Fed rate cuts back in focus: Weekly Market Recap

By Gerald Wong, CFA • 07 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Stocks rose with rising hopes of a Fed rate cut in December.

As we enter the last month of 2025, I’ve noticed that my social feeds are suddenly filled with posts by friends on their year-end holidays.

And while they’re making use of the strong Singapore dollar to spend overseas, the rest of us are checking something else… our year-end finances.

This is usually when people start asking, “Is there any tax relief I can enjoy before the year ends?” Same question, every December.

While updating our Supplementary Retirement Scheme (SRS) guide this week, I stumbled on a heartening statistic. The number of SRS account holders has grown from just over 100,000 ten years ago to nearly 470,000 as of December 2024. To me, it shows that more people in Singapore are taking retirement planning seriously.

This week, we break down how you can use SRS to enjoy tax relief and grow your retirement savings at the same time.

If you’re thinking about starting your investing journey in 2026, we also rounded up the best brokerages and trading platforms in Singapore.

One highlight that stood out: Moomoo’s new CDP linkage, which lets you own Singapore stocks directly in CDP at lower costs. It’s a feature many investors have been waiting for.

And for those hunting for a place to park their savings, we've updated the best fixed deposit and savings account rates for December. With the T-bill yield bouncing to 1.41% in the latest auction, we find out if there are better pockets of value elsewhere.

As we wind down for the year, it might be a good time to take a moment, look back at your financial goals, and set yourself up for a stronger 2026.

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

🏛 All eyes on US rate cut

What happened?

The US Federal Reserve’s preferred inflation gauge, the personal consumption expenditures (PCE) index, rose 0.3 percent in September, matching August’s increase.

The release was delayed earlier due to the federal government shutdown.

What does this mean?

With no surprises in the latest inflation data, investors continued to expect a rate cut at the Fed’s final meeting of the year.

Based on the CME FedWatch Tool, markets are now pricing in an 86 percent probability of a December cut as of 6 December.

Why should I care?

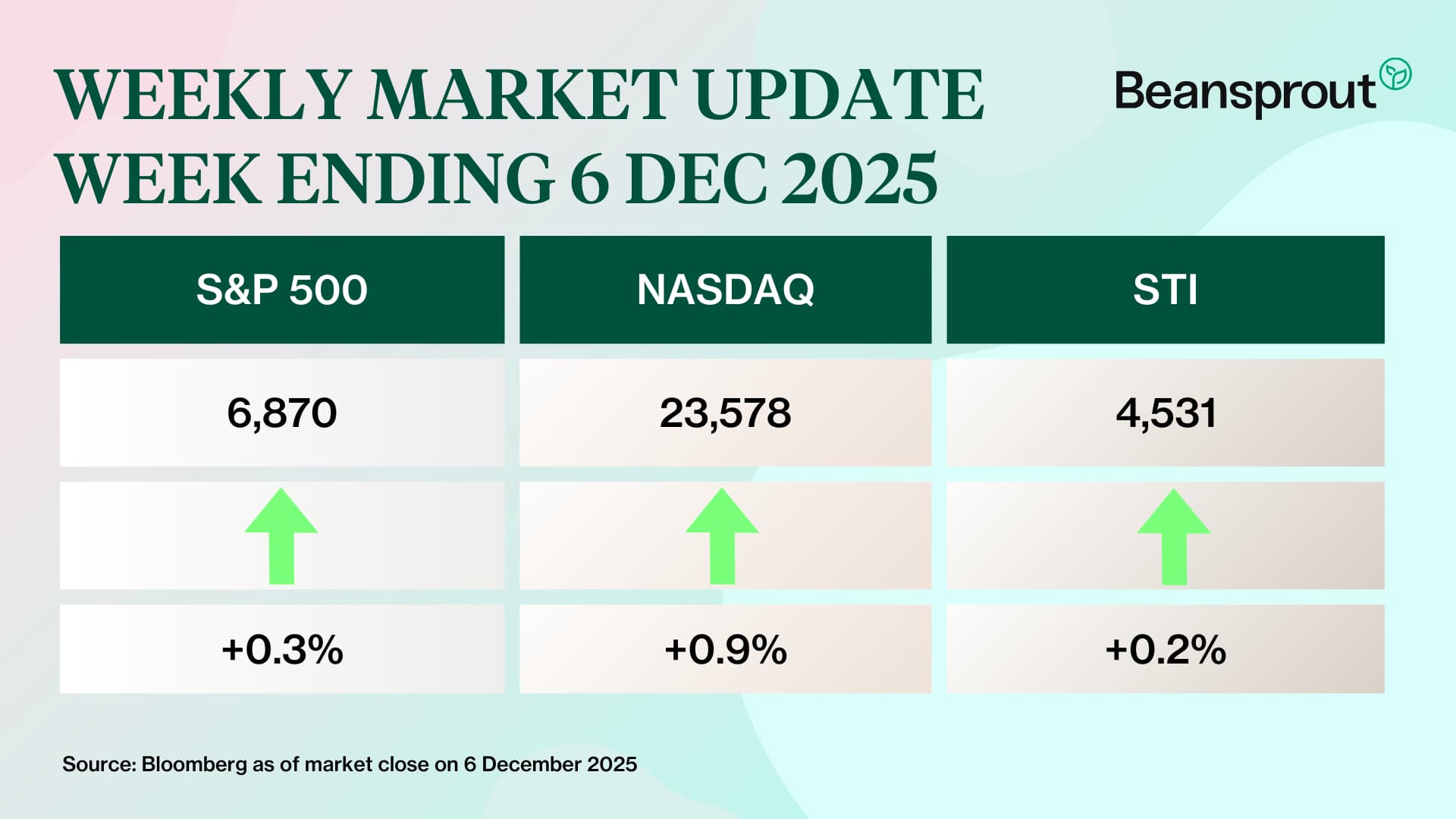

U.S. stocks continued to climb as hopes for another rate cut increased, with the tech-heavy Nasdaq leading the gains.

Sentiment improved in Singapore as well, with the Straits Times Index (STI) supported by Jardine-related names after DFI Retail Group unveiled a three-year strategic roadmap targeting double-digit profit growth and a higher dividend payout at its Investor Day.

🚗 Moving This Week

- DFI Retail Group has unveiled a three-year strategic roadmap targeting double-digit profit growth and a higher dividend payout. In an investor day presentation, the group outlined a plan to increase underlying profit at a compound annual growth rate of 11 to 15% between 2025 and 2028. DFI also announced a new dividend policy, raising its payout ratio from 60% to 70% effective from the final dividend of 2025. Read more here.

- Seatrium has begun arbitration proceedings against a Maersk Offshore Wind affiliate over the termination of a US$475 million contract signed in 2022. It is seeking a declaration that the termination was wrongful, confirmation that the contract remains valid, and orders for the buyer to take delivery and pay the outstanding instalment — or otherwise, for damages to be assessed. The company added that 80% of the contract value is due only upon delivery, reflecting a legacy payment structure predating its merger with Keppel Offshore & Marine. Read more here.

- UltraGreen.ai surged 12% on Wednesday (Dec 3) morning from its offer price of US$1.45, as the company started trading on Singapore Exchange’s (SGX) mainboard. The initial public offering (IPO) is the largest one since 2017, outside of real estate investment trust (Reit) listings. It raised US$150 million and debuted with a market capitalisation of US$1.6 billion.

- Singapore Land Group (SingLand), has entered into four sale-and-purchase agreements to buy a 3,992 square metre plot in the Marina Square complex for an aggregate consideration of S$99.1 million. The acquisition is part of a drive to rejuvenate the Marina Square complex, SingLand added.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

SRS in Singapore: How to unlock tax savings and grow your retirement funds

Learn how the Supplementary Retirement Scheme (SRS) in Singapore helps you unlock tax savings while growing your retirement funds. Understand the key benefits and investment options.

🤓 What we're looking out for next week

- Wednesday, 10 December 2025: US Federal Reserve Meeting, Oracle earnings

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments