Stocks gain on US-China optimism but Fed cools rate cut hopes: Weekly Market Recap

By Gerald Wong, CFA • 02 Nov 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Markets gained on upbeat US-China talks, then cooled as the Fed warned rate cuts remain uncertain.

This week, all eyes were on two key events, the highly anticipated Trump-Xi meeting and the Federal Reserve’s policy announcement.

But what really caught my attention were the headlines about F&B closures and Amazon cutting 14,000 jobs.

It’s a reminder that even with stocks hovering near record highs, there’s still plenty of uncertainty in the economy.

Reflecting this uncertainty, my cousin reached out this week to learn how to start building passive income for greater financial security.

Here is what I shared with her:

- Start with a financial plan to understand your goals, risk appetite, and reasons for investing. Check out our guide on how to start investing.

- Learn about different investment options such as bonds and Singapore REITs.

- Stay diversified by gaining broad exposure through exchange traded funds (ETFs) or mutual funds.

- Alternatively, use a robo-advisor to gain access to curated investment portfolios.

- Start small and invest consistently to build confidence, using tools like a regular savings plan.

If you’re looking for inspiration, tune in to our latest podcast with our Money Diaries guest Jalyn Cai, who shared how she achieved financial freedom at 36.

This week, we also explore 3 Singapore REITs with dividend yields of above 5% and what to expect at the upcoming T-bill auction.

The job market may be uncertain, but each step we take to strengthen our finances brings us closer to security and freedom.

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

🏛 Fed cools rate cut hopes

What happened?

US President Donald Trump and Chinese President Xi Jinping have agreed to a one-year trade truce.

The deal includes a reduction of US tariffs on Chinese imports, a suspension of China’s export controls on rare earth materials, and the resumption of China’s purchases of US soybeans and other agricultural products.

What does this mean?

The easing of trade tensions brought some relief to markets, though investors remained focused on what the Federal Reserve might do next.

As widely expected, the Fed cut interest rates by 25 basis points in its latest meeting. However, Fed Chair Jerome Powell cautioned that another cut in December is far from certain.

According to the CME FedWatch Tool, the probability of another 0.25% rate cut in the December meeting has fallen to 69% as of 31 October, down from 92% a week earlier.

Why should I care?

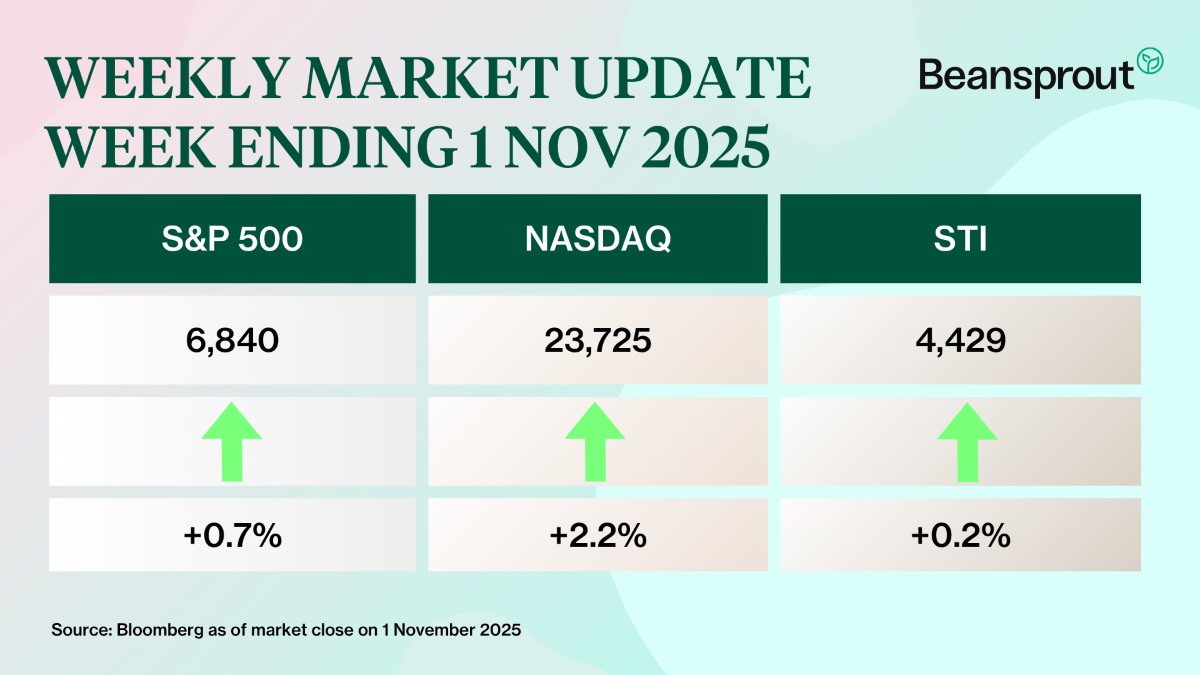

US stocks posted modest gains this week, with the rally led by a handful of mega-cap technology companies, particularly those riding the wave of artificial intelligence investments.

US government bond yields bounced after comments from the Federal Reserve, with the 10-year Treasury yield closing at 4.08% on 1 November 2025, up from a weekly low of 3.97% on 28 October.

In Singapore, the Straits Times Index (STI) inched up. Gains in industrial names like Sembcorp Industries helped offset weakness in REITs, which came under pressure from higher bond yields.

🚗 Moving This Week

- CapitaLand Integrated Commercial Trust’s (CICT) net property income (NPI) grew 1.6 per cent year on year to S$294.4 million for the third quarter ended September 2025. The increase comes on the back of CICT’s acquisition of CapitaSpring office in August this year, as well as the progressive handover of its office property in Germany, Gallileo, to its anchor tenant, the European Central Bank. Read more here.

- Mapletree Industrial Trust (MIT) has reported a distribution per unit (DPU) of 3.18 cents for the 2QFY2025/2026 ended Sept 30, down 5.6% y-o-y. This was driven by a decline in net property income with the portfolio divestment of three industrial properties in Singapore on August 15, lower contribution from the North American Portfolio from non-renewal of leases, and the depreciation of US dollar against Singapore dollar. Read more here.

- Mapletree Logistics Trust (MLT) has reported a distribution per unit (DPU) of 1.815 cents for the 2QFY2025/2026 ended Sept 30, down 10.5% y-o-y. This was driven by a decline in gross revenue and NPI for the 2QFY2025/2026 due to forex impact from weaker regional currencies and divestments. Read more here.

- CapitaLand Ascott Trust (CLAS) gross profit rose 1 per cent year on year for the third fiscal quarter ended September. This was driven by stronger operating performance, portfolio reconstitution and asset enhancement initiatives. These mitigated the impact of depreciation of foreign currencies against the Singapore dollar. Read more here.

- Lendlease REIT reported a committed portfolio occupancy of 95 per cent for its first quarter ended Sep 30, up from 92.1 per cent in the previous quarter. This was “driven by active leasing efforts” for Building 3 of the Sky Complex property in Milan, Italy. Read more here.

- Wilmar reported a net loss of US$347.7 million for the third quarter ended Sep 30, due to a payment of 11.9 trillion rupiah (S$926.6 million) in relation to the group’s actions amid a shortage of cooking oil in the country. Excluding the payment, Wilmar’s Q3 core net profit rose 71.6 per cent to US$357.2 million, from US$208.1 million a year earlier. Read more here.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

3 Singapore REITs with dividend yields of above 5% (Oct 2025)

Here’s 3 REITs listed in Singapore with attractive dividend yields to help boost your passive income amidst lower interest rates.

🤓 What we're looking out for next week

- Monday, 3 November 2025: Netlink Trust earnings, Palantir earnings

- Tuesday, 4 November 2025: SIA Engineering, Elite UK REIT earnings, AMD earnings, Mapletree Logistics Trust ex-dividend

- Wednesday, 5 November 2025: AIMS APAC REIT, Manulife US REIT, Parkway Life REIT earnings, First REIT ex-dividend

- Thursday, 6 November 2025: DBS, UOB, Stoneweg European Stapled Trust earnings, 6 Month Singapore T-bill Auction

- Friday, 7 November 2025: OCBC, Frasers Logistics & Commercial Trust earnings

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments