3 best-performing Singapore blue chip stocks in January. Can the rally continue?

Stocks

By Gerald Wong, CFA • 31 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

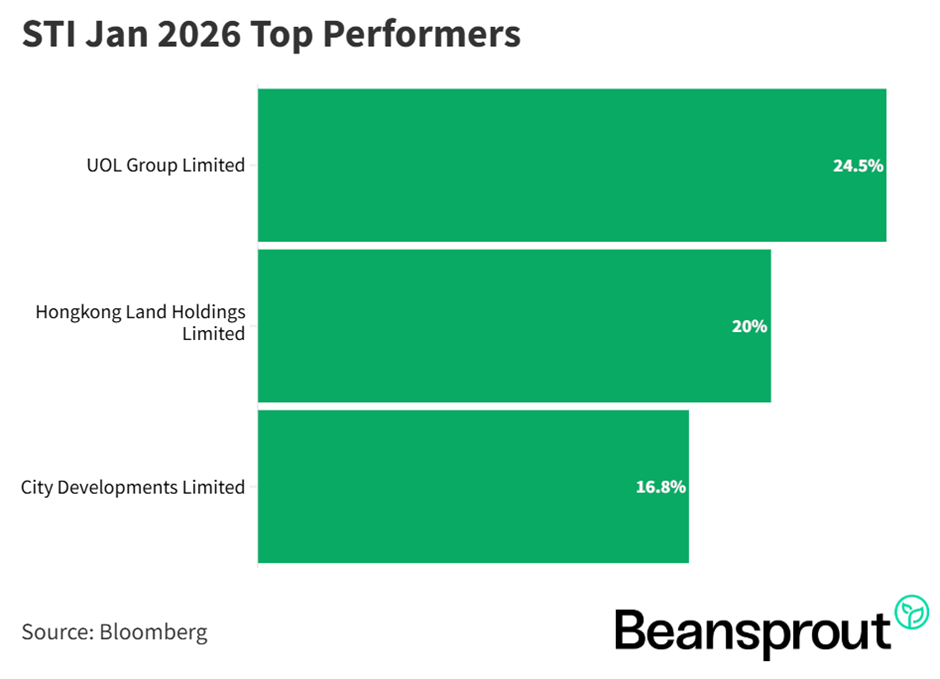

We look at the top three Singapore blue-chip stocks in January 2026. With gains of 17% or more year to date, we find out if their rally can be sustained.

What happened?

Singapore’s stock market has kicked off 2026 on a strong note.

Following its strong performance in 2025, Singapore stocks continued to rally in the first month of the new year.

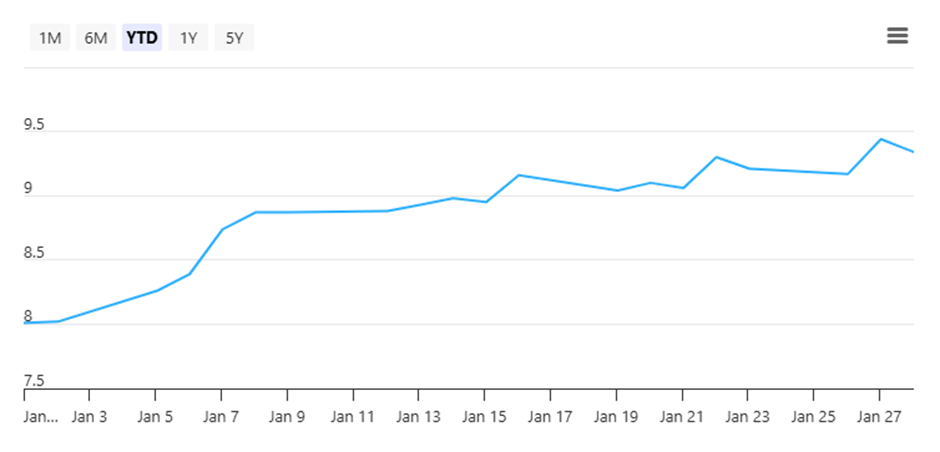

The STI reached a record high of 4,923 points on 27 January 2026, supported by strong performances from the local banks and property developers.

Earlier, we shared the best performing Singapore blue chip stocks of 2025, and the worst performing Singapore blue chip stocks of 2025.

In this article, we take a closer look at the 3 best-performing Singapore blue chip stocks that rallied in January 2026. We examine their recent share price performance, latest earnings, ongoing developments, and dividend yield.

3 best-performing Singapore blue chip stocks in January 2026

#1 - UOL Group Limited (SGX: U14)

UOL Group is a leading property and hospitality group with a portfolio of development and investment properties, hotels, and serviced suites.

It was one of the top 3 performers among the blue chips in 2025 and it has extended its streak in January 2026.

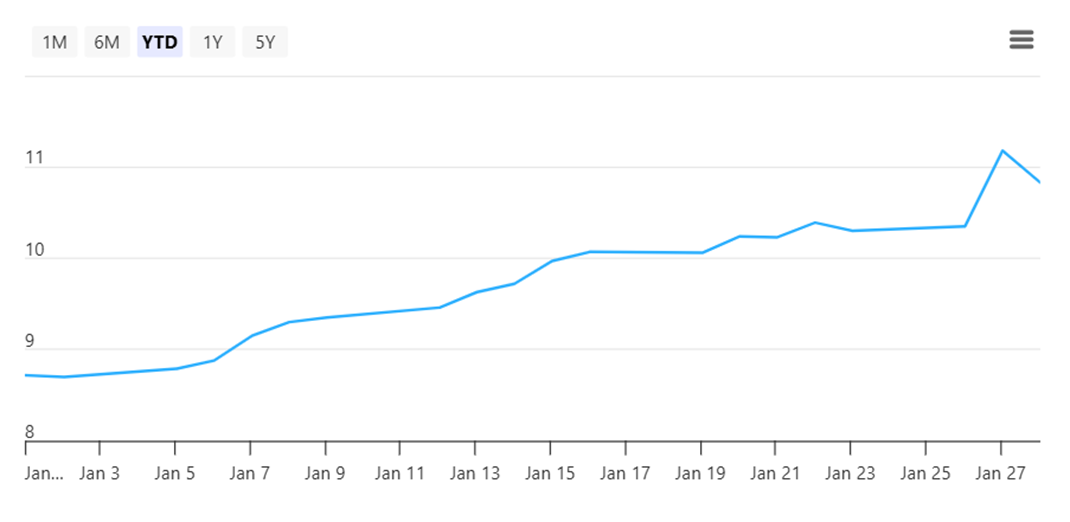

As of 28 January 2026, UOL’s share price stood at S$10.83, reflecting a month-to-date performance of +24.5%.

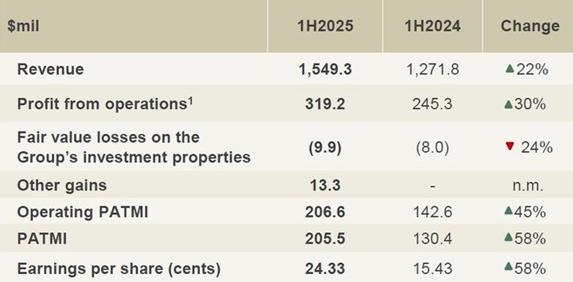

UOL Group reported a profit after tax and minority interest (PATMI) of S$205.5 million for 1H 2025, a 58% increase year-on-year.

Revenue rose by 22% to S$1.55 billion, driven by higher contributions across most segments.

UOL Group has seen strong momentum in its residential launches.

UpperHouse at Orchard Boulevard saw nearly 54% of its 301 units sold on its launch day in July 2025, achieving an average price of S$3,350 psf.

In October, UOL Group and CapitaLand Development announced that 658 (99%) of the 666 units at Skye at Holland have been sold on the first day of launch.

High take-up rates were also recorded for Watten House (95% sold), Pinetree Hill (88% sold), and Meyer Blue (69% sold) as of August 2025.

Strategic portfolio reconstitution has also been a key theme driving UOL’s growth.

In mid-January 2026, a consortium involving UOL Group and SingLand’s joint venture (Horizon Residential) was awarded the S$1.5 billion tender for the Hougang Central integrated residential-and-commercial site, which will be built around/linked to transport infrastructure including the MRT station and bus interchange.

UOL Group said the acquisition, which is intended to replenish its land bank for future residential development in Singapore, will be financed mainly through bank borrowings and shareholder loans.

Separately, in 2H25, UOL’s property arm SingLand submitted a revised proposal to URA to redevelop Marina Square into Singapore’s first “hyper-mixed” development, introducing three new elements: a residential tower, a serviced apartment block and a mixed-use tower integrating hospitality, office and performing arts spaces.

In early December 2025, SingLand, via an indirect subsidiary, also announced the S$99.1 million acquisition of a land parcel at 6 Raffles Boulevard, which would support the broader redevelopment plan, including enhancements to public spaces.

UOL successfully divested PARKROYAL Yangon in May 2025, which contributed to "other gains" in its financial statements.

Key portfolio reconstitution moves encompassed the proposed sale of Kenex mall in Singapore for a consideration of S$375 million recently in September 2025 and the sale of Park Royal on Kitchener Road in Singapore back in October 2023, alongside benefits from a pickup in private residential sales volumes in Singapore.

The Group maintains a healthy balance sheet with a net gearing ratio of 0.25x as of June 2025.

UOL’s current P/B ratio of 0.8x is higher than its historical average P/B ratio of 0.53x.

UOL Group typically declares dividends annually at the rate of approximately 20-50% of the profit after tax and minority interest (PATMI).

Based on the previous financial year (FY2024), the group paid a first and final dividend of S$18.0 cents per share. The trailing dividend yield is approximately 1.7% based on the current share price of S$10.83 as of 28 January 2026.

Find out how much dividends you would have received as a shareholder of UOL Group Limited in the past 12 months with the calculator below.

- UOL Group Limited share price history and share price target

- UOL Group Limited dividend forecast and dividend yield

#2 - Hongkong Land Holdings Limited (SGX: H78)

Hongkong Land Holdings Limited is a major Asian real estate group specializing in premium commercial and mixed-use developments.

Its Singapore portfolio includes landmarks such as Marina Bay Financial Centre and One Raffles Quay, complemented by flagship assets in Hong Kong, Mainland China, and key cities across Southeast Asia.

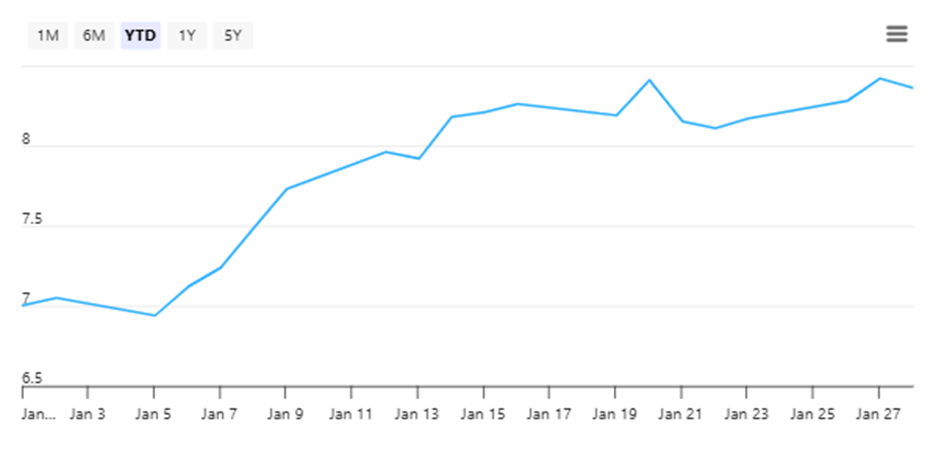

As of 28 January 2026, the share price was US$8.36, with a month-to-date performance of +20%.

For 1H 2025, Hongkong Land reported an underlying profit of US$297 million.

In Q3 FY2025, Hongkong Land underlying profit fell 13% from a year earlier. This was primarily due to lower contributions from the development properties segment, following the strategic decision to exit the build-to-sell residential business.

Notably, its Net Asset Value (NAV) per share increased for the first time since 2018 to US$13.62, supported by stabilizing valuations in its core investment portfolio and an active share buyback program.

Hongkong Land is executing its "Strategic Vision 2035," pivoting toward ultra-premium gateway assets and third-party capital management, with a goal of recycling up to US$10 billion of capital over a decade and achieve at least US$4 billion of capital recycling by end-2027.

Significant progress has been made, including the US$1 billion transformation of its Central Hong Kong portfolio and the S$739 million sale of its residential developer MCL Land in October 2025.

Capital recycling has accelerated in Singapore. In December 2025, Hongkong Land agreed to sell its one-third stake in MBFC Tower 3 to Keppel REIT (agreed property value S$1.45 billion) and announced the formation of its first Singapore private real estate fund, the Singapore Central Private Real Estate Fund (SCPREF).

The fund will be seeded with its stakes in One Raffles Quay and MBFC Towers 1 & 2 (plus One Raffles Link) and is expected to start with over S$8 billion AUM, making it Singapore’s largest private real estate fund at launch.

Net proceeds from the MBFC Tower 3 sale will lift Hongkong Land’s cumulative capital recycling since 2024 to US$2.8 billion (from US$2.1 billion), putting it at ~70% of its US$4 billion capital-recycling target for 2027.

As of 28 January 2026, Hongkong Land Holdings share price was US$8.36, Hongkong Land’s shares trade at a price-to-book (P/B) ratio of about 0.63x, higher than its 5-year historical average of 0.32x.

Based on its latest annual dividend of US$0.23 per share, Hongkong Land offers a trailing 12-month dividend yield of approximately 2.8% based on the current share price of US$8.36 as of 28 January 2026.

Find out how much dividends you would have received as a shareholder of Hongkong Land Holdings Limited in the past 12 months with the calculator below.

Related Links:

- Hongkong Land Holdings Limited share price history and share price target

- Hongkong Land Holdings Limited dividend forecast and dividend yield

#3 - City Developments Limited (SGX: C09)

City Developments Limited (CityDev) is a leading global real estate company with a network spanning 112 locations in 29 countries.

CityDev is one of Singapore's largest commercial landlords and has built a significant presence as a prominent residential developer.

As of 28 January 2026, CityDev’s share price was S$9.34, with a month-to-date performance of +16.8%.

CityDev has delivered a resilient operating performance, underpinned by an active capital recycling strategy and a strong residential launch pipeline.

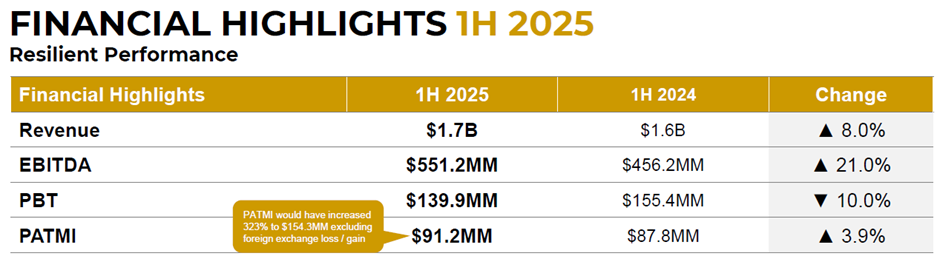

For the first half of 2025, CityDev reported an 8% year-on-year increase in revenue to S$1.7 billion, while PATMI edged up to S$91.2 million, supported by the full profit recognition from the completed Copen Grand EC.

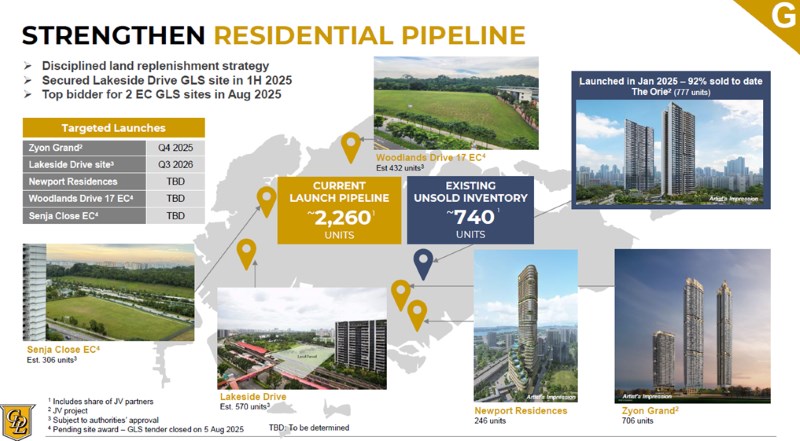

On the development front, the launch of The Orie in January 2025 was a major contributor, with 92% of its 777 units sold to date.

CityDev also strengthened its land bank by securing the Lakeside Drive GLS site and emerging as the top bidder for two Executive Condominium sites in August 2025. In addition, the launch of Parktown Residence (a joint venture with UOL Group) in Tampines has been well received, achieving over 90% sales.

CityDev also kicked off 2026 with the launch of Newport Residences, a 246-unit freehold CBD project at the former Fuji Xerox Towers site on Anson Road (part of the mixed-use Newport Plaza), with previews from 16 January 2026 and sales bookings starting 31 January 2026.

Beyond Singapore, CityDev has continued to scale its “Living Sector” strategy, expanding its private rented sector (PRS) and purpose-built student accommodation (PBSA) portfolios in the UK and Japan to grow recurring income streams. In November 2025, CityDev’s hotel arm, Millennium & Copthorne Hotels, divested a 250-unit multifamily property in Sunnyvale, California, for US$143.5 million to a US institutional investor.

Following this transaction, CityDev’s global living portfolio comprises approximately 7,600 multifamily units and student accommodation beds across Singapore, Japan, the UK and Australia, with a combined gross development value of about S$3.7 billion.

In December 2025, CityDev completed the acquisition of Holiday Inn London, Kensington High Street, for £280 million (approximately S$480.2 million), expanding its Central London hotel portfolio to over 3,000 rooms. During the same month, CityDev divested Quayside Isle at Sentosa Cove for S$97.3 million, further accelerating capital recycling and value realisation.

City Developments Limited's current P/B ratio of 0.95x is higher than its historical average P/B ratio of 0.71x.

CityDev paid a total dividend of 11.0 cents per share in 2025, comprising an 8.0 cent final ordinary dividend and a 3.0 cent special interim dividend.

Based on CityDev’s trailing 12-month dividend of S$0.11, CityDev's trailing dividend yield stands at about 1.2% at the current share price of S$9.34 as of 28 January 2026.

Find out how much dividends you would have received as a shareholder of City Developments Limited in the past 12 months with the calculator below.

Related Links:

- City Developments Limited share price history and share price target

- City Developments Limited dividend forecast and dividend yield

What would Beansprout do?

Property developers are benefitting from the lower interest rates, which have led to improved sentiment towards the sector, as well as a recovery in new launch sales.

The top 3 best performing Singapore blue chip stocks in January 2026 - UOL, Hongkong Land and City Developments, are all property stocks,

These property companies have also been active in recycling their capital.

All three companies are redeploying capital from mature or non-core assets into areas with stronger long-term visibility, including prime commercial properties, hospitality assets, and living-sector developments.

Across the 3 names, UOL and City Developments are more exposed to Singapore property.

UOL Group Limited (SGX: U14) offers diversified exposure across residential development and hospitality, underpinned by a healthy balance sheet and disciplined portfolio reconstitution.

City Developments Limited (SGX: C09) stands out for the scale and consistency of its capital recycling, which has previously translated into shareholder returns such as the 3.0-cent special interim dividend declared in 1H 2025.

On the other hand, Hongkong Land Holdings Limited (SGX: H78) represents a more focused play on ultra-premium commercial real estate, with its strategy closely tied to the long-term strength of global financial hubs such as Singapore and Hong Kong. Meanwhile, Its ongoing asset injection and fund management initiatives reflect a deliberate shift toward an asset-light, capital-efficient model.

We expect continued tailwinds for the Singapore property sector, with lower interest rates providing a tailwind for the sector. Read more about our outlook for the Singapore property sector here.

With their recent rally, all three stocks are trading above their historical average P/B ratio. They also offer dividend yields ranging from about 1% to 3%, below the dividend yield of the Straits Times Index.

Investors looking for income may potentially look for other Singapore stocks that may offer a potentially higher dividend yield of above 3% using our Singapore DIvidend Stock Screener.

You can find out what may drive further potential upside in Singapore stocks here.

Alternatively, if you’d prefer broad exposure to the Singapore market, you can also consider learning more about the Straits Times Index (STI), which tracks the performance of Singapore’s largest blue chip companies. Learn more about the STI ETF and how to choose the best STI ETF for your portfolio here.

Check out the best stock trading platforms in Singapore with the latest promotions to invest in Singapore blue chip stocks.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments