Markets react as Fed cuts rates: Weekly Market Recap

By Gerald Wong, CFA • 14 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

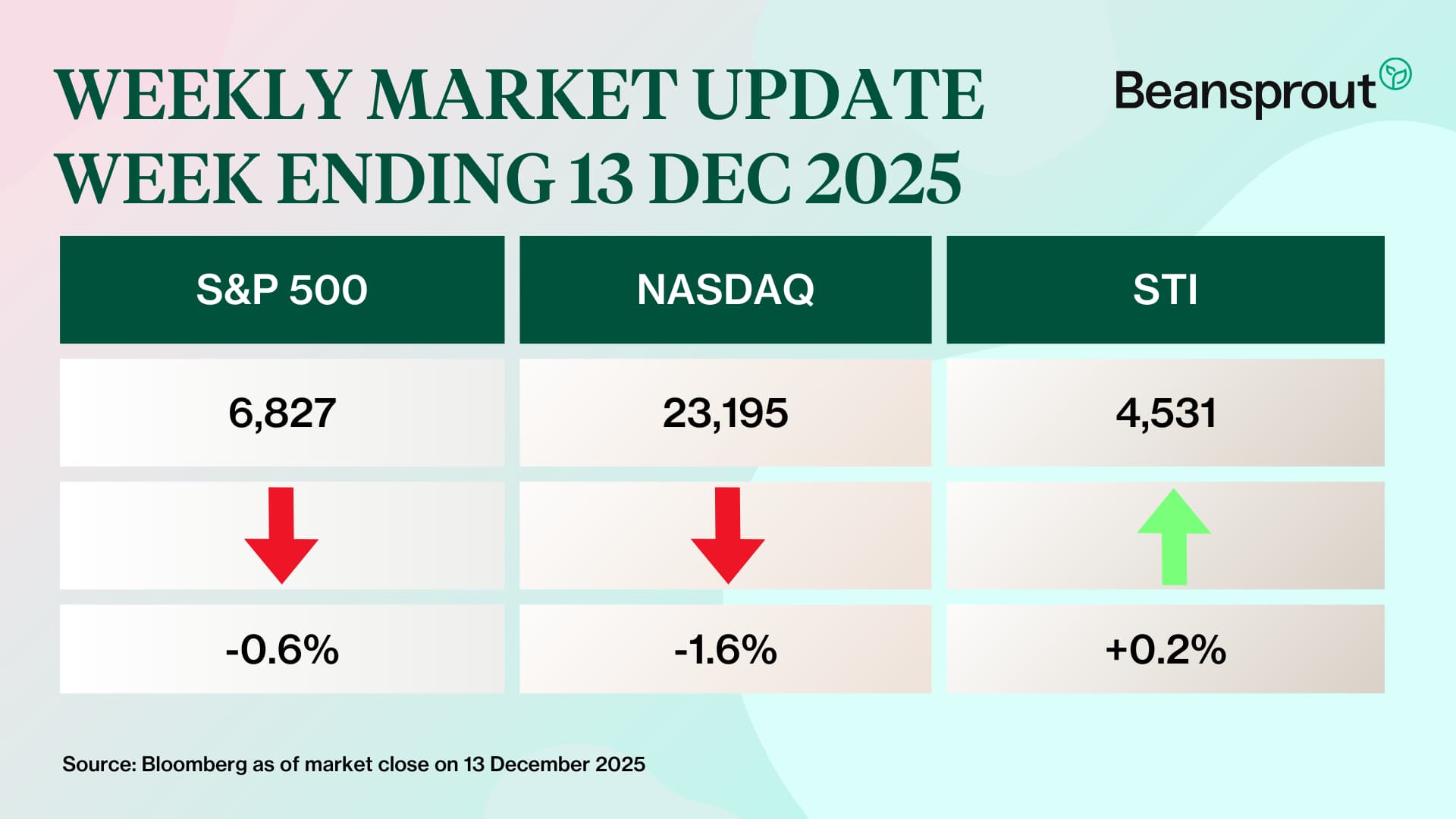

Global stocks and bonds traded mixed after the Fed cut interest rates as expected.

As we get closer to the end of the year, I find myself naturally slipping into reflection mode.

That’s probably why this week’s Money Diaries podcast with former Wall Street banker Gail Wong really stuck with me.

She shared something simple but powerful. That wealth is about living in a way that feels consistent with who you are. Not who you think you should be, or who Instagram says you should be.

I think investing works the same way. It’s not about chasing the highest returns, but about choosing an approach that fits your objectives, lifestyle, and comfort with risk.

Take risk appetite, for example. While the long-term returns of U.S. markets are compelling, not everyone is able or willing to stomach the volatility that comes with it. And that’s okay.

If you’re more focused on generating income from your investments, we share a few ways to build passive income streams. We also look at where to park your cash for higher yield, and whether there could be a further bounce in the yield at the upcoming 6 month T-bill auction.

For REIT investors, acquisitions are often seen as a way to grow distributions. This week, we take a closer look at Keppel REIT’s acquisition of Marina Bay Financial Centre Tower 3, which is expected to be dilutive to distribution per unit (DPU), and what that means for investors.

As the year winds down and we start planning for the next, it might be a good time to step back and ask a simple question. “How do I want to build wealth in a way that feels right for me?”

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

🏛 Fed cuts rates as expected

What happened?

The US Federal Reserve cut its target interest rate by 0.25% (25 basis points), in line with market expectations.

This marks the Fed’s third consecutive rate cut.

What does this mean?

Despite the rate cut, the Fed’s statement suggested that further easing may pause for now.

At the same time, renewed concerns around AI weighed on sentiment after Oracle, a recent beneficiary of AI enthusiasm, reported quarterly revenue that missed market expectations.

The company also guided for a sharp increase in capital expenditure, raising fresh questions about the pace and returns of AI spending.

Why should I care?

The S&P 500 touched fresh all-time highs during the week, supported by the Federal Reserve’s interest rate cut.

However, technology stocks later pulled back as concerns resurfaced over elevated valuations and whether heavy spending on artificial intelligence infrastructure will deliver returns.

In Singapore, the Straits Times Index (STI) rose alongside the U.S. market. Gains were led by Hongkong Land after the sale of its stake in Marina Bay Financial Centre Tower 3 to Keppel REIT. Jardine Matheson also rose, following the strong share price increase by DFI Retail Group last week.

🚗 Moving This Week

- Keppel REIT has announced the acquisition of an additional one-third interest in Marina Bay Financial Centre Tower 3, as well as a preferential offering to fund the purchase. Read our analysis here.

- Sembcorp Industries will acquire Alinta Energy, Australia’s fourth-largest utilities provider. The deal values Alinta at an enterprise value of A$6.5 billion (S$5.6 billion), with an estimated purchase price of A$5.6 billion to be paid in cash via bridge and working-capital facilities. Read more here.

- A consortium of Seatrium and GE Vernova was awarded a contract on Thursday (Dec 11) by European transmission operator TenneT to connect North Sea wind power to Germany’s grid. The win lifts Seatrium’s new contract value for FY2025 to more than S$4 billion so far. It is the consortium’s fourth project under the five-year framework agreement with TenneT signed in March 2023. Read more here.

- Singapore’s Land Transport Authority (LTA) has approved ComfortDelGro and its autonomous vehicle partner Pony.ai to begin testing their AV shuttles in the residential district of Punggol. Read more here.

- Mapletree Pan Asia Commercial Trust (MPACT) said on Wednesday (Dec 10) that its subsidiary Festival Walk will sell Festival Walk Tower—the office component of the Hong Kong property—for nearly HK$2 billion (S$328.1 million) to an unrelated third party. The tower has 213,982 sq ft of lettable area across seven tenants and had a 94.2% committed occupancy as at Sep 30. Read more here.

- Lippo Malls Indonesia Retail Trust (LMIRT) has launched a non-underwritten rights issue at S$0.007 per unit, aiming to raise S$63 million to repay existing loans and related obligations. The issue price represents a 53.3% discount to its Oct 31 closing price of S$0.015, according to the Reit’s filing with the Singapore Exchange. Read more here.

- Yangzijiang Maritime, Centurion Accommodation Reit and Golden Agri-Resources have been added to two iEdge Singapore indices, with the changes taking effect at the start of trading on Dec 22. The three counters will join both the iEdge Singapore Next 50 Index, which is market-cap weighted, and the iEdge Singapore Next 50 Liquidity Weighted Index. Learn more about the Next 50 index here.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

Where to park your cash for higher yield? T-bills vs Fixed Deposit vs SSB (Dec 2025)

We share the best ways to earn a yield on your cash through fixed deposits, Singapore T-bills, SSBs and money market funds.

🤓 What we're looking out for next week

- Tuesday, 16 December 2025: US non-farm payrolls data

- Wednesday, 17 December 2025: US retail sales data

- Thursday, 18 December 2025: US Core CPI data, Singapore 6 Month T-Bill Auction, Bank of Japan meeting

- Friday, 19 December 2025: Bank of Japan meeting

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments