Silver hits record high. Here's how to buy silver in Singapore (2025)

alternative asset 101

By Gerald Wong, CFA • 25 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Learn how to buy silver in Singapore in 2025, from physical silver bullion bars to ETFs and silver savings accounts.

What happened?

Gold and silver have been making the headline recently.

With gold reaching record highs, silver has also followed suit and hit an all-time high at US$54 per ounce on 16 October 2025.

After we shared how to buy gold in Singapore and how to buy gold from UOB, I have seen some discussion in the Beansprout community about to buy silver in Singapore.

With its lower price per ounce compared to gold, silver offers investors a more affordable entry point into precious metals.

However, before investing into silver, understanding what drives silver’s value can help decide if it deserves a place in your portfolio.

In this article, we will explore the different ways to gain exposure to silver investment and understand silver as an asset class.

How to buy silver in Singapore?

There are a few ways to invest in silver in Singapore, depending on how actively you want to manage your investment.

Like gold, investors may choose to buy and hold physical silver bars or coins, open a silver savings account with a bank, or gain exposure through silver ETFs and stocks listed on the stock market, or trade silver CFDs.

Each option comes with its own set of risks, liquidity, and costs, so it’s important to understand how each works before getting started.

| Investment option | Liquidity | Fees | Ownership |

|---|---|---|---|

| Physical Silver | Low | High | Direct |

| Silver Savings Account | High | Moderate | Indirect |

| Silver Stock/ETFs | High | Low | Indirect |

| Silver CFDs/futures | High | Moderate | No ownership or indirect |

Here’s a closer look at the main ways you may buy silver and what to consider for each.

Buying physical silver bullion in Singapore

If you prefer the reassurance of owning silver directly, you may want to consider buying physical silver such as silver bullion bars & coins.

In Singapore, physical silver can be purchased from UOB’s Main Branch or authorised bullion dealers such as BullionStar and Silver Bullion, which offer a wide range of internationally recognised products.

Common sizes include 1-ounce, 10-ounce, and 1-kilogram bars. Prices are quoted based on the global silver spot rate plus a dealer premium.

Owning physical silver comes with other practical considerations:

Pros of owning physical silver:

- Direct ownership: Physical silver is a tangible asset that you fully own, providing reassurance and control over your investment.

- No counterparty risk: Your holdings are not dependent on any bank, broker, or third party.

Cons of owning physical silver:

- Storage and security: Storing silver at banks or with vaulting providers will incur additional storage and insurance costs.

- Liquidity challenges: Selling physical silver may take time and may involve lower buyback prices compared to the spot rate.

For investors who value direct ownership and long-term wealth preservation, physical silver may be appealing despite its costs and storage needs.

Silver Savings Accounts

If you prefer not to deal with physical storage, a silver savings account offers a convenient way to gain exposure to silver prices.

These accounts allow you to buy and sell silver at market prices through the bank, while the bank manages the storage and security on your behalf.

In Singapore, both OCBC and UOB currently offer silver savings products designed to make investing in precious metals more accessible.

OCBC’s Precious Metals Account lets investors buy and sell silver digitally through the OCBC Digital app, starting from as little as 0.01 ounces (or 0.31 grams) with no physical storage required. It provides an easy entry point for retail investors who want flexibility and low minimum investment amounts.

You must first have an OCBC deposit account and access to the OCBC app. Read our OCBC 360 account review here.

UOB’s Silver Savings Account (SSA) allows investors to hold silver in paper form. However, there is a monthly service fee, which will be the higher of 0.2 ounces of silver or 0.375% per year of your highest silver balance for that month, and a minimum transaction size of 10 ounces of silver for SSA.

You must have an existing UOB current or savings account to open a Silver Savings Account (SSA). You can open a UOB One Savings Account and UOB Stash Savings Account to get started easily.

UOB is currently running a Leap of Fortune Savings Promotion offering up to S$380 guaranteed cash when you top up an eligible UOB savings account and register. Learn more about the UOB Leap of Fortune Savings promotion here.

Both the UOB and OCBC accounts provide exposure to silver prices without the need to handle or store physical bullion. However, they differ in their minimum investment size, fees, and do note that neither offers the option to convert your holdings into physical silver.

Pros of opening a silver savings account

- Easy to manage: You can buy and sell silver directly through online or mobile banking, without worrying about physical storage or security.

- Flexible access: Silver can be traded conveniently at market prices, offering higher liquidity compared to physical bars or coins.

Cons of opening a silver savings account

- No physical ownership: The silver is held by the bank, so you do not have possession of the metal itself.

- Service fees: Account maintenance and transaction fees may apply, which may slightly reduce your overall returns.

Silver ETF and stocks

For those looking for a simple and low-cost way to invest in silver, exchange-traded funds (ETFs) and silver mining stocks are among the most accessible options.

Silver ETFs are funds that aim to mirror the performance of silver prices.

They are listed on global stock exchanges and can be traded easily through online brokerage platforms, just like any other stock.

This provides an easy way for investors to gain exposure to silver without having to handle physical bullion.

Some ETFs, such as the iShares Silver Trust (NYSE: SLV) and the abrdn Physical Silver Shares ETF (NYSE: SIVR), hold physical silver in vaults to closely track spot prices.

Others, such as the Global X Silver Miners ETF (NYSE: SIL), invest in a portfolio of silver mining companies, offering indirect exposure to silver prices through the earnings of these producers.

Here are some popular silver ETFs include:

| ETF | Ticker | Exchange | Exposure | Expense Ratio |

|---|---|---|---|---|

| iShares Silver Trust | SLV | United States | Physical Silver | 0.50% |

| abrdn Physical Silver Shares ETF | SIVR | United States | Physical Silver | 0.30% |

| Global X Silver Miners ETF | SIL | United States | Silver mining companies | 0.65% |

| Source: ETF Manager’s websites, as of 21 October 2025 | ||||

Pros of investing in Silver stocks or ETFs:

- Lower minimum capital requirement: Investors may begin with smaller amounts compared to buying physical silver.

- Ease of trading: You can buy or sell ETFs and stocks anytime during trading hours, offering flexibility and liquidity.

- No storage concerns: There is no need to manage or insure physical metal holdings.

Cons of investing in silver stocks or ETFs:

- Management fees: ETFs typically charge annual expense ratios that slightly reduce long-term returns.

- Market risk: The value of silver ETFs and mining stocks may move with broader market conditions, and may not always mirror silver prices exactly.

- Non-direct ownership: Investors do not hold the underlying silver directly, as the metal is stored and managed by the fund on their behalf.

Silver futures and CFDs to hedge

Lastly, we have silver futures and Contracts for Difference (CFDs).

Silver futures and CFDs allow traders to speculate on silver price movements. These are leveraged instruments, which means you could open a larger position with a smaller amount of capital.

However, this also means potential losses could also be magnified, so futures and CFDs generally require a good understanding of leverage and risk management.

Apart from speculation, silver futures and CFDs could also be used as a strategy to hedge against price fluctuations.

Pros of trading silver futures and CFDs:

- Trade both ways: You could take long or short positions to benefit from both rising and falling silver prices.

- Hedging tool: You may take a short position to protect your portfolio by hedging against potential price correction.

- Leverage: You could gain larger exposure with a smaller upfront investment.

Cons of trading silver futures and CFDs:

- Leverage risk: The use of borrowed funds may magnify both profits and losses, making risk management essential.

Silver futures and CFDs may appeal to more active traders who want to hedge or trade short-term price movements, but it’s important to fully understand the risks before getting started.

Learn about investing in futures here.

Discover the best CFD trading platform in Singapore here.

Why invest in silver?

Silver has long been valued as both a precious metal and an industrial commodity, giving it a unique role among investors.

While gold is often seen purely as a store of value, silver’s appeal extends beyond wealth preservation to real-world applications that drive its demand.

One key reason investors consider silver is its potential as a hedge against inflation and currency depreciation. Like gold, silver tends to hold its value when paper assets weaken, offering diversification in a portfolio.

Silver also offers a lower entry cost compared to gold, allowing investors to gain exposure to precious metals with a smaller amount of capital.

Beyond investment demand, silver is also widely used in industries such as aerospace, electronics, and the production of electric vehicles, supporting steady global demand.

Comparing Silver and Gold

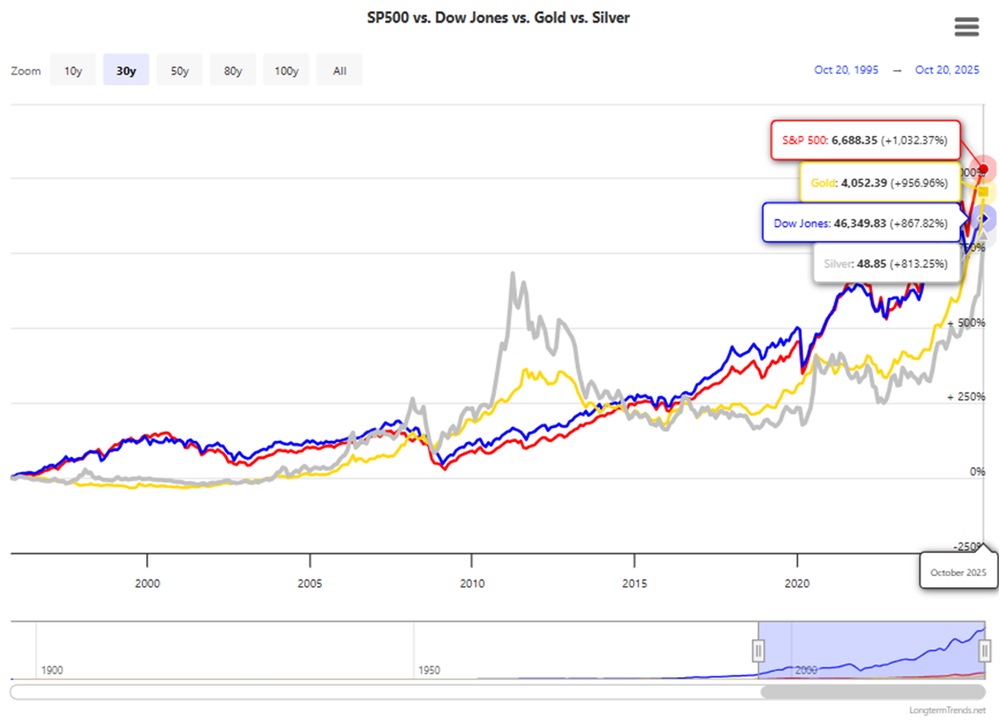

The price of silver has risen significantly over the past 30 years.

However, its growth has been slower compared to the increase in gold prices and the S&P 500 equity benchmark.

Between 2010 and 2015, silver outperformed both gold and major equity indices in certain years.

It is also worth noting that silver prices tend to be more volatile than gold due to its industrial exposure and smaller market size.

| Aspect | Silver | Gold |

| Price per Ounce (as of 24 October 2025) | ~US$50 - 60 | ~US$4,000 - 4,300 |

| Market capitalisation | US$2.7 trillion | US$28.3 trillion |

| Market perception | Industrial usage and safe-haven metal | Primarily a safe-haven and monetary metal |

| Volatility | More volatile due to industrial demand | More stable, moves mainly on macro sentiment |

| Demand drivers | Electronics, solar panels, EVs, investment demand | Central banks, jewellery, investment demand |

| Correlation with economy | More sensitive to industrial growth and commodity cycles | Usually moves inversely to risk sentiment |

| Performance in crises | Benefits, but may lag gold initially due to industrial slowdown | Typically outperforms during uncertainty |

| Potential upside | Greater cyclicality; may outperform in global recovery phases | May provide steadier long-term capital preservation |

Key factors affecting silver prices

Silver’s price is influenced by a complex blend of global economic, monetary and industrial factors.

While it shares a few drivers with gold, silver’s significant role in manufacturing and technology means its price behaviour can differ.

1. Strength of the US dollar

Because silver is denominated in US dollars, its value is closely tied to the performance of the dollar.

A weaker dollar makes silver cheaper for investors holding other currencies, which may boost demand and push prices higher. Conversely, a stronger dollar typically puts downward pressure on silver.

2. Interest rates

Silver does not provide interest or dividends. When interest rates rise, investors may favour income-generating assets like bonds, reducing the appeal of non-yielding assets such as silver.

On the flip side, lower rates or expectations of rate cuts often increase silver’s attractiveness as an alternative asset.

3. Inflation

Inflation erodes the purchasing power of fiat currencies, and many investors turn to precious metals like silver as a store of value.

When inflation is rising, silver may become more attractive as a hedge — though this relationship may be less consistent compared to gold.

4. Geopolitical tensions and uncertainty

Events such as geopolitical conflict, economic sanctions, or trade disruption may drive demand for safe-haven or non-fiat assets.

While silver is not as purely a safe-haven asset as gold, it may benefit from spikes in uncertainty when investment demand rises.

5. Supply and demand

The price of silver is also shaped by the balance between supply and demand.

On the supply side, silver production depends heavily on mining activity, as much of it is produced as a by-product of other metals. Limited new supply could contribute to price increases when demand rises.

Silver prices are driven by shifts in both investment and industrial demand.

Recent data shows central banks increasing silver accumulation, while industrial demand from major economies like China and India continues to grow, particularly in sectors such as electronics and clean energy.

Overall, silver prices reflect how investors view global risk, inflation, and economic growth, making it a dynamic asset that responds to both financial and industrial trends.

6. Correlation with gold

Silver prices are often influenced by movements in gold. The gold–silver ratio, which is the number of ounces of silver needed to buy one ounce of gold, serves as a key relative valuation metric.

A higher ratio may signal that silver is undervalued compared to gold, prompting traders to buy silver expecting it to catch up.

7. Ties to the global economy

More than half of silver demand stems from heavy industry and high-tech applications, from smartphones and EV components to solar panels, according to the World Silver Survey.

As a result, similar to equity indices like the S&P 500, silver tends to respond more directly to global economic growth cycles than gold; demand often rises when economies expand.

Risks of buying silver

While silver may help protect wealth and provide diversification, it is not without risks.

Before deciding to invest, here are some of the key factors to be aware of that may affect returns:

1. Price volatility

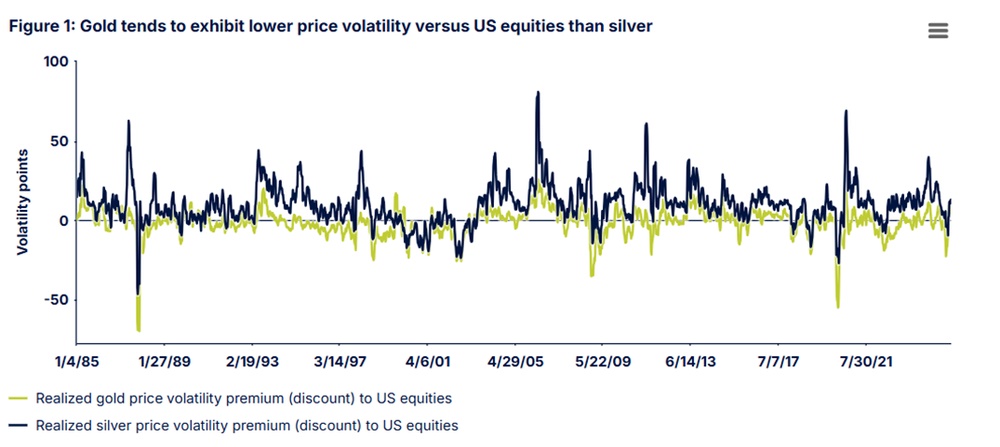

Silver prices tend to fluctuate more than gold due to its dual role as both an investment asset and an industrial metal.

Over the past 40 years, weekly data show that gold prices have lower realized volatility in comparison to silver against US equities.

2. No income generation

Unlike stocks or bonds, silver does not provide any regular income such as dividends or interest.

Any potential return comes entirely from price appreciation, so your gains depend on how silver prices move over time.

3. Liquidity and transaction costs

Physical silver may be harder to sell quickly compared to paper-based investments such as ETFs or savings accounts.

Investors may also face dealer spreads, storage costs, and insurance fees that may reduce overall returns.

4. Market and policy risks

Silver prices are affected by global economic conditions, geopolitical risks, central bank policies, and investor sentiment.

A slowdown in manufacturing activity or a stronger US dollar could cause prices to fluctuate.

To sum up, you should carefully consider the risks associated with silver in relation to your personal financial goals and risk tolerance even though it may diversify a portfolio and act as a hedge against inflation.

What would Beansprout do?

In Singapore, investors can gain exposure to silver through several main avenues, each differing in cost, liquidity, and convenience.

Those seeking direct ownership may buy physical silver bars or coins from authorised dealers such as UOB, BullionStar, or Silver Bullion, though storage and insurance costs apply.

For easier access, silver savings accounts offered by OCBC and UOB allow investors to trade silver digitally without handling bullion, though these accounts charge maintenance fees and do not grant physical ownership.

If you don’t already have a UOB account, you can consider opening the UOB One Savings Account and UOB Stash Savings Account to earn higher interest on your cash while managing your silver transactions.

In addition, UOB is currently running a Leap of Fortune Promotion offering up to S$380 guaranteed cash when you top up an eligible UOB savings account and register. Learn more about the UOB Leap of Fortune Savings promotion here.

Alternatively, investors may choose silver exchange-traded funds (ETFs) or silver-related stocks, which offer high liquidity and low transaction costs. Learn more about ETFs here.

More advanced traders may consider silver CFDs and futures, which allow speculation on price movements with leverage. However, CFDs and futures carry higher risk due to potential amplified losses. Learn more about investing futures here.

Ultimately, the best approach depends on an investor’s goals, risk appetite, and preferred level of involvement — whether owning physical metal, trading digitally, or investing through financial instruments.

If you are looking to have exposure to gold, learn more in our guide on how to buy gold in Singapore here.

If you're looking to open a brokerage account, check out our comparison of the best online brokerage & trading platform in Singapore here.

If you’re looking to hedge with silver CFDs, you can compare the best CFD trading platform in Singapore here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments