CICT and CapitaLand Ascendas REIT in focus: Weekly Review with SIAS

Stocks

Powered by

By Gerald Wong, CFA • 09 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We share about CapitaLand Integrated Commercial Trust (CICT) and CapitaLand Ascendas REIT (CLAR) in the latest Weekly Market Review.

What happened?

In this week's Weekly Market Review in partnership with Securities Investors Association Singapore (SIAS), we discuss key developments in the global equity market alongside CapitaLand Integrated Commercial Trust (CICT) and CapitaLand Ascendas REIT (CLAR).

Watch the video to learn more about what we are looking out for this week.

Weekly Market Review

1:33 - Macro Update

- The Straits Times Index (STI) rose 0.6% to reach close to the 5,000 level.

- A sharp divergence occurred in the US, where the Dow Jones surged 2.5% to cross the 50,000 mark for the first time, while the tech-heavy Nasdaq fell 1.9% due to a sell-off in software stocks.

- US software stocks faced their sharpest correction since 2022, driven by fears that generative AI (like ChatGPT and Claude) will disrupt traditional software business models.

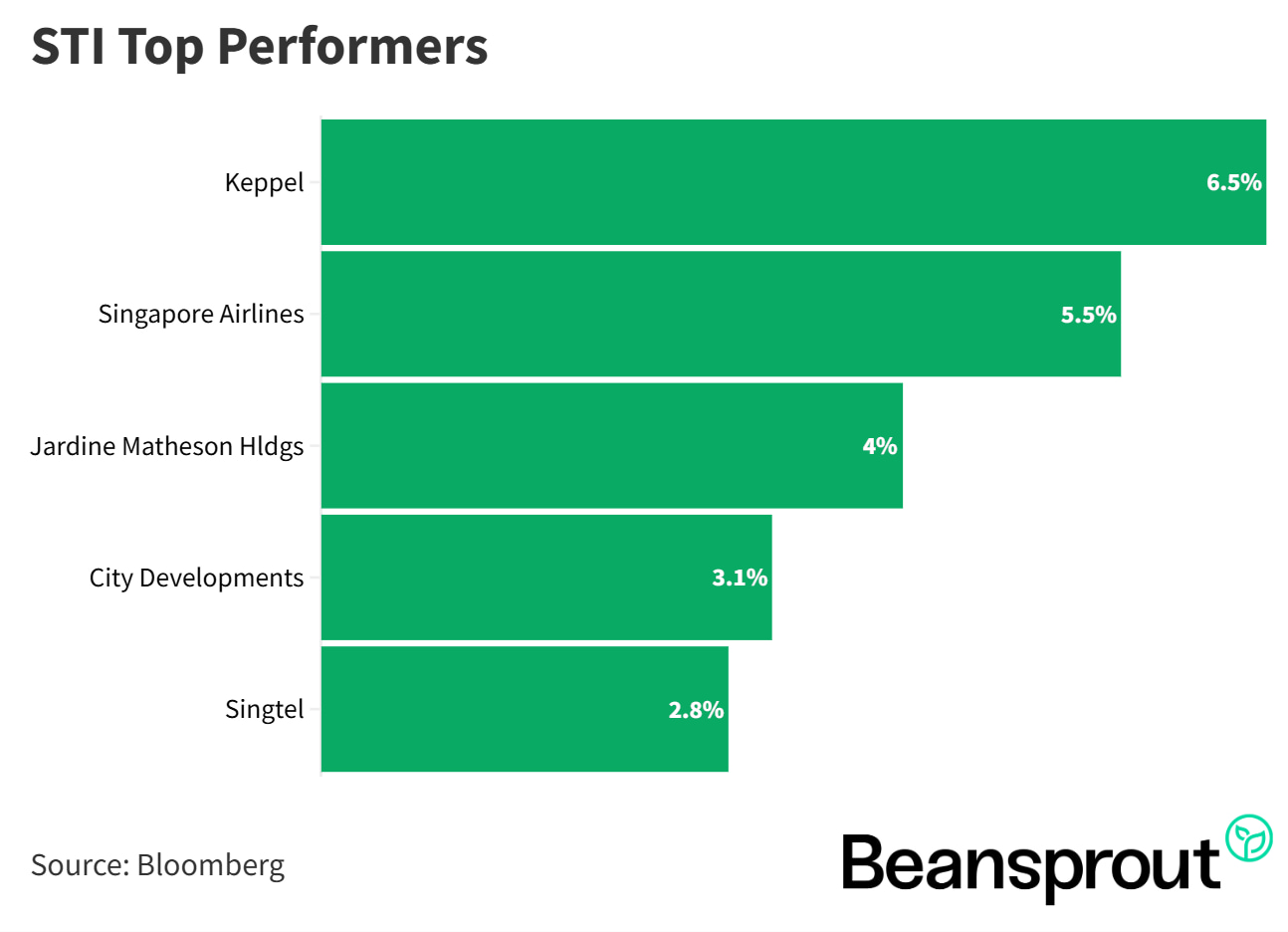

- Keppel Ltd jumped 6.5% following strong full-year results and the appointment of Piyush Gupta as chairman, while Singtel rose 2.8% on news of a $10.2 billion data center deal with KKR.

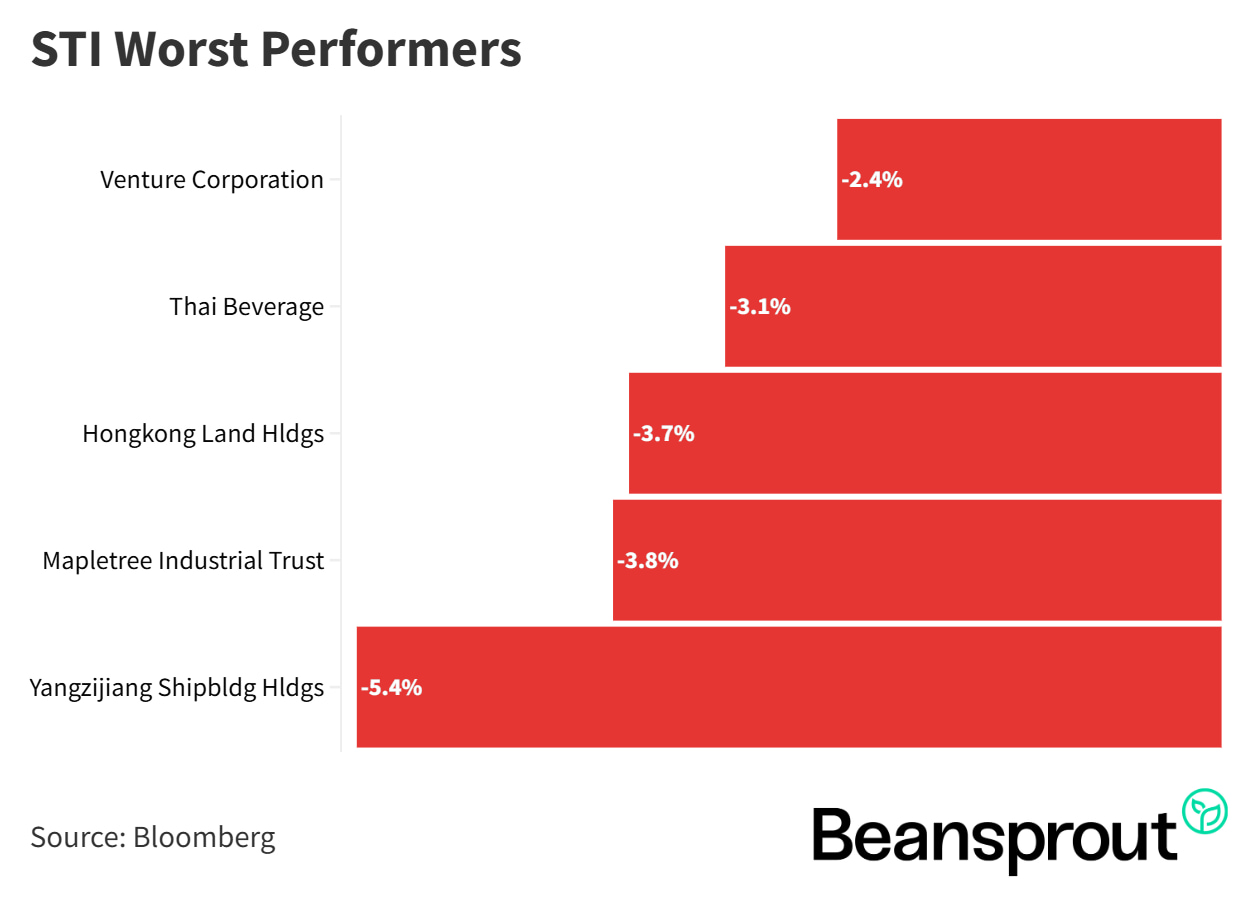

- Conversely, cyclical stocks came under pressure, with Yangzijiang Shipbuilding dropping 5.4% and Mapletree Industrial Trust falling 3.8%.

STI Top Performers:

STI Worst Performers:

- Yangzijiang Shipbldg Hldgs

- Mapletree Industrial Trust

- Hongkong Land Hldgs

- Thai Beverage

- Venture Corporation

CapitaLand Integrated Commercial Trust (CICT) - SGX: C38U

- CICT shares rebounded to above $2.40 after reporting a strong set of full-year results.

- The REIT declared a 2H 2025 DPU of 5.96 cents (up 9.4% YoY), bringing the full-year DPU to 11.58 cents (up 6.4%).

- Performance was driven by a 6.8% increase in 2H Net Property Income, supported by contributions from CapitaSpring and a healthy portfolio occupancy of 97%.

- Retail rental reversions remained strong at positive 6.6%, while the cost of debt improved to 3.2% (down from 3.6%).

Related Links:

- CapitaLand Integrated Commercial Trust Share Price and Share Price Target

- CapitaLand Integrated Commercial Trust forecast and dividend history

CapitaLand Ascendas REIT (CLAR) - SGX: A17U

- CLAR saw its share price dip after posting a 2% decline in 2H 2025 DPU to 7.528 cents, largely due to an expanded unit base.

- Overall portfolio occupancy fell to 90.9%, dragged down by the UK/Europe portfolio which dropped to 92% due to a redevelopment project.

- On the bright side, rental reversions accelerated to 19.6%, with Singapore reversions hitting 20.2%.

- Management guided for mid-single-digit rental reversions for FY2026.

- CapitaLand Ascendas REIT Share Price and Share Price Target

- CapitaLand Ascendas REIT forecast and dividend history

Technical Analysis

Straits Times Index (STI)

- The index reached a new all-time high of 4,980 points last Thursday and is currently just 40 points shy of the psychological 5,000 level.

- Momentum indicators like the MACD and RSI are currently very stretched which suggests that the market is overextended.

- Traders should expect some profit taking and a potential technical correction once the index touches the strong resistance at the 5,000 mark.

- A pullback towards the uptrend support line or the neutral baseline on the indicators is highly possible in the near term.

Dow Jones Industrial Average

- The index achieved a historic milestone by crossing the 50,000 mark for the first time to close at a record 50,115 points.

- It posted one of its best weekly performances in months with a 2.5% gain largely driven by optimism surrounding a potential US trade deal with India.

- The strong upward move contrasts with the broader market weakness and highlights a significant rotation into blue chip stocks.

- The index has shown extraordinary strength compared to the tech heavy Nasdaq which faced significant selling pressure throughout the week.

S&P 500

- The index remains in a range bound formation as it consolidates between the recent lows and the 7,000 resistance level.

- Key indicators provide little direction with the RSI trending around the 50 point neutral mark and the MACD hovering close to its baseline.

- The market has repeatedly failed to push through the 7,000 all time high which continues to act as a stiff resistance ceiling.

Nasdaq Composite Index

- The tech heavy index remains the weakest performer after dropping 1.8% last week and is currently trading near the 23,000 support level.

- Momentum is bearish with the RSI reading at 44 points which is below the neutral 50 threshold.

- The MACD remains negative although the selling pressure appears to be subsiding slightly following the Friday rebound.

- Resistance is firmly established at the 24,000 level which aligns with the highs seen in December and late January.

What to look out for this week

Monday, 9 February: DBS, Elite UK REIT earnings

Tuesday, 10 February: CapitaLand Investment earnings

Wednesday. 11 February: Prime US Reit earnings

Thursday, 12 February: Starhub, iFast earnings, Singapore 6 month T-bill Auction

Friday, 13 February: Lendlease REIT earnings, US consumer price index (CPI) data

Get the full list of stocks with upcoming dividends here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments