Stocks bounce on rising rate cut hopes: Weekly Market Recap

By Gerald Wong, CFA • 23 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

US and Singapore stocks rise on heightened rate cut expectations

I was recently invited by ChannelNewsAsia to join their Money Talks podcast to share my thoughts on investing in overseas ETFs.

One of the key points I raised was currency risk, something especially relevant for investors in Singapore who plan to retire and spend in Singapore dollars.

With the US dollar swinging quite a bit against the Singapore dollar this year, this risk has become even harder to ignore.

That naturally leads to the question: how can we generate passive income while keeping our investments in Singapore dollars?

This has become more pressing as fixed deposit rates continue to fall, with growing expectations of Fed rate cuts in the months ahead.

This week, we explored several Singapore-dollar options:

- Exchange Traded Funds (ETFs) listed on SGX, such as the Nikko AM Singapore STI ETF and ABF Singapore Bond Index Fund.

- Mutual funds like the Fullerton SGD Cash Fund and Fullerton Short Term Interest Rate Fund.

- Singapore Savings Bonds (SSBs), with the latest issuance offering a 10-year average yield of 2.11% p.a.

As I mentioned in the podcast, investors today have more choices than ever. It used to feel like we only had “yong tau foo” but now “laksa” is on the menu too.

Still, the starting point is the same: ask yourself what your investment objectives are. If your goal is to spend in Singapore dollars during retirement, which investments will give you peace of mind and help you achieve the lifestyle you want?

Happy growing!

Gerald, Founder of Beansprout

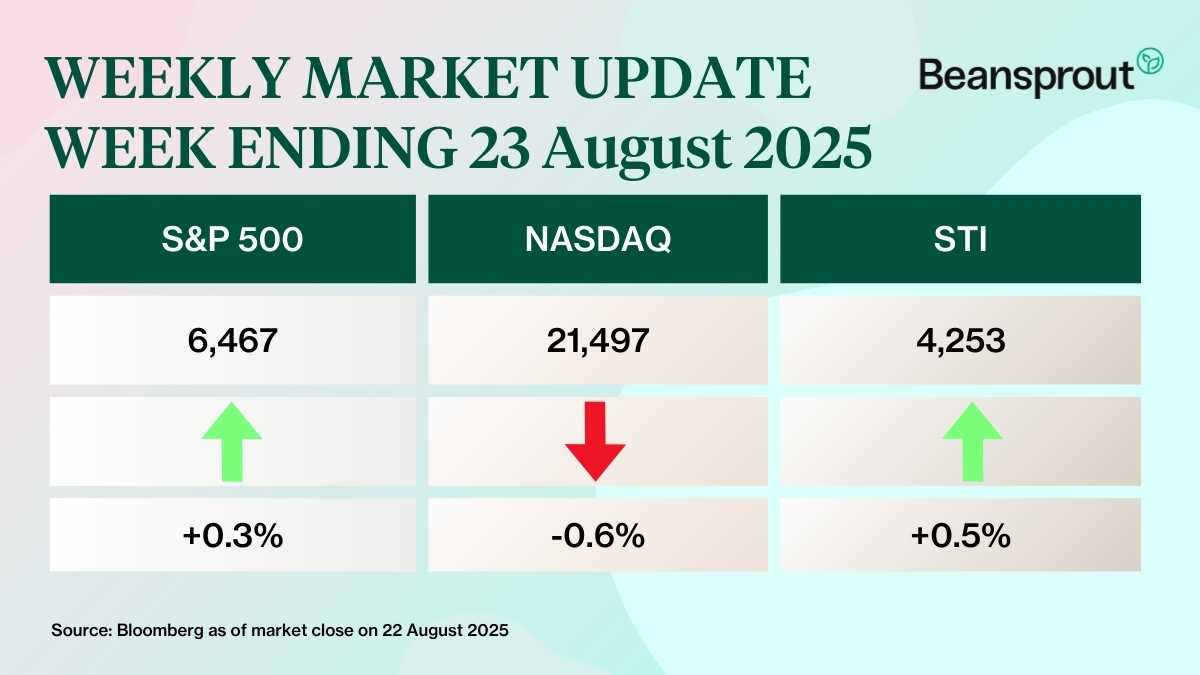

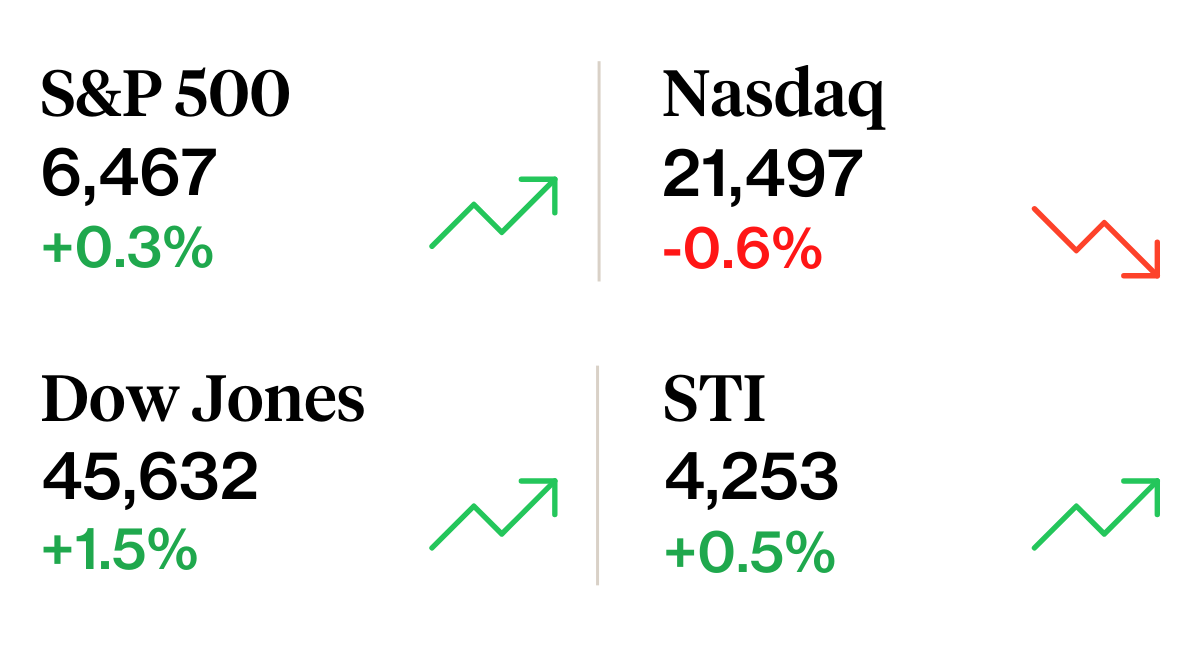

⏰ This Week In Markets

🏛 Rising rate cut hopes

What happened?

In his annual Jackson Hole speech, Fed Chair Jerome Powell signaled that financial conditions “may warrant” interest rate cuts.

He pointed to an unusual mix of weak labour demand and declining labour supply, noting that this raises downside risks for employment.

Powell also emphasised that the Fed is moving “carefully” in its policy approach as it monitors how the economy evolves.

What does this mean?

Powell’s comments at Jackson Hole were seen as leaving the door open for interest rate cuts.

Markets reacted quickly, with the CME FedWatch Tool showing traders now pricing in more than a 91% chance of a rate cut at the Fed’s September meeting.

Why should I care?

U.S. stocks rebounded on Friday after a weak start to the week, as rising expectations of Fed rate cuts lifted investor sentiment.

However, tech stocks slipped on profit-taking, with renewed worries about the sustainability of heavy AI-related infrastructure spending weighing on the sector.

U.S. government bond yields also fell as traders priced in stronger chances of rate cuts.

In Singapore, equities saw a modest recovery, boosted by REITs with lower bond yields. Mapletree Logistics Trust gained 2.6%, while CapitaLand Integrated Commercial Trust rose 2.3%.

🚗 Moving This Week

- Singapore Airlines (SIA)’s passenger traffic in July 2025 was 6.2 per cent higher compared with the previous year. The increase in passenger traffic for SIA and Scoot outpaced the 2.8 per cent expansion in passenger capacity. As a result, the group’s passenger load factor rose to 88.5 per cent, up 2.9 percentage points from the prior year. Read more here.

- SATS grew its Q1 earnings 9.1 per cent year on year to S$70.9 million for the first quarter ended Jun 30, 2025, boosted by growth in aviation cargo and food service volumes. Read more here.

- CapitaLand Ascendas Reit (Clar) announced the proposed divestments of five Singapore properties for a total sale consideration of S$329 million. These divestments are being proposed at premiums of about 6 per cent over the properties’ total market valuation and 20 per cent over the original purchase price. This follows Clar’s target of about S$300 million to S$400 million in divestments in Singapore, Europe, the US and Australia this year. Read more here.

- Frasers Hospitality Trust’s (FHT) stapled security holders approved the privatisation offer at a scheme meeting. This is the second time in three years that Frasers Property has attempted to privatise the stapled group. It tried to do so in September 2022 for S$0.70 per stapled security, though the attempt narrowly failed. Read more here.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

SSB 10-year return at 2.11%. Better than fixed deposits and T-bills?

The current issuance of the Singapore Savings Bond (SSB) offers a 10-year average return of 2.11% per year. We compare this to fixed deposits and T-bills to find out if it's worth applying for the SSB.

🤓 What we're looking out for next week

- Monday, 25 August 2025: PropNex ex-dividend

- Tuesday, 26 August 2025: Singapore Savings Bonds (SSB) application closing date

- Wednesday, 27 August 2025: Nvidia earnings, Delfi, Genting Singapore ex-dividend

- Thursday, 28 August2025: APAC Realty ex-dividend, Singapore 6-month Singapore T-bill auction

- Friday, 29 August 2025: Alibaba earnings

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Join the Beansprout Telegram group and Facebook group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments