OCBC 360 Review: Is it worth making this your main savings account?

Savings Account

By Beansprout • 02 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The OCBC 360 account offers bonus interest on your savings when you credit your salary, grow your balance, or insure/invest with OCBC. Read our comprehensive review to see if it’s the right high yield savings account for you.

What is the OCBC 360 account?

The OCBC 360 account is one of Singapore’s most popular high-yield savings accounts, offering up to 2.45% p.a. effective interest on the first S$100,000 of your deposits when you credit your salary, save, and spend..

As OCBC’s flagship savings account, the 360 Account rewards you for everyday banking behaviour but you’ll need to meet certain criteria to unlock the higher interest rates.

Let’s take a closer look at how the OCBC 360 Account works, and how you can make the most of it.

What is the interest rate on the OCBC 360 account?

The OCBC 360 Account offers an interest rate of up to 2.45% p.a. on the first S$100,000 of your deposits when you credit your salary, save, and spend.

You can earn an additional 3.00% a year when you insure and invest with your OCBC 360 account.

Note that you will earn a base interest of 0.05% a year on your entire account balance regardless of whether you fulfil the below categories.

Like the UOB One account and DBS Multiplier account, the OCBC 360 account offers a tiered interest rate depending on the amount of deposit in the account and your ability to meet different categories.

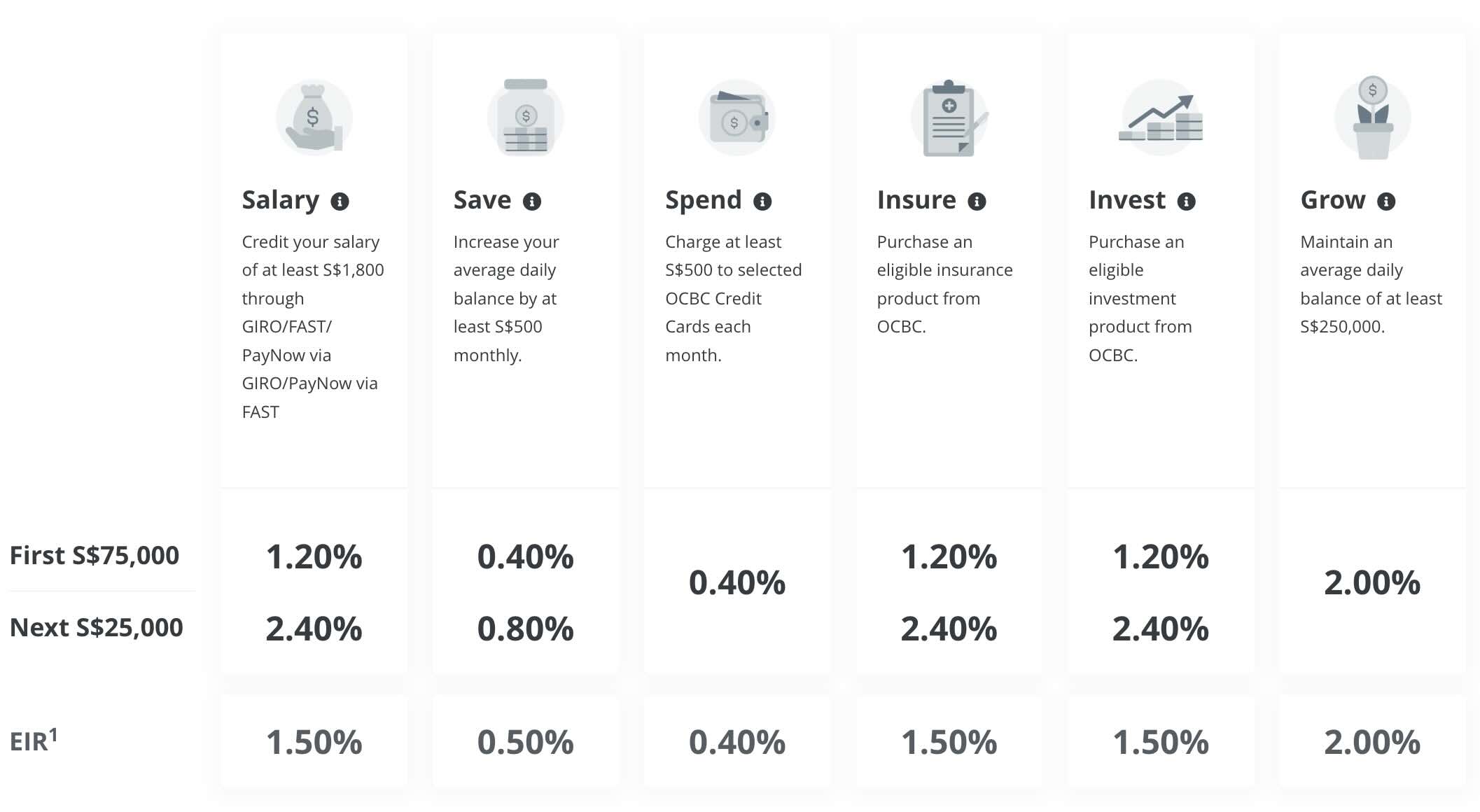

These categories include the following:

Salary: Credit your salary of at least S$1,800 through Giro

Save: Increase your average daily balance by at least S$500 monthly

Spend: Charge at least S$500 to selected OCBC credit cards each month

Insure: Purchase an eligible insurance product from OCBC

Invest: Purchase an eligible investment product from OCBC

Grow: Maintain an average daily balance of at least S$250,000

The interest rate you are able to earn on the OCBC 360 account will then depend on how many of these categories you are able to meet.

We can look at the effective interest rate (EIR) earned on the OCBC 360 account across various tiers. To calculate the effective interest rate, we can add the total interest received across different tiers.

The effective interest rate is the average interest rate you would get by dividing the total interest earned by your average balances.

Below is the maximum EIR as of 2 January 2025:

| Bonus Category | Criteria | Bonus Interest (p.a.) |

| Salary | Credit ≥ S$1,800 via GIRO/FAST/PayNow | 1.20% (first S$75k), 2.40% (next S$25k) |

| Save | Increase balance by ≥ S$500 monthly | 0.40% (first S$75k), 0.80% (next S$25k) |

| Spend | Spend ≥ S$500 on selected OCBC cards | 0.40% (first S$75k) |

| Insure | Buy eligible insurance | 1.20% (on first S$75k for 12 months) 2.40% (on next S$25k for 12 months) |

| Invest | Buy eligible investment | 1.20% (on first S$75k for 12 months) 2.40% (on next S$25k for 12 months) |

| Grow | Maintain ≥ S$250k avg. daily balance | 2.00% (on first S$100k) |

You will still earn a base interest of 0.05% p.a. on your account balance regardless of bonus category fulfilment.

This would mean that the maximum effective interest rates for meeting each criteria will be the following from 1 August 2025:

| OCBC 360 Maximum Effective Interest Rates (from 1 August 2025) | |

| Categories Met | Estimated Max EIR (p.a.) |

| Salary + Save | 2.05% |

| Salary + Save + Spend | 2.45% |

| Salary + Save + Spend + Insure / Invest | 3.95% |

| Salary + Save + Spend + Insure + Invest | 5.45% |

How do I earn the maximum interest rate of 5.45% per annum on the OCBC 360 account?

If you are able to hit the salary, save, spend, insure and invest categories and have S$100,000 of deposits in the OCBC 360 account, you will earn the maximum effective interest rate of 5.45% per annum.

The insure and invest categories will be harder to hit, which is why you get a much higher interest rate if you are able to fulfil them!

To qualify for the insurance and/or investment interest rate, you will need to purchase an eligible product from OCBC. The keyword here is eligible and it comes with a price tag.

For insurance, you need to purchase a minimum amount of S$2,000 for Regular Premium: Protection/Legacy product, S$4,000 for Regular Premium: Endowment/Retirement product or S$20,000 for Single Premium Insurance product.

For Investment, you need to purchase a minimum amount of S$20,000 for Unit trusts and structured deposits or S$200,000 for bonds and structured products.

You should note that the financial products you buy will only qualify for 12 months of bonus interest.

This means that you will need to buy another financial product after the 12 months is up. The question you’ll have to ask yourself is whether you’d want to buy another insurance product next year.

What are the requirements for the OCBC 360 account?

To apply for the OCBC 360 account, you will need to be at least 18 years old.

You will need to make an initial deposit of S$1,000 and maintain a minimum average daily balance of S$3,000.

A fall-below fee of S$2 will be imposed if your minimum average daily balance falls below S$3,000. However, the good news is that the fall-below fee will be waived for the first year.

UOB One vs OCBC 360 vs DBS Multiplier – Which is the best savings account in Singapore?

Many of you are probably wondering if the OCBC 360 account is better than the UOB One account and DBS Multiplier account.

This is especially so after the DBS Multiplier account was made simpler with effect from 1 August 2023.

As there are many tiers involved, we have done the math to find out which is the best savings account in Singapore.

Our calculation is based on a few assumptions –

- You do not buy insurance/investment products from the Bank

- You save and/or spend at least S$500 respectively a month and

- You credit your monthly salary into the bank

- You spend the minimum amount with their credit cards

Here, we can see which bank offers the best interest rate across the various balance amount shown below.

Account monthly average balance | Maximum effective interest rate (per annum) | Winner |

| First S$75,000 |

| OCBC 360 |

| More than S$75,000 Less than S$100,000 |

| OCBC 360 |

| More than S$100,000 Less than S$150,000 |

| UOB One |

| More than S$150,000 Less than S$250,000 |

| UOB One |

| S$250,000 |

| OCBC 360 |

| Source: Various bank websites, Beansprout Compare Savings Accounts tool, as of 2 January 2026 | ||

Are there any sign-up promos for the OCBC 360 account?

If you are opening an OCBC 360 account, you can enjoy a welcome perk depending on whether you are new to OCBC or already banking with them.

- New OCBC customers: Credit a salary of at least S$1,800 into your 360 Account by the next month after account opening, and you’ll get a 1-year Disney+ Premium subscription worth S$189.98.

- Existing OCBC customers: Credit the same minimum salary, and you’ll receive an S$80 cash reward.

For new customers, the Disney+ redemption code will be emailed by the 15th working day of the following month.

How to open a OCBC 360 Account

You can open a savings account online here, or head down to a OCBC branch.

To apply you will require the following:

- Singaporeans and Singapore PRs: NRIC and an image of your signature

- Foreigners: Passport and a valid pass (e.g. Employment Pass (EP) or S-Pass or Student Pass)

In addition, you will need any one of the following documents that shows your residential address

- Phone bill

- Half-yearly CPF statement

- Any bank statement

Final verdict on OCBC 360 account

The OCBC 360 account offers an attractive interest rate of up to 2.45% per annum if you are able to credit your salary into the OCBC 360 account, increase your average daily balance by $500 and spend at least $500 on an OCBC 365 credit card every month.

However, the hurdle is fairly high to get to the interest rate tier of 5.45% per annum unless you invest and insure with OCBC.

That said, it still offer one of the highest interest rates for savings accounts in Singapore if you are able to meet the salary credit criteria.

The interest rate offered by the OCBC 360 account is also higher than the latest T-bill and it has the higher rate than the latest Singapore Savings Bond.

Like many other savings accounts in Singapore, the interest rate on the OCBC 360 accounts falls to 0.05% per annum for the portion of your monthly average balances above S$100,000.

To maximise your interest earned, you might want to consider another high yield savings account for balances above S$100,000.

To find out other ways to make your savings work hard, check out our guide to best ways to earn a passive income in Singapore.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest tips on making your savings work harder.

Find out which savings account allows you to earn the highest interest rate on your savings.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

2 questions

- wong C • 03 May 2025 04:10 AM

- landi • 07 Nov 2024 03:42 AM

- perry • 27 Nov 2024 07:09 AM