Interest rates are falling. Time to look at short-term bond funds?

Mutual Funds

Powered by

By Nicole Ng • 04 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Are short-term bond funds like the Fullerton Short-Term Interest Rate Fund a viable option in a falling interest rate environment? Learn the feature, risks, and how they compare to money market funds and bond funds.

This post was created in partnership with Fullerton Fund Management. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

With Singapore T-bill yields falling further in the latest auction and savings account rates being cut, I’m left wondering what I can do to grow my cash savings and generate passive income.

It’s a sentiment shared by the Beansprout community, with many looking for alternatives.

For those comfortable with a little more risk for potentially better returns, while still keeping volatility manageable, short-term investment-grade bond funds may be the next step up.

In this article, we’ll explore how short-term bond funds like the Fullerton Short-Term Interest Rate Fund (FSTIR) work, how they compare to money market funds and longer-term bond funds, and key considerations if you’re thinking about such funds in today’s environment.

What is the Fullerton Short-Term Interest Rate Fund?

The Fullerton Short-Term Interest Rate Fund (FSTIR) is a fixed income investment fund managed by Fullerton Fund Management, an established investment firm in Singapore.

Fullerton is part of Seviora Group, an independent asset management group, owned by Temasek. Income Insurance, a leading Singapore insurer, is a minority shareholder of Fullerton.

The fund aims to provide capital appreciation over the medium term by investing in a diversified mix of high-quality bonds that mature within five years.

In the bond fund universe, we can categorise this fund as a short-term bond fund.

Learn more about the Fullerton Short Term Interest Rate Fund here

Why consider short-term bond funds?

#1 – Access to credit bonds coupled with portfolio diversification

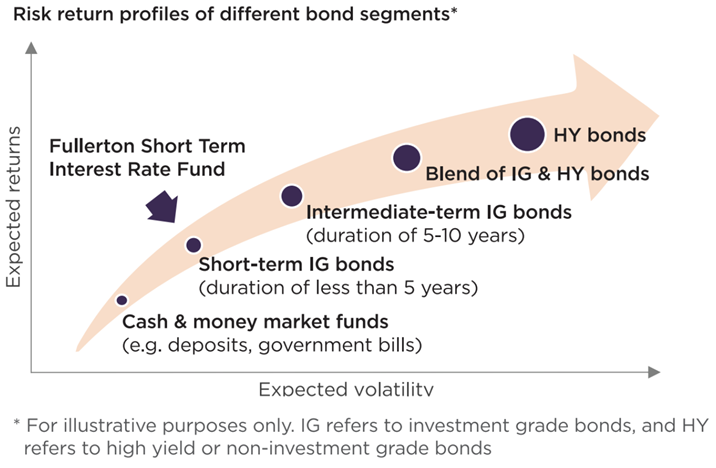

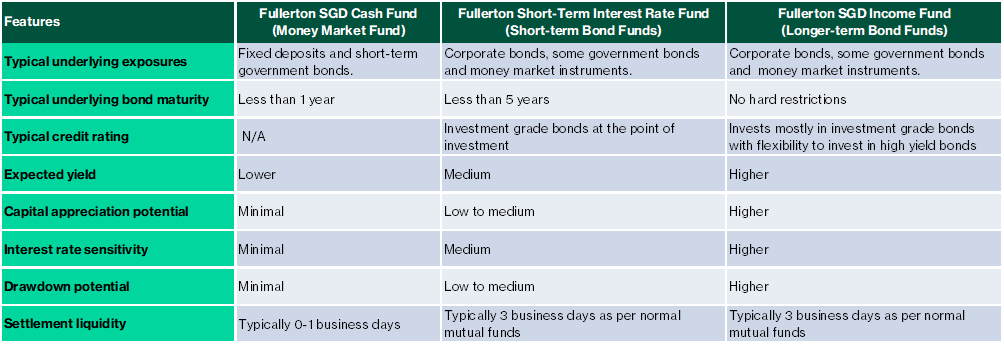

Short-term bond funds like the Fullerton Short-Term Interest Rate Fund (FSTIR) offer a middle ground between money market funds and longer-term bond funds.

Money market funds usually stick to very short-term instruments, like cash, deposits, or treasury bills, which may make them very stable, but also means returns can be quite limited.

Short-term bond funds, such as Fullerton Short-Term Interest Rate Fund, on the other hand, invest in a wider mix of mostly high-quality, short-dated corporate bonds and some government bonds, including those of Singapore financial institutions and real estate firms.

All the underlying bonds held in the Fullerton Short-Term Interest Rate Fund are rated investment grade, meaning the Fund is either rated at least BBB- by Standard & Poor’s or Baa3 by Moody’s (or their respective equivalents).

Investment-grade bonds are considered to have a relatively lower risk of default.

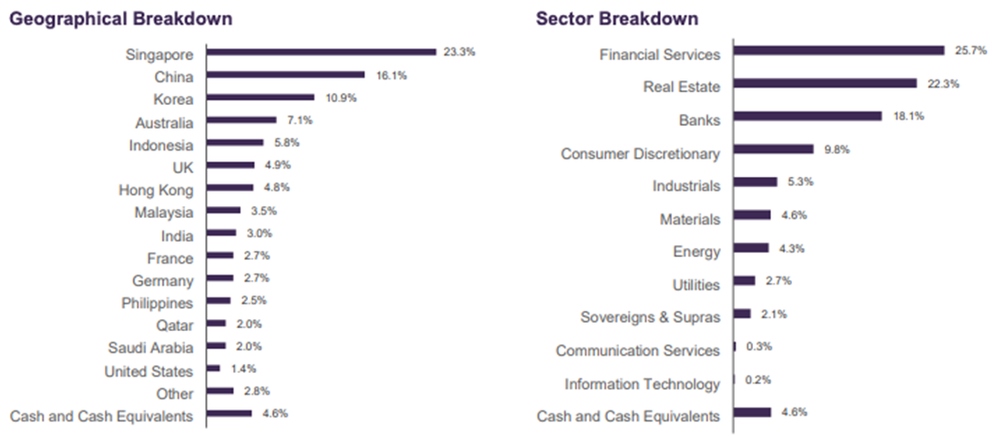

As of 30 June 2025, the Fund holds a global diversified portfolio of 142 bonds, with 23.3% exposure to Singapore.

The rest are mainly from other Asian countries. The fund also has exposures to developed markets such as Europe.

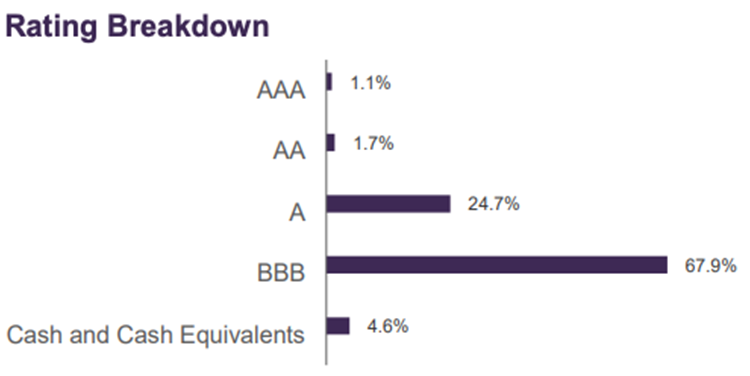

About 67.9% of the portfolio is invested in BBB-bloc rated bonds, which are at the lower end of the investment grade spectrum but still seen as creditworthy.

Unlike investing directly into a T-bill or a handful of individual bonds, short-term bond funds like the Fullerton Short-Term Interest Rate Fund also offer greater diversification by spreading investments across multiple bond issuers and sectors.

This helps to potentially diversify risk, so you’re not overly dependent on the performance of any one issuer.

The Fullerton Short-Term Interest Rate Fund’s foreign currency-denominated fixed income securities are also fully hedged back to SGD1.

This helps proactively manage currency fluctuations that could potentially affect your returns.

And importantly, the Fullerton Short-Term Interest Rate Fund offers daily liquidity.

You can redeem your units anytime if you need the cash2.

1Except for a 5% frictional currency limit to account for possible deviations from a 100% hedge 2Subject to the Terms and Conditions of the Fund’s prospectus

#2 – Potentially better yield resilience compared to money market funds

If you already have money in money market funds, short-term bond funds like Fullerton Short-Term Interest Rate Fund aren’t necessarily a replacement.

But they may complement your portfolio depending on your goals and how much risk you’re comfortable taking.

Because Fullerton Short-Term Interest Rate Fund invests in a diversified portfolio of short-term bonds with maturities of up to 5 years, it can lock in higher yields on bonds it buys today and hold onto them for a few years, even if interest rates start to come down during that period.

In a falling interest rate environment, this can offer potentially more attractive returns compared to T-bills or money market funds.

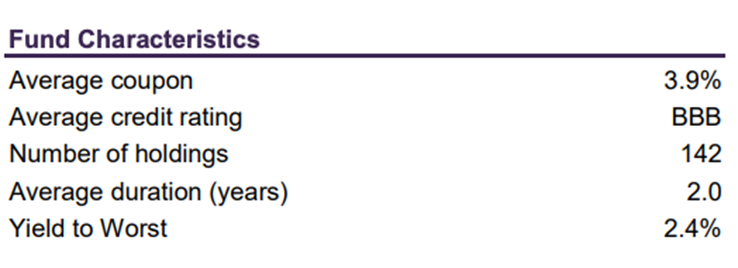

As of 30 June 2025, the Fund has an average coupon of 3.9% and a Yield to Worst of 2.4% (after hedging).

Yield to Worst refers to the lowest possible yield the fund could earn if the bonds in the portfolio are paid off earlier than expected.

The average duration of the Fund sits at around 2.0 years currently, which reflects how sensitive the Fund is to interest rate changes — the lower the duration, the less its price will fluctuate when rates move.

Compared to money market funds, which focus on much shorter maturities (usually 1 year or less), the fund offers slightly longer interest rate exposure.

While money market yields can respond quickly to rising rates, they also tend to fall just as quickly when rates decline.

In contrast, the Fund’s short-duration positioning helps cushion against a rapid drop in yield, offering potentially better income resilience in a falling rate environment.

Learn more about how the Fullerton Short Term Interest Rate Fund differs from money market funds

#3 – Potentially lower volatility than long-term bonds

Long-term bond funds, which hold bonds with longer maturities of over 5 years, can see larger capital gains if interest rates fall sharply.

But, this also means they’re more vulnerable if rate cuts get delayed or if rates stay elevated, leading to bigger price declines and more volatility.

In contrast, short-term bond funds like the Fullerton Short-Term Interest Rate Fund maintain a much shorter duration profile.

In the case of the Fullerton Short-Term Interest Rate Fund, it has an average portfolio duration of just 2.0 years currently.

This shorter duration helps limit how much the fund’s price moves in response to interest rate changes, offering a steadier ride even as markets react to shifting rate expectations.

While short-term bond funds may not capture as much upside as long-term bond funds in a rapid rate-cutting cycle, they can provide a more stable experience for investors who prefer to avoid large swings in portfolio value, especially in today’s uncertain interest rate environment.

Risks and considerations

#1 - Not capital guaranteed

Unlike fixed deposits or T-bills, which guarantee your principal if you hold them to maturity, FSTIR is a unit trust.

This means your capital is not guaranteed, and the value of your investment can fluctuate depending on market conditions.

While the fund invests in high-quality bonds, market price movements may still affect your portfolio value, especially if you withdraw your investment during periods of volatility.

#2 - Active management

The Fullerton Short-Term Interest Rate Fund is actively managed, which means a professional investment team is constantly monitoring the market, assessing risks, and making portfolio adjustments to help optimise returns.

The fund offers several share classes such as

- C Class (Accumulation): Returns are reinvested into the fund, and no distributions are made.

- C1 Class (Distribution): The Fund may declare quarterly distributions at its discretion, and distribution amounts can vary depending on the fund’s coupon income and market conditions.

Naturally, active management comes with fees:

- The fund charges a management fee of 0.50% per year for its C and C1 share classes.

- On top of that, there are other operating expenses bringing the Total Expense Ratio (TER) to approximately 0.53% p.a. for C share class and 0.55% p.a (annualised) for the C1 share class.

#3 - Corporate bond exposure

Because the Fullerton Short-Term Interest Rate Fund invests mainly in corporate bonds, there is exposure to credit risk, meaning the chance that a bond issuer might default on its payments.

To manage this, the fund invests only in investment-grade bonds, with all holdings rated at least BBB- by Standard & Poor’s or Baa3 by Moody’s (or their respective equivalents), which are considered lower-risk compared to non-investment-grade bonds.

The investment team also applies its own internal credit assessments and actively monitors the financial health of the companies it invests in.

This means the bonds in the fund are well looked after by a team of dedicated investment professionals.

If any credit concerns arise, the team can act quickly to reduce exposure.

Additionally, by focusing on bonds with maturities of less than 5 years, the fund further seeks to manage default risk compared to longer-term bond funds, where the risk of default can increase over longer time horizons.

#4 – Interest rate risk

As we’ve mentioned earlier, bond funds, including the Fullerton Short-Term Interest Rate Fund, are still affected by interest rate movements.

While the fund’s shorter average duration of around 2.0 years currently helps reduce its sensitivity to rate swings compared to long-term bond funds, some level of interest rate risk remains.

This is where active management plays an important role.

The investment team actively adjusts the portfolio’s duration based on the macroeconomic environment.

As of 30 June 2025, the fund maintains a more defensive stance by focusing on shorter-dated, investment-grade SGD-denominated bonds to help cushion the portfolio from interest rate uncertainties.

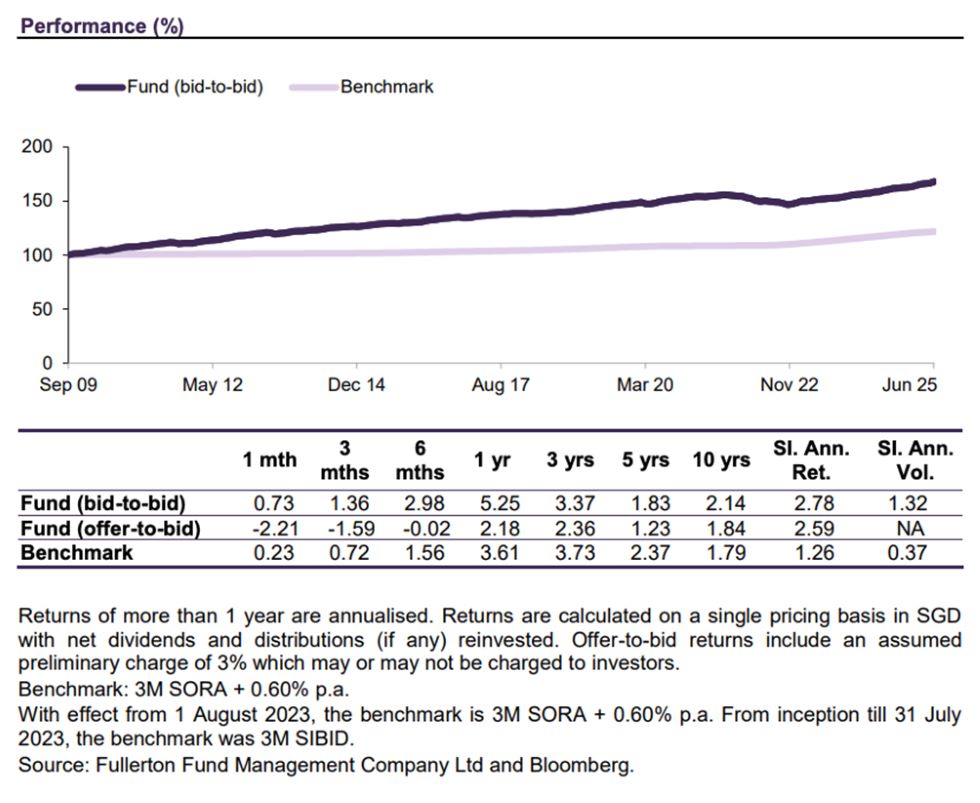

How has the Fullerton Short-Term Interest Rate Fund performed?

The Fullerton Short-Term Interest Rate Fund has grown to an AUM of nearly S$1 billion as of 30 June 2025.

More recently and on a total return basis, the Fullerton Short-Term Interest Rate Fund C class has delivered a positive net return of 5.25% (bid-to-bid) over the past 1 year and 2.98% (bid-to-bid) over the past 6 months as of 30 June 2025.

Performance of Fullerton Short-Term Interest Rate Fund SGD A Class

Performance-wise, the fund has delivered historically strong performance over its 21-year history since it was incepted in September 2004.

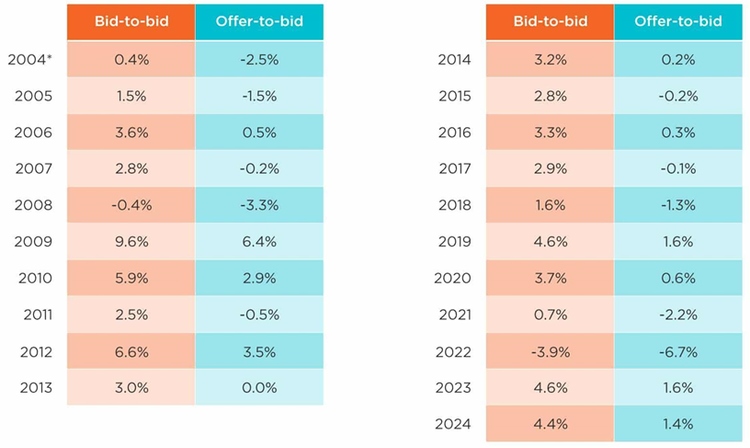

Looking at Fullerton Short-Term Interest Rate Fund’s longer-term track record (using its A class, which has the longest history), the fund has delivered positive calendar-year net returns in 19 out of the past 21 years, demonstrating its focus on capital preservation while still delivering steady growth over time.

Calendar year performance of Fullerton Short-Term Interest Rate Fund SGD A Class since inception

Characteristics of selected Fullerton Cash and Income strategies

What would Beansprout do?

With falling interest rates back in focus, many investors are once again faced with the challenge of balancing returns, risks, and liquidity when managing their cash or short-term savings.

Money market funds and T-bills remain solid options for relatively low-risk, highly liquid holdings, but may see yields drift lower as rates decline.

On the other end, longer-term bond funds can offer higher potential returns, but with greater price volatility if rate expectations shift.

This is where short-term bond funds like the Fullerton Short-Term Interest Rate Fund may serve as a useful middle ground.

It offers a higher return potential than money market funds, while reducing volatility compared to longer-duration bonds.

The Fullerton Short-Term Interest Rate Fund also provides a diversified portfolio of high-quality corporate bonds, with SGD hedging to minimise currency risk.

Of course, the Fullerton Short-Term Interest Rate Fund still comes with risks3 to consider, including but not limited to credit and interest rate risks, and it is not capital guaranteed.

Find out more about the Fullerton Short Term Interest Rate Fund here.

Where can I buy the Fullerton Short-Term Interest Rate Fund?

You can access the Fullerton Short-Term Interest Rate Fund through the following distributors:

- Moomoo

- FSMOne by iFAST

- PhillipCapital

- Tiger Brokers

- Webull

- DBS

- Standard Chartered

- Endowus

- Grow with Singlife

- Maybank

- Citibank

Read also:

- Fullerton SGD Cash Fund: A safer and liquid option to park your cash?

- With US dollar volatility, is it time to look at SGD-denominated funds?

3Refer to the Fund’s prospectus for the full list of risk disclosures of the Fund

Important Information

Disclaimer: This is the result of a paid collaboration with Fullerton Fund Management Company Ltd (UEN: 200312672W). This publication is for information only and does not constitute financial advice or recommendation. Your specific investment objectives, financial situation and needs are not considered here. The value of units in the Fund and any accruing income from the units may fall or rise. Any past performance, prediction or forecast is not indicative of future or likely performance. Any past payout yields and payments are not indicative of future payout yields and payments. Distributions (if any) may be declared at the absolute discretion of Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) and are not guaranteed. Distribution may be declared out of income and/or capital of the Fund, in accordance with the prospectus. Where distributions (if any) are declared in accordance with the prospectus, this may result in an immediate reduction of the net asset value per unit in the Fund. The Fund does not offer any performance or capital guarantee. Investors should note that investments in the Fund may expose investors to risks that are different from pure deposit products. Any investments in the Fund must not at any time be thought of as similar to a deposit in a bank. Applications must be made on the application form accompanying the prospectus, which can be obtained from Fullerton or its approved distributors. You should read the prospectus and seek advice from a financial adviser before investing. If you choose not to seek advice, you should consider whether the Fund is suitable for you. The Fund may use or invest in financial derivative instruments. Please refer to the prospectus of the Fund for more information. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments