3 ways to lower your taxes in Singapore before year end

Retirement

By Gerald Wong, CFA • 23 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Find out how to enjoy tax relief in Singapore using CPF top-ups and SRS contributions.

What happened?

It's getting close to the end of the year.

As we approach 31 December, many of you might be planning how to lower your taxes in 2026.

Earlier, we have shared how you can use the Supplementary Retirement Scheme (SRS) to enjoy tax relief.

This led to questions about whether there are other ways to unlock tax savings.

Apart from SRS, we can also enjoy tax savings with cash top-ups to our CPF accounts.

Taken together with CPF contribution changes from January 2026, this means we can build our retirement savings while lowering our taxes.

Let us dive deeper into how these work.

3 ways to lower your taxes in Singapore

#1 - CPF Cash Top-Up Relief under the RSTU Scheme

Under the Retirement Sum Topping-Up (RSTU) Scheme, we can make cash top-ups to CPF accounts to boost retirement savings while enjoying tax relief.

If you are below 55, cash top-ups go to the Special Account (SA).

If you are 55 and above, top-ups go to the Retirement Account (RA).

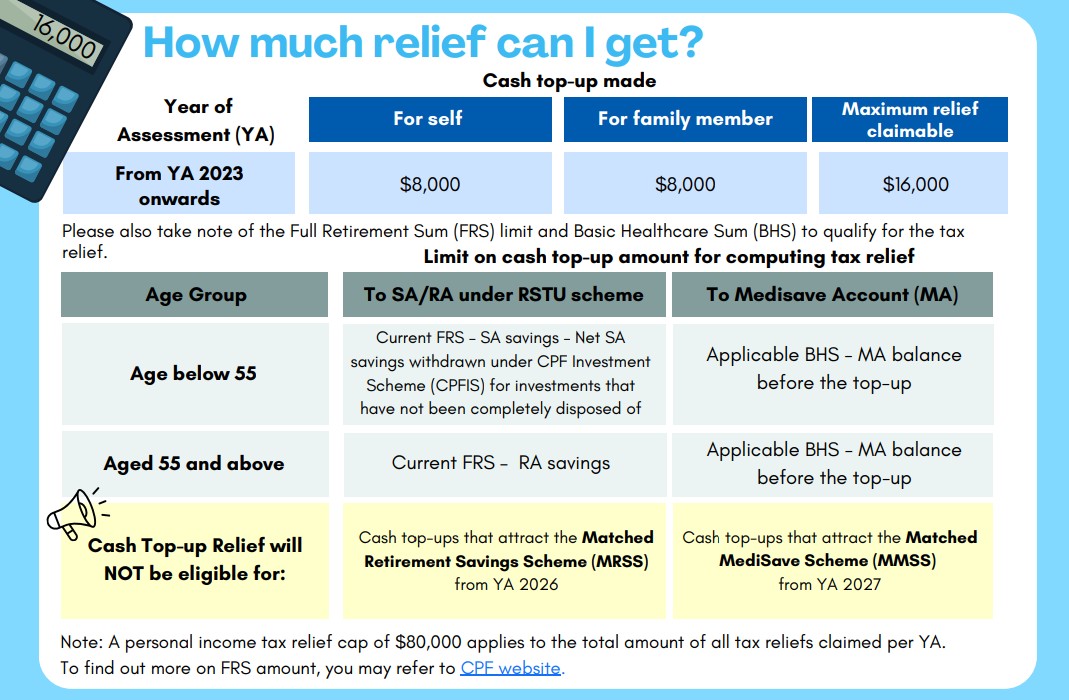

You may claim tax relief of up to S$8,000 per calendar year for top-ups to your own CPF accounts.

In addition, you may claim another S$8,000 for top-ups made to eligible loved ones, provided their income does not exceed the qualifying threshold set by IRAS.

This gives a combined maximum of S$16,000 per calendar year for eligible CPF cash top-ups that do not attract MRSS and/or MMSS grants, subject to the overall personal tax relief cap of S$80,000.

It’s worthwhile to note that only cash top-ups qualify. Transfers from your CPF Ordinary Account do not give any tax relief.

Who you top up for | Maximum tax relief per year | Conditions |

Yourself | Up to S$8,000 for both | Only up to current year’s FRS. |

Employee/platform workers | ||

Loved one^ | Up to S$8,000 across all loved ones | Only up to current year’s FRS. Spouse/sibling must have annual income ≤ $8k in previous year or is handicapped* |

| *Handicapped refers to people who are incapacitated because of physical or mental infirmity. ^Loved one refers to parents, parents-in-law, grandparents, grandparents-in-law, spouse and siblings (includes step-family and adoptive family members). | ||

Also, if your CPF savings have reached the Full Retirement Sum (FRS), you will not be eligible for the CPF Cash Top-up Relief.

| Year turn 55 | Full Retirement Sum (FRS) |

| 1 July 2015 to 2016 | $161,000 |

| 2017 | $166,000 |

| 2018 | $171,000 |

| 2019 | $176,000 |

| 2020 | $181,000 |

| 2021 | $186,000 |

| 2022 | $192,000 |

| 2023 | $198,800 |

| 2024 | $205,800 |

| 2025 | $213,000 |

| 2026 | $220,400 |

| 2027 | $228,200 |

There is also an important change to take note of while topping up for eligible loved ones too.

From YA2026 onwards, CPF cash top-ups that qualify for the Matched Retirement Savings Scheme (MRSS) will no longer qualify for CPF Cash Top-Up Tax Relief.

This means that if you top up S$2,000 in cash to your parent’s CPF Retirement Account in 2025 and the full amount qualifies for the Matched Retirement Savings Scheme, your parent may receive up to S$2,000 in government matching grants, but you will not be able to claim any CPF Cash Top-Up Relief on that S$2,000 when filing your taxes for YA2026.

Alternatively, if you top up S$3,000, only the portion that does not attract the government matching grant (S$1,000 in this example) can be claimed for CPF Cash Top-Up Relief when filing your YA2026 taxes.

The first S$2,000 receives the MRSS grant but does not reduce your taxable income.

This is an important change to consider when planning family CPF top-ups.

#2 - MediSave Account (MA) voluntary cash top-ups

Beyond cash top-ups to your Special Account or Retirement Account, you can also make voluntary cash top-ups to your MediSave Account (MA).

However, it is important to note that voluntary MediSave cash top-ups fall under the same CPF Cash Top-Up Relief framework as the Retirement Sum Topping-Up (RSTU) scheme.

This means the S$8,000 self-tax relief limit is shared between:

- CPF cash top-ups to your own Special Account or Retirement Account under RSTU, and

- Qualifying voluntary MediSave cash top-ups

There is no separate S$8,000 tax relief cap specifically for MediSave contributions.

Once the combined total of RSTU and qualifying MediSave top-ups reaches S$8,000, any additional amount will no longer reduce your taxable income.

For the calendar year 2025, the Basic Healthcare Sum (BHS) is S$75,500. Voluntary MediSave cash top-ups are capped at this amount.

Any contribution that brings your MediSave balance above the Basic Healthcare Sum will not earn tax relief.

If such a contribution is accepted by CPF, it will also not be refunded, even though no tax relief is given.

Hence, it is crucial to track how much of the S$8,000 self-relief limit you have already used across both RSTU and MediSave top-ups before making additional contributions.

| Effective | Basic Healthcare Sum (BHS) |

| 1-Jan-25 | $75,500 |

| 1-Jan-24 | $71,500 |

| 1-Jan-23 | $68,500 |

| 1-Jan-22 | $66,000 |

| 1-Jan-21 | $63,000 |

| 1-Jan-20 | $60,000 |

| 1-Jan-19 | $57,200 |

| 1-Jan-18 | $54,500 |

| 1-Jan-17 | $52,000 |

| 31 Dec 2016 and earlier | $49,800 |

#3 - Supplementary Retirement Scheme (SRS) contributions

The Supplementary Retirement Scheme, or SRS, is a voluntary savings scheme that encourages you to save for retirement while reducing taxable income.

It is basically a complementary scheme to the Central Provident Fund (CPF) system open to Singaporeans, PRs, or foreigners residing in Singapore.

The voluntary contributions made to your SRS account are eligible for tax relief, and the funds within your SRS account can be invested in a wide range of financial instruments such as stocks, unit trusts, and exchange-traded funds (ETFs).

Here are some of the key features of the SRS:

Contributions to SRS are eligible for tax relief

You can invest using the funds in SRS in a wide range of instruments, including stocks, REITs, ETFs, and bonds.

Investment returns are tax-free before withdrawal

Only 50% of withdrawal sum from SRS is subject to tax at retirement

The maximum withdrawal period is 10 years

The maximum contribution limits for 2025 are:

- S$15,300 for Singaporeans and Permanent Residents

- S$35,700 for foreigners

SRS contributions are also subject to the overall personal tax relief cap of S$80,000.

Use our SRS Tax Savings Calculator to find out how much you can save on taxes by topping up your SRS account.

SRS contributions offer more flexibility compared to CPF top-ups.

You may choose to withdraw before your retirement age, but early withdrawals are fully subject to tax and will incur a 5% penalty.

Unlike your CPF ordinary account (OA) which offers an interest rate of 2.5% p.a., your SRS account only earns you 0.05% interest per annum.

Therefore, you can consider various options to earn a potentially higher return after you contribute to your SRS.

There are various investment options available for you to invest the money in your SRS account. You can learn more about how to choose the best investment option for your SRS funds here.

To qualify for tax relief, funds must be successfully credited into the SRS account by 31 December.

How to Do CPF and MediSave Top-Ups?

Making a CPF or MediSave top-up is straightforward and can be done entirely online.

The method you use depends on whether you are topping up Special Account or Retirement Account balances under the Retirement Sum Topping-Up scheme, or making a MediSave Account top-up.

Where to do SA or RA Top-Ups under the RSTU Scheme?

If you are topping up a CPF Special Account or Retirement Account under the Retirement Sum Topping-Up scheme, you can do so through the following channels:

#1 - myCPF mobile app

You can log in using Singpass, tap on the menu icon, select “Services”, choose “Cash Top-Up and CPF Transfers”, and then proceed with “Cash Top-Up”.

This is one of the most convenient options for quick year-end top-ups.

#2 - CPF online form for cash top-ups and CPF transfers for retirement

This option allows you to make a cash top-up online using PayNow QR.

It is suitable if you prefer using a browser instead of the mobile app.

#3 - GIRO with CPF

GIRO arrangements are useful if you want to make regular or recurring CPF cash top-ups without having to log in each time.

For more details on SA or RA top-ups, you can refer to the CPF Board website.

Where to do MediSave Account Top-Ups?

If you are making a MediSave Account top-up, the process is slightly different.

MediSave top-ups can be made using the Top Up MediSave Account online form, which supports payment through PayNow QR.

This option applies whether you are topping up your own MediSave Account or someone else’s, subject to eligibility rules and caps.

For self-employed persons, it is important to ensure that MediSave payable obligations are up to date before making voluntary MediSave contributions.

For more details on MediSave top-ups, you can also refer to the CPF Board website.

What Would Beansprout Do?

As we get to the end of the year, there are a few ways we can save on taxes and grow our retirement funds.

This would include CPF cash top-ups and SRS contributions.

If I had to choose between CPF top ups and SRS contributions, I would start by asking a simple question. When do I need this money and do I intend to invest with these funds?

CPF top ups allow us to earn an interest rate of up to 6% per annum on retirement savings. However, I will need to make sure I will not need the funds before retirement.

While SRS contributions also give us tax relief, the SRS funds only earn an interest of 0.05% per annum.

I would make sure that my SRS funds are invested for long-term growth, as cash sitting idle will only have an interest rate of 0.05% p.a. You can learn about the ways to invest your SRS to grow your retirement savings here.

Likewise, I would also consider my need to access this pool of money in the short term, as early withdrawals come with a 5% penalty and full taxation.

You can use our SRS Tax Savings Calculator to find out how much you can save on taxes by topping up your SRS account.

As always, it is important to remember that all tax reliefs contribute towards the overall personal tax relief cap of S$80,000.

All qualifying contributions must be completed by 31 December 2025 to enjoy tax relief in 2026.

If you are keen to start making use of SRS, do check out the list of ongoing promotions below.

[Exclusive Longbridge Promotion] Get 5% p.a. interest boost on S$5,000 with Longbridge Cash Plus for 365 days (worth up to S$250). In addition, get a free S$50 Fairprice voucher when you sign up for a Longbridge account via Beansprout. Plus, take part in our festive lucky draw with S$1,200 CapitaVouchers to be won! Promo ends on 31 December 2025. Learn more about the Longbridge promo here.

Are there any ongoing promotions for SRS?

Tigers Brokers SRS Promotion: Receive ~S$20 worth of STI ETF shares (ES3.SI) when you link your SRS account and make your first trade. Learn more about Tiger Brokers’ SRS solutions here.

Syfe Promotion: Earn up to S$1,500 in fee credits when investing in SRS-eligible portfolios. Both new and existing users of Syfe are eligible for this promotion. Valid until 31 December 2025. Learn more about Syfe's SRS solutions here.

Endowus Promotion (New Users): Get S$100 in Endowus Fee Credits by investing at least S$1,000 (via Cash, CPF, or SRS). Valid until 31 December 2025. Learn more about Endowus' SRS solutions here.

Stashaway SRS Promotion (New Users): Get up to 12 months of management fee waivers and a +0.2% p.a. return booster on Simple Plus when you deposit fresh SRS funds. Learn more about Stashaway here.

OCBC SRS Promotion: Enjoy up to S$30 cash reward when you invest a minimum of S$15,000 of your SRS funds into eligible Unit Trusts via the OCBC app using the promo code “BYE25UT”. Valid until 31 December 2025. Learn more about OCBC 360 savings account here.

FSMOne Promotion: Receive up to S$200 worth of cash account credits when you invest SRS monies in Unit Trusts or ETFs. Valid from 1 Nov 2025 to 30 January 2026. Learn about FSMOne here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments