Mapletree Pan Asia Commercial Trust & Keppel DC REIT in focus: Weekly Review with SIAS

Stocks

Powered by

By Gerald Wong, CFA • 27 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We share about the Mapletree Pan Asia Commercial Trust and Keppel DC REIT in the latest Weekly Market Review.

What happened?

In this week's Weekly Market Review in partnership with Securities Investors Association Singapore (SIAS), we discuss key developments in the global equity market alongside the Mapletree Pan Asia Commercial Trust and Keppel DC REIT.

Watch the video to learn more about what we are looking out for this week.

Weekly Market Review

1:50 - Macro Update

The S&P 500 reached above 6,800 points, setting new record highs as all major US indices continued to post strong gains.

September inflation came in at 3%, slightly below expectations (3.1%), reinforcing confidence that the Federal Reserve may proceed with rate cuts.

Investors anticipate a 25-basis-point rate cut at the upcoming meeting, with an additional cut expected in December.

The Straits Times Index (STI) rebounded to around 4,400 points, supported by strength in cyclical stocks and property developers.

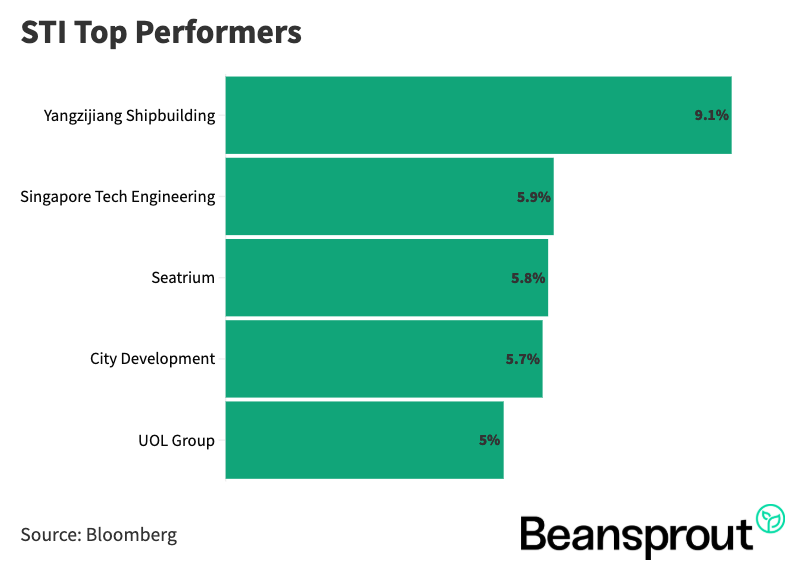

Notable performers included Yangzijiang Shipbuilding (+9.1%), City Developments (+5.7%), and UOL (+5%), with all STI components showing positive weekly performance.

STI Top Performers:

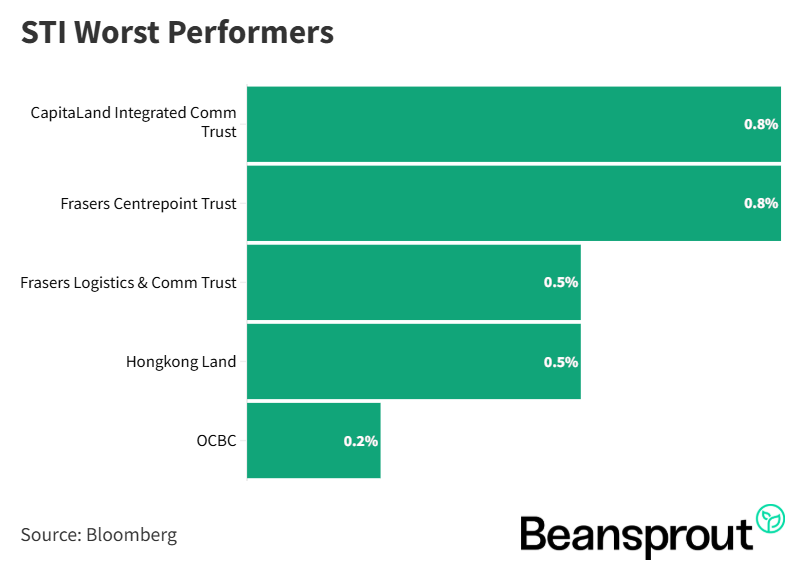

STI Worst Performers:

- CapitaLand Integrated Comm Trust

- Frasers Centrepoint Trust

- Frasers Logistics & Comm Trust

- Hongkong Land

- OCBC

Mapletree Pan Asia Commercial Trust

Mapletree Pan Asia Commercial Trust (MPACT) reported 3Q distribution per unit of 2.01 cents (+1.5% YoY), supported by a 16.4% drop in finance expenses despite a 2.2% dip in net property income.

Singapore assets (VivoCity, MBC) contributed 56% of net property income, offsetting weaker performance from Japan and China assets. Overall occupancy stood at 88.9%, with VivoCity fully occupied at 100%.

VivoCity saw strong rental reversions (+14.1%), but overseas softness led to an overall reversion of –0.1%. The REIT completed the sale of two Japan office buildings, shifting portfolio weight toward Singapore (57% of AUM, 61% of NPI).

Gearing stood at 37.6%, with the weighted average cost of debt reduced from 3.56% to 3.23%.

Current valuation shows a P/B of 0.84x and a dividend yield of 5.4%.

Learn more about 3 Singapore REITs with dividend yields of above 5% here.

Related Links:

Mapletree Pan Asia Commercial Trust (N2IU) share price history and share price target

Mapletree Pan Asia Commercial Trust (N2IU) dividend history and dividend forecasts

Keppel DC REIT

Keppel DC REIT's distributable income rose 55.5% in the first nine months of 2025, driven by new data center acquisitions; DPU grew 8.8% to 7.67 cents.

Portfolio occupancy was 96%, leverage 29.8%, and cost of debt declined due to lower rates.

Keppel DC REIT trades near its 52-week high (~$2.40) with a P/B of 1.5x. Current dividend yield of 4.2% is slightly below historical averages

Read our analysis on Keppel DC REIT here.

Related links:

12:33 - Technical Analysis

Straits Times Index (STI)

The Straits Times Index (STI) rose 0.4% to 4,440 on Monday morning, with resistance levels at 4,474 and 4,500, supported by a bullish technical outlook.

Key support levels are 4,326 (50-day moving average) and 4,284 (lower Bollinger band). A MACD crossover above the signal line suggests an emerging uptrend.

The RSI climbed to 63, indicating strong upward momentum and a potential continuation of the rally in the coming weeks.

The STI appears to be in the early stage of the next leg up, backed by positive momentum on both MACD and RSI indicators.

Bank stocks led the rally: DBS +1%, UOB +0.26%, OCBC +0.48%, alongside a 0.5% rise in REITs, signaling strength across multiple sectors.

Learn more about the Straits Times Index (STI) here.

Dow Jones Industrial Average

Inflation figures came in mostly in line or slightly below expectations, providing the Federal Reserve room to deliver another 25-basis-point rate cut in the upcoming meeting.

The softer inflation data and rate-cut expectations pushed the Dow Jones Industrial Average up more than 2% last week to 47,326 points.

The Dow is now above the upper Bollinger band (47,184), suggesting potential overextension and the need to monitor for a pullback.

MACD remains positive and continues to expand, signaling short-term bullish momentum, while the RSI at 63 indicates healthy but elevated market strength.

The market appears optimistic, supported by strong bank earnings, but investors are advised to watch for early signs of resistance or reversal in the coming weeks.

S&P 500

Over 70% of S&P 500 companies reporting earnings beat analyst expectations, reflecting continued corporate strength despite some softening in US job data.

The S&P 500 closed at 6,791 points last Friday, up about 0.8% for the day and 1.9% for the week, marking strong momentum into year-end.

The index faces resistance at 6,807 (recent all-time high) and potentially at the psychological 7,000 level, which analysts view as the next target.

A MACD crossover indicates a possible sustained uptrend; RSI at 62 suggests healthy bullish momentum with further room to rise.

While upside momentum looks positive, investors should monitor closely for reversal signals as the index tests the upper Bollinger band near resistance levels.

Nasdaq Composite Index

The Nasdaq Composite closed at 23,204 points, up 1.15% on Friday and over 2% for the week.

The index is testing the upper Bollinger band at 23,219 points, signaling potential resistance and the need to watch for short-term reversals.

Both MACD and RSI (around 60–61) suggest positive momentum and the possibility of a continued uptrend.

Market sentiment remains strong across major indices, with analysts recommending staying invested short-term while watching for pullback opportunities to re-enter.

What to look out for this week

Tuesday, 28 October 2025: CapitaLand Integrated Commercial Trust, Mapletree Logistics Trust earnings, Singapore Savings Bond (SSB) application closing date, Beansprout webinar: Can AvePoint ride the AI wave to grow?

Wednesday, 29 October 2025: Microsoft, Alphabet, Meta Earnings, Mapletree Industrial Trust Earnings, US Federal Reserve meeting

Thursday, 30 October 2025: Keppel, Wilmar, Lendlease REIT earnings, Apple, Amazon earnings, Mapletree Pan Asia Comm Trust ex-dividend

Friday, 31 October 2025: CapitaLand Ascendas REIT earnings, Suntec REIT ex-dividend, US Core PCE Price Index Data

Get the full list of stocks with upcoming dividends here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments