US stocks fall from record highs with renewed tariff fears: Weekly Market Recap

By Gerald Wong, CFA • 12 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

US stocks tumble after reaching all-time highs on heightened US-China trade tensions

When I woke up on Saturday morning, the first thing I saw was the news that US stocks had pulled back after renewed US tariffs on China.

What a quick change in mood. Just last week, I was sharing that markets were hitting all-time highs, with stocks climbing steadily on bullish sentiment.

With volatility back, it’s natural to feel uneasy. Hence, I thought it might be helpful to share three practices I use to keep my emotions in check.

- Remember that pullbacks are normal: I remind myself not to panic as markets move in cycles.

- Revisit your portfolio, not your emotions: I check if my portfolio still fits my financial goals and if I am able to stomach the volatility before making any adjustments.

- Look for opportunities, not just losses: Corrections bring opportunities. I keep a watchlist so I know what to add when prices fall.

If you’re looking to update your watchlist, we’ve analysed 4 Singapore blue-chip stocks that recently hit record highs to see if their dividend yields remain attractive.

We’ve also compared DBS, UOB and OCBC to find out which bank looks most appealing after DBS’s strong run this year.

If you are looking to make use of the market dip to start investing, we compare the fees of stock trading platforms to find the best brokerage account in Singapore.

And if you prefer to stay defensive, check out our comparison of T-bill, fixed deposit and savings account yields, especially after the 6-month T-bill yield stayed steady at 1.44% in the latest auction.

While market dips can feel uncomfortable, staying calm and focused on the long term has always worked better for me than reacting to every headline.

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

🏛 Stocks retreat from record highs

What happened?

US President Donald Trump announced on Friday that the United States will impose new tariffs of 100% on Chinese imports starting 1 November, on top of the existing duties already in place.

This came shortly after he shared on social media that he was considering a “massive increase of tariffs on Chinese products,” in response to China’s plan to introduce new export controls on rare earth materials.

What does this mean?

In short, tensions between the US and China have flared up again after a period of fragile peace.

Trump’s comments also cast doubt on an upcoming meeting with Chinese President Xi Jinping, which many investors had hoped would ease tensions.

The renewed uncertainty, coupled with the ongoing US government shutdown, has made investors more cautious, raising concerns about how these events might affect global growth and market sentiment in the weeks ahead.

Why should I care?

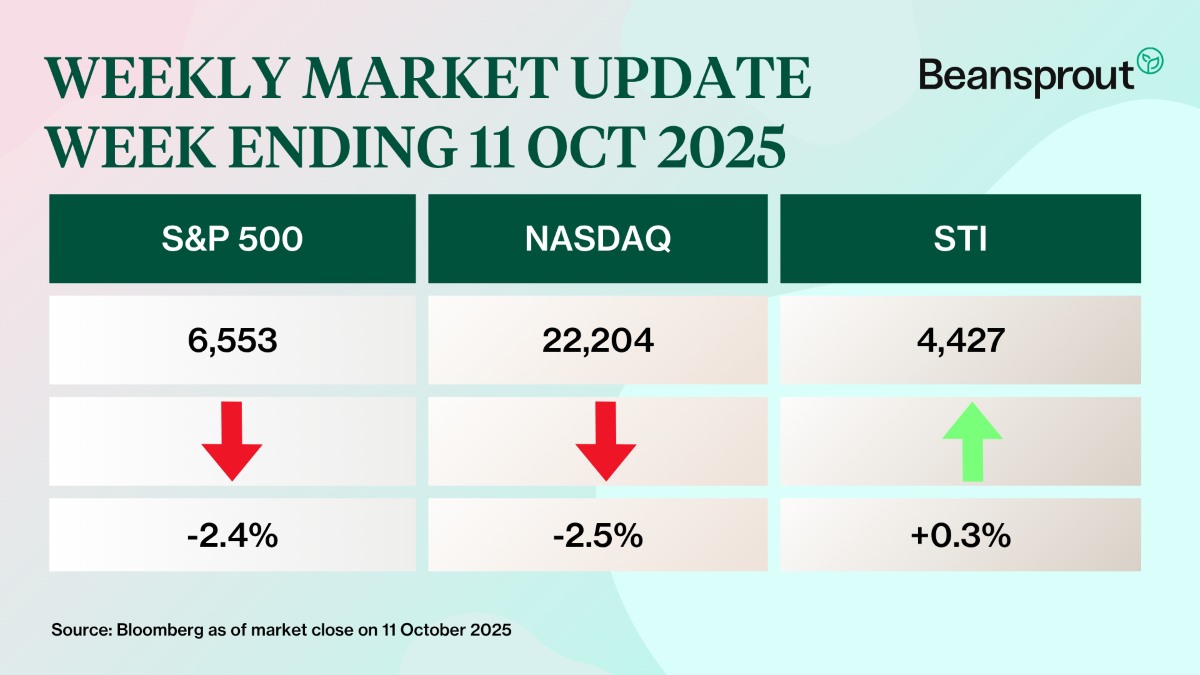

US stocks fell sharply on Friday after President Trump reignited tariff concerns, reversing earlier gains that had pushed the S&P 500 to a record high earlier in the week.

Amid the renewed uncertainty, investors turned to safe-haven assets. Gold surged to a new high of US$4,074 per ounce, while silver also climbed to a record level. Both were supported by safe-haven demand as the US government shutdown dragged on and trade tensions escalated. Learn more about investing in gold here.

Back home, Singapore’s Straits Times Index (STI) also hit a record high above 4,470 points before pulling back later in the week. Learn more about the Straits Times Index (STI) here.

🚗 Moving This Week

- Keppel REIT has announced the acquisition of a suburban shopping mall in Sydney, Australia, as well as a private placement to fund the purchase. Read our analysis here.

- CapitaLand Ascendas REIT (CLAR) is proposing to acquire three properties in Singapore for a total consideration of $565.8 million. Upon the completion of the acquisition around 1Q2026, CLAR’s Singapore portfolio will account for 68% of its total assets under management (AUM). Should the acquisitions be completed on Jan 1, 2024, CLAR’s DPU is expected to improve by around 0.124 cents or 0.8% for the FY2024 ended Dec 31, 2024 on a pro forma basis. Read more here.

- SGX reported a 50.8 per cent year-on-year rise in its securities turnover volume in September, as demand for local equities maintained its momentum on the local bourse. The daily average value stood at S$1.5 billion in September 2025, a 4.7 per cent year-on-year climb. Read more here.

- A consortium comprising UOL Group, Singapore Land Group and Kheng Leong placed the highest bid of S$524.3 million for a Dorset Road private-housing site tender. The offer of S$1,338 per square foot per plot ratio (psf ppr) was towards the upper end of the S$1,000 to S$1,400 psf ppr forecast by the analysts. Read more here.

- Sembcorp Industries will acquire 100% ownership of ReNew Sun Bright, a solar power asset in India, for $246 million. Upon completion of the acquisition, Sembcorp’s gross renewable energy capacity installed and under development in India will reach 6.9 gigawatt (GW). Read more here.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

Where to park your cash for higher yield? T-bills vs Fixed Deposit vs SSB (Oct 2025)

We share the best ways to earn a yield on your cash through fixed deposits, Singapore T-bills, SSBs and money market funds.

🤓 What we're looking out for next week

- Tuesday, 14 October 2025: JPMorgan, Goldman Sachs, Citigroup earnings

- Wednesday, 15 October 2025: Keppel REIT Ex-Dividend, US CPI Data, Singapore 1-year T-Bill Auction, Bank of America earnings

- Thursday, 16 October 2025: SGX Ex-Dividend, US PPI Data

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments