Keppel - Sale of M1’s Telco business drives S$1.0 billion in cash proceeds

Stocks

By Gerald Wong, CFA • 11 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Keppel is selling M1's telco business to unlock close to S$1.0 billion in cash proceeds.

What happened?

There has been a hive of activity amongst Singapore blue chip stocks recently.

Recently, we saw DBS' share price reached a record high of above S$50 after it reported a strong set of 1H 2025 results.

REITs have also been purchasing assets, with CapitaLand Integrated Commercial Trust (CICT) buying the remaining 55% stake in CapitaSpring for S$1.05 billion.

It is no wonder that there has been renewed interest in Singapore's stock market in the past few months.

Today, we saw Keppel announcing that it will sell M1’s telco business to Simba for S$1.43 billion.

This led to some discussion in the Beansprout community about what the transaction would mean for Keppel, especially since the share price of Keppel has reached 52-week highs in recent weeks.

Let us dive deeper to find out.

Keppel sells M1's telco business to Simba

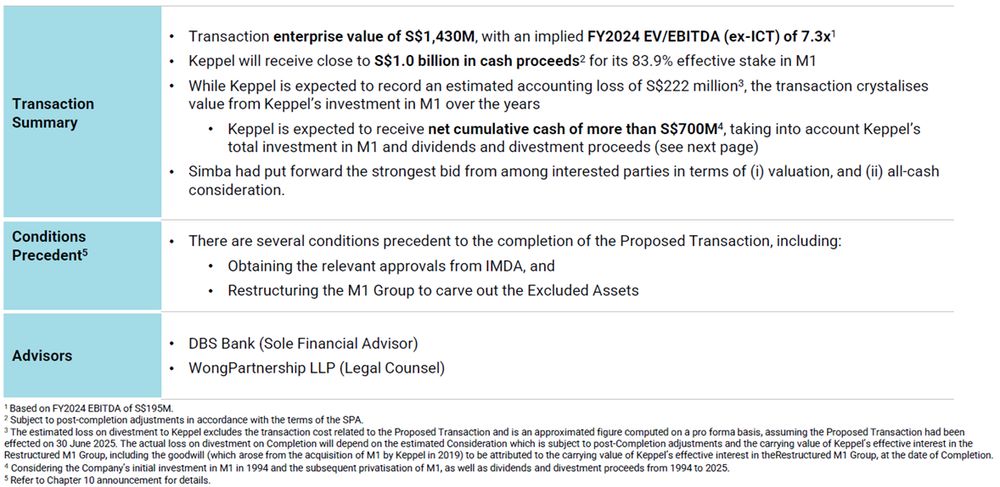

Keppel announced that it will sell the telco business in M1 to Simba for S$1.43 billion.

Based on Keppel’s 83.9% effective stake in M1, Keppel is expected to receive about S$1.0 billion in cash proceeds.

The divestment amount is based on the enterprise value and represents an attractive implied valuation of EV/EBITDA 7.3x.

The divestment is expected to complete in the next few months, subject to regulatory approval. The transaction does not require any shareholder approvals from Keppel nor Simba.

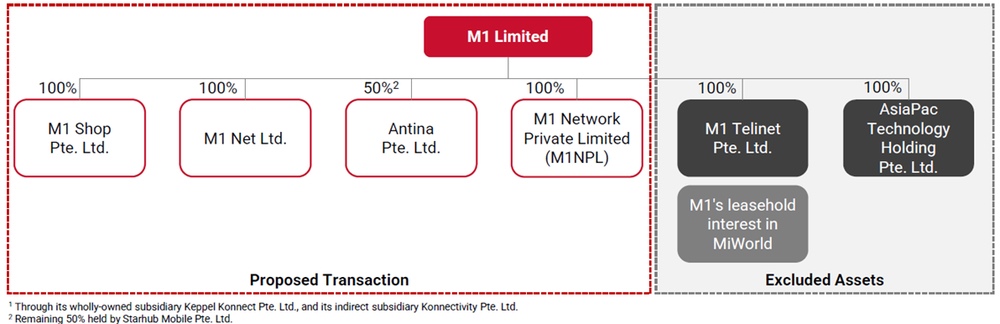

Post the divestment, Keppel will retain M1’s fast-growing ICT business which complements Keppel’s integrated connectivity business, including data centres and subsea cables.

The excluded assets, valued at about S$300m are shown below, in the grey box on the right :

Divestment rationale

According to Keppel, the sale is expected to drive positive financial effects.

It is expected to increase its proforma 1H25 earnings per share (EPS), and improve its return on equity (ROE).

With the cash proceeds of S$1.0 billion, there is scope for management to use the sales proceeds for investment into growth opportunities, to reduce debt and to reward shareholders.

#1 – Positive earnings impact based on 1H25 pro forma earnings per share

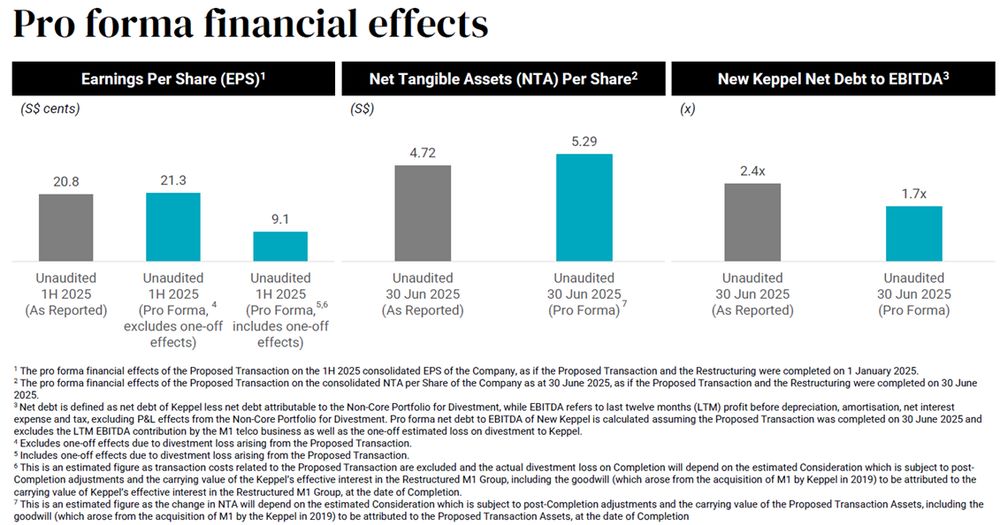

The sale of M1's telco business is expected to be accretive to Keppel's earnings per share (EPS).

Excluding M1's telco business on a pro forma basis, 1H25 EPS is expected to improve to 21.3 cents, an increase of 2.4% from the reported 1H25 EPS of 20.8 cents.

However, Keppel is expected to book an estimated accounting loss of S$222 million in the near term with the sale of M1's telco business.

It is estimated that M1 contributed about S$40-50 million in net profit to Keppel in FY2025. Assuming S$25 million in 1H25, this represents about 5.8% of Keppel's 1H25 net profit of S$431 million (excluding non-core portfolio for divestment).

While the sale will lead to a loss of profit contribution from M1 in the near term, new earnings contributors from the Infrastructure and Connectivity segments may help to drive future earnings growth.

For example, the hydrogen-compatible Keppel Sakra Cogen Plant is on track to start operations in 1H 2026. In addition, Keppel plans to grow the data centre portfolio’s gross power capacity from 650 MW in 2024, to 1.2 GW in the next few years. The Bifrost Cable System is expected to complete in 2H25 with more subsea cable systems planned.

#2 - Cash proceeds would improve balance sheet

Management plans to use the cash proceeds to fund growth opportunities, lower the company’s debt and to reward shareholders.

The S$1.0 billion in cash proceeds is expected to strengthen Keppel's balance sheet.

Proforma net debt to EBITDA as of 30 Jun 2025 would improve to 1.7x, compared with the reported 2.4x.

#3– Strategic focus as an asset-light global asset manager and operator

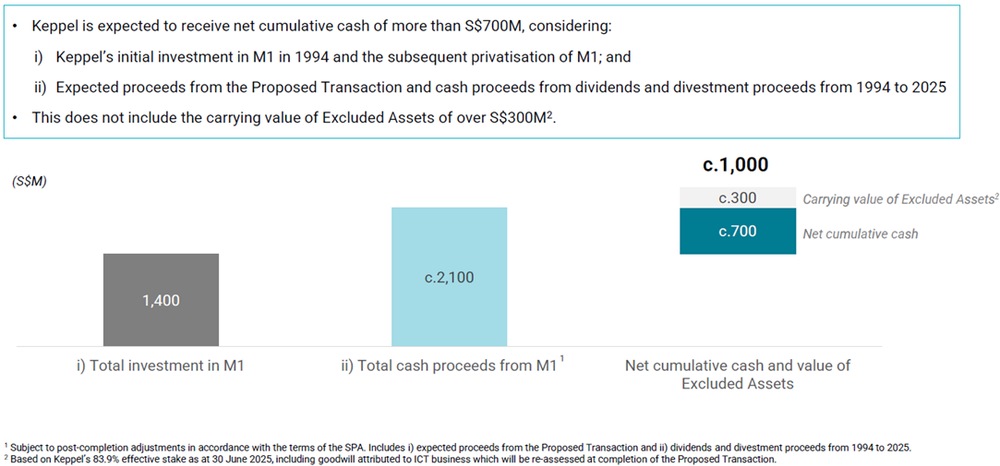

The divestment crystallised the value of Keppel’s investment in M1 over the years. Having invested in M1 in 1994, the current divestment is expected to realise the investment gains of around S$1.0 billion.

As part of the business transformation into a global asset manager and operator, Keppel has identified S$14.4 billion of non-core portfolio for monetisation.

M1’s telco business is not part of the identified non-core portfolio but the consumer telco business of M1 is a non-core business to Keppel.

Divesting the consumer telco business lowers the capital expenditure needed to maintain this segment. Retaining M1’s ICT business sharpens the company’s focus within the Connectivity segment.

Management expects the high growth ICT business and the assets including data centres and subsea cables, to complement Keppel’s integrated connectivity business.

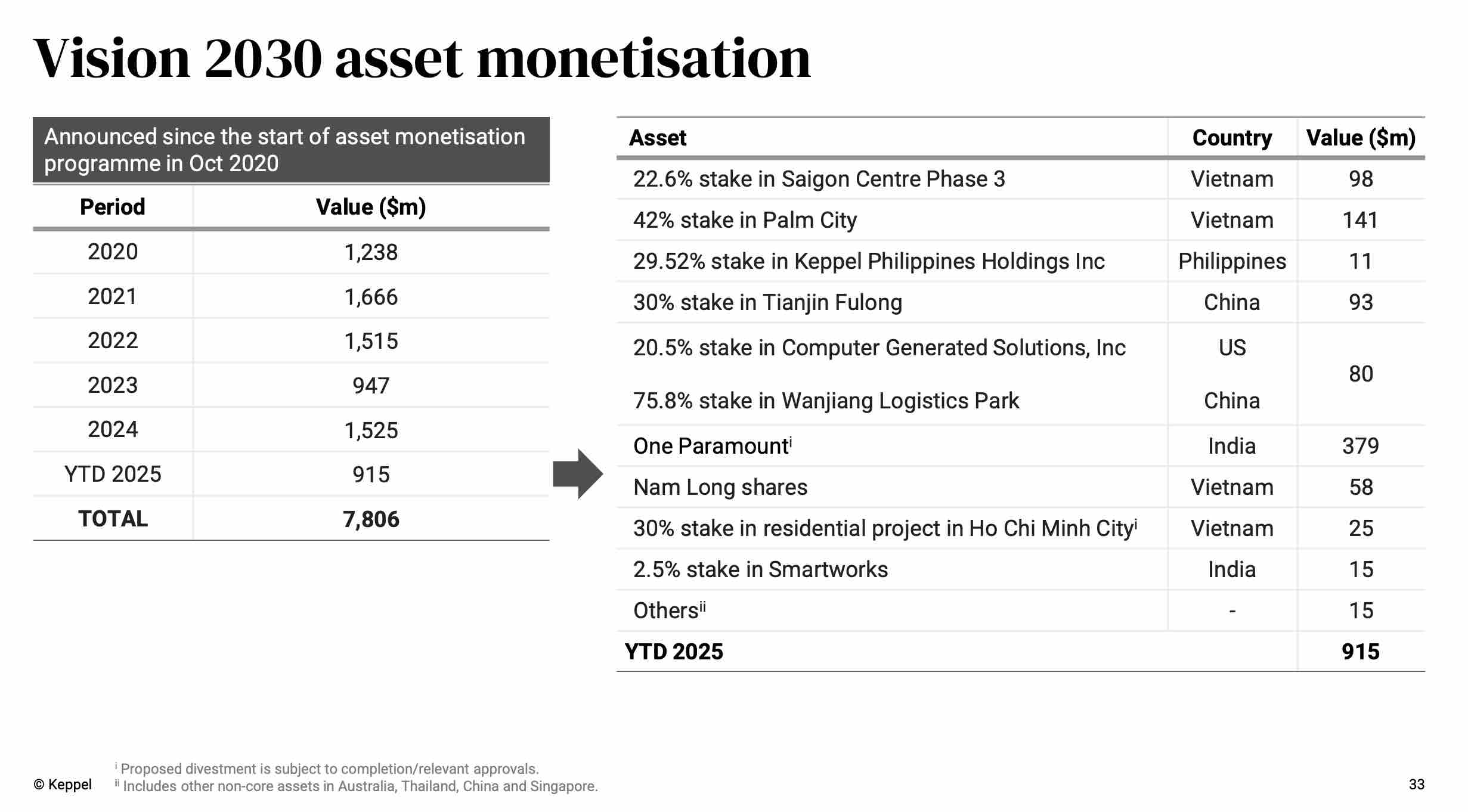

Since embarking on its $17.5 billion asset monetisation programme in October 2020, Keppel has announced over $7.8 billion in monetisation to date.

This include the announcement of divestment of about S$915 million of assets year-to-date, excluding the sale of M1's telco business.

As a result, it has reaffirmed its asset monetisation target to S$10 to S$12 billion by end 2026 as the recent Investor Day in May 2025.

Management will decide on the allocation of use of cash proceeds when the transaction is completed.

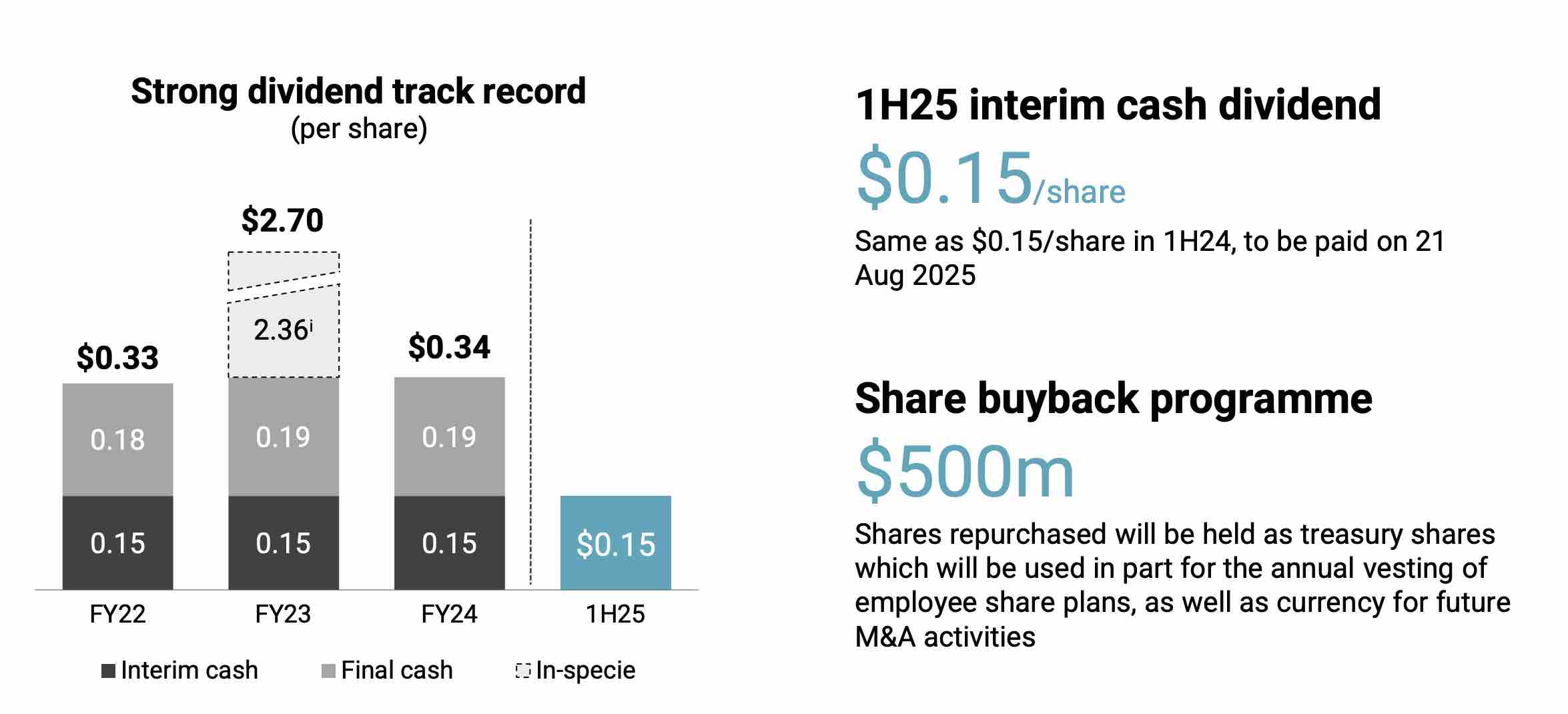

In its recent 1H 2025 results, Keppel announced an interim dividend per share of 15.0 cents, unchanged from the previous year.

On the back of Keppel’s progress in asset monetisation, Keppel recently announced a S$500 million Share Buyback Programme where the company will progressively repurchase its shares from the open market

Who is Simba and what's the impact to Singapore's telco sector?

Simba, formely known as TPG Singapore, is a Singapore telco that secured the fourth telco license.

Apart from M1 and Simba, the other key telcos are Singtel and Starhub.

According to Keppel, the combined Simba and M1’s telco business is expected to scale more efficiently with accelerated investments into 5G and digital infrastructure.

What would Beansprout do?

Keppel's share price has surged recently following its Investor Day in May, and 1H 2025 earnings where the company reported a 25% increase in net profit (excluding non-core portfolio for divestment).

Based on its share price of S$8.58, the share price has risen by 48% over the past 1 year, outperforming a 30% increase for Singapore's benchmark STI index.

The divestment of M1's telco business is likely to be taken positively by investors.

It is expected to be boost Keppel's earnings per share on a pro-forma basis, and improve the company's returns.

The cash proceeds of S$1.0 billion would also help to improve the company's balance sheet.

Strategically, the sale of M1's telco business is expected to accelerate Keppel's transformation into an asset-light asset manager and operator.

It would also put the company closer to achieving its target of S$10 to S$12 billion of asset monetisation by end-2026.

Based on Keppel's dividend payout of S$0.34 per share in FY 2024, Keppel offers a dividend yield of 4.0%.

Related links:

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in Keppel.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments