Stocks bounce with positive earnings: Weekly Market Recap

By Gerald Wong, CFA • 10 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

US and Singapore stocks bounce on positive earnings and rising rate cut hopes

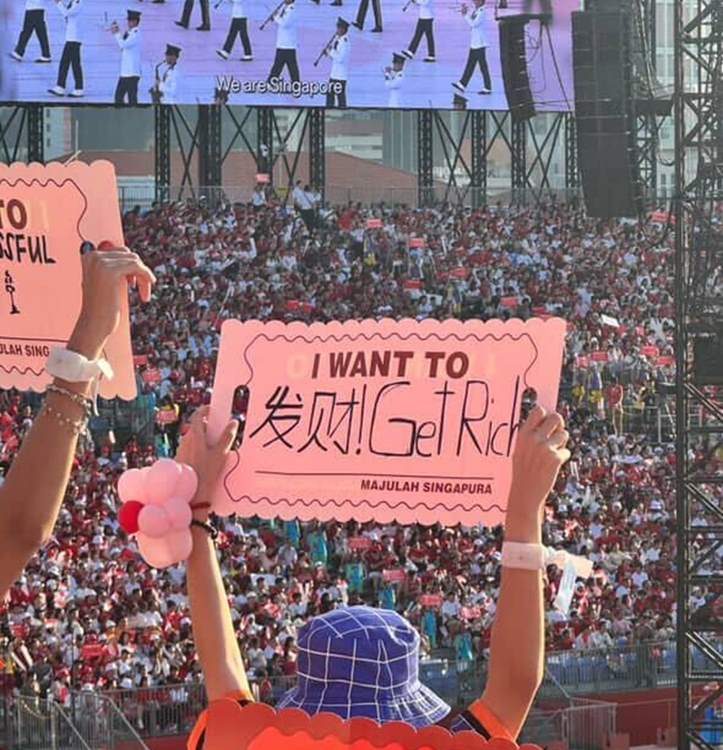

I hope you enjoyed yesterday’s National Day Parade as much as I did.

One of my favourite moments was seeing participants hold up placards sharing their wishes for themselves and Singapore.

Naturally, many of us want to grow our wealth. But as we celebrate how far we’ve come, it’s just as important to pause and understand why we’re chasing these goals.

For some, it’s about having a greater mental safety net through saving. For others, it might be achieving financial freedom through investing. And for many, it’s having retirement adequacy by building steady passive income streams.

This week, income seekers had their eyes on the allotment of the Astrea 9 PE bond, which drew record applications, likely fuelled by falling yields in other popular options. The upcoming T-bill auction is also expected to see yields remain under pressure as Fed rate cuts look increasingly likely.

In the stock market, DBS hit a record high above S$50 after reporting its latest earnings, while UOB and Sembcorp Industries saw selling pressure.

For REIT investors, CapitaLand Integrated Commercial Trust (CICT) announced its second major acquisition in a year with CapitaSpring, following last year’s purchase of ION Orchard. We take a closer look at what this could mean for the REIT’s portfolio.

If you’d like to find out your money personality in a fun way, do try our quiz to see if you’re a Savvy Sean or a Thrifty Tracy, and stand to win S$60 vouchers in our SG60 giveaway.

Regardless of what character you are, it’s worth remembering—there’s no single path to building wealth. The best one is the one that works for you.

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

🚀 Positive company news boost markets

What happened?

Positive company updates helped lift investor sentiment this week.

In Singapore, DBS surprised on the upside with a 1% rise in 1H2025 net profit, defying expectations of a drop in earnings amid pressure on net interest income from falling rates.

Over in the US, Apple announced plans to invest an additional US$100 billion — on top of a previously pledged US$500 billion — to boost U.S.-based manufacturing over the next four years. The move could reportedly shield the company from steep semiconductor tariffs under the Trump administration.

What does this mean?

Despite the drag from U.S. trade tariffs, upbeat company news helped ease concerns about corporate earnings.

Meanwhile, expectations of a U.S. rate cut grew stronger after several Fed officials hinted that policy easing could be on the horizon.

According to the CME FedWatch Tool, markets are now pricing in close to a 90% chance of the Fed lowering rates at its September meeting.

Why should I care?

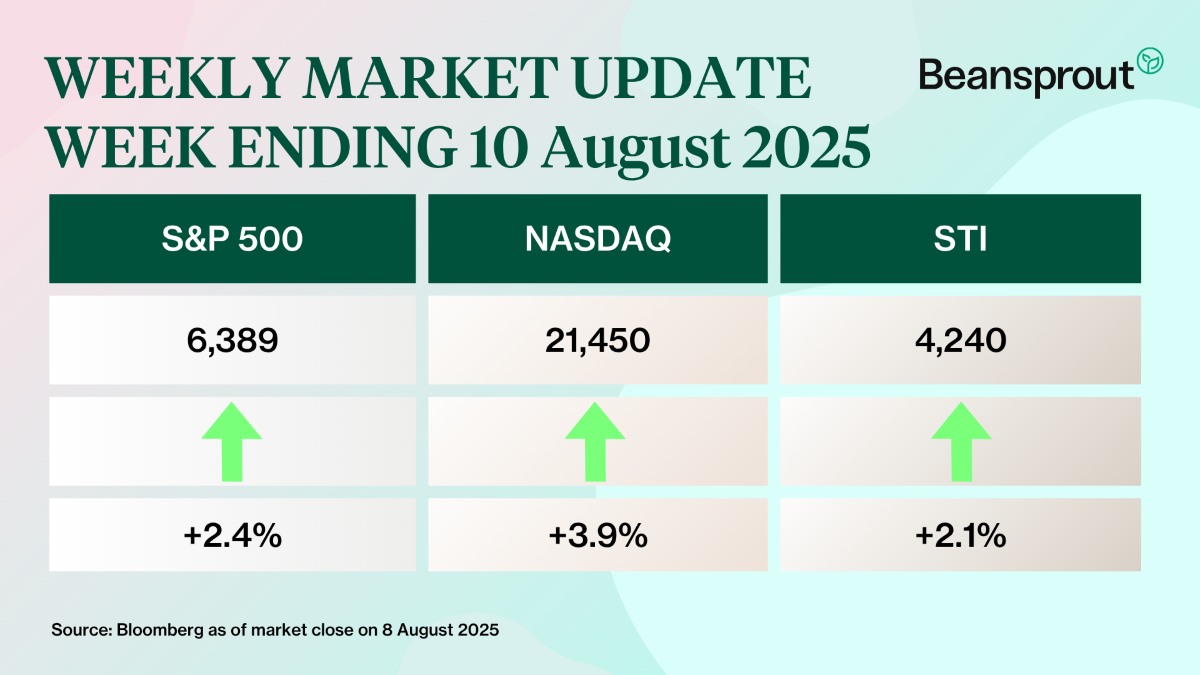

After last week’s pullback, the S&P 500 rose 2.4% to finish just shy of a new all-time closing high, while the Nasdaq Composite surged 3.9% to notch a new record.

Back in Singapore, the STI also increased 2.1% led by gains by DBS and Yangzijiang Shipbuilding following stronger than expected earnings.

🚗 Moving This Week

- DBS’ net profit for the second quarter ended Jun 30, 2025 rose 1% year on year to S$2.82 billion, driven by growth in its wealth management fee income. DBS declared an ordinary dividend of S$0.60 per share and a capital return dividend of S$0.15 per share for the period. bringing the quarter’s total dividend payout to S$0.75 per share. Read our analysis here

- UOB’s net profit for the second quarter fell 6% year-on-year to S$1.34 billion as net interest income eased on lower margins. UOB declared an interim dividend of S$0.85 per share for the half-year ended Jun 30, down from S$0.88 in the previous year. Read our analysis here

- Sembcorp Industries reported that its earnings fell 1 per cent to S$536 million for the first half ended Jun 30, on the back of lower turnover from its gas business. The company proposed an interim dividend of S$0.09 per share, up from S$0.06 per share in the year-ago period. Read our analysis here

- CapitaLand Integrated Commercial Trust’s (CICT) distribution per unit (DPU) rose by 3.5 per cent to S$0.0562 for its first half ended Jun 30, 2025. Separately, the REIT announced that it would acquire the remaining 55 per cent interest in CapitaSpring, a Grade A office tower in Raffles Place, for S$1 billion. Read our analysis here.

- Parkway Life REIT’s has raised its first-half distribution per unit (DPU) by 1.5 per cent to S$0.0765. The higher DPU and distributable income came on the back of the acquisitions of one more nursing home in Japan and 11 nursing homes in France in H2 FY2024, though this was partially offset by the depreciation of the yen. Read our analysis here.

- Yangzijiang Shipbuilding reported a record-high net profit of 4.2 billion yuan (S$752.6 million) for the six months ended Jun 30, 2025, marking a 36.7% year-on-year increase. The increase was driven by increased contributions from associated companies and joint ventures, including Yangzi-Mitsui Shipbuilding and Tsuneishi Zhoushan. Read more here.

- Genting Singapore reported a 34 per cent drop in profit for the first half of the year to S$234.7 million. The decline in profit was partly driven by a 12 per cent drop in gaming revenue to S$839.4 million, and a 19 per cent fall in room revenue to S$98.4 million. An interim dividend of S$0.02 per share was declared for the half year, unchanged from the year before. Read more here.

- SGX reported that its net profit for the second half ended June 2025 declined 2.6 per cent to S$308 million. The company has proposed a final quarterly dividend of S$0.105 per share, up from S$0.09 per share in the same quarter a year ago. Read more here.

- CapitaLand Ascendas REIT’s distribution per unit fell 0.6 per cent for the half-year ended June to S$0.07477. The REIT’s revenue declined 2% year-on-year, mainly due to the divestment of five properties in Australia, Singapore and the US, as well as the decommissioning of a property in the UK for redevelopment in June 2024. Read more here.

- Lendlease REIT posted a marginal improvement of 1.8 per cent in its distribution per unit (DPU) to S$0.018 for the half-year ended Jun 30. Separately, the REIT announced that it will be divesting the office component of the Juong commercial-retail development Jem to Keppel for S$462 million, with the proceeds to be used to pay down debts and potentially for distribution to unitholders. Read more here.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

Astrea 9 Bond - Full allocation for Class A-1 applications of up to S$11,000

Investors who applied for S$11,000 and below of Astrea 9 Class A-1 Bonds received full allocation.

🤓 What we're looking out for next week

Earnings Announcements

- Tuesday, 12 August 2025: Prime US REIT, Wilmar International earnings

- Wednesday, 13 August 2025: EC World REIT, City Developments, UOL Group, Stoneweg Europe Stapled Trust, United Hampshire US REIT earnings

- Thursday, 14 August 2025: CapitaLand Investment, ST Engineering, Manulife US REIT, Sasseur REIT earnings

Dividend Announcements

- Monday, 11 August 2025: CapitaLand Ascendas REIT, Keppel, Lendlease REIT ex-dividend

- Tuesday, 12 August 2025: CapitaLand Integrated Commercial Trust ex-dividend

- Wednesday, 13 August 2025: First REIT, Parkway Life REIT ex-dividend

- Thursday, 14 August 2025: Credit Bureau Asia, DBS, Sheng Shiong, Acrophyte Hospitality Trust, IREIT Global ex-dividend

- Friday, 15 August 2025: Daiwa House Logistics Trust, Info-Tech, Sembcorp Industries, UOB ex-dividend

Key US Announcements

- Tuesday, 12 August 2025: US CPI data

- Thursday, 14 August 2025: US PPI data

- Friday, 15 August 2025: US Retail Sales data

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Join the Beansprout Telegram group and Facebook group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments