Should you invest in gold in 2026?

Commodities

By Gerald Wong, CFA • 15 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Is gold still worth owning in 2026? Explore the key reasons to invest in gold, price drivers, and how Singapore investors can gain exposure.

What happened?

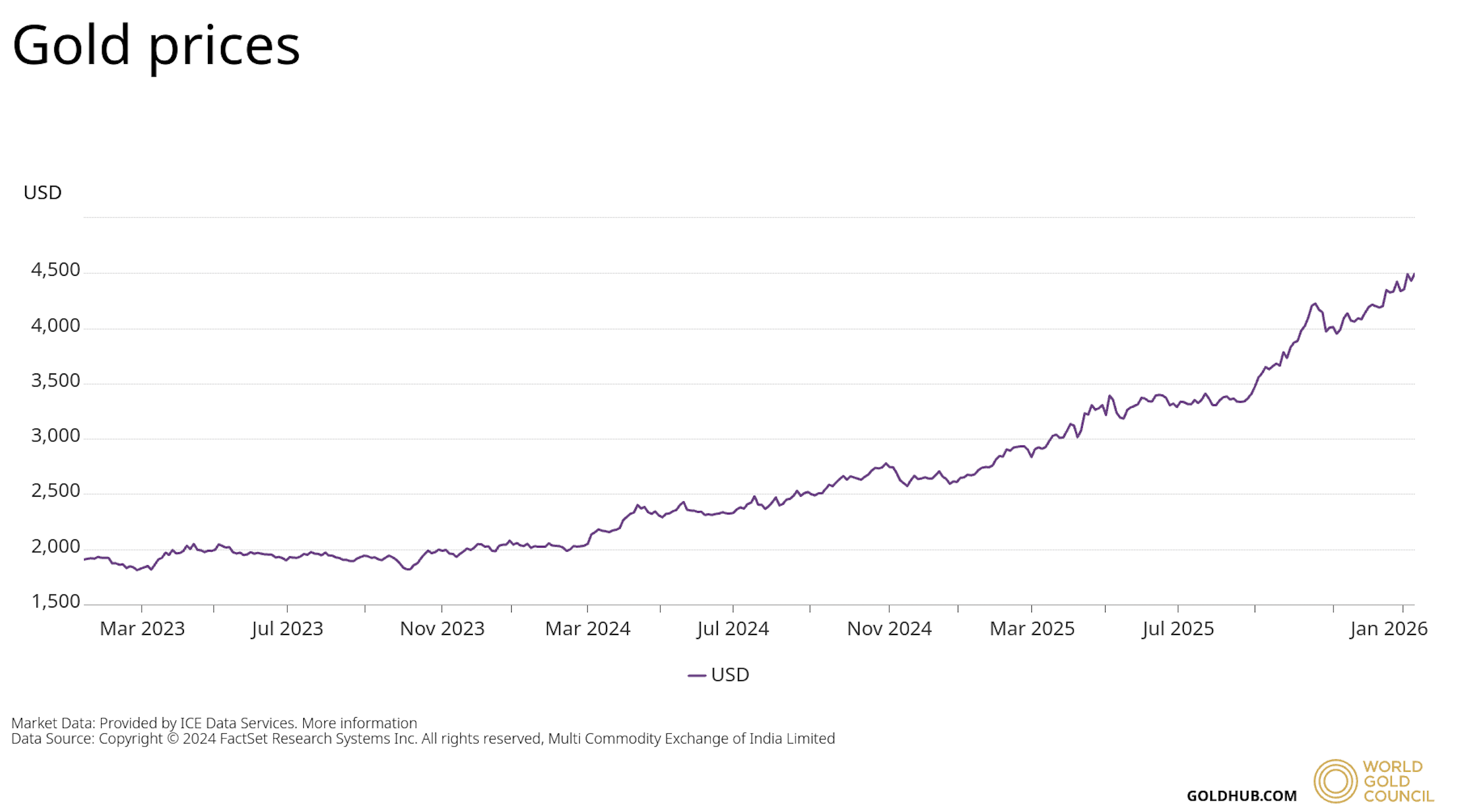

Gold prices continue to climb in 2026.

However, the reasons for owning the precious metal tend to remain constant over decades.

Gold is often viewed not just as a commodity, but as a strategic financial asset used to preserve wealth and insure portfolios against uncertainty.

While I have previously shared how to buy gold in Singapore and gold hitting record high back in October 2025, the recent further rally has led many to ask whether the asset still offers value for new or existing portfolios.

In this article, we’ll dive into the fundamental reasons to consider gold, drivers of gold price, and the various ways you can invest in gold in Singapore.

Why invest in gold?

Gold is regarded as a strategic asset because of its unique behavior relative to other asset classes.

There are four structural pillars that support gold as a long-term investment.

#1 - Competitive historical returns

A common misconception is that gold acts only as a safety net and does not generate growth.

However, historical data paints a different picture.

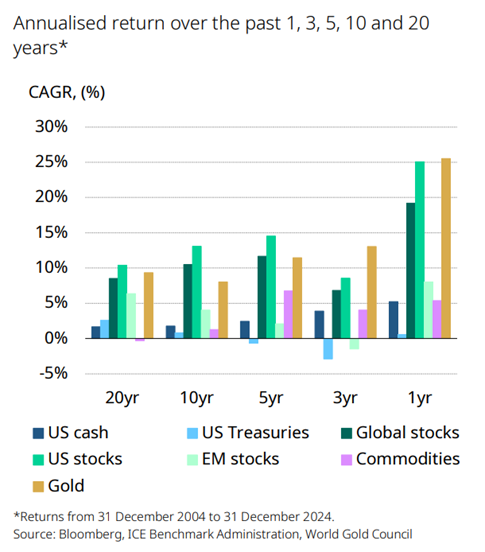

Since the end of the gold standard in 1971, gold has achieved an annualized return of nearly 8% in US dollar terms.

Over various time horizons ranging from 1 to 20 years, gold has frequently performed competitively against major asset classes, including commodities, emerging market stocks, and US Treasuries.

It has thus proven to generate positive returns across diverse economic cycles.

#2 - Effective portfolio diversifier

Gold helps diversify portfolios by acting as a liquid safe haven with low correlation to traditional assets, helping hedge inflation and currency risk while reducing volatility.

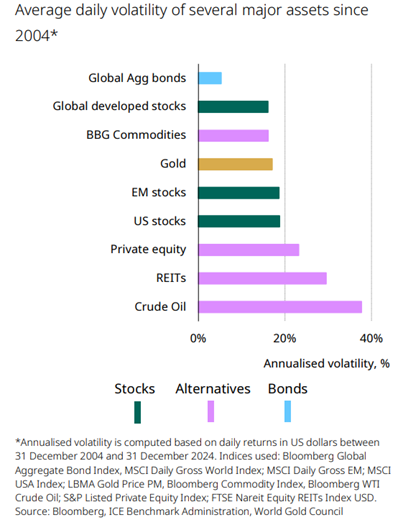

Compared to other major assets like REITs, private equity, or crude oil, gold historically demonstrates lower annualised volatility.

This shows that when equity markets are volatile, gold often holds its value or appreciates.

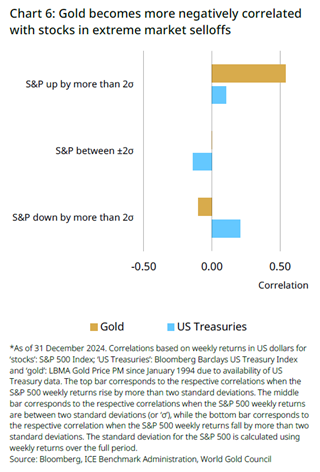

Research from the World Gold Council also suggests that this negative correlation tends to strengthen during extreme market sell-offs.

By adding gold to a standard portfolio of stocks and bonds, investors can potentially reduce their overall portfolio volatility and minimize drawdowns.

#3 - High liquidity

Gold is one of the most liquid assets in the world. Its average daily trading volumes often surpass those of major stock indices.

By the end of 2025, average daily trading volumes reached a record US$361 billion, often surpassing the volumes of major stock indices.

This deep liquidity ensures that investors can easily convert their gold holdings into cash at any time without facing significant price spreads or difficulty finding a buyer.

#4 - Reliable store of value and hedge

Gold is widely recognized as a store of value because it is a finite physical asset.

Unlike fiat currencies, which can be printed by central banks in unlimited quantities, the supply of gold is scarce and grows slowly at a rate of approximately 1.7% per year.

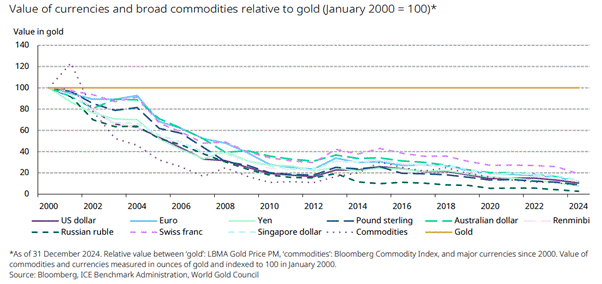

This scarcity makes gold an effective hedge against the erosion of purchasing power. Since the year 2000, major currencies—including the US dollar and Singapore dollar—have seen a significant decline in purchasing power when measured against gold.

What are the drivers of gold price?

Unlike stocks, which are driven by earnings, or bonds, which are driven by yields, gold is influenced by a distinct set of macroeconomic forces.

Understanding these drivers can help investors make more informed long-term decisions about the role gold plays in their portfolios.

#1 - Interest rates and opportunity cost

One of the strongest influences on gold prices is real interest rates.

Since gold does not pay interest or dividends, holding it carries an opportunity cost when interest rates are high.

When central banks cut interest rates, this opportunity cost falls.

As a result, gold often becomes more attractive relative to interest-bearing assets such as bonds or savings accounts, supporting higher prices.

#2 - US monetary expansion and debt

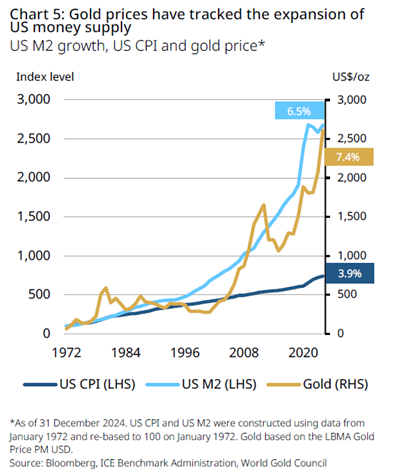

Gold prices have historically moved in tandem with the expansion of the US money supply (M2).

As central banks increase money supply and the US national debt reaches record levels (approaching US$38 trillion by late 2025), concerns over currency debasement tend to grow.

Because gold cannot be printed, it is commonly used as a hedge against the declining purchasing power of fiat currencies during periods of monetary expansion.

#3 - Central bank demand

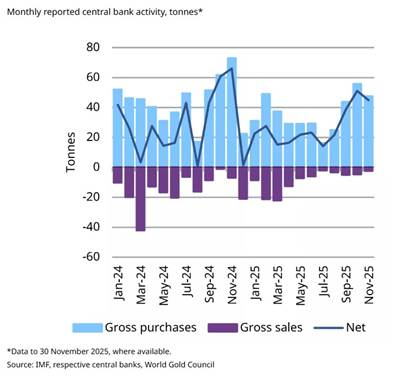

Central banks are among the largest holders of gold.

In recent years, official institutions have increasingly shifted their reserves away from fiat currencies and into gold to diversify their holdings.

With no credit or counterparty risk, gold serves as a strategic store of value for nations seeking to strengthen their balance sheets or mitigate geopolitical and financial risks.

#4 - Geopolitical uncertainty

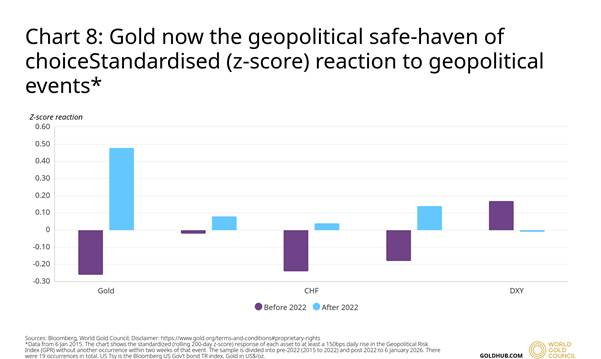

Gold has long been regarded as a classic safe-haven asset.

During periods of geopolitical tension, war, or political instability, investors often flock to gold as a form of portfolio insurance.

These episodes typically trigger a surge in demand, pushing gold prices higher when global uncertainty peaks.

#5 - Supply and demand dynamics

Gold is a finite resource, with supply growing slowly at an estimated rate of about 1.7% per year. This limited growth provides long-term support for its value.

On the demand side, gold is supported not just by investors, but also by pro-cyclical consumption.

Economic expansion often leads to increased demand for jewelry and technology, particularly in major markets like China and India.

What are the risks of investing in gold?

Even though gold is often seen as a safe haven, it is not risk free. Below, we share some of the risks when investing in gold.

#1 - Market risk

Market risk is one of the most important considerations when investing in gold. While gold is often perceived as a stable store of value, its price can be surprisingly volatile over short periods.

Movements in gold prices are influenced by a range of factors, including changes in interest rate expectations, inflation data, currency trends, and shifts in investor sentiment.

For example, a stronger US dollar or rising real yields can reduce the attractiveness of holding gold compared to interest bearing assets, putting downward pressure on prices.

These swings can be uncomfortable, especially for investors who expect gold to behave as a steady hedge in uncertain markets.

#2 - No income generation

Another key risk is that gold does not generate income.

Unlike stocks that pay dividends or bonds that provide interest, gold relies purely on price appreciation for returns. In an environment where interest rates remain higher for longer, or where other income assets offer attractive yields, the opportunity cost of holding gold can rise.

This can limit gold’s appeal and weigh on its performance, even during periods of uncertainty.

How to invest in gold?

Depending on your goals for cost, convenience, and ownership, here are the primary alternatives to invest in gold in Singapore.

- Physical Gold: Investors can buy bars or coins from reputable dealers or at the UOB Main Branch Gold Counter. This offers direct ownership but requires secure storage and insurance.

- Gold ETFs: This is a popular and liquid method for most investors. The SPDR Gold Shares ETF (SGX: O87 / GSD) is listed on the Singapore Exchange, 100% physically backed, and is SRS-eligible and CPF-OA approved.For those prioritizing lower costs, the iShares Gold Trust (IAU) in the US offers a lower expense ratio of 0.25%. Find out which are the best gold etfs here.

- Gold-mining stocks: Investing in gold mining companies allows you to benefit from business revenue. However, these stocks carry corporate risks and may not track the price of gold perfectly.

- Gold CFDs: For more active traders, CFDs offer leveraged exposure to both rising and falling markets. However, it carries high risk and you do not own the actual metal.

You can learn more on the ways to buy gold here.

What would Beansprout do?

When thinking about adding gold to an investment portfolio, I see it more as a tool for diversification rather than for speculation.

Gold does not generate income and it is not meant for short term trading. Its real value lies in diversification and protection, especially during periods of market stress or uncertainty.

This is why gold tends to work best as a long term component within a well balanced portfolio, rather than a tactical bet.

I am also disciplined about sizing. For most investors, a modest allocation is usually sufficient. Many portfolio frameworks suggest around 5% to 10%, depending on your risk tolerance and how the rest of your assets are allocated.

If you are considering adding gold, it may also make sense to do so gradually instead of investing a lump sum at one go. Staggering your purchases over time can help reduce the pressure of trying to get the timing right.

Ultimately, gold does not need to shine every year to be useful. By keeping a steady, long term allocation, it can quietly play its role in helping your portfolio stay resilient through different market cycles.

If you are interested in buying gold, learn how to buy gold in Singapore here.

If you are keen to buy physical gold, find out how to buy physical gold from UOB with our step by step guide here.

To gain access to gold in a simple and low-cost way, find out the best gold ETF in Singapore here.

If you are looking for a simple, low-cost way and regulated exposure, the SPDR Gold Shares ETF is a practical local solution, especially since it is SRS-eligible and CPF-OA approved.

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in gold ETFs.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments