Gold hits record highs in 2026. Can the rally continue?

Commodities

By Ng Hui Min • 18 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

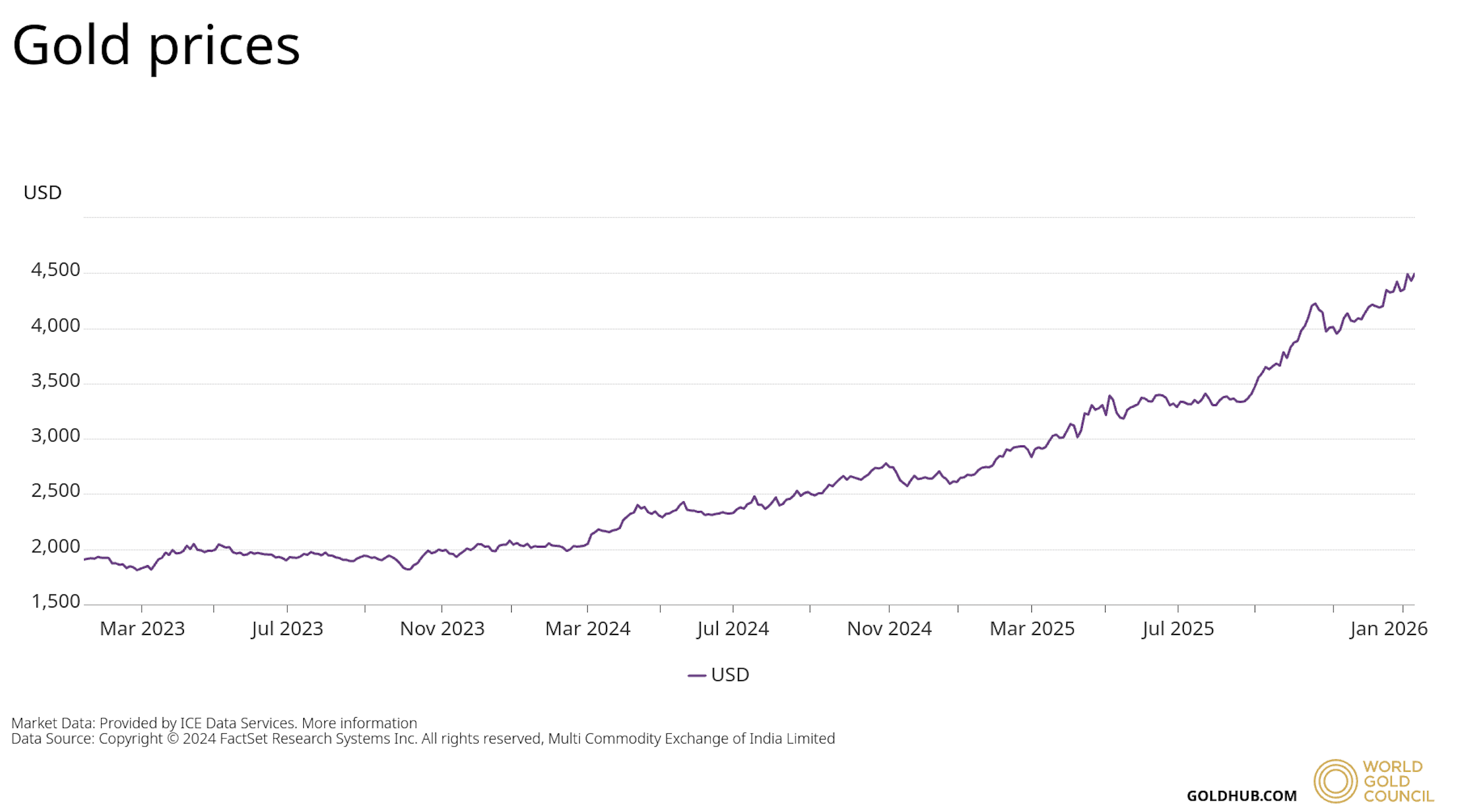

Gold prices reached a record high of above US$4,600/oz in on 12 January amid escalating geopolitical uncertainty.

What happened?

Gold entered 2026 with renewed momentum, hitting its first record high of the year above US$4,600/oz on 12 January.

The move followed a strong finish to 2025, when gold climbed to US$4,449/oz on 23 December, capping off a stellar year.

Gold prices rose 4.2% in December, taking full-year gains to 67%, as underlying macro, geopolitical and policy drivers continued to support demand for bullion.

I saw discussions in the Beansprout community asking whether the rally can continue.

Earlier, we have explored what is driving gold's rally and if the momentum can continue. We have also looked at what is driving the rally in silver prices, and whether it is a good alternative to gold for those looking to diversify their portfolios.

Let's dive into the structural drivers that powered gold prices in 2025 and see if they remain intact in 2026.

What is driving the rally in gold prices?

Gold’s move continues to be supported by a combination of geopolitics, policy uncertainty, official-sector buying, and investment flows, rather than any single catalyst.

#1 - Safe-haven demand amid uncertainty

Geopolitical risk remains a persistent source of support for gold.

The Venezuela episode earlier in January showed how quickly geopolitical flashpoints can re-emerge and prompt investors to reassess tail risks and seek portfolio insurance.

The recent elevated political uncertainty in Iran also contributed to a more cautious global risk environment, supporting demand for traditional safe-haven assets, including gold.

At the same time, escalating policy uncertainty in the United States has become an increasingly important factor.

The U.S. Justice Department served grand jury subpoenas on Federal Reserve Chair Jerome Powell, reviving concerns about the independence of the Federal Reserve and adding to safe-haven demand as the dollar softened.

These developments have helped lift gold to fresh record highs topping US$4,600/oz, demonstrating that even short-lived escalations in political or institutional risk can widen the range of potential outcomes and favour defensive assets such as gold.

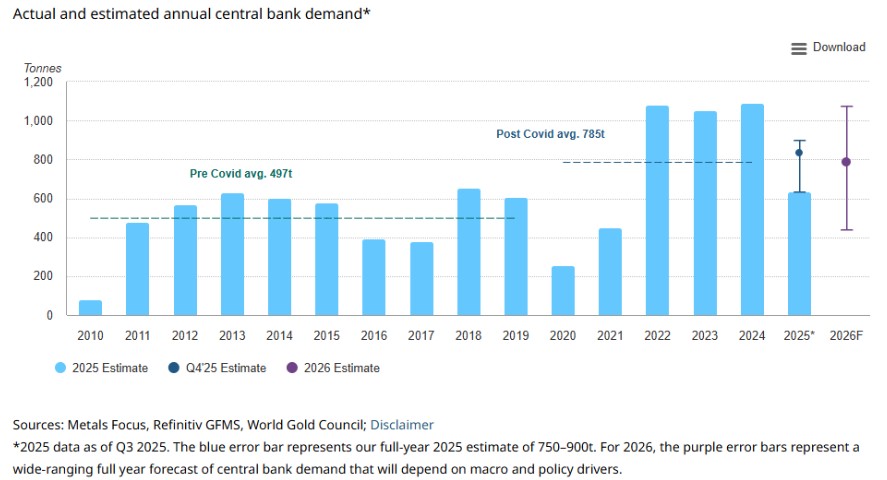

#2 — Central bank accumulation is not stopping

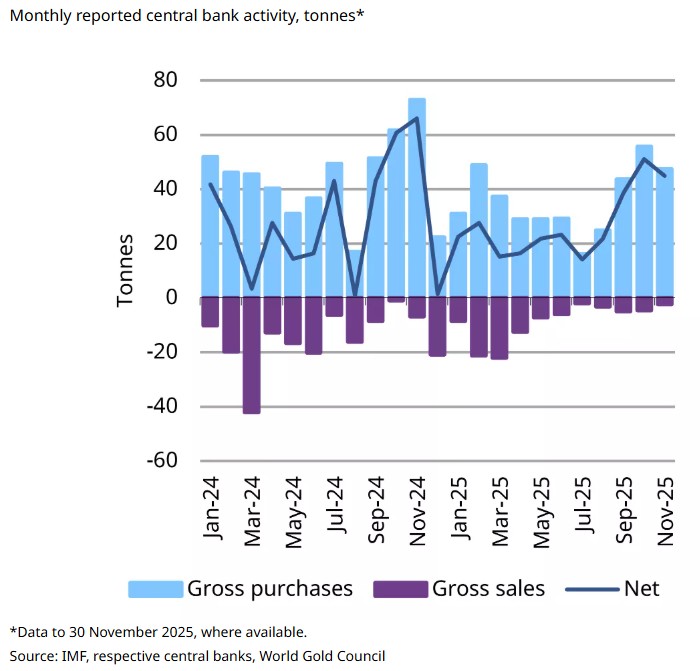

One of the most important structural pillars of this rally remains central bank demand.

The World Gold Council’s latest data shows central banks purchased a net 45 tonnes in November, bringing reported total buying to 297 tonnes from January to November 2025.

Buying remains broad-based.

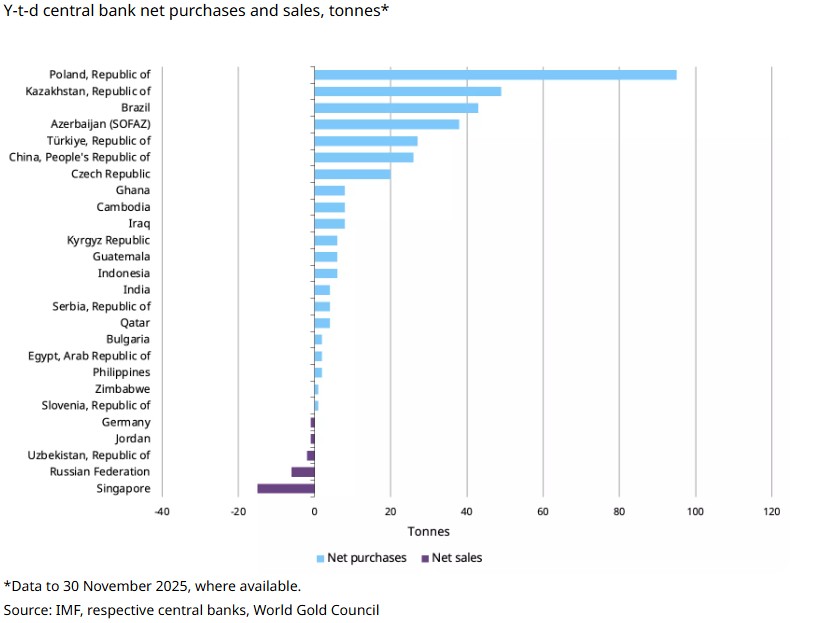

Poland added 12 tonnes in November and remains the largest buyer year-to-date at 95 tonnes.

Brazil added 11 tonnes, extending its recent accumulation trend, while additional purchases were reported from Uzbekistan, Kazakhstan, the Kyrgyz Republic, the Czech National Bank, the People’s Bank of China, and Bank Indonesia.

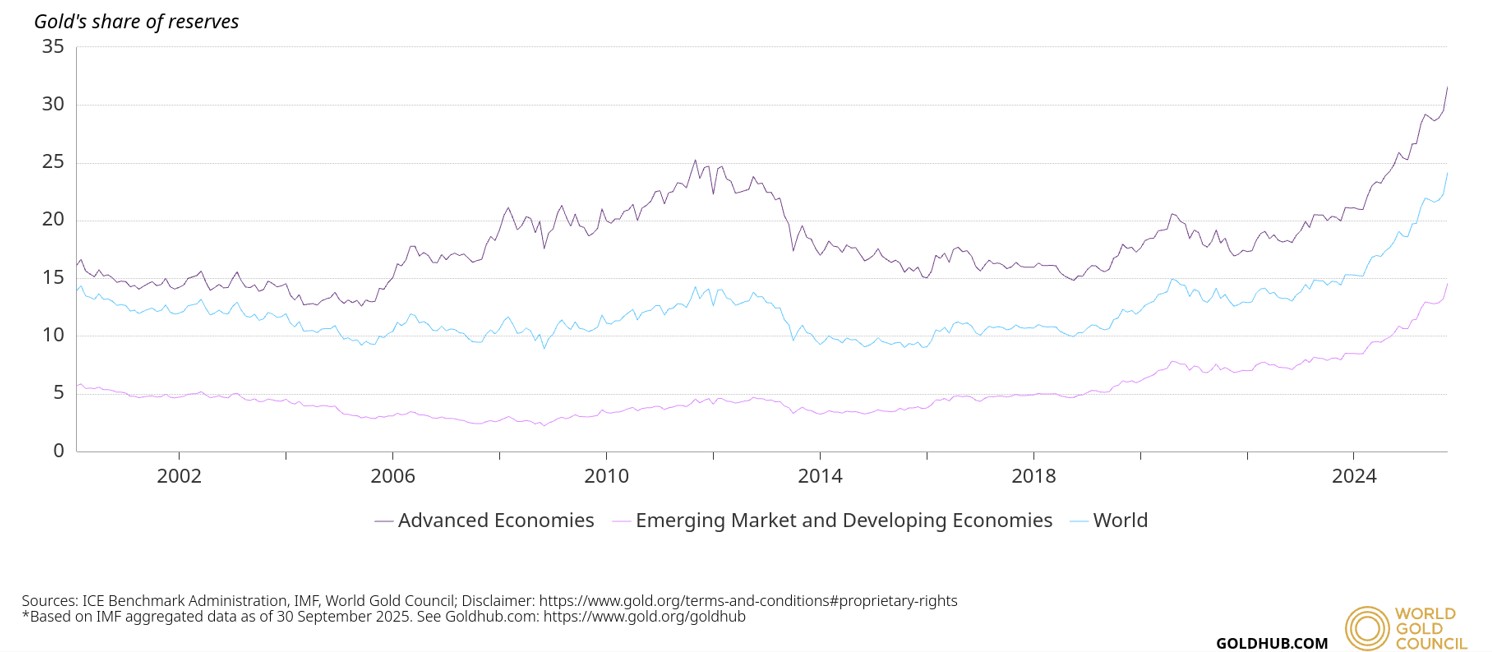

More importantly, the World Gold Council (WGC) highlights a structural reason this trend may persist.

Emerging-market gold reserves remain well below those of advanced economies as a share of total reserves.

In a world of elevated geopolitical and policy risk, this leaves room for further accumulation, particularly if tensions escalate.

#3 — Gold production is not peaking yet

On the supply side, fears of an imminent production peak appear overstated.

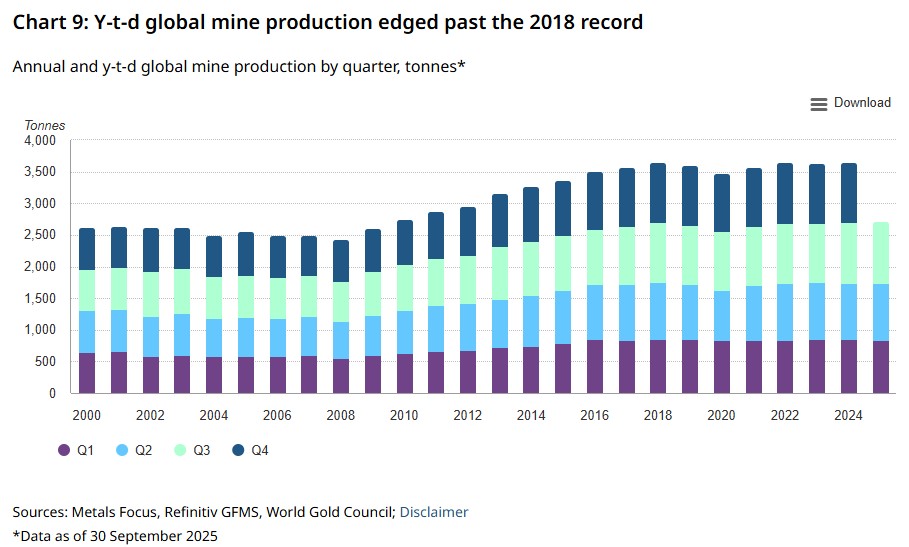

According to the WGC, mined gold production reached 3,645 tonnes in 2024, the second-highest level on record.

Production in first 3 quarters in 2025 totalled 2,717 tonnes, up 16 tonnes year-on-year.

The WGC’s base case is that 2025 is well positioned to achieve a new record, supported by higher margins, new projects, expansions, and increased artisanal and small-scale output.

That said, even at record prices, mine supply does not respond instantly.

Long project lead times and operational constraints mean production tends to adjust slowly, with the WGC expecting output to gradually plateau over the coming years rather than surge sharply.

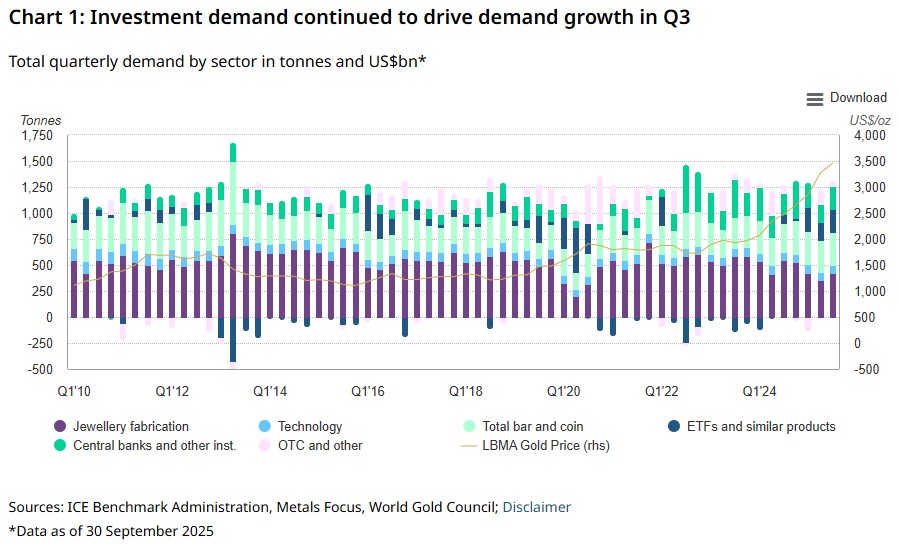

#4 — The demand mix has shifted

At elevated price levels, jewellery demand typically softens. However, gold can continue to rally if the marginal buyer is either price-insensitive or return-oriented.

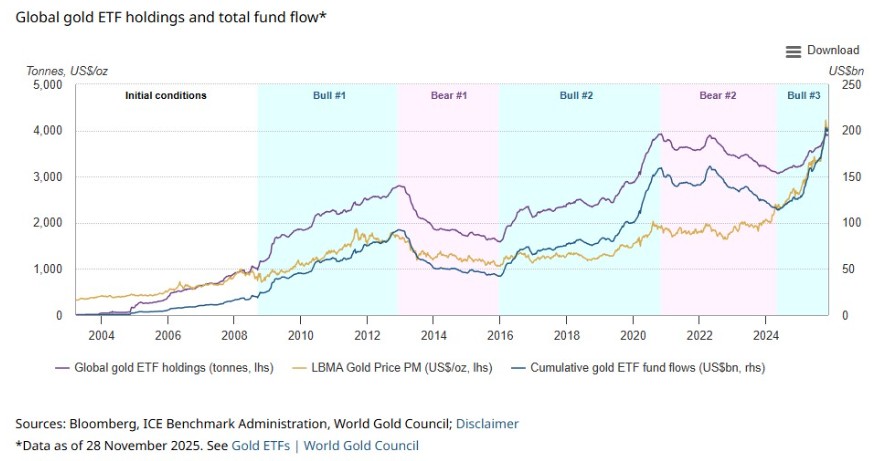

That has clearly been the case. In Q3 2025, the WGC reported record ETF demand of 222 tonnes, with US$26bn of global inflows, pushing total ETF holdings to 3,838 tonnes, just 2% below the November 2020 peak.

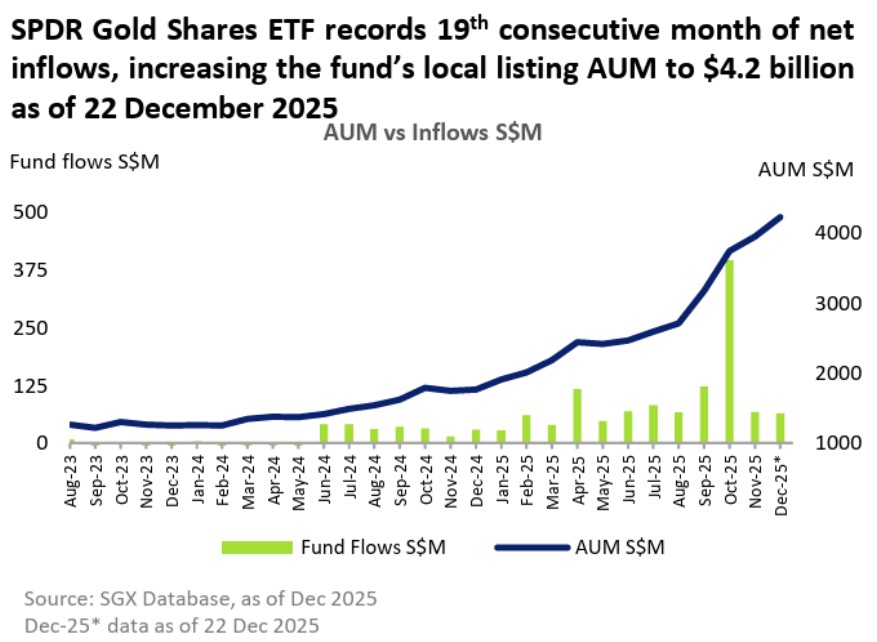

Locally, steady investor interest can be seen in the continued expansion of Singapore’s gold market.

As of 22 December 2025, the SPDR Gold Shares ETF had recorded net inflows for 19 consecutive months, bringing its assets under management on the Singapore exchange to nearly S$4.2 billion.

ETF flows matter because they can tighten the market quickly.

Once prices break higher, momentum can become self-reinforcing, particularly when combined with strong official-sector demand.

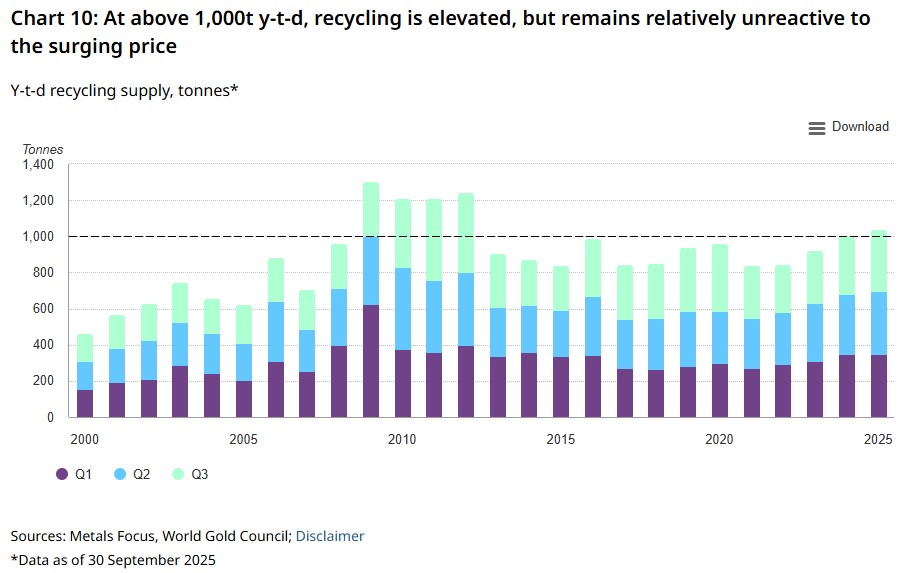

#5 — Recycling has been more muted than expected

Higher prices usually bring more scrap supply to market, but recycling has been more restrained than many expected in 2025.

One reason is the increased use of gold as collateral for loans, particularly in India.

The WGC estimates that more than 200 tonnes of gold jewellery have been pledged through the formal sector this year alone.

This has been supportive in limiting secondary supply, but it also introduces a two-way risk.

If economic conditions weaken sharply, forced liquidation of pledged gold could lift recycling volumes and weigh on prices.

#6 — Monetary policy and dollar weakness

Monetary policy remains another key pillar of support.

According to CME FedWatch, the Federal Reserve is expected to cut rates twice in 2026, reducing the opportunity cost of holding gold.

As a non-yielding asset, gold becomes more attractive when interest rates decline.

At the same time, a weaker US dollar has boosted international demand.

As of 12 Jan 2026, the US Dollar Index is down 8.8% since end-2024, providing a meaningful tailwind.

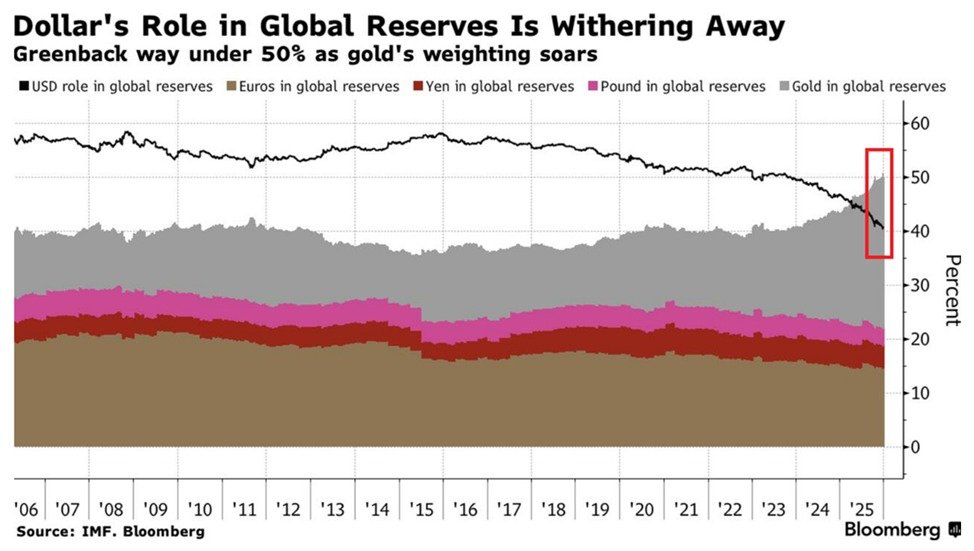

Beyond cyclical factors, a deeper structural shift is underway.

According to IMF and Bloomberg, or the first time in decades, the market value of gold held by foreign central banks has overtaken their holdings of US Treasuries.

Central bank gold reserves are now valued at close to US$4 trillion, broadly matching, and in some estimates exceeding foreign-held US government debt.

This development underscores gold’s role as a neutral, non-printable reserve asset at a time when fiscal sustainability and policy credibility are increasingly in focus.

What may move gold prices in 2026?

Several major financial institutions have published bullish forecasts for gold, although analysts emphasise the need to monitor different economic scenarios.

HSBC has suggested that gold could reach around US$5,000 per ounce in the first half of 2026, supported by elevated geopolitical risks and rising global debt levels.

Morgan Stanley, meanwhile, sees gold moving toward US$4,800 per ounce by the fourth quarter of 2026, driven by continued central bank demand and a more supportive monetary backdrop.

According to a recent World Gold Council survey, 95% of central banks expect to further increase their gold reserves over the next 12 months, highlighting the ongoing diversification away from traditional reserve assets.

In addition, many institutional investors such as pension funds and superannuation funds remained under-allocated to gold in 2025 and are expected to increase their exposure in 2026 as part of broader portfolio diversification efforts.

That said, the path forward is unlikely to be smooth.

For example, the Bloomberg Commodity Index underwent its annual rebalancing between 9 and 15 January.

The index caps the weight of any single commodity, gold’s target allocation is being reduced from about 20.4% to 14.9%, potentially forcing passive funds to sell an estimated 2.4 million troy ounces over a short period.

Such mechanical flows can create outsized short-term volatility in both gold and silver, even when underlying fundamentals remain unchanged.

Beyond technical factors, a repricing of US yields, renewed US dollar strength, or a sharp improvement in global risk sentiment could trigger meaningful corrections in gold prices, even if longer-term demand drivers remain supportive.

What Would Beansprout Do?

The current gold rally appears to be driven by structural drivers, as Central banks continue to add to reserves, and investment flows have stayed resilient.

At the same time, geopolitical and policy uncertainties persist, as seen in recent developments around Venezuela and ongoing trade-related risks.

That said, the run-up has been steep, and investors should be careful not to chase prices blindly.

When thinking about adding gold to an investment portfolio, I see it more as a tool for diversification rather than for speculation.

Gold does not generate income and it is not meant for short term trading. Its real value lies in diversification and protection, especially during periods of market stress or uncertainty.

This is why gold tends to work best as a long term component within a well balanced portfolio, rather than a tactical bet.

I am also disciplined about sizing. For most investors, a modest allocation is usually sufficient. Many portfolio frameworks suggest around 5% to 10%, depending on your risk tolerance and how the rest of your assets are allocated.

If you are considering adding gold, it may also make sense to do so gradually instead of investing a lump sum at one go. Staggering your purchases over time can help reduce the pressure of trying to get the timing right.

Ultimately, gold does not need to shine every year to be useful. By keeping a steady, long term allocation, it can quietly play its role in helping your portfolio stay resilient through different market cycles.

If you are interested in buying gold, learn how to buy gold in Singapore here.

If you are keen to buy physical gold, find out how to buy physical gold from UOB with our step by step guide here.

To gain access to gold in a simple and low-cost way, find out the best gold ETF in Singapore here.

If you are looking for a simple, low-cost way and regulated exposure, the SPDR Gold Shares ETF is a practical local solution, especially since it is SRS-eligible and CPF-OA approved.

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in gold ETFs.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments