CICT and CapitaLand Ascendas REIT in focus: Weekly Review with SIAS

Stocks

Powered by

By Gerald Wong, CFA • 01 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We share about CapitaLand Integrated Commercial Trust (CICT) and CapitaLand Ascendas REIT (CLAR) in the latest Weekly Market Review.

What happened?

In this week's Weekly Market Review in partnership with Securities Investors Association Singapore (SIAS), we discuss key developments in the global equity market alongside CapitaLand Integrated Commercial Trust (CICT) and CapitaLand Ascendas REIT (CLAR).

Watch the video to learn more about what we are looking out for this week.

Weekly Market Review

1:34 - Macro Update

- The S&P 500 slipped by 0.1% to 6,460 points while the Nasdaq dropped by 0.2%, reflecting a slight pullback towards the end of the week.

- Singapore’s Straits Times Index gained 0.4%, reaching 4,270 points and edging close to its all-time high.

- Investor confidence in a September US Federal Reserve rate cut has risen significantly, with market expectations now close to 90%.

- Singapore government bond yields declined sharply, with the 10-year yield falling to 1.78% from nearly 3% at the start of the year and the one-year yield down to 1.55%.

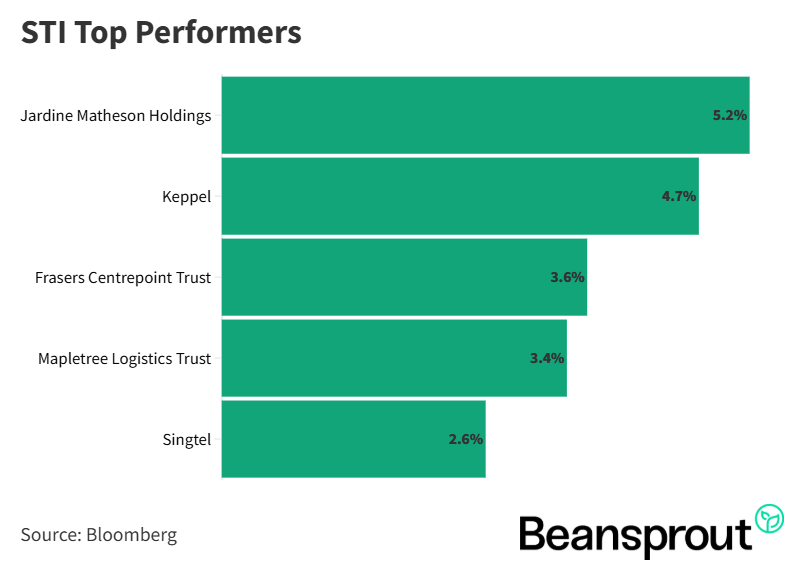

- Singapore REITs benefited from this trend, with Fraser Centrepoint Trust up 3.6% and Mapletree Logistics Trust up 3.4% as sentiment toward the sector improved.

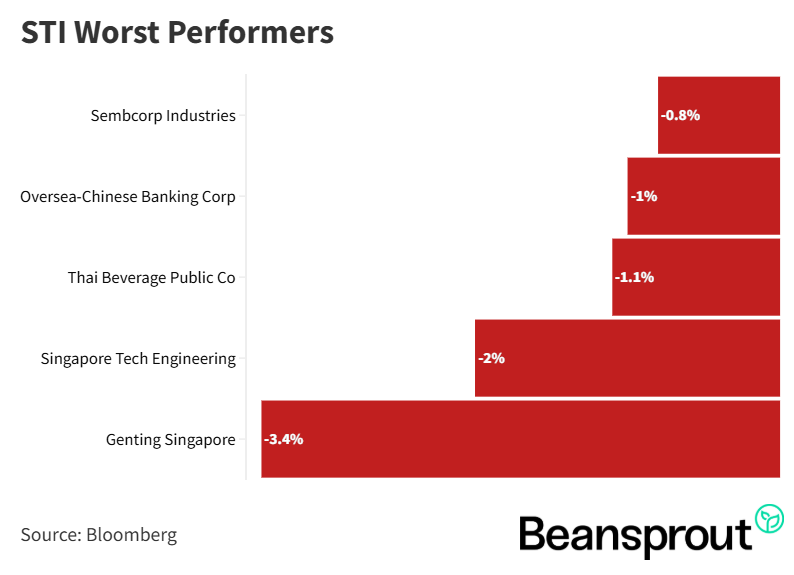

- Among the week’s notable losers, Genting Singapore fell 3.4%, ST Engineering slipped 2%, and OCBC declined by 1%.

STI Top Performers:

STI Worst Performers:

CapitaLand Integrated Commercial Trust (CICT)

- CICT’s unit price has rebounded to $2.27 after April lows, supported by resilient fundamentals across its mixed portfolio of suburban and downtown retail, CBD office, and other commercial spaces.

- About 95% of revenue is generated from Singapore, providing stability.For 1H 2025, distribution per unit (DPU) rose 3.5% to 5.62 cents, driven partly by the Ion Orchard acquisition, with retail and integrated developments contributing to higher net property income.

- Occupancy remains healthy at 96.3% as of June 2025.Rental reversions were positive, averaging 7.7%, led by strong uplifts in suburban malls (+8.8%) and downtown malls (+6.9%), reflecting resilient consumer demand and favorable lease renewals.

- DPU growth has been steady over the past few years, rising from 10.4 cents in 2021 to 10.88 cents in 2024, underscoring CICT’s track record of delivering consistent income growth.

- The trust continues to expand strategically, recently acquiring a 55% stake in CapitaSpring in the CBD, expected to be accretive to DPU.

- Net gearing is kept below 40% through equity fundraising, maintaining financial prudence.

- At current levels, CICT offers a dividend yield of 4.9%, close to its historical average of 5.2%.

Related links:

- CapitaLand Integrated Commercial Trust (CICT) share price history and share price target

- CapitaLand Integrated Commercial Trust (CICT) dividend history and dividend forecast

CapitaLand Ascendas REIT (CLAR)

- CLAR’s portfolio is diversified across geographies, with 65% of assets in Singapore and the rest in the US, UK, Europe, and Australia.

- Its holdings are well-spread across business parks, life sciences, logistics, and business space assets, providing balanced exposure across industrial sub-sectors.

- For 1H 2025, distribution per unit (DPU) slipped 0.6% year-on-year to 7.477 cents, contrasting with growth seen in CICT.

- This slight decline reflects a softer performance, though portfolio occupancy improved to 91.8%, up 0.3% from the prior quarter.

- Rental reversions were healthy at 8% in Q2 2025, though moderating from earlier quarters and last year. Positive trends were broad-based across Singapore, the US, and Australia, signaling resilient leasing demand.

- The trust has been active on the acquisition front, adding 9 Tai Seng Drive and 5 Science Park Drive in Singapore. These are expected to be DPU-accretive and strengthen its local presence in high-value industrial and life sciences hubs.

- At current levels, CLAR offers a dividend yield of 5.7%, consistent with its historical average

Related links:

- CapitaLand Ascendas REIT (CLAR) share price history and share price target

- CapitaLand Ascendas REIT (CLAR) dividend history and dividend forecast

11:45 - Technical Analysis

iEdge S-REIT Index

- The index advanced about 2% last week to roughly 1,074 points, helped by a gap up on renewed expectations that the US Federal Reserve will deliver its first rate cut in September.

- The move echoes a similar upswing seen around the same period last year when rate-cut hopes lifted REITs before momentum faded into year-end amid election and tariff disruptions.

- From a levels perspective, the next major resistance sits near 1,143 points, last year’s September peak, implying close to 10% potential upside if the current recovery persists.

- With rates drifting lower and sector sentiment improving, the setup favors a continued grind higher toward that resistance, though confirmation from incoming macro data would strengthen the case for follow-through.

Straits Times Index

- The STI pushed up to about 4,277 last Friday, just shy of its all-time high at 4,282, before profit taking emerged near the top of the recent range.

- Price action remains range-bound, with sellers active on tests of the highs and dip-buyers stepping in on weakness. Immediate support is clustered around 4,200 where the lower Bollinger Band has risen to about 4,196, with a stronger cushion around 4,150 aligned to the 50-day moving average near 4,158.

- Momentum signals are mixed: MACD has been drifting lower for two to three weeks, consistent with consolidation, while RSI around 60 remains healthy and leaves room for another retest of the highs if buyers regain control.

Dow Jones Industrial Average

- The Dow closed near 45,544 after a modest 0.2% pullback, consolidating just below the record high at 45,757 set on 22 August.

- The dip looked like routine month-end profit taking into the US Labor Day long weekend rather than a change in trend, with futures indicating some stabilization.

- First support is around 45,000, backed by the 20-day moving average near 44,823 and deeper support at the 50-day moving average around 44,424.

- MACD remains positive and curling higher and RSI near 62 is comfortably below overbought, together suggesting the path of least resistance remains up if macro news does not disappoint.

S&P 500

- The S&P 500 notched a fresh all-time high at 6,508 last Thursday before easing to about 6,460, with price now oscillating inside an upper-range channel.

- Near-term support sits at the 20-day moving average around 6,417, while a stronger confluence base lies near 6,300 where the 50-day moving average aligns with the lower Bollinger Band around 6,316 to 6,303.

- MACD remains slightly negative, though the gap between the MACD and signal lines is narrowing, with a potential crossover signaling a new uptrend in the coming weeks.

- MACD is slightly negative but flattening, signaling digestion rather than deterioration, and RSI has eased yet remains comfortably above 50, keeping the uptrend intact.

- Barring a negative macro surprise, the index looks set to track its highs and attempt another push if momentum rebuilds after consolidation.

Nasdaq Composite Index

- The Nasdaq reached 21,742 last Thursday, just below the 13 August record at 21,803, before slipping to 21,496 as the tech-heavy gauge cooled from recent strength.

- The first pivot to watch is the 20-day moving average around 21,420, with a more important support band near 20,900 where the 50-day moving average and lower Bollinger Band converge.

- Momentum is in a pause phase: MACD is slightly down but broadly horizontal, and RSI around 55 sits below neutral yet has repeatedly rebounded from the 50 area this month, a pattern that argues for buy-the-dip behavior near support.

- A sustained rebound from those zones would set up another challenge of the 21,803 record, contingent on upcoming catalysts and broader rate expectations.

What to look out for this week

Monday, 1 September 2025: US Labour Day Holiday, Jardine Cycle and Carriage Ex-Dividend, Venture Corp Ex-Dividend, SSB application opening

Tuesday, 2 September 2025: NIO earnings

Friday, 5 September 2025: US Nonfarm Payrolls data

Get the full list of stocks with upcoming dividends here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments