These 3 Singapore REITs led the gains in 2025. Are their dividends still worth It?

REITs

By Gerald Wong, CFA • 29 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Discover the top 3 Singapore REITs with the best year-to-date performance in 2025. We find out if their dividend yields remain attractive with the rally in their unit prices.

What happened?

The Singapore REIT sector has recovered this year.

The benchmark iEdge S-REIT Index has generated total returns of 14.7% year-to-date as of 5 December 2025, marking it as the strongest yearly performance since 2019.

Although the sector continues to lag the Straits Times Index (STI) over the past year, there were still a few that managed to deliver higher returns than the STI.

Earlier, we shared the top performing Singapore blue chip REITs, which include Suntec REIT, CapitaLand Integrated Commercial Trust (CICT) and Mapletree Pan Asia Commercial Trust.

These REITs gained up to 23% in 2025, outperforming the STI.

Looking outside the blue chip REITs, there were certain REITs that gained as much as 37% in 2025.

Let’s take a closer look at three SGX-listed REITs that have outperformed in terms of year-to-date price performance and find out if their dividend yields are still worth it.

3 Singapore REITs with the best year-to-date performance in 2025

#1 - Alpha Integrated Real Estate Investment Trust (SGX: M1GU)

Alpha Integrated REIT, previously known as Sabana industrial REIT, operates a diversified portfolio of 18 industrial properties in Singapore, including high-tech industrial, warehouse and logistics, and general industrial assets.

Its crown jewel asset is the New Tech Park at Lorong Chuan.

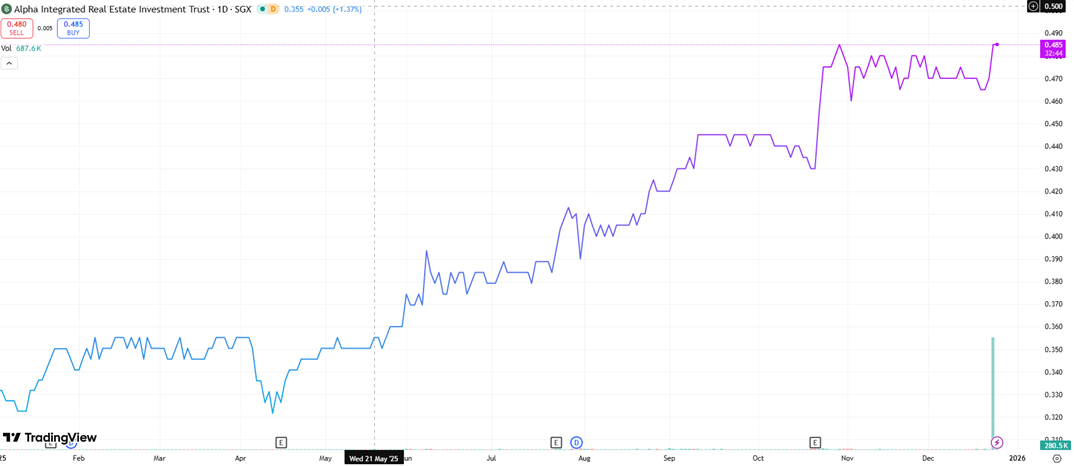

The REIT’s unit price has run up 36.6% year-to-date to S$0.485 as of 23 December 2025, making it the best performing S-REIT in 2025.

Alpha Integrated REIT also reported a strong set of earnings for the first nine months of the year.

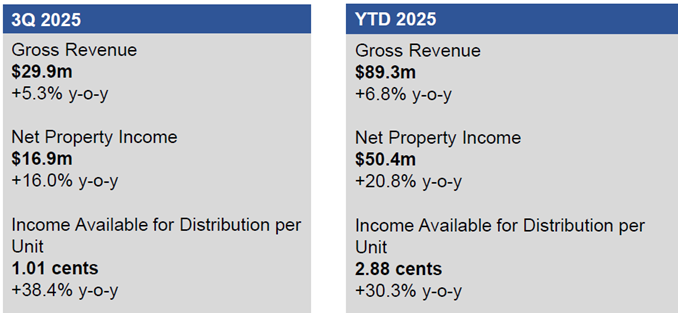

For the first nine months of 2025, gross revenue rose 6.8% year-on-year to S$89.3 million, while net property income (NPI) surged 20.8% to S$50.4 million.

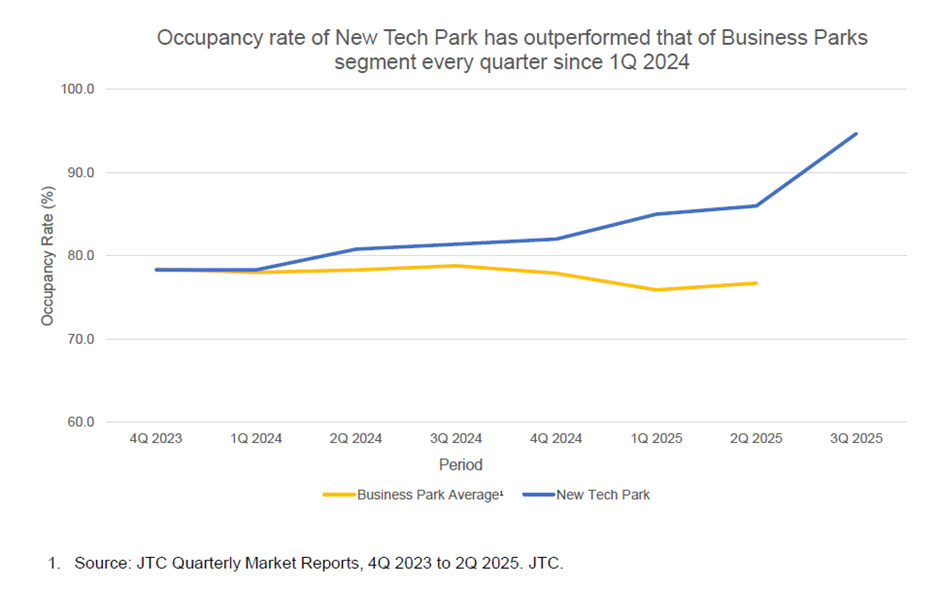

Overall portfolio occupancy improved to 87.0% as of 30 September 2025. Notably, the occupancy rate at New Tech Park hit a 12-year high of 94.7%.

The REIT achieved a positive rental reversion of 11.3% in 3Q 2025, marking 19 consecutive quarters of positive rental reversions.

Income available for distribution per unit in 3Q 2025 was at 1.01 cents, matching the same high as in 2Q 2025.

Distribution per unit (DPU) grew significantly by approximately 27% year-on-year from 1.34 cents to 1.70 cents for 1H FY2025.

Based on its annualised DPU and a unit price of S$0.485 (as of 23 December 2025), Alpha Integrated Real Estate Investment Trust offers a dividend yield of approximately 6.2%.

Related links:

- Alpha Integrated REIT share price history and share price target

- Alpha Integrated REIT dividend history and dividend forecasts

#2 - Centurion Accommodation REIT (SGX: 8C8U)

Recently listed on the SGX Main Board in September 2025, Centurion Accommodation REIT is the first pure-play purpose-built living accommodation REIT in Singapore.

Its portfolio includes Purpose-Built Worker Accommodation (PBWA) assets in Singapore and Purpose-Built Student Accommodation (PBSA) assets in the UK and Australia.

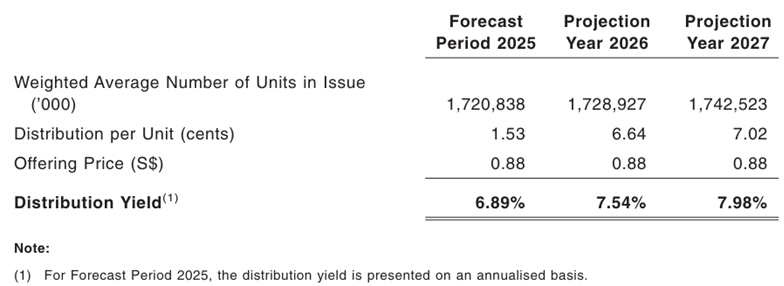

The REIT saw its unit price climb 27.3% year-to-date increase from its IPO price of S$0.88 to S$1.12 as of 23 December 2025.

The REIT’s initial portfolio comprises 14 assets with a total appraised value of approximately S$1.8 billion. This includes 5 PBWA assets in Singapore and 9 PBSA assets overseas.

The REIT benefits from favourable supply-demand dynamics in Singapore’s worker accommodation sector and the resilience of the student accommodation sector in the UK and Australia.

It also has a pipeline for growth, including the acquisition of Epiisod Macquarie Park in Australia.

Based on its projected distribution per unit of 6.64 cents for FY 2026 and at the unit price of S$1.12 (as of 23 December 2025), the REIT offers a forward dividend yield of approximately 5.9%.

Related links:

- Centurion Accommodation REIT Initiation Report - Visible growth and attractive dividend yield

- Kopi-C with Centurion REIT CEO: Centurion’s human-centred approach to living accommodations

- Centurion Accommodation REIT share price history and share price target

#3- Acrophyte Hospitality Trust (SGX: XZL)

Acrophyte Hospitality Trust, formerly ARA US Hospitality Trust, is a pure-play U.S. upscale select-service hospitality trust.

Its portfolio comprises premium brand hotels such as Hyatt Place and Hyatt House located across the United States.

The hospitality trust rounded out the list with a 26.90% year-to-date to US$0.250 as of 23 December 2025.

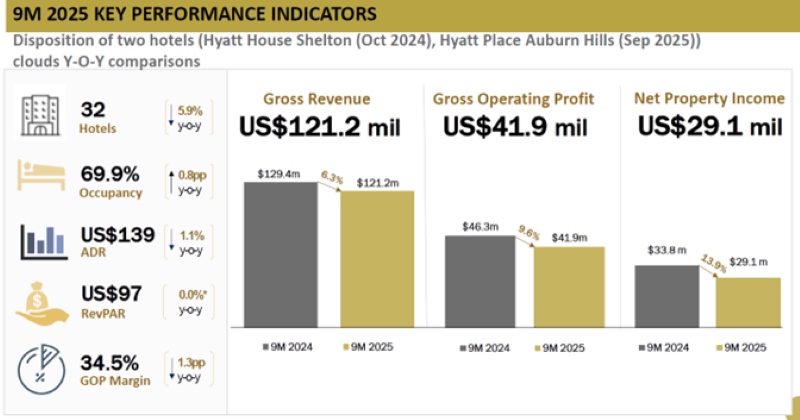

For the first nine months of 2025 (9M 2025), gross revenue was US$121.2 million, a decline of 6.3% year-on-year, largely due to the disposal of hotels in its portfolio.

The portfolio achieved an occupancy rate of 69.9% in 9M 2025, a slight increase of 0.8 percentage points year-on-year. Revenue Per Available Room (RevPAR) remained stable at US$97.

Net property income (NPI) for the same period was US$29.1 million, a decline of 13.9% year-on-year.

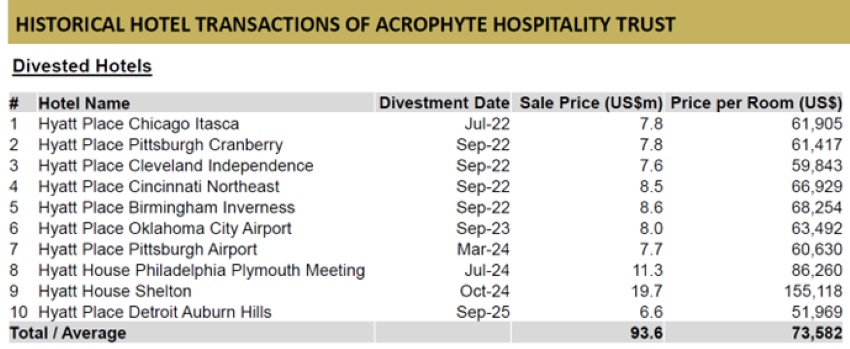

The Trust has been active in capital recycling, having divested 10 hotels over the past four years to unlock value, including the sale of Hyatt Place Detroit Auburn Hills in September 2025.

Proceeds are being directed towards brand-mandated renovations to preserve competitiveness.

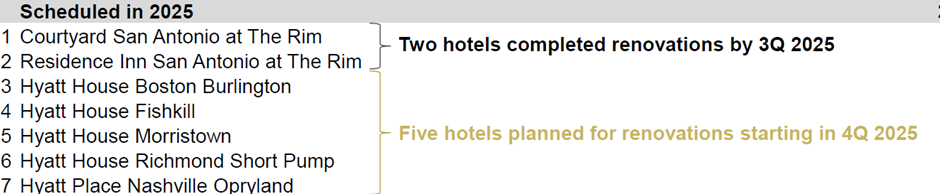

Five additional hotels are scheduled to undergo brand-mandated renovations between 2025 and 2026, following the completion of two hotels earlier in 2025.

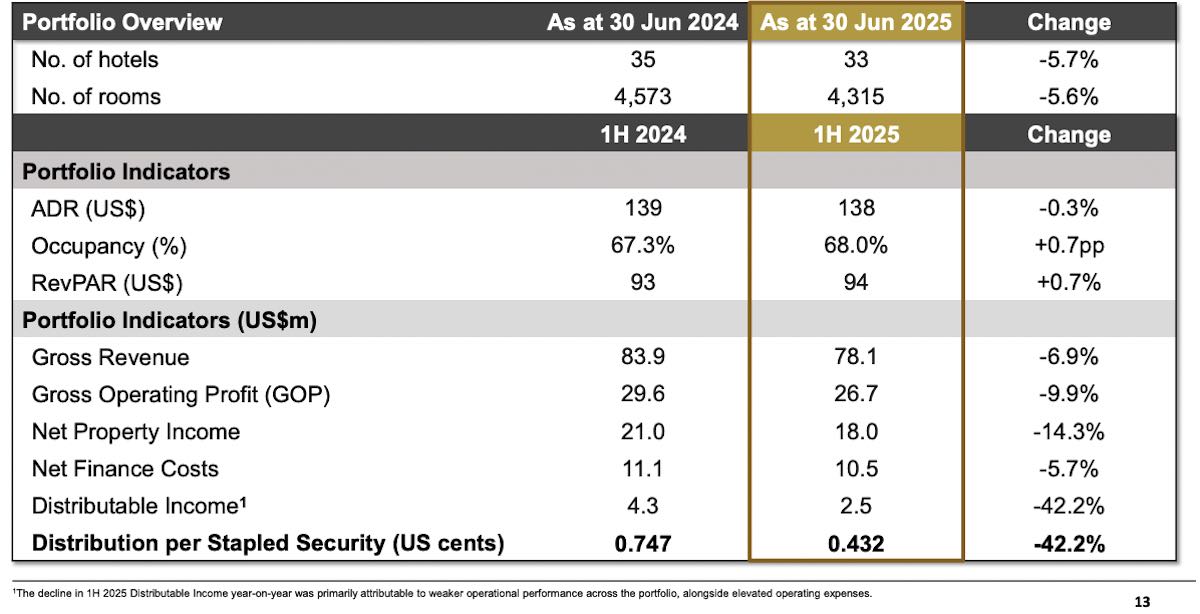

With the decline in net property income, Acrophyte Hospitality Trust's distributions were also impacted.

Its distribution per stapled security was US 0.432 cents in 1H 2025, representing a 42.2% decline compared to the previous year.

Based on its annualised DPU and a unit price of US$0.250 (as of 23 December 2025), Acrophyte Hospitality Trust offers a dividend yield of approximately 3.5%.

Related links:

- Acrophyte Hospitality Trust share price history and share price target

- Acrophyte Hospitality Trust dividend history and dividend forecasts

What would Beansprout do?

All three REITs had experienced a rebound in 2025, delivering gains that exceeded the Straits Times Index (STI) and best performing blue chip REITs.

For Alpha Integrated REIT, this was supported by growth in its distribution per unit. On the other hand, Acrophyte Hospitality Trust saw a decline in its distribution per unit in 1H 2025.

Currently. Alpha Integrated REIT currently offers the highest dividend yield of 6.2%. Its yield is supported by improving portfolio occupancy and sustained positive rental reversions.

Centurion Accommodation REIT comes in next with a forward dividend yield of approximately 5.9%, based on its projected FY 2026 distribution. Although it is the newest listing among the three, its yield remains relatively attractive, supported by favourable supply-demand dynamics in worker and student accommodation.

Acrophyte Hospitality Trust has the lowest forward dividend yield at around 3.5%. Its performance is more closely tied to the U.S. hospitality sector, with distributions influenced by travel demand, asset divestments, and ongoing renovation requirements.

Looking ahead into 2026, we expect Singapore REITs are likely to benefit from falling interest rates.

However, we expect the divergence in the performance of Singapore REITs to persist, with returns continuing to depend on factors such as sub-sector exposure, geographical mix, and the extent of debt that has been hedged at fixed rates.

Within the sector, we favour REITs that can sustain and grow distributions through active portfolio management, such as asset enhancements, selective acquisitions, or rental reversion opportunities.

To screen for Singapore REITs with lowest price-to-book valuation or highest dividend yield, check out our best Singapore REIT screener.

You can find out what may drive further potential upside in Singapore stocks here.

If you are new to investing in Singapore REITs, you can start to learn more about Singapore REITs here.

If you prefer diversification without picking individual REITs, you can also gain exposure through Singapore REIT ETFs.

[Beansprout Exclusive Longbridge Promotion] Get 5% p.a. interest boost on S$5,000 with Longbridge Cash Plus for 365 days (worth up to S$250). In addition, get a free S$50 Fairprice voucher within 5 working days when you sign up for a Longbridge account via Beansprout. Plus, take part in our festive lucky draw with S$1,200 CapitaVouchers to be won! T&Cs apply. Learn more about the Longbridge promotion here.

Lastly, you can also check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in REITs.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments