Silver nears record highs. Can it outshine gold?

Commodities

By Ng Hui Min • 26 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Silver prices recently hit record highs, sparking comparisons with gold. Find out whether gold or silver offers better opportunities for investors in 2025.

What happened?

Like gold prices, silver prices have surged recently.

Silver recently reached a record high of US$53.6 per ounce, outpacing gold’s rally on a percentage basis.

While the price of silver has moderated since then to below US$50 per ounce, I have still seen a lot of discussion in the Beansprout community comparing silver and gold as investment options.

Earlier, we have explored what is driving gold's rally and if the momentum can continue. We also looked at various ways that we can buy gold in Singapore.

In this article, we will dive into what is driving the rally in silver prices, and whether it is a good alternative to gold for those looking to diversify their portfolios.

What is driving demand for silver?

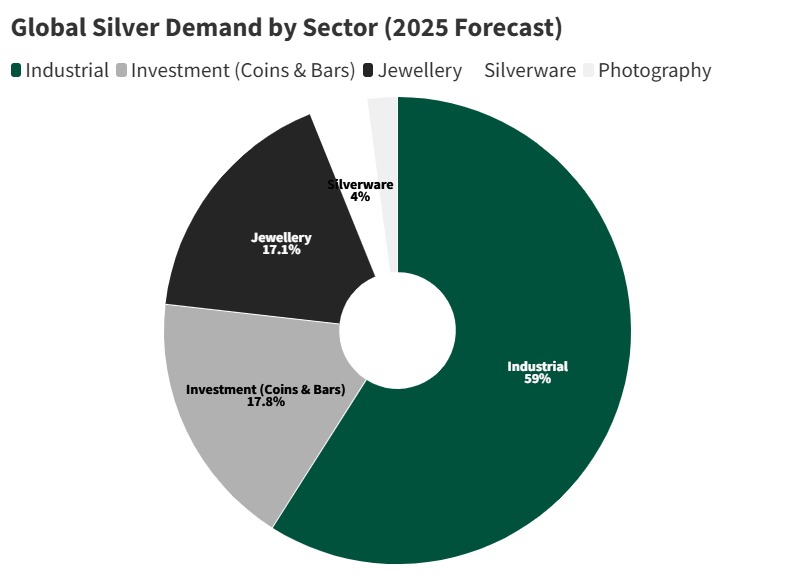

Silver has a unique dual role as both an industrial metal and an investment asset.

A large part of silver’s consumption (around 59%) is industrial, as it is an indispensable component in high-growth, modern technologies, e.g. solar, electronics and EVs.

Silver has a role to play in the green energy transition story as silver is critical for solar panels (photovoltaics) which is seeing strong demand.

Silver is also an important component for electric vehicles, as well as 5G technology, advanced electronics and AI hardware.

On the investment side, silver is riding the same safe-haven wave that has propelled gold.

Investors are buying silver as protection against inflation, currency debasement, and geopolitical uncertainty.

Similar to gold, silver also has a safe haven appeal. It also benefits from global economic uncertainty, geopolitical risks and concerns about inflation and fiat currency stability.

The expectation of a weaker U.S. dollar and interest rate cuts by central banks makes non-yielding assets more attractive, boosting precious metals across the board.

Importantly, silver also benefits from momentum-driven flows.

#1 - Supply Constraints and Market Tightness

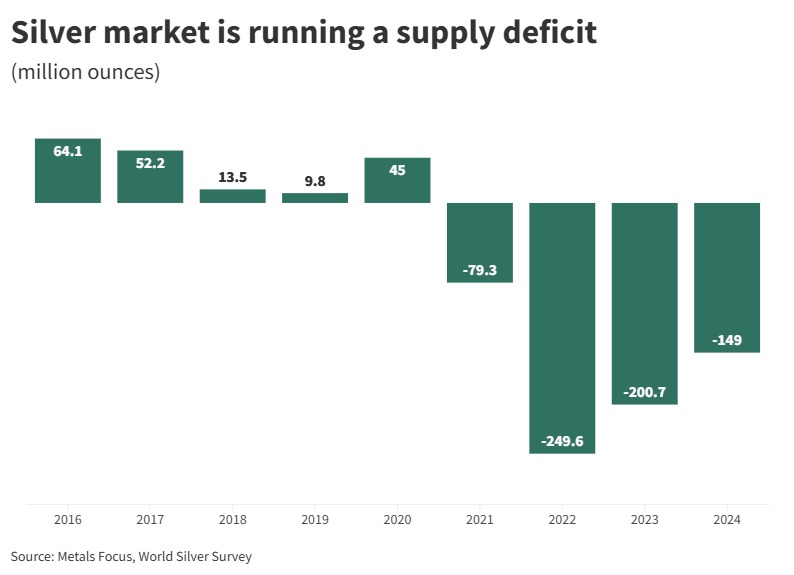

The market is facing a structural supply deficit, meaning demand has consistently outpaced new supply for several years.

About 70% of silver is mined as a byproduct of other metals (like copper, lead, and zinc).

This means supply cannot quickly ramp up simply because silver prices are high; its production is tied to the economics of base metals.

This deficit, combined with the surge in buying, has led to extreme tightness in the physical market.

The cost to borrow physical silver in the London market (lease rates) has exploded, a sign of severe scarcity.

Significant physical demand, particularly from countries like India (which is a massive consumer), has depleted readily available inventory in major trading hubs.

What drove silver’s outperformance to gold recently?

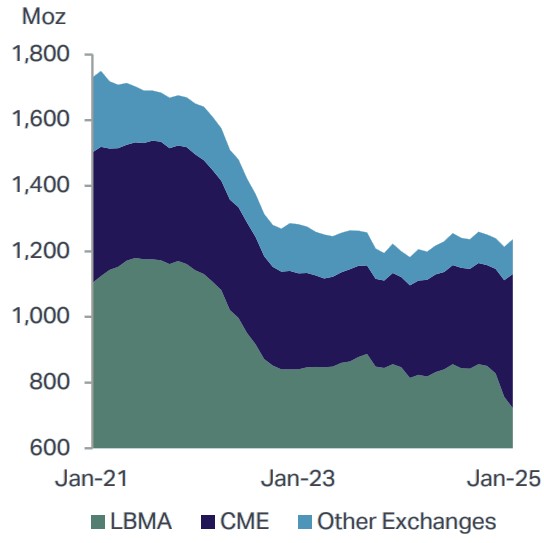

One of the reason is the increasingly low inventory levels in London compared to New York has led to a short squeeze.

Heavy buying, particularly from India, drained inventories in London vaults.

As a result, lease rates — the cost to borrow physical silver — spiked to multi-year highs, signaling acute scarcity.

Traders who had sold silver forward were forced to cover positions, driving a classic short squeeze.

Figure: London & Exchange* Vault Inventories

Source: Metals Focus, LBMA, Respective Exchanges, World Silver Survey

Why are we seeing strong demand from India?

The run-up to Diwali on October 20 has supercharged silver demand in India, traditionally one of the busiest periods for precious metal buying.

Imports have almost doubled compared to last year as jewellers scrambled to restock despite soaring bullion prices.

On the ground, buyers are now paying premiums of more than 10% above global benchmark prices — a clear sign of how tight supply has become.

This surge in Indian demand has drawn even more silver out of Western vaults, adding pressure to an already squeezed physical market.

Silver vs Gold - What to Look Out For?

Looking ahead, investors in silver can look out for a few factors.

#1 - State of industrial demand

Silver’s long-term bull case rests heavily on the growth of solar panels, electric vehicles, and advanced electronics.

Any slowdown in these sectors — for example from weaker global manufacturing or a pullback in clean energy subsidies — could take the shine off silver demand.

#2 - Changes in investor sentiment

Silver’s smaller market size means even modest shifts in capital flows can drive big price moves.

If the fear trade eases or investors rotate back into equities, silver could correct sharply, particularly given the lack of central bank buying as a stabilizing force.

#3 - Supply conditions in the London market

The recent squeeze has been a powerful driver of the rally, but if inventories rebuild or lease rates normalize, the urgency in physical buying could fade.

That would remove an important source of upward momentum.

#4 - Gold-to-silver ratio

The gold-to-silver ratio remains an important indicator.

The ratio measures the amount of silver to equal the value of one ounce of gold.

Currently, the gold-to-silver ratio is at about 84. This means that it takes about 84 ounces of silver to equal the value of one ounce of gold.

The ratio has bounced from its 1-year low of about 78.

This may indicate that silver’s period of outperformance relative to gold is losing steam.

What would Beansprout do?

Silver has surged to near record highs in October, driven partly by a liquidity squeeze in London.

Despite the momentum, we should be mindful of the risks when investing in silver.

Unlike gold, silver doesn’t benefit from steady central bank demand. Gold remains around ten times scarcer and far more practical for reserve managers, making it the preferred safe-haven asset.

Silver, on the other hand, is closely tied to industrial demand in sectors such as solar panels, electronics, and electric vehicles. That gives it long-term potential from the green energy transition, but also exposes it to cyclical swings.

Because the silver market is only about one-ninth the size of gold’s, prices tend to move more sharply in both directions.

This volatility may offer larger potential upside during rallies, but also deeper pullbacks when sentiment turns. Hence, silver may present more tactical opportunities rather than a portfolio core.

Gold may remain more steady as an anchor for investors looking to diversify their portfolios into precious metals. Learn more about our views on gold here.

If you are keen to invest in gold, check out our guide to on how to buy gold in Singapore. You can also find out how to buy gold from UOB.

If you are keen to invest in silver, check out our guide on how to buy silver in Singapore.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments