Nvidia posts mixed earnings and T-bill yields slide: Weekly Market Recap

By Gerald Wong, CFA • 31 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Nvidia reported mixed earnings while the Singapore T-bill yield fell further.

Over lunch with the team on Friday, the topic of retirement adequacy came up.

A recent ADP Research report highlighted that 60% of workers in Singapore were living paycheck to paycheck in 2024. Many Singaporeans also seem to be prioritising experiences and self-care over financial planning.

It’s a worrying trend, but it also raises an important question: how can we take the first step towards ensuring retirement adequacy?

For most of us, CPF remains the foundation of our retirement needs. This week, we look at a few ways to grow your CPF savings.

For those investing their CPF and SRS funds, you now have more options. We look into how you can invest in eligible SGX stocks and ETFs through Tiger Brokers.

Meanwhile, with the latest 6-month Singapore T-bill yields falling to 1.44%, investors have turned their attention back to bond funds. In my latest podcast, I find out how bond funds typically respond to falling rates and how you can gain exposure.

At the end of the day, financial planning doesn’t have to feel like a burden. I like to think of it as a form of self-care, where the small steps we take today can enable us to live better tomorrow.

Happy growing!

Gerald, Founder of Beansprout

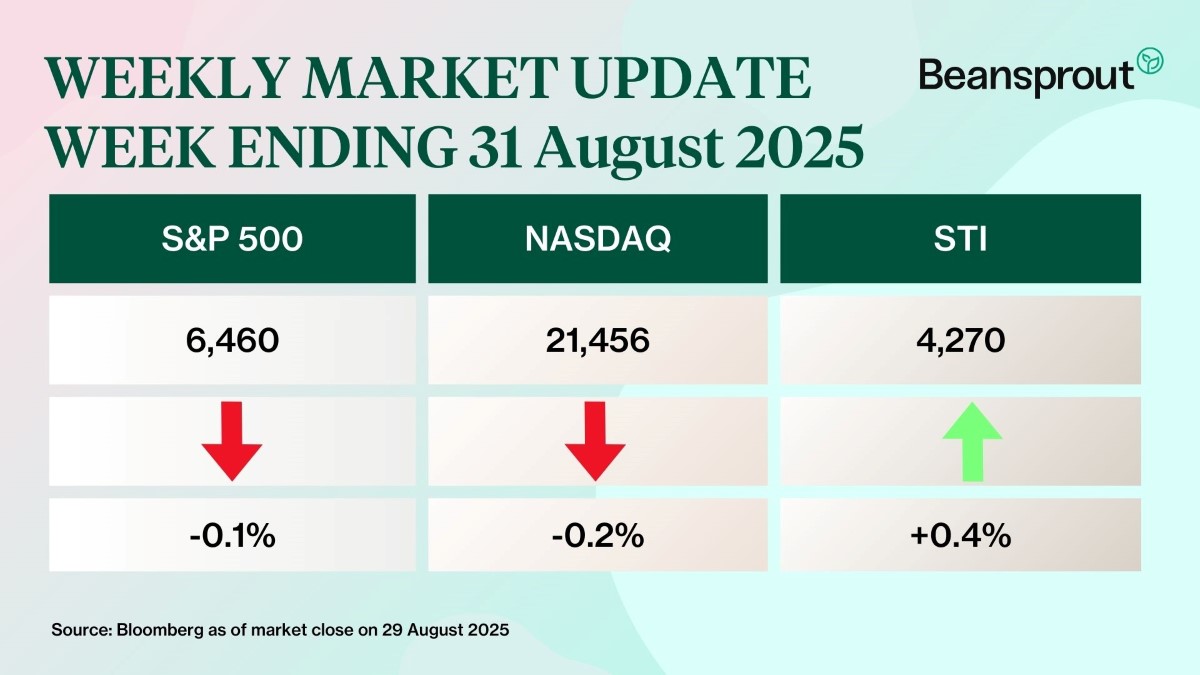

⏰ This Week In Markets

🏛 Nvidia earnings mixed

What happened?

US chipmaker Nvidia reported quarterly revenue and earnings that came in above market expectations.

The world’s most valuable company by market capitalisation also issued strong guidance for the next quarter, even as revenue growth continued to moderate from earlier record-breaking quarters.

What does this mean?

Nvidia’s latest results helped calm fears that the AI-fuelled rally might be overhyped, with earnings once again beating expectations.

Adding to the optimism, the U.S. economy expanded at an annualised rate of 3.3% in Q2, slightly stronger than the earlier estimate of 3%.

Investors are now turning their attention to the Fed. According to the FedWatch tool, markets are pricing in an 86% chance of a rate cut at the September meeting.

Why should I care?

U.S. stocks dipped slightly on lighter trading volumes ahead of the holiday weekend.

In Singapore, the Straits Times Index (STI) added +0.4%, lifted by REITs as lower bond yields boosted sentiment. Gains were led by Frasers Centrepoint Trust (+3.6%) and Mapletree Logistics Trust (+3.4%).

🚗 Moving This Week

- Keppel Limited has filed an arbitration claim against Seatrium over liabilities related to Operation Car Wash. Seatrium announced on 30 July that it had reached a settlement with the Brazilian and Singapore authorities over offences related to the long-running case. Based on the final settlement payment, Keppel says its indemnity claim against Seatrium would amount to S$68.4 million. Read more here.

- CapitaLand Investment's China REIT, CapitaLand Commercial C-REIT (CLCR), has received approval to register for a listing. CLCR is expected to raise some RMB2.1 billion, or $375 million, through the issuance of 400 million units. The listing is likely to be by the end of the year.

- CapitaLand Ascott Trust has acquired three rental housing properties in Japan for a total of 4 billion yen (S$34.2 million). The transaction is expected to have a distribution per stapled security (DPS) accretion of 0.3 per cent. Read more here.

- Sabana REIT has appointed Karen Lee as the CEO of its new internalised manager. Lee, who has over 20 years of experience, was previously the deputy CEO of the merged ESR REIT and CEO of ARA LOGOS Logistics Trust before it merged with ESR. Read more here.

- Sea Ltd has reclaimed its title as South-east Asia’s most valuable publicly traded company, surpassing DBS Group Holdings after a 300 per cent comeback rally powered by its e-commerce arm Shopee.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

How to grow your CPF for retirement adequacy

We explore how can you grow your CPF savings to ensure you have enough to retire.

🤓 What we're looking out for next week

- Monday, 1 September 2025: US Labour Day Holiday, Jardine Cycle and Carriage Ex-Dividend, Venture Corp Ex-Dividend, SSB application opening

- Tuesday, 2 September 2025: NIO earnings

- Friday, 5 September 2025: US Nonfarm Payrolls data

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Join the Beansprout Telegram group and Facebook group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments