3 Singapore blue chip REITs with dividend yields of above 5%

REITs

By Gerald Wong, CFA • 08 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We take a closer look at three Singapore blue chip REITs offering dividend yields above 5% and break down their latest dividend announcements.

What happened?

I have been getting quite a lot of questions on Singapore REITs.

After we shared the 3 best-performing Singapore blue chip stocks in January, many were wondering if Singapore REITs will gain more traction with lower interest rates.

After all, there were several REITs that managed to perform better than the Singapore market in 2025.

It appears that Singapore REITs remain a popular choice for investors seeking passive income through regular distributions.

In this article, I'll take a look at the latest earnings of three Singapore blue REITs that offers a dividend yield of above 5%, and find out if they may be worth adding to your watchlist.

3 Singapore blue chip REITs with dividend yields above 5%

#1 - Mapletree Industrial Trust (SGX: ME8U)

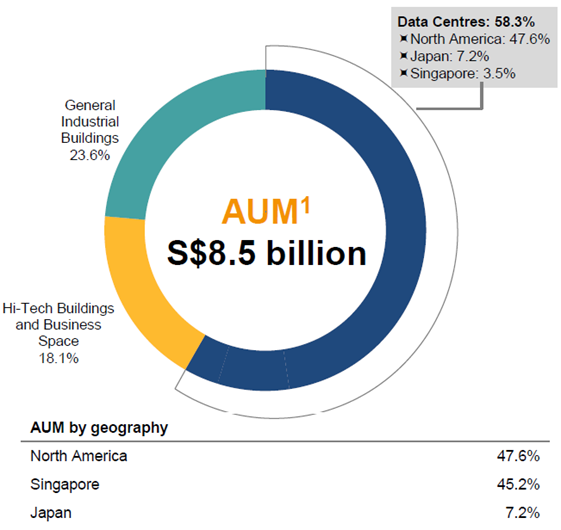

Mapletree Industrial Trust (MINT) owns a portfolio of 136 properties valued at approximately S$8.5 billion.

Its portfolio is increasingly focused on data centres, which now account for 58.3% of its AUM as of 31 December 2025.

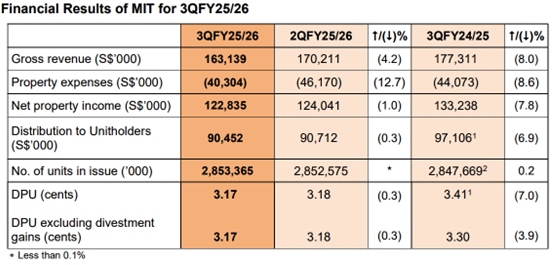

For the third quarter ended 31 December 2025 (3Q FY25/26), Mapletree Industrial Trust's gross revenue fell 8.0% year-on-year to S$163.1 million, and NPI decreased 7.8% to S$122.8 million.

This was primarily due to the divestment of three Singapore industrial properties and lower occupancy in the North American portfolio.

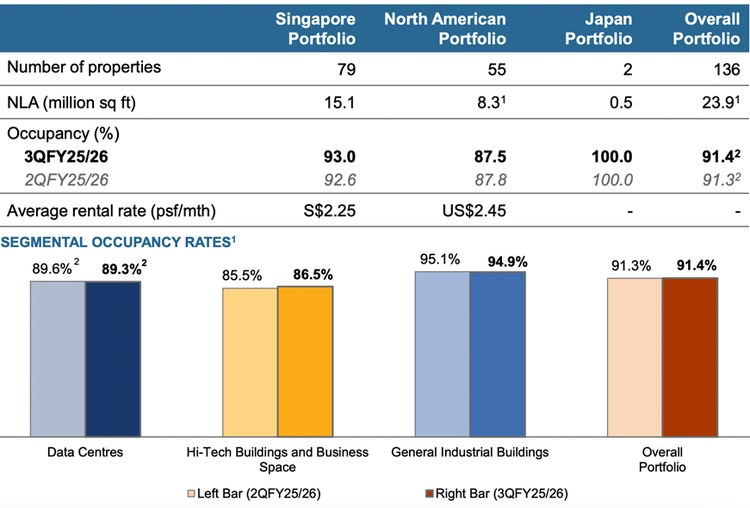

Overall portfolio occupancy improved slightly to 91.4% from 91.3% in the preceding quarter.

The Singapore portfolio continued to perform well, achieving positive rental reversions of 7.1%.

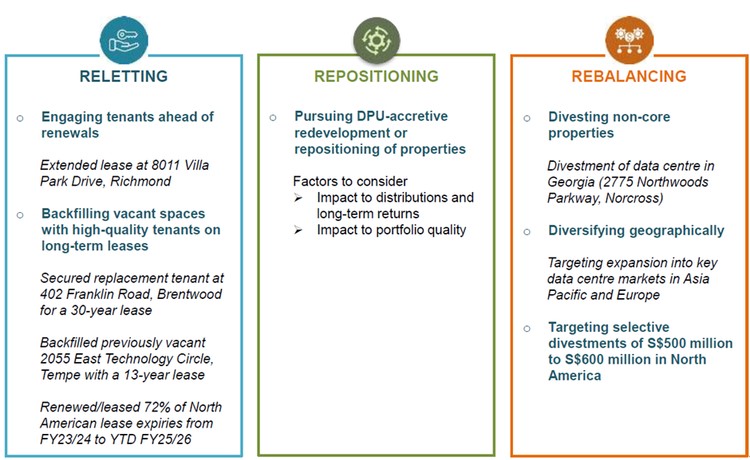

In the US, leasing progress also continues, with renewals completed and proactive backfilling/lease extensions ahead of expiries (including a new 13-year lease at 2055 East Technology Circle, Tempe, and an extension at 13831 Katy Freeway, Houston).

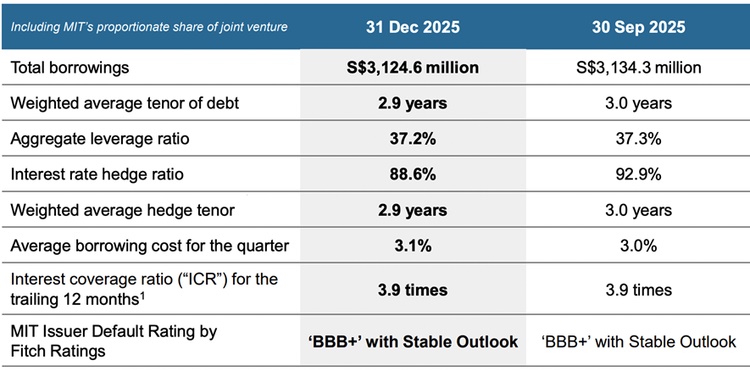

Mapletree Industrial Trust maintains a healthy aggregate leverage ratio of 37.2%, providing headroom and liquidity to pursue acquisitions.

Divestment proceeds have been used to repay debt, keeping average borrowing costs around 3.0% and interest coverage at ~3.9x, with 88.6% of its debt hedged to fixed rates.

That said, management flagged that ~S$600m of interest rate swaps are due to expire over 2H26–FY27, which could lift borrowing costs toward ~3.3–3.4% (c.20–30bps above current levels), even as the broader rate environment has eased.

Management is targeting selective divestments of between S$500 million and S$600 million in North America to rebalance the portfolio toward higher-growth data centre assets in Asia Pacific and Europe.

Potential acquisition pipelines include DCs in Japan and Korea, European opportunities, and possibly the sponsor’s 50% stake in US data centres.

The key near-term swing factor is execution timing as gaps between divestments and acquisitions may cause temporary DPU volatility.

In addition, the US data centre portfolio still faces known non-renewal risk. The expected vacates in FY26 are modest, but FY27 expiries are more meaningful (including the well-flagged AT&T lease which is ~2.5% of gross rental income), which keeps pressure on near-term DPU growth unless acquisitions or backfilling come through.

Mapletree Industrial Trust announced a DPU of 3.17 cents for 3Q FY25/26, down 7.0% from 3.41 cents in the previous year.

This is due to non renewal leases in the US and downtime in North American data centers despite strong rental reversions in the Singapore portfolio.

Based on its unit price of S$2.04 as of 4 February 2026, Mapletree Industrial Trust offers a trailing 12-Month (TTM) dividend yield of approximately 6.4%.

Find out how much dividends you would have received as a shareholder of Mapletree Industrial Trust in the past 12 months with the calculator below.

Related links:

- Mapletree Industrial Trust share price history and share price target

- Mapletree Industrial Trust dividend history and dividend forecasts

#2 - Mapletree Logistics Trust (SGX: M44U)

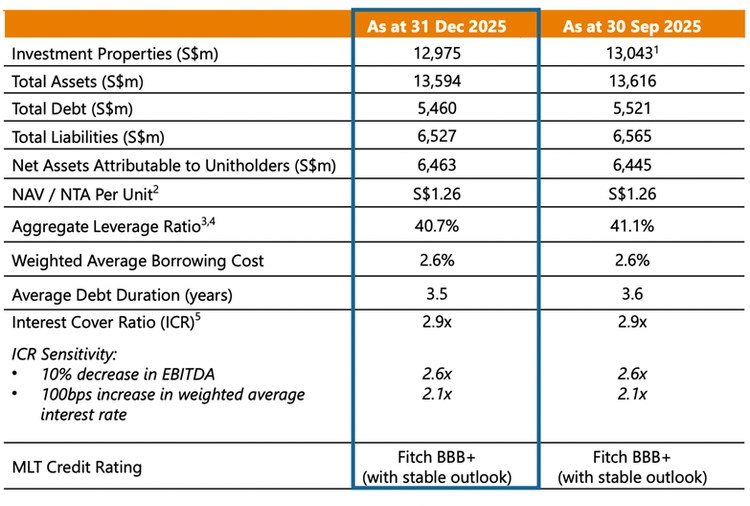

Mapletree Logistics Trust (MLT) manages a portfolio of 174 properties consisting of logistics and industrial assets across Asia Pacific with an asset under management (AUM) of S$13.0 billion as at 31 December 2025.

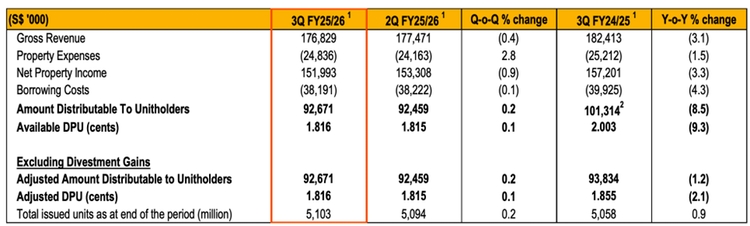

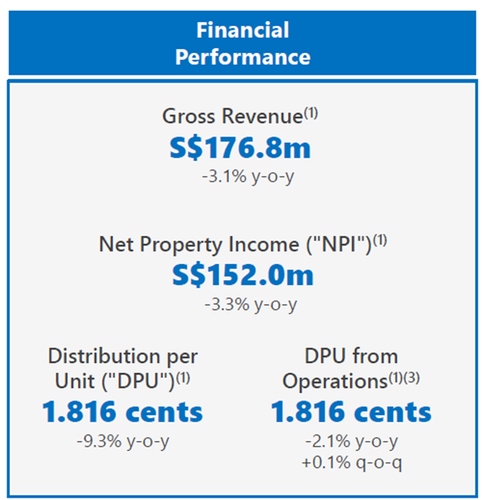

In its third quarter ended 31 December 2025 (3Q FY25/26), gross revenue decreased 3.1% year-on-year to S$176.8 million, while net property income (NPI) fell 3.3% to S$152.0 million.

The drag was mainly attributed to the weakness of regional currencies against the Singapore Dollar, alongside the absence of income from 12 divested properties.

Operating metrics remained resilient, with portfolio occupancy improving to 96.4% from 96.1% in the previous quarter.

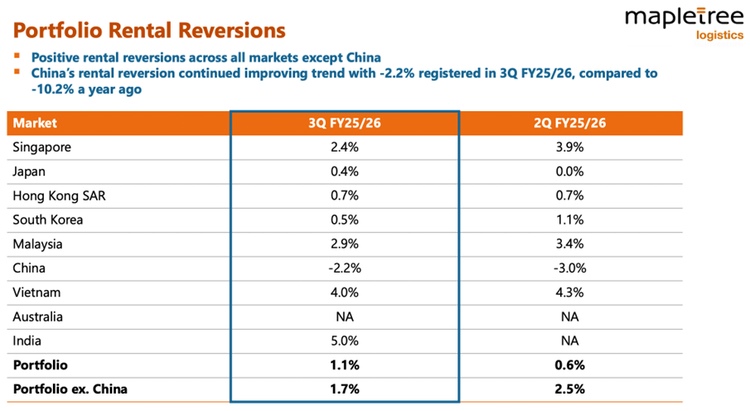

Rental reversions remained positive at +1.1% overall, and would have been +1.7% excluding China.

Across key markets, leasing momentum was generally constructive, with positive reversions reported in Singapore, Hong Kong, South Korea, Malaysia and Vietnam, while Japan improved back to flat from negative territory previously.

China remains the swing factor (c.15% of revenue and c.18% of assets), but the pace of decline has moderated meaningfully versus a year ago, pointing to an early stabilisation trend.

Management reiterated that China reversions are expected to trend toward zero around 4Q FY25/26–1Q FY26/27.

Mapletree Logistics Trust continues to execute its portfolio rejuvenation strategy through selective divestments of older, low-yielding assets and redeploying into higher-quality opportunities.

In 2025, it has divested six properties at an average premium of approximately 20% over valuation.

In China, management continues to target divesting assets to its sponsor-led RMB fund around 4Q FY25/26–1Q FY26/27 as part of its longer-term de-risking and recycling strategy.

Aggregate leverage is steady at 40.7%, with management using divestment proceeds to repay loans and keep gearing within comfortable bounds.

Hedging is high (~84% of total debt is fixed/hedged), and borrowing costs have remained resilient at ~2.6% (flat QoQ), helped by lower SGD/HKD base rates.

With the current hedge profile, management expects the cost of debt to remain broadly stable.

Interest coverage remains comfortable at ~2.9x.

Mapletree Logistics Trust reported a distribution per unit (DPU) of 1.816 cents for 3Q FY25/26, a 9.3% decrease from the previous year, largely due to higher finance costs and the absence of divestment gains.

Based on its unit price of S$1.31 as of 4 February 2026, MLT offers a trailing 12-Month (TTM) dividend yield of approximately 5.6%.

Find out how much dividends you would have received as a shareholder of Mapletree Logistics Trust in the past 12 months with the calculator below.

Related links:

- Mapletree Logistics Trust share price history and share price target

- Mapletree Logistics Trust dividend history and dividend forecasts

#3 - Mapletree Pan Asia Commercial Trust (SGX: N2IU)

Mapletree Pan Asia Commercial Trust (MPACT) holds a S$15.7 billion portfolio of 15 commercial properties across Singapore, Hong Kong, China, Japan, and South Korea.

Its core Singapore assets include VivoCity and Mapletree Business City.

With meaningful exposure to Greater China and Southeast Asia, the REIT is often viewed as a proxy for the regional commercial property cycle.

Mapletree Pan Asia Commercial Trust was one of the best performing blue chip REITs in terms of price performance in 2025.

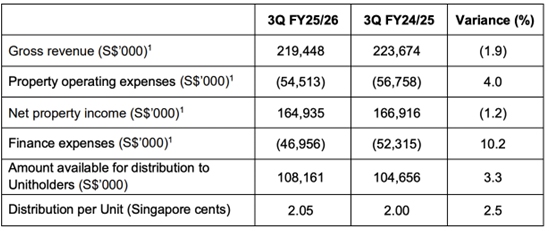

In its third quarter ended 31 December 2025 (3Q FY25/26), gross revenue decreased 1.9% year-on-year to S$219.4million, while net property income (NPI) declined 1.2% S$164.9 million, reflecting weaker contributions from overseas markets (notably Hong Kong/China), the impact of divestments in Japan, and FX headwinds (weaker HKD, RMB and JPY versus SGD).

On a constant-currency basis, however, performance was firmer, with gross revenue and NPI up 1.2% and 0.5% YoY respectively.

Singapore continued to be the stabilising anchor (~64% of revenue) , with Singapore NPI growing 5.3% year-on-year.

VivoCity, in particular, saw NPI rise by 10.1%, supported by positive rental reversions of 14.7% benefitting from its Basement 2 asset enhancement initiative and 100% occupancy. Its shopper traffic and tenant sales were also higher year-to-date.

The Singapore office portfolio also held up well with Mapletree Business City and other office assets reporting high occupancies (around the mid-90% range), and management expects this to edge up as new tenants are secured.

At the portfolio level, committed occupancy was 88.1% as of 31 December 2025. While Singapore assets remained robust, the trust faced headwinds in overseas markets, particularly China and Japan, where occupancy levels lagged at 83.6% and 73.1% respectively.

In Hong Kong, Festival Walk remained defensively positioned with high occupancy (~98.4%), but tenant sales continued to soften despite higher footfall due to ongoing retail sales leakage to Shenzhen.

Leasing conditions in Hong Kong and China remain challenging, with negative reversions in these markets, so management’s priority is to defend occupancy and lock in key tenants (including extensions secured at certain assets, albeit at lower rents).

Mapletree Pan Asia Commercial Trust has proposed the divestment of the office component of Festival Walk in Hong Kong, with completion expected in February 2026.

The transaction should help reduce debt and lift the portfolio’s Singapore weighting to ~61% post-divestment, increasing the trust’s concentration in its more resilient market.

Balance sheet metrics remain comfortable, with gearing around 37% and an all-in cost of debt of ~3.20% (fixed-rate debt ~72%).

If rates stay around current levels, management also expects savings as fixed-rate swaps roll off, providing an additional cushion to DPU as the overseas recovery remains gradual.

Despite these headwinds, Mapletree Pan Asia Commercial Trust's DPU grew by 2.5% year-on-year to 2.05 cents for 3Q FY25/26, supported by lower financing expenses.

Based on its unit price of S$1.46, MPACT offers a trailing 12-Month (TTM) dividend yield of approximately 5.5%.

Find out how much dividends you would have received as a shareholder of Mapletree Pan Asia Commercial Trust in the past 12 months with the calculator below.

Related links:

- Mapletree Pan Asia Commercial Trust share price history and share price target

- Mapletree Pan Asia Commercial Trust dividend history and dividend forecasts

What Would Beansprout Do?

Singapore REITs are often seen as beneficiary of lower interest rates.

Many of them also offer attractive dividend yields of 5% and above. 3 of the Singapore blue chip REITs that offer a dividend yield of above 5% include Mapletree Industrial Trust, Mapletree Logistics Trust, and Mapletree Pan Asia Commercial Trust.

However, beyond the headline dividend yields, it is also important to understand the underlying performance of the REITs.

Across the 3 REITs, Mapletree Industrial Trust (MINT) has the highest dividend yield of 6.4%. However, its distribution per unit have declined with divestments, as well as lease non-renewals and downtime in its North American portfolio.

This is followed by Mapletree Logistics Trust (MLT) providing a dividend yield of around 5.6%. Likewise, Mapletree Logistics' Trust distribution per unit has declined with currency headwinds and China leasing weakness.

Mapletree Pan Asia Commercial Trust (MPACT) offers a dividend yield of about 5.5%. However, we have seen its distribution per unit rising in the latest results, supported by strong performance at VivoCity and lower financing costs.

Mapletree Pan Asia Commercial Trust is also set to have a larger part of its portfolio coming from Singapore after the divestment of the Hong Kong office component at Festival Walk, targeted for completion in Feb 2026.

Looking ahead into 2026, we expect Singapore REITs are likely to benefit from falling interest rates.

However, we expect the divergence in the performance of Singapore REITs to persist, with returns continuing to depend on factors such as sub-sector exposure, geographical mix, and the extent of debt that has been hedged at fixed rates.

Within the sector, we favour REITs that can sustain and grow distributions through active portfolio management, such as asset enhancements, selective acquisitions, or rental reversion opportunities.

To screen for Singapore REITs with lowest price-to-book valuation or highest dividend yield, check out our best Singapore REIT screener.

If you are new to investing in Singapore REITs, you can start to learn more about Singapore REITs here.

If you prefer diversification without picking individual REITs, you can also gain exposure through Singapore REIT ETFs.

[Beansprout Exclusive Longbridge Promotion] Get bonus S$50 FairPrice voucher within 5 working days, plus 5% p.a. interest boost coupon (worth ~S$100) when you sign up for a Longbridge account via Beansprout. Plus, S$1,380 CapitaVouchers to be won in our exclusive Huat Together Lucky Draw! Promo ends on 28 February 2026. T&Cs apply. Learn more about the Longbridge promotion here.

Lastly, you can also check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in REITs.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments