Keppel REIT expands in Australia with S$335 million shopping mall purchase

REITs

By Gerald Wong, CFA • 08 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Keppel REIT has announced the acquisition of a suburban shopping mall in Sydney, Australia, as well as a private placement to fund the purchase.

What happened?

Recently, Singapore REITs have been on a shopping spree.

We have seen Keppel DC REIT acquiring a Japan data centre, CapitaLand Ascendas REIT expanding its Singapore portfolio, and CapitaLand Integrated Commercial Trust (CICT) buying CapitaSpring in the past few months.

The lower interest rates have provided an opportunity for Singapore REITs to pursue growth opportunities through asset acquisition once again.

This has helped to boost the dividend yields offered by Singapore REITs to above the T-bill yields.

Recently, Keppel REIT has announced the acquisition of a suburban shopping mall in Sydney, Australia, as well as a private placement to fund the purchase.

Let us dive deeper into the acquisition to find out how it may also help to lift Keppel REIT’s dividend yield.

Acquisition of Top Ryde City Shopping Centre

Keppel REIT is acquiring a 75% effective interest in Top Ryde City Shopping Centre, a freehold retail mall in Sydney, Australia for A$393.8 million (approximately S$334.8 million).

The remaining 25% effective interest will be acquired by a wholly owned subsidiary of MA Financial Group.

The wholly owned subsidiaries of MA Financials will also be the asset manager and property manager for Top Ryde City Shopping Centre.

For its 75% stake, Keppel REIT will pay A$295.35 million (approximately S$251.1 million) for the acquisition.

Of the purchase consideration, 60% of this will be funded from the fully underwritten private placement and the issuance of subordinated perpetual securities.

The remaining 40% will be funded from 100% Australian dollar-denominated debt.

The purchase price of A$393.8 million is in line with the asset’s independent valuation including the rental guarantee, and represents a 2.2% premium to the valuation of A$385.5 million excluding the rental guarantee.

As part of the transaction, the vendor will provide approximately A$11.4 million to support potential rental shortfalls and leasing-related costs arising from existing or future vacancies.

The transaction is expected to complete by 1Q2026, subject to regulatory approval.

About Top Ryde City Shopping Centre

Top Ryde City Shopping Centre is a high-quality, freehold mall, located along Devlin Street, which is part of the A3 arterial route connecting northern and southern Sydney.

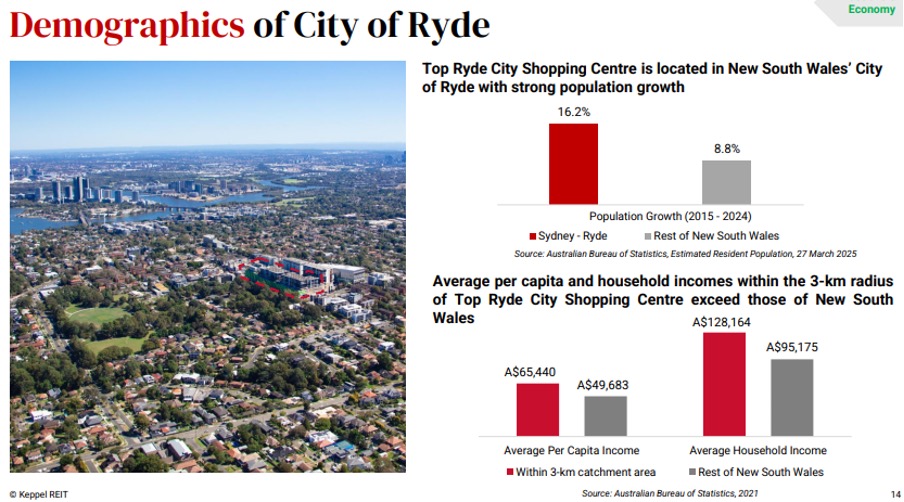

It is situated in the city of Ryde, a region which has strong population growth and higher average household income, compared to the rest of the New South Wales region.

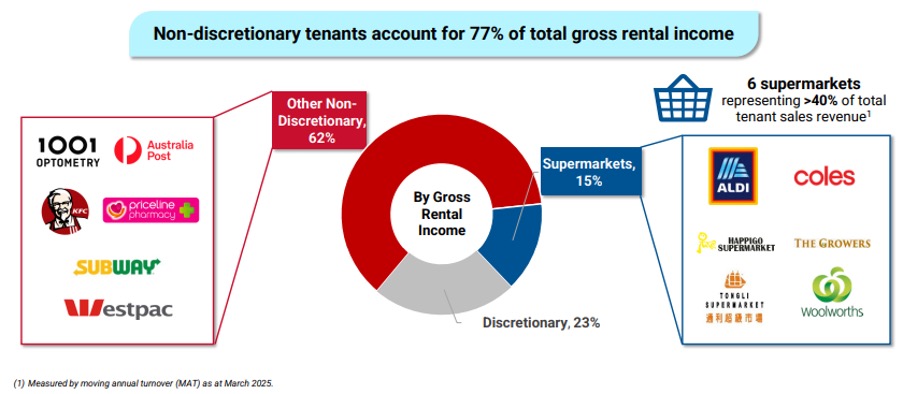

The mall is part of a mixed-use development which includes a residential component and non-discretionary tenants accounting for 77% of the total gross rental income.

The mall is anchored by 6 supermarkets, including ALDI, Coles, Woolworths and others, as well as Big W and Kmart.

It is a defensive asset with high committed occupancy rate of >95% since 2023.

As of June 2025, the occupancy rate stands at 96% with a weighted average lease expiry of 4.2 years by committed gross rent.

First foray into pure-play retail asset

This acquisition marks Keppel REIT’s first foray into first pure-play retail asset.

The management believes this acquisition could help diversify its portfolio and enhance portfolio resilience in the long term.

Retail assets continue to offer attractive yields, and suburban retail particularly, has shown strong resilience and good growth potential.

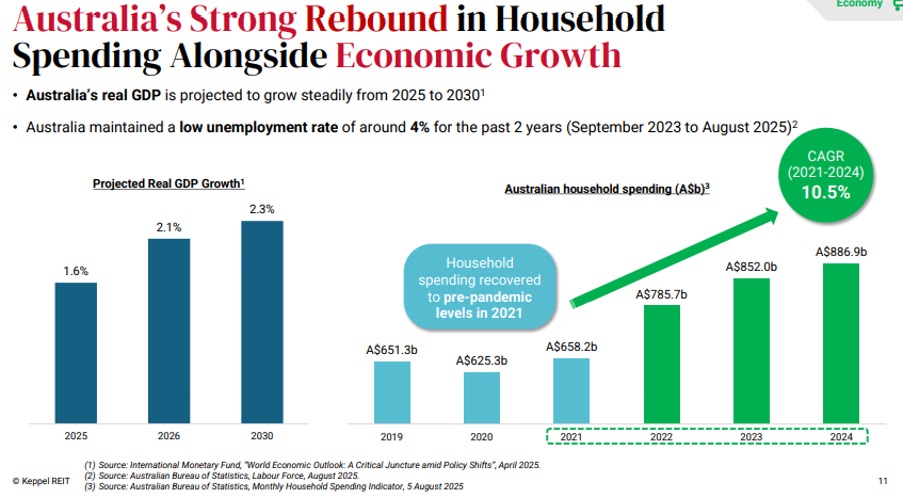

The mall offers exposure to the strong Australia’s economy, underpinned by strong fundamentals and sustained consumer demand.

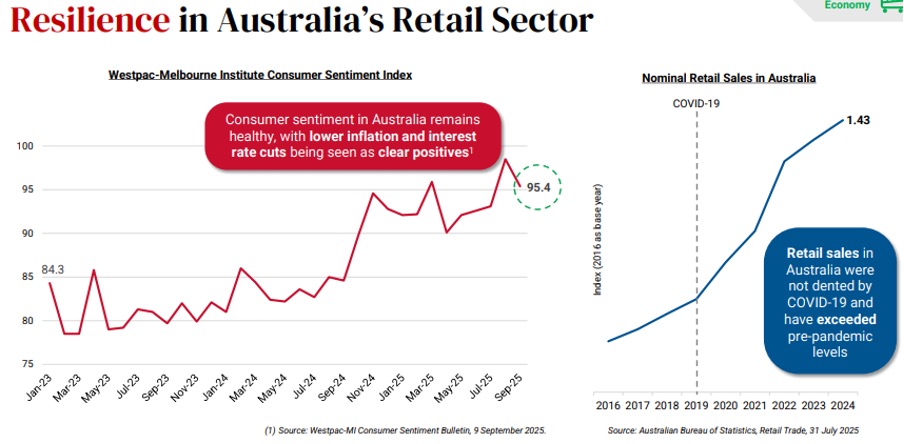

Australia’s retail sector has demonstrated resilience as retail sales were not impacted by Covid-19 and have even exceeded pre-pandemic levels.

In addition, as the population in Australia continues to grow, retail space per capita is projected to decline.

This diverging trend underscores the attractiveness of suburban retail assets.

Accretion to distribution per unit (DPU)

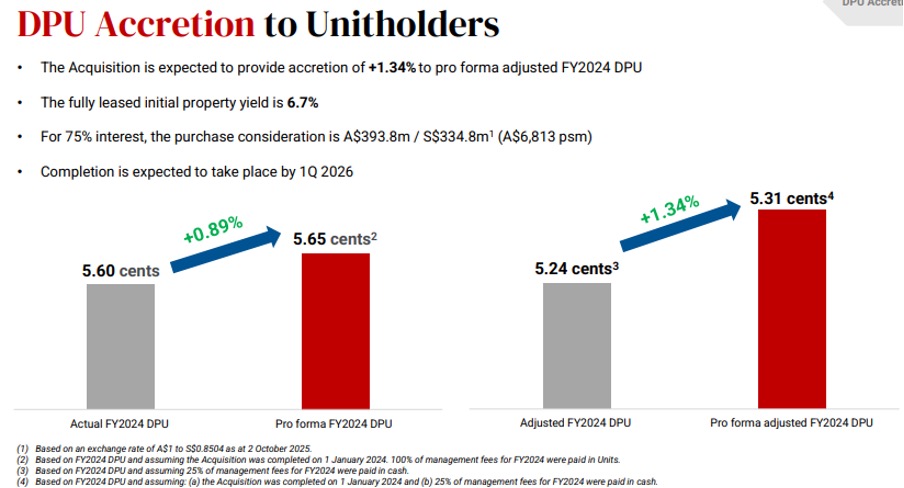

On a pro forma basis, Keppel REIT’s FY2024 distribution per unit (DPU) would have risen by 0.9% to 5.65 cents.

Assuming 25% of management fees are paid in cash, DPU would have risen 1.3% to 5.31 cents on an adjusted pro-forma basis.

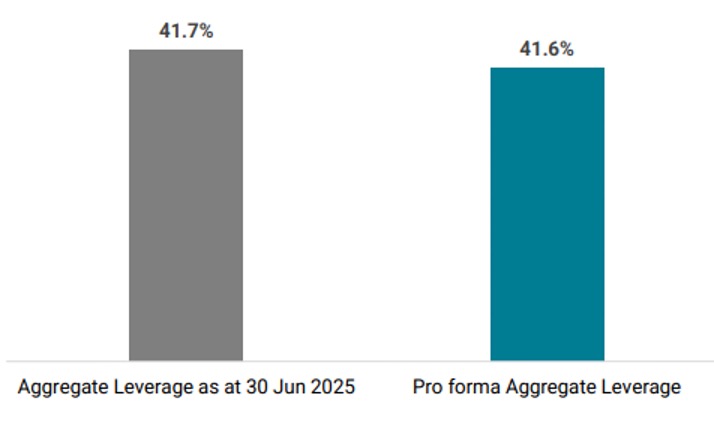

Following the acquisition, the REIT’s aggregate leverage is estimated to decrease slightly from 41.7% to 41.6% as of 1H2025.

Enhance portfolio resilience

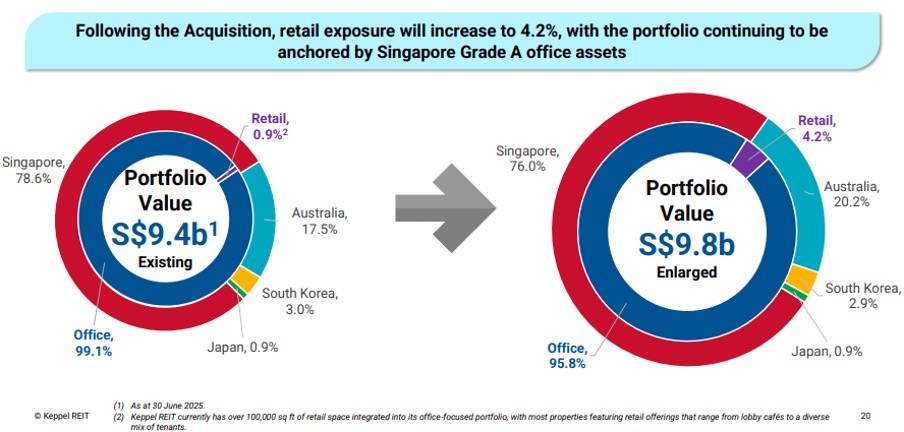

Currently, Keppel REIT has more than 100,000 square feet of retail space integrated into its office-focused portfolio, with most properties featuring retail options that range from lobby cafés to a diverse mix of tenants.

Post acquisition, Keppel REIT’s Singapore-centric portfolio value will increase to S$9.8 billion across 14 properties in Singapore (76.0%), Australia (20.2%), South Korea (2.9%) and Japan (0.9%).

Office assets would comprise 95.8% and retail assets would comprise 4.2% of the portfolio value.

The management has shared that Keppel REIT will continue to be Singapore-centric and office-focussed. Retail assets will not exceed 20% of its total portfolio value in the long term.

Private placement

To fund part of the acquisition, Keppel REIT announced a fully underwritten private placement to raise S$113.0 million.

A total of 112.5 million units (approximately 2.89% of total number of units currently in issue) will be issued at a price range of between S$0.983 and S$1.004.

I saw a question in the Beansprout community about whether retail investors can participate in the private placement of Keppel REIT.

It is worth noting that unlike the preferential offering of Keppel DC REIT, the private placement is to institutional, accredited and other investors.

What would Beansprout do?

Keppel REIT’s acquisition of Top Ryde City Shopping Centre marks its entry into a pure-play retail asset and helps the REIT which is largely focused on Singapore office assets currently to diversify its portfolio.

The freehold suburban mall enjoys a 96% occupancy rate and a strong tenant mix anchored by major supermarkets, offering stable rental income.

According the the management of Keppel REIT, the deal is expected to lift FY2024 DPU by 0.9% to 5.65 cents.

Keppel REIT currently trades at a dividend yield of 5.8%, close to its historical average.

We note that Keppel REIT is one of the best-performing Singapore REITs year-to-date, with a share price gain of 18.4% so far this year.

Following the bounce in Keppel REIT's share price, it is currently trading at a P/B ratio of 0.84x, above its historical average P/B ratio.

You can read about our outlook for Singapore REITs in a falling interest rate environment here.

To screen for Singapore REITs with lowest price-to-book valuation or highest dividend yield, check out our best Singapore REIT screener.

If you are new to investing in Singapore REITs, you can start to learn more about Singapore REITs here.

If you prefer diversification without picking individual REITs, you can also gain exposure through Singapore REIT ETFs.

Related links:

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in Keppel REIT.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments