A practical way to protect your investments during downturns

Trading

By Nicole Ng • 09 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Learn how futures hedging works and how you can manage equity, currency and gold risks during volatile markets without selling your investments.

What happened?

The markets have been anything but predictable as we head into 2026.

Volatility has picked up across many asset classes.

US stocks have been on a remarkable run in 2025.

But the S&P 500 and Nasdaq 100 saw pullbacks amid lingering concerns about AI spending and the ongoing impact of FOMC decisions on interest rates towards the year-end.

Meanwhile, gold also experienced a pullback after a run-up where its price soared past US$4,400 per ounce.

The US dollar has also faced more volatility in 2025.

For Singapore investors that hold USD-denominated ETFs, or keep part of our portfolios in US dollars for diversification or yield, currency moves can impact returns.

As an investor watching these developments, you might be feeling a familiar tension: your portfolio looks healthy on paper, but there's that nagging worry about what happens if the market turns.

Do you sell and risk missing out on further gains? Do you hold tight and hope for the best?

Or is there a smarter way to protect your hard-earned investments without sitting on the sidelines?

This is where hedging with futures comes into play.

Hedging is a practical tool, like buying insurance, that offsets potential losses in your existing portfolio without forcing you to liquidate your core holdings and adds a safety net to your portfolio.

But the right knowledge with risk management is needed.

In this article, I will explain what hedging is, how it works, and how to use futures to hedge your portfolio against rising uncertainty.

What is hedging?

We often hear about hedge funds and how people hedge their positions in times of crisis and uncertainty.

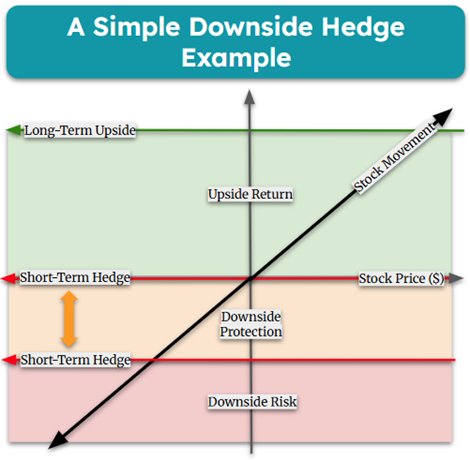

Hedging is a risk management strategy that offsets potential losses in investments.

Think of it like insurance: it protects your portfolio but may limit upside potential.

Hedging is not in any way expressing a directional market view but managing the downside risk in the portfolio.

According to market practitioners, more retail investors are looking beyond return chasing and focusing on managing downside risk.

James Ooi, Chief Market Strategist at Tiger Brokers, notes that rising volatility has changed how many retail investors approach their portfolios:

“Given the spike in volatility across equities, FX, and commodities this year, we are clearly seeing more retail clients asking about ways to protect their portfolios, rather than simply chasing returns. Rather than selling core holdings and sitting out market corrections, a growing number of investors want to stay invested while actively managing downside risk.”

“This has led to rising interest in futures as an efficient and flexible risk-management tool, especially following tariff escalation and broader macro uncertainty earlier this year.”

Now, let me explain in examples how I can apply futures in times of uncertainty to my existing portfolio.

Hedging with futures

Futures are one of the most widely used and efficient instruments for hedging.

Futures contracts are agreements to buy or sell an asset at a predetermined price on a future date.

They are widely used because they allow investors to manage risk without having to adjust their underlying holdings.

For investors, some common hedging scenarios include:

#1 – Equity portfolio hedging

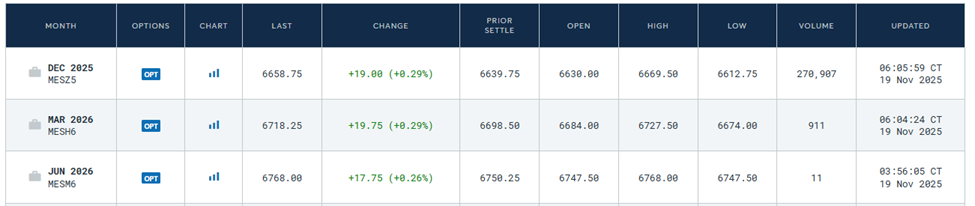

Investors who hold a portfolio of US or global equities can use broad index futures, such as S&P 500 (ES & MES) or Nasdaq (NQ & MNQ) futures, to offset market-wide downside risk without selling their holdings.

In this example, I’ll walk through how to use Micro E-Mini S&P 500 (MES) futures to hedge a US$10,000 SPY.US position, helping reduce the downside risk from a concentrated exposure.

In this scenario, the SPY portfolio fell from US$30,000 to US$28,946.83, resulting in a loss of US$1,053.17.

| Portfolio | Value (US$) | Price (US$) |

| SPY.US Portfolio Value (12 Nov 2025) | 30,000 | 684.79 |

| SPY.US Price (19 Nov 2025) | 28,946.83 | 660.75 |

| Estimated SPY Portfolio Loss | 1053.17 | - |

| Short MESH6 for Hedging (17 Nov 2025) | - | 6,800.25 |

| Reference Price MESH6 (19 Nov 2025) | - | 6,720.25 |

| Estimated MESH6 Hedge Gain | 400 | - |

| Net Portfolio Result (-US$1053.17 + US$400) | -653.17 | - |

However, the short MES hedge gained US$400 as futures prices moved lower over the same period.

While the net result is still a loss, the drawdown narrows to US$653.17 instead of the full decline.

This demonstrates how a simple futures hedge can meaningfully reduce short-term downside risk and help stabilise a portfolio in volatile markets.

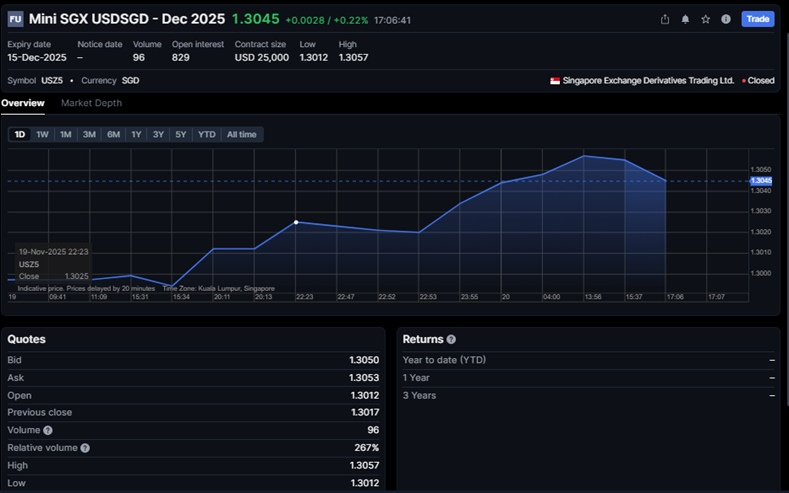

#2 – Currency risk hedging

For many Singapore investors, currency risk is often an overlooked source of volatility.

If you invest in US stocks, US-listed ETFs like SPY or QQQ, or hold USD-denominated bonds, your returns are affected not just by how those assets perform, but also by how the US dollar moves against the Singapore dollar.

When the USD strengthens, currency movements can enhance returns. But when the USD weakens, part (or even all) of the gains may be eroded once converted back into SGD.

This is where FX futures can be used as a risk-management tool, helping investors manage currency exposure without selling their underlying investments.

While USD/SGD futures are commonly used for direct SGD hedging, major currency pairs like EUR/USD, AUD/USD, and USD/JPY are also actively traded and widely used by investors to manage broader USD exposure and global currency risk.

When deciding which FX futures to use, understanding contract sizes across different currency pairs is essential, as this directly affects how much exposure you are hedging:

| FX Futures Contracts Sizes | ||

|---|---|---|

| Currency Pair | Futures Standard Contract Sizes | Micro FX Futures Contract Sizes |

| EUR/USD | 125,000 Euros | 12,500 Euros |

| AUD/USD | 100,000 Australian Dollars | 10,000 Australian Dollars |

| GBP/USD | 62,500 British Pounds | 6,250 British Pounds |

| CAD/USD | 100,000 Canadian Dollars | 10,000 Canadian Dollars |

| JPY USD | 12,500,000 Japanese Yen | 1,250,000 Japanese Yen |

For example, if part of your portfolio is exposed to the euro and you are concerned that the EUR may weaken against the USD, you could use the Micro EUR/USD futures contract (M6E) to hedge that risk.

Each M6E contract represents €12,500, so a 1% move in EUR/USD would translate to roughly €125 in value change per contract (before considering leverage and margin impact).

Because the contract size is small, investors can scale their hedges gradually and match exposure more precisely.

Futures can also be used even when you don’t have an underlying portfolio.

For example, the Japanese yen has experienced some of the largest declines towards the end of 2025, and if you believe the Japanese yen may continue to decline against the USD, you could take a position in Micro JPY/USD (MJY) to express that view directly.

In all cases, it’s important to remember that futures require margin and positions can move quickly, so keeping sufficient buffer helps avoid margin calls.

Hedging and directional trades can both reduce risk or capture opportunities, but they can also limit gains if currencies move in your favour or opposite to your expectations, which is why choosing contracts that reflect the currencies actually driving your portfolio or investment view remains key.

#3 – Hedging against inflation or uncertainty

During periods of elevated inflation or global uncertainty, many investors choose to hold gold as a long-term portfolio stabiliser.

Gold is often held through instruments such as gold ETFs, which provide ongoing exposure to gold prices as a hedge against inflation, currency debasement, or deteriorating risk sentiment.

However, even safe-haven assets like gold can experience sharp pullbacks, especially after strong rallies or when market expectations around interest rates and liquidity shift.

This is where futures can be used as a risk-management tool.

Suppose you already hold a long-term position in a gold ETF as part of your portfolio.

You believe in gold’s role as a hedge over the long run, but you are concerned about near-term volatility or a potential pullback.

Instead of selling your ETF and potentially disrupting your long-term allocation, you could use gold futures to hedge part of that downside risk.

For example, you may take a short position in Micro Gold Futures (MGC) during periods of heightened uncertainty. If gold prices fall in the short term, losses on your ETF position may be partially offset by gains on the futures position.

A Micro-Gold Futures (MGC) contract is usually 10 troy ounces.

If gold is trading at US$4,158.4 per ounce, one MGC contract provides a notional exposure of:

- US$41,584 (10 × US$4,158.4)

If gold prices decline to US$4,105.5, the futures position would gain approximately:

- US$529 (US$52.9 × 10)

This gain can help offset the decline in value of your gold ETF over the same period.

To limit losses, you could set a stop-loss and reassess whether the hedge is still necessary. If uncertainty persists, the hedge can be maintained or rolled forward, and if conditions stabilise, the futures position can be closed while the long-term gold ETF holding remains intact.

How to hedge effectively

Beyond the mechanics, understanding how and when to hedge plays a critical role in helping investors stay disciplined during volatile markets.

James Ooi explains that learning how to hedge can fundamentally change how investors respond to volatility:

“Learning how to hedge helps investors move from merely reacting to market swings to being in control of risk. Instead of selling good assets during a drawdown, hedging allows investors to manage downside, reduce volatility, and stay invested through different market cycles.”

“For retail investors in particular, understanding tools like futures builds discipline and risk awareness. It shifts decision-making away from emotion and toward structured risk control, leading to more consistent portfolio outcomes over time.”

Step 1: Assessment of exposure

Before putting on any hedge, you need clarity on what you’re protecting.

This could be exposure to a specific currency, a broad equity index, individual stocks, or even sector-specific positions.

Take stock of how much of your portfolio sits in each asset class or sector, and identify where the most meaningful risks lie. A good hedge starts with knowing exactly which parts of your portfolio are vulnerable.

Step 2: Choose the right contract

Selecting the appropriate futures contract, both in terms of contract size and expiry, is crucial. Your hedge should closely match the size and nature of your underlying exposure, whether that’s a specific stock, an index, or a currency.

The closer the contract aligns with what you’re trying to protect, the more effective your hedge will be.

Step 3: Determine the hedge ratio

The hedge ratio helps you calculate how many futures contracts you need to offset your exposure.

A simple way to calculate your hedge ratio is:

Number of contracts = Portfolio value ÷ Contract notional value

This provides a practical estimate of how much future exposure is required.

For example, using the earlier illustration:

If your SPY portfolio is worth US$25,000 and the MES contract value is US$34,001.25 (calculated as US$6,800.25 × 5), you would need approximately 1 contract to hedge your position.

Step 4: Monitor and adjust

A hedge is not a “set and forget” tool.

As your portfolio value changes, markets move, or contract expiry approaches, the effectiveness of your hedge can change. Regular monitoring and adjusting when necessary ensures your hedge protection stays effective.

Considerations when hedging with futures

#1 – Basis risk

Futures prices may not always move in perfect sync with the underlying asset. This mismatch can result in either over-hedging or under-hedging.

For example, MES Futures moves by tick size $1.25 (0.25 × $5) while the underlying, SPY, moves directly in dollar terms (e.g., $0.01 increments).

Both generally move in the same direction, but not by the exact same magnitude.

This small mismatch can create slight deviations in hedge effectiveness.

#2 – Position sizing risk

Accurate position sizing is crucial because incorrect sizing can leave gaps in your hedge.

Using the MES example:

- If MES is priced at 6,800.25,

- 1 MES contract = 6,800.25 × $5 = $34,001.25 of exposure.

This means hedging a $30,000 SPY portfolio with 1 MES contract would slightly over-hedge your exposure. If the market moves sharply, this could lead to unintended losses.

#3 – Margin requirements

Futures contracts require both initial and maintenance margin.

Large price swings may trigger margin calls, requiring additional capital to maintain the position.

Most brokers offer margin calculators to estimate initial and maintenance margins before placing the trade.

#4 – Reduced upside potential

A hedge is designed to reduce downside risk, but it can also limit upside if the market rallies.

By offsetting part of your exposure, you’re essentially trading some potential gains for greater stability. It’s important to be comfortable with this trade-off.

Tip:

If you’re new to hedging, consider starting with a paper trading account. It’s a risk-free way to understand how futures behave and how different hedge structures respond to market movements before committing real capital.

When to consider hedging

Investors often turn to hedging when market uncertainty rises, and price swings become harder to predict.

This could be due to macro events, earnings volatility, geopolitical risks, or simply elevated market valuations.

What matters most is having clarity on why you’re hedging.

In practice, futures are often used precisely because they offer flexibility that other risk-management approaches lack.

According to James Ooi:

“Futures are often preferred when investors anticipate a sharp pullback rather than a full trend reversal, and want to hedge temporarily without giving up long-term positions.”

“They are also useful during highly volatile periods, where stop-losses risk being triggered repeatedly, or when markets are closed and liquidity is limited. With near-24-hour trading and relatively low margin requirements, futures allow investors to remain invested while managing risk more efficiently.”

A well-defined objective, whether it’s protecting gains, managing short-term volatility, or cushioning a concentrated position, ensures the hedge you put in place actually aligns with the risk you’re trying to manage.

What would Beansprout do?

Volatility may be an unavoidable part of investing, but how you respond to it doesn’t have to be.

As we’ve seen through 2025’s sharp swings across equities, currencies, and commodities, even a well-constructed portfolio can feel exposed when markets turn quickly.

Hedging with futures offers a practical middle ground, one that lets you stay invested while adding an extra layer of protection.

By understanding what you’re hedging, selecting the right contracts, sizing your positions carefully, and monitoring them over time, you can use futures to cushion the impact of market pullbacks without having to sell your core holdings.

Hedging isn’t about predicting the next move or eliminating all risk. It’s about giving yourself the flexibility to navigate uncertainty with more confidence.

If you are new to futures hedging, the best approach is to start small and learn the mechanics without putting capital at risk.

Test drive your strategy and knowledge using CME's new Trading Simulator for some risk-free practice.

Disclaimer

Any information provided in this article is meant purely for informational and investor education purposes and should not be relied upon as financial or investment advice, or advice on corporate finance.

This article is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to purchase any financial product or subscribe or enter any transaction. This article also does not take into account your personal circumstances, e.g. investment objectives, financial situation or particular needs and shall not constitute financial advice. You should consult your own independent financial, accounting, tax, legal or other competent professional advisors.

The information provided in this article are on an “as is” and “as available” basis without warranty of any kind, whether express or implied. Beansprout does not recommend any particular course of action in relation to any investment product or class of investment products. No information is presented with the intention to induce any person to buy, sell, or hold a particular investment product or class of investment products.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments