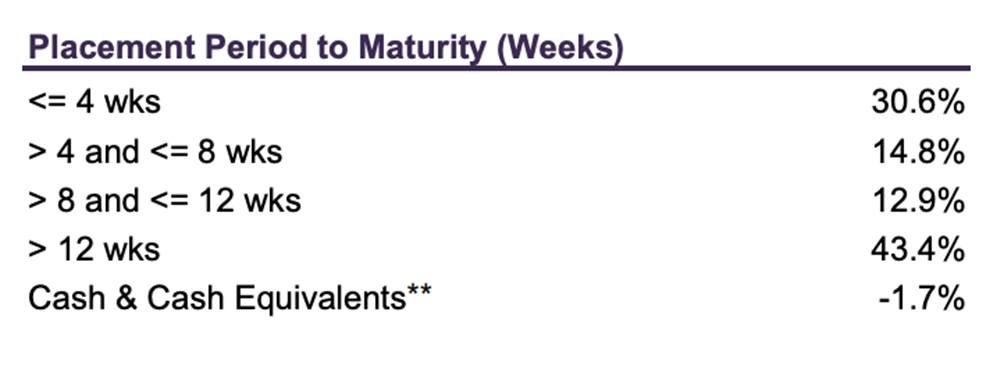

Most of these deposits have very short maturities, typically under three months, so the Fund stays highly liquid.

2Please refer to the Fund's prospectus for the full list of risk disclosures of the Fund.

What’s also appealing is the quick T+1 redemption3 and a low management fee of just 0.16% p.a (for Share Classes A, C, and D).

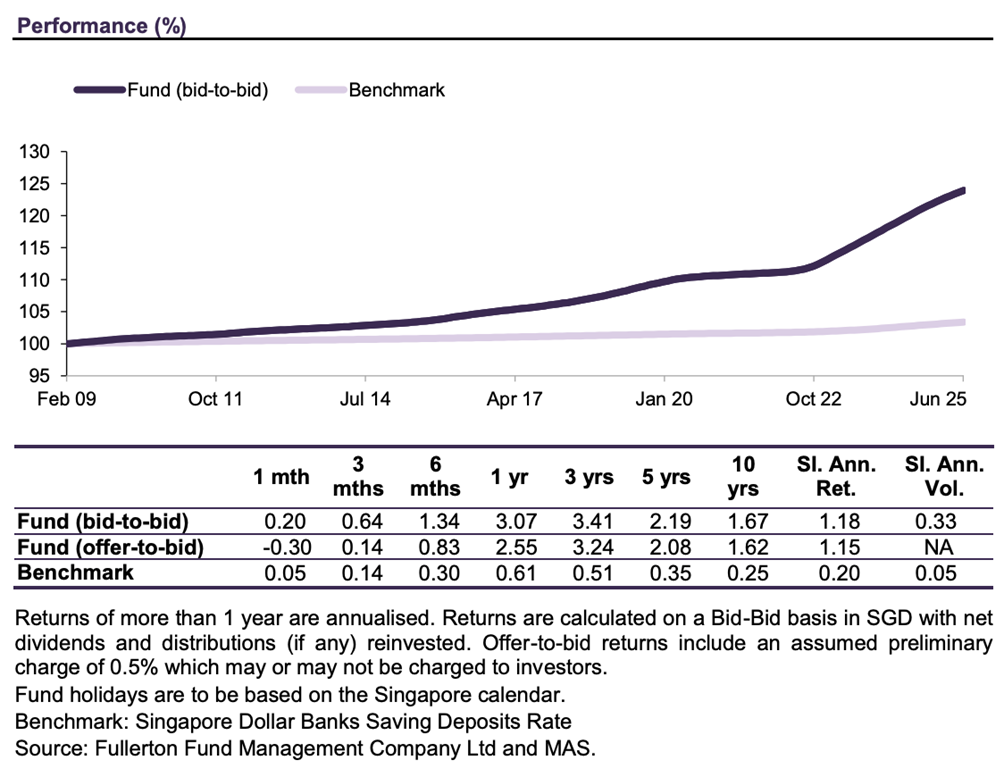

The gross yield on a 5-day rolling average4 was 2.0% p.a as of 30 June 2025.

The Fund has an annualised volatility of 0.33% since inception in February 2009, meaning that its returns have remained relatively stable over time with minimal fluctuations.

And since the fund doesn’t hold any bonds, there’s also minimal duration risk5 (the risk that a fund’s value will fluctuate due to changes in interest rates).

Learn more about the Fullerton SGD Cash Fund here.

3Subject to redemption gate of 25% of fund AUM on any dealing day, per Fund prospectus.

4Refers to the weighted average yields of underlying holdings over the last 5 business days of the month.

5Please refer to the Fund's prospectus for the full list of risk disclosures of the Fund.

#2 – Fullerton SGD Savers Fund

Next up is the Fullerton SGD Savers Fund. This is a relatively new option that sits in between a pure cash fund and a short-duration bond fund.

It was launched in 2023 and currently manages around S$47 million in assets, as of 30 June 2025.

This fund seeks to balance two things many investors want: liquidity and yield, targeting a potentially higher return than SGD fixed deposits rates. .

What makes this fund interesting is its hybrid approach.

It may invest in SGD fixed deposits with high-quality local and foreign financial institutions.

In addition, it also adds exposure to short-term government bonds and investment-grade corporate credits with a minimum long term credit rating of BBB by Fitch, Baa2 by Moody's or BBB by Standard & Poor's (or their respective equivalents), some of which are denominated in foreign currencies.

To manage foreign currency risk, all non-SGD exposures are fully hedged into SGD, except 5% frictional currency limit.

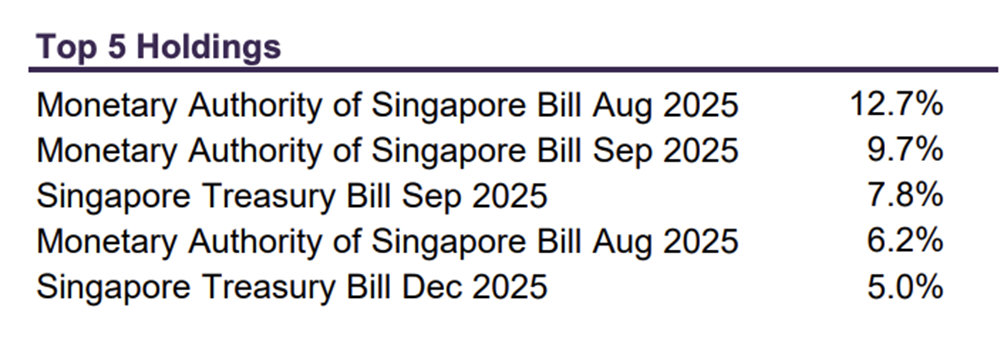

The fund currently holds about 31 positions, with most of them being MAS Bills and Singapore Treasury Bills, as of 30 June 2025.

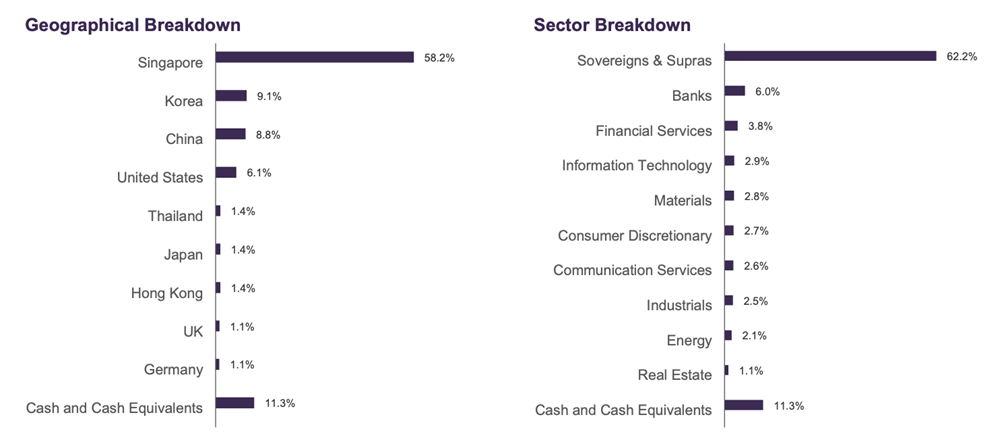

That results in a portfolio that is 58.2% allocated to Singapore, 62.2% to sovereign and supranational issuers, and 56% rated AAA.

The management fee is 0.30% p.a (for Classes A and A2).

Another unique feature is that the fund can invest in other mutual funds, such as the Fullerton SGD Cash Fund, allowing it to get certain exposures more efficiently instead of managing them directly.

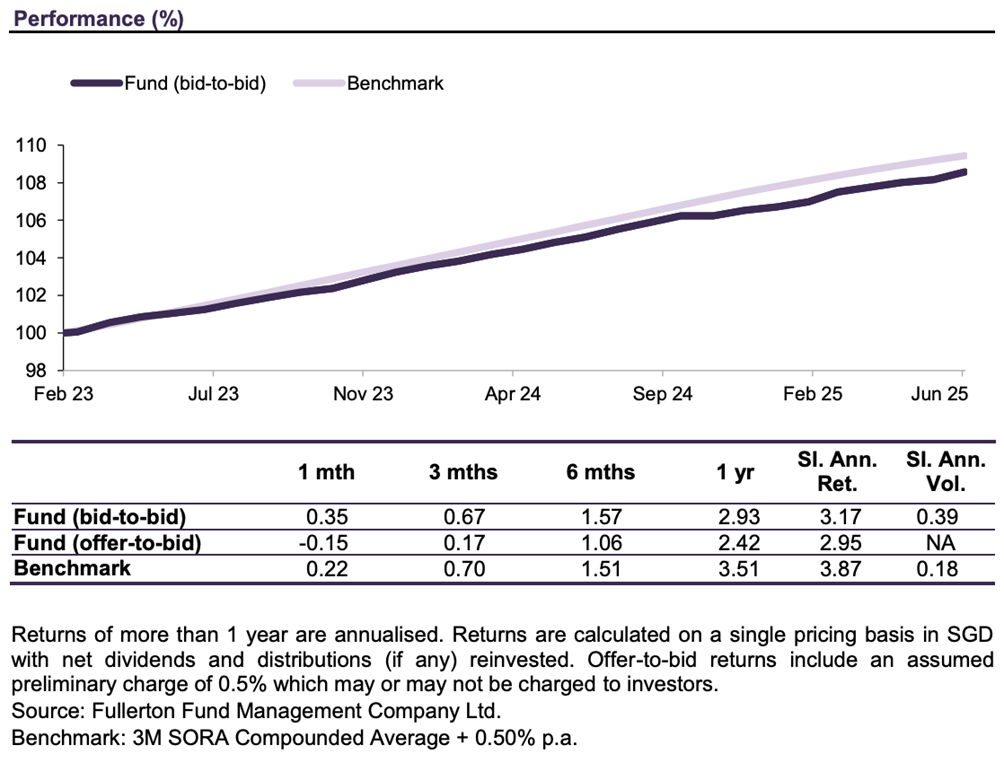

Given its short-term bond exposure, the fund’s benchmark is the 3-month SORA Compounded Average plus 0.50% p.a..

Over the past year (as of 30 June 2025), the fund returned 2.93 % bid-to-bid, which is about 0.58 % below its benchmark.

For those looking for income, Class A2 currently offers a quarterly distribution6.

This fund still prioritises safety and liquidity, but has the flexibility to go after higher returns by blending in quality bonds, making it an option to consider for enhanced cash management for idle cash.

Learn more about the Fullerton SGD Savers Fund here

6Quarterly distribution at the fund manager's absolute discretion which may be declared out of income and/ or capital. You may refer to Fullerton's website for details on historical payouts.

#3 – Fullerton Short Term Interest Rate Fund

The Fullerton Short Term Interest Rate Fund could be an option for investors looking for more than just capital preservation.

The fund aims to provide, medium-term capital growth for investors.

The fund invests in a curated mix of short-dated government and corporate bonds, with maturities of up to five years.

About 23% of the portfolio has geographical exposure to Singapore, while the rest is spread across other parts of Asia and selected global markets.

Any foreign currency bonds (mainly in USD) are fully hedged back to SGD (except 5% frictional currency limit) to minimise currency risk.

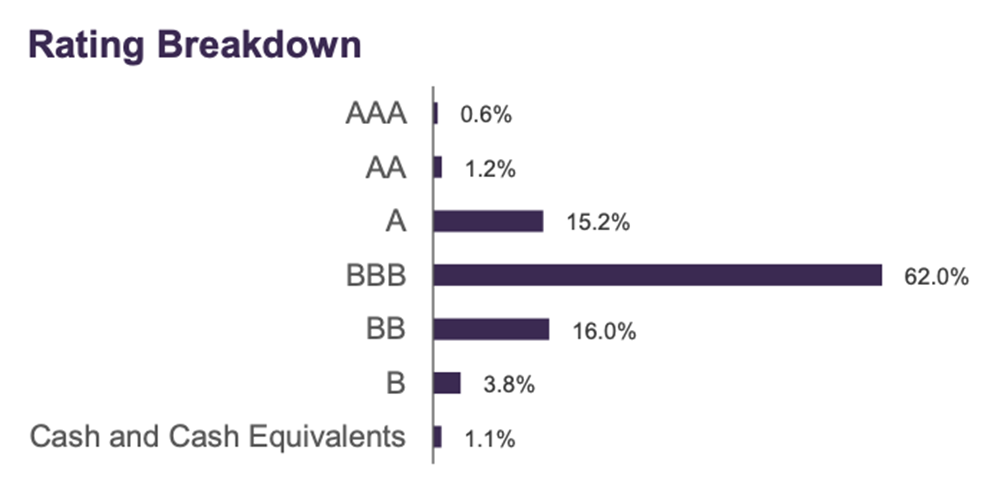

Importantly, all the bonds are investment grade, and roughly 68% are rated BBB as of 30 June 2025, which provides a good balance of potential yield and credit quality.

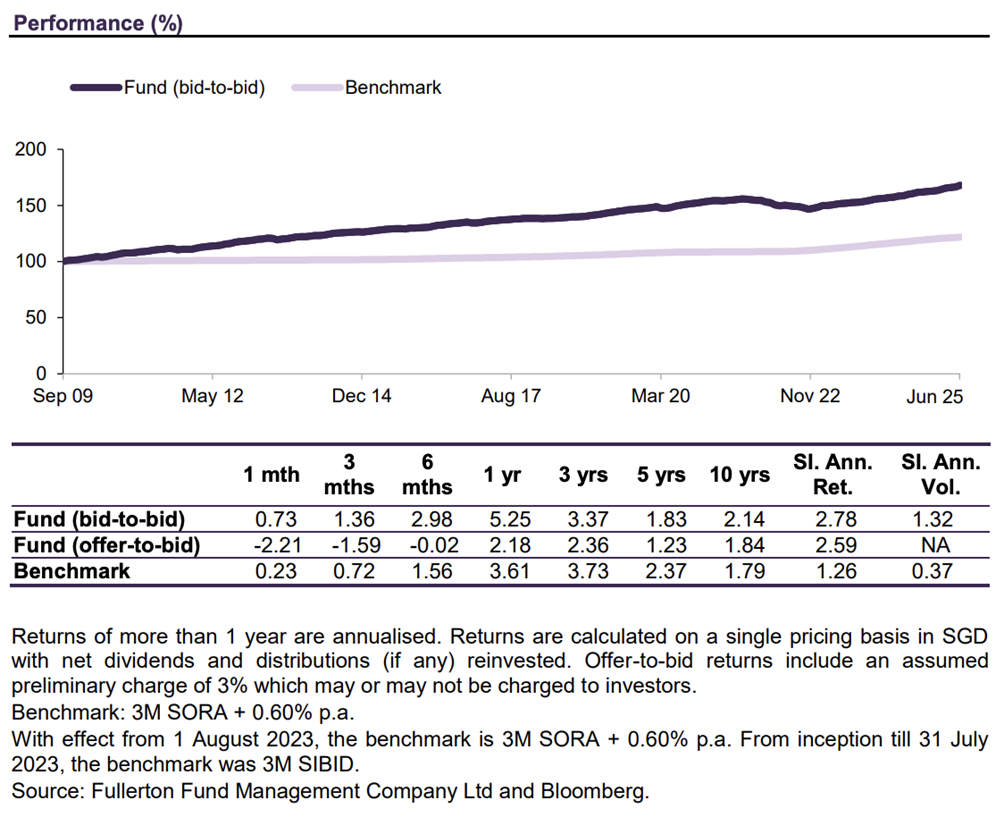

It’s benchmarked against the 3-month SORA + 0.60% p.a., which reflects its short-term duration focus.

Over the past year, the fund returned a respectable 5.25% bid-to-bid (as of 30 June 2025), outperforming its benchmark by around 1.64%.

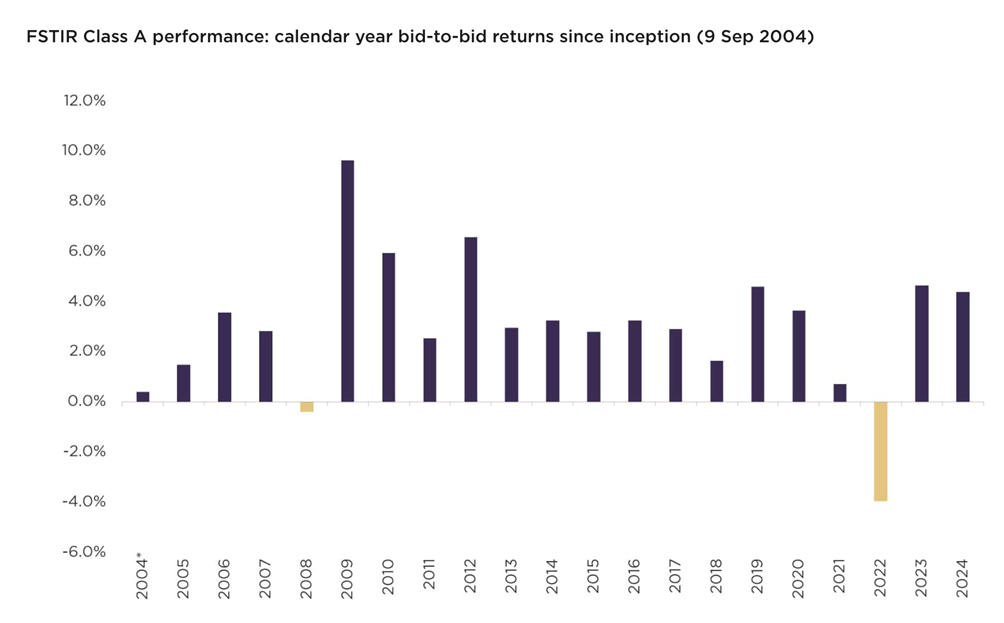

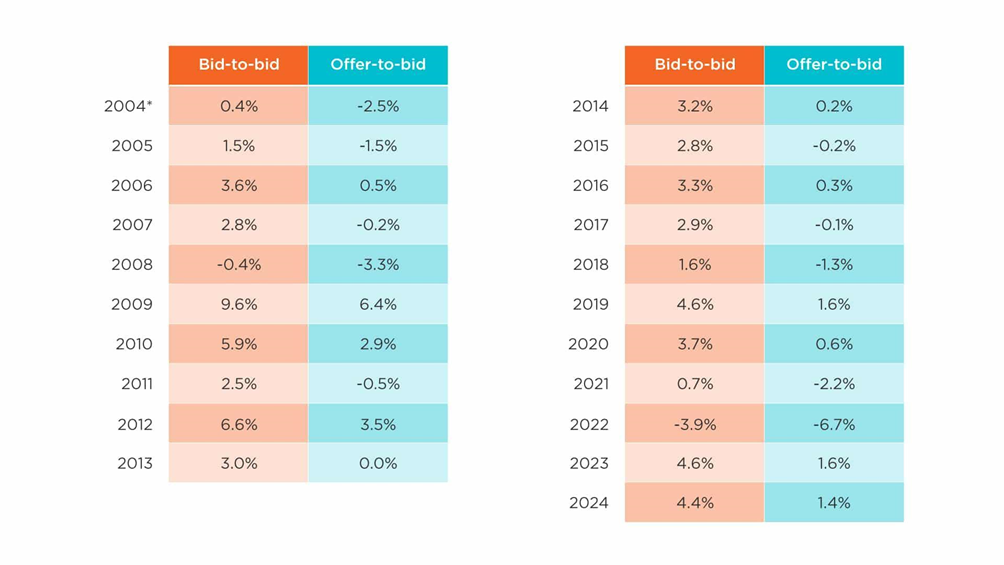

The fund has also consistently delivered positive calendar year net returns in 19 out of the past 21 calendar years.

For income seekers, Class C1 offers a quarterly distribution7.

Based on historical performance and global diversification, this fund could be an option for those looking to upgrade from cash or near-cash instruments to potentially have medium-term capital growth while still being conservative.

Learn more about the Fullerton Short Term Interest Rate Fund here

7Quarterly distribution at the fund manager's absolute discretion which may be declared out of income and/ or capital. You may refer to fullerton's website for details on historical payouts.

#4 – Fullerton SGD Income Fund

The Fullerton SGD Income Fund is a fund to consider for long-term capital appreciation or income, in SGD terms.

It focuses primarily on fixed income securities, with a diversified credit portfolio that seeks to add value from interest rate accurals, bond selection while managing credit and duration by selecting bonds of different maturitires to optimise returns.

This is a globally diversified bond fund with the ability to invest up to 30% in high-yield bonds8.

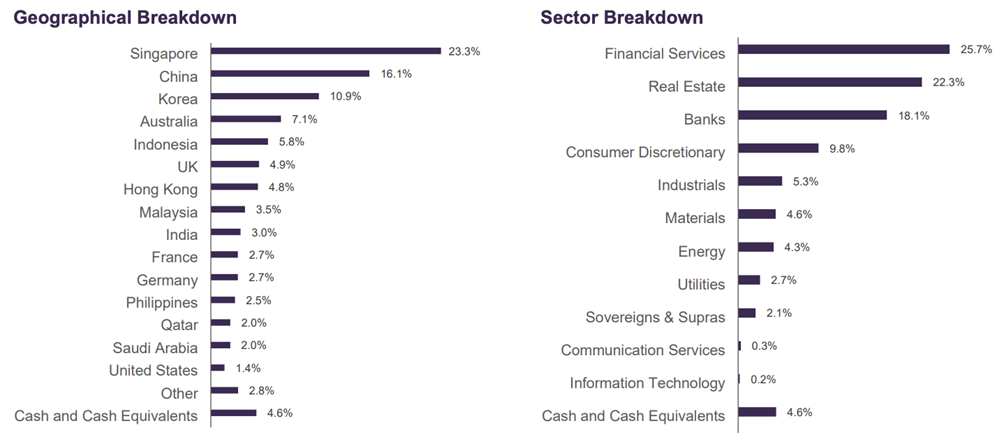

While it has a higher geographical exposure to Singapore, it’s not limited to local markets. The fund may invest in foreign currency bonds as well, though all currency exposures are fully hedged back to SGD (except 5% frictional currency limit).

The investment approach combines top-down macroeconomic analysis to assess where interest rates might be heading, with bottom-up credit research, which helps in selecting individual bonds and structuring the portfolio across the yield curve.

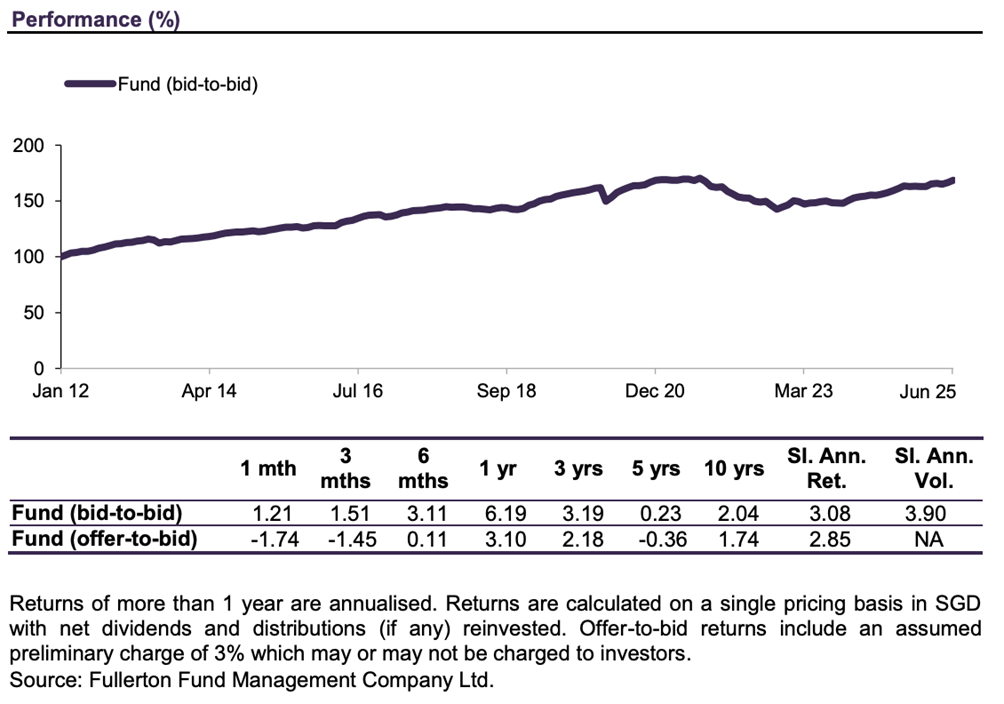

Launched in 2012, the fund currently manages over S$800 million in assets (as of 30 June 2025) and holds around 200 bonds.

About 62% are rated BBB, while about 19 % are high-yield, giving it a credit profile that seeks to balance yield with quality.

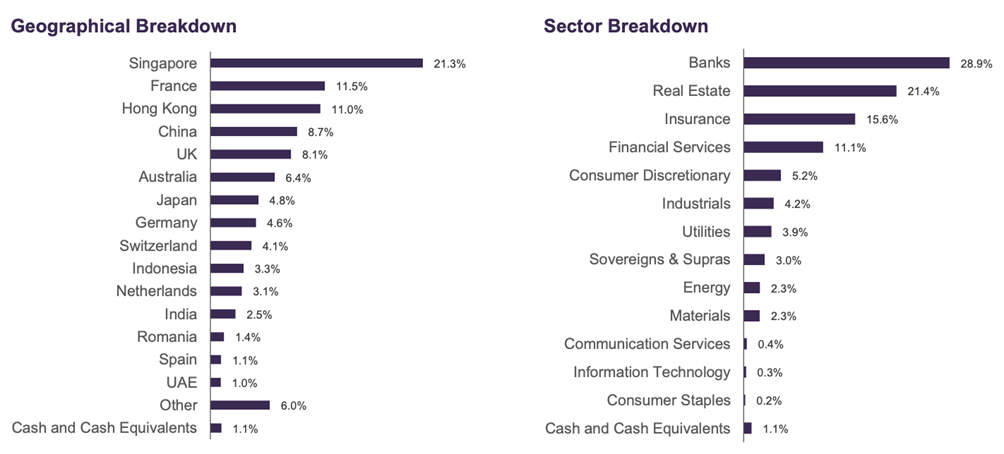

The portfolio is geographically diversified, with 21% in Singapore and the rest spread across Asia, Europe, and other regions.

Most of the holdings are corporate bonds, with minimal exposure (just 3%) to sovereign or supranational debt.

The fund charges a management fee of 0.80% (Class A).

Unlike some other bond funds, this one doesn’t track a specific benchmark, it’s actively managed on a total return basis, giving the investment team the flexibility to respond to changing market conditions.

The fund is managed by Melvin Lee, Fullerton’s lead credit fund manager, who also oversees their SGD bond strategies.

Over the past year, the fund returned a solid 6.19 % bid-to-bid (as of 30 June 2025), showing its potential to deliver returns even in a more cautious environment.

For those looking for regular payouts, Class A offers a quarterly distribution9.

Based on the fund’s characteristics, this fund is slightly more aggressive but still relatively defensive Asia-tilted credit fund that’s backed by SGD exposure and a historically strong long-term track record.

Learn more about the Fullerton SGD Income Fund here

8Bonds with a long-term credit rating of less than BBB- by Standard & Poor's, Baa3 by Moody's or BBB- by Fitch (or their respective equivalents).

9Quarterly distribution at the fund manager's absolute discretion which may be declared out of income and/ or capital. You may refer to fullerton's website for details on historical payouts.

Why SGD-denominated funds?

#1 - Stable currency with strong fundamentals

The Singapore Dollar (SGD) is widely recognised as one of the most stable currencies in Asia, and even globally.

Decades of prudent fiscal and monetary policy have earned Singapore a coveted AAA sovereign credit rating, a distinction shared by only a few countries in the world.

The country’s healthy reserves, consistent economic growth, and relatively well-managed inflation all contribute to this reputation.

What also helps is the way Singapore manages the SGD.

Rather than letting the currency float freely, it’s pegged to a basket of currencies from Singapore’s major trading partners.

It has typically traded within a narrow band of 1.30 to 1.40 against the USD. As of 11 July 2025, it is hovering around 1.28.

This approach has helped keep volatility low, especially during global market turbulence.

#2 - Alignment with liabilities

As a Singapore-based investor, it could be more intuitive to hold investments in SGD, especially since housing, bills, groceries, and everyday spending are all SGD-denominated.

Having assets and income payouts in the same currency helps reduce friction when managing expenses or servicing loans.

It also removes the need to worry about currency conversion, which can erode returns over time or create unexpected shortfalls.

#3 - Reduce currency risk

When you invest in a unit trust or mutual fund, the portfolio is typically managed in a base currency.

If your investments are not in the same currency as the portfolio, or if the fund doesn’t hedge its currency exposures, you’re exposed to currency risk, where exchange rate movements can affect your overall returns.

All four Fullerton funds featured are SGD-denominated, and they typically hedge all non-SGD exposures back to SGD, subject to 5% frictional currency limit (except for Fullerton SGD Cash Fund, which does not have foreign currency exposure).

Risk factors and considerations

#1 - Not capital guaranteed

Unlike fixed deposits or T-bills, where your principal is backed by the issuer, unit trusts and mutual funds do not come with capital guarantees.

This means your investment value can fluctuate, and you may get back less than what you initially put in, especially in the short term.

#2 - Interest rate risk

Bond funds are affected by changes in interest rates.

This is called duration risk—the risk that bond prices will fall when interest rates rise.

The longer the fund’s average duration, the more sensitive it is to these movements.

The Fullerton funds vary in their interest rate sensitivity, as of 30 June 2025:

- The Fullerton SGD Savers Fund has a very low duration of 0.9 years, meaning it has minimal exposure to rate changes.

- The Fullerton Short Term Interest Rate Fund has a low duration of 2.0 years, striking a balance between yield and stability. It has a yield-to-worst of 2.4%.

- The Fullerton SGD Income Fund has a longer duration of 4.4 years and therefore higher interest rate sensitivity, though it is actively managed to adjust duration as market conditions evolve. It has a yield-to-worst of 3.5%.

#3 - Corporate bond exposure

All three bond funds—the SGD Savers Fund, Short Term Interest Rate Fund, and SGD Income Fund—invest in corporate bonds, which carry a degree of credit risk.

This is the risk that an issuer might default on its payments.

Here’s how each fund manages this risk, as of 30 June 2025:

- The SGD Savers Fund has about 26% exposure to corporate bonds, with the rest in sovereign and high-quality instruments. All corporate holdings are investment-grade.

- The Short Term Interest Rate Fund primarily holds corporate bonds that are also investment-grade.

- The SGD Income Fund has a more flexible strategy, allowing up to 30% in high-yield bonds. As of 30 June 2025, it had about 19% in high yield, with the remaining 81% investment grade.

To manage credit quality, Fullerton follows strict internal credit assessment guidelines, ensuring that all holdings meet high standards and are regularly monitored.

This process helps the investment team respond quickly to any negative developments and maintain the overall resilience of the portfolio.

Refer to the Fund prospectus for the full list of risk disclosures of respective funds.

What would Beansprout do?

The US dollar’s decline this year reflects a broader lack of confidence, driven by rising uncertainty around both domestic and international US policies.

For investors based in Singapore, this environment makes a strong case for prioritising SGD as the core investment currency, especially when your daily spending and liabilities are already in SGD.

The four Fullerton funds featured in this article are all SGD-denominated, with a large portion of their underlying investments also in SGD.

That significantly reduces currency risk for local investors and provides more stability in today’s volatile environment.

As a Singapore-based asset manager, Fullerton also brings deep expertise in managing SGD-focused strategies, making them well-positioned to navigate local market dynamics.

Whether you’re looking for a cash-enhancement tool like the Fullerton SGD Cash Fund, a slightly higher-yielding option like the SGD Savers Fund, or a more diversified bond portfolio with regional exposure like the Short Term Interest Rate Fund or SGD Income Fund, there’s something here for a range of risk appetites and return expectations.

If you're looking to strengthen the SGD core of your portfolio, these funds offer a solid starting point.

To find out more about these funds, visit the Fullerton website

Where can I buy these Fullerton funds?

You can access these Fullerton funds through the following distributors:

- Moomoo

- FSMOne by iFAST

- PhillipCapital

- Tiger Brokers

- Webull

- DBS

- Standard Chartered

- Endowus

- Grow with Singlife

- Maybank

- Citibank

Read also:

- Fullerton SGD Cash Fund: A safer and liquid option to park your cash?

- Interest rates are falling. Time to look at short-term bond funds?

Important Information

This is the result of a paid collaboration with Fullerton Fund Management Company Ltd (UEN: 200312672W). This publication is for information only and does not constitute financial advice or recommendation. Your specific investment objectives, financial situation and needs are not considered here. The value of units in the Fund and any accruing income from the units may fallor rise. Any past performance, prediction or forecast is not indicative of future or likely performance. Any past payout yields and payments are not indicative of future payout yields and payments. Distributions (if any) may be declared at the absolute discretion of Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) and are not guaranteed. Distribution may be declared out of income and/or capital of the Fund, in accordance with the prospectus. Where distributions (if any) are declared in accordance with the prospectus, this may result in an immediate reduction of the net asset value per unit in the Fund. The Fund does not offer any performance or capital guarantee. Investors should note that investments in the Fund may expose investors to risks that are different from pure deposit products. Any investments in the Fund must not at any time be thought of as similar to a deposit in a bank. Applications must be made on the application form accompanying the prospectus, which can be obtained from Fullerton or its approved distributors. You should read the prospectus and seek advice from a financial adviser before investing. If you choose not to seek advice, you should consider whether the Fund is suitable for you. The Fund may use or invest in financial derivative instruments. Please refer to the prospectus of the Fund for more information.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments