Singapore stocks reach fresh highs: Weekly Market Recap

By Gerald Wong, CFA • 16 Nov 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

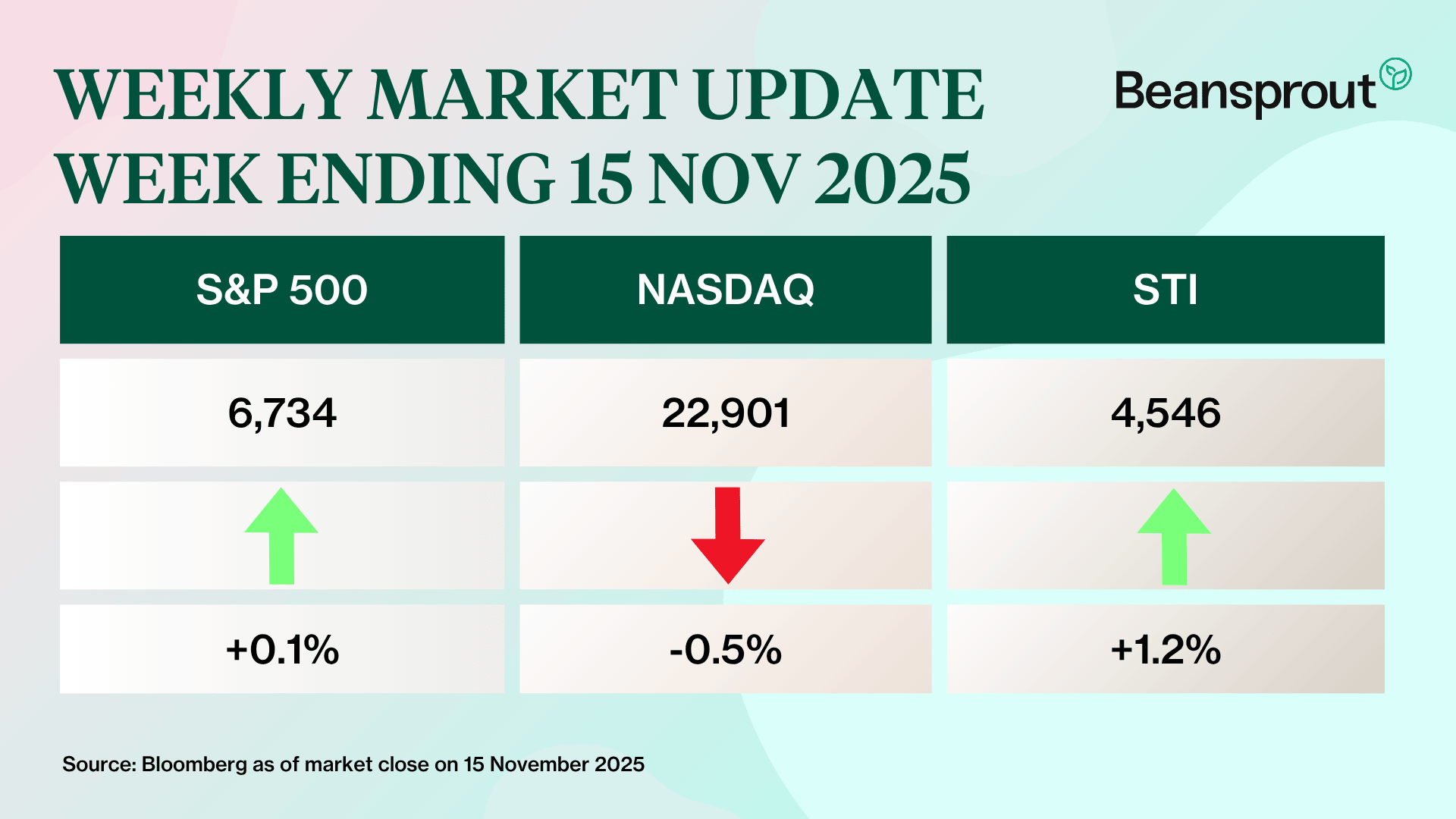

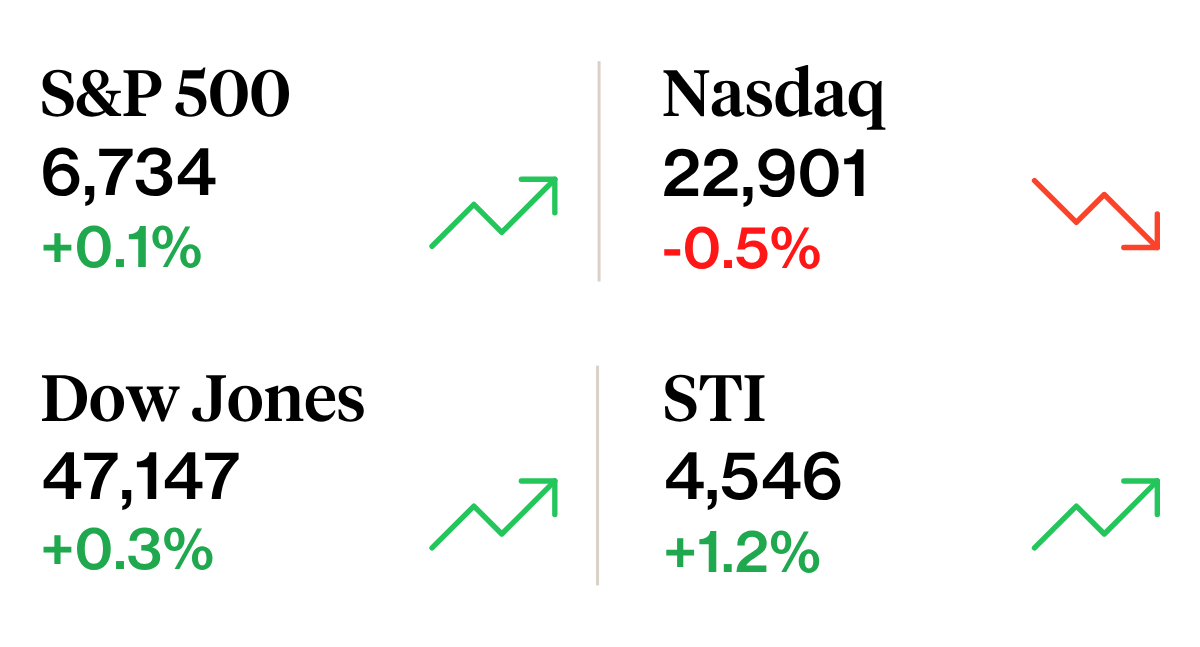

Singapore's Straits Times Index (STI) rallied to record highs with positive earnings surprises.

I was in Brunei this week for an education seminar, and the conversations I had there felt very familiar. Many people were asking the same question we often hear in Singapore: how can I grow my wealth and feel more financially secure?

It turns out the challenges are similar too. Interest rates are falling, savings accounts are earning less, and many are now looking for better ways to make their money work harder.

What I’ve found helpful is to start with a few small steps to grow my wealth.

- Find the best place to park our cash: With the upcoming T-bill yield in Singapore expected to stay low, we take a look this week at where you can still park your cash for higher yields.

- Grow passive income: As interest rates decline, Singapore stocks which offer attractive dividend yields have been drawing fresh interest back home, pushing the STI to new all-time highs. We review four Singapore blue chip stocks to see whether their dividend yields remain attractive even after the recent run-up in prices.

- Diversify your portfolio. We’ve previously shared how gold can help diversify portfolios. This week, we dive deeper into this topic to explore how to approach gold trading amid the price swings, and take a closer look at Laopu gold, now accessible through a Singapore Depository Receipt.

It was heartening to see that no matter where we are, we all share the same dream to grow steadily and build a better future.

So wherever you are on your journey, remember this: start small, stay consistent, and keep learning. Even small steps can take you far.

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

🏛 Reduced expectations of Fed rate cuts

What happened?

Comments from U.S. Federal Reserve officials this week suggest that a rate cut in December is far from certain.

Policymakers noted that signals from the labour market remain mixed and “difficult to interpret,” adding that the Fed will need to “proceed with caution” as it evaluates upcoming data.

What does this mean?

Investor expectations for aggressive rate cuts cooled after the Fed’s comments. According to the CME FedWatch tool, the probability of a rate cut at the December meeting fell to about 55% as of 14 November, down from nearly 95% a month ago.

This shift in sentiment came even as markets welcomed the positive news that the longest U.S. government shutdown on record ended on Wednesday, after President Donald Trump signed a spending bill to keep the government funded through January 30.

Why should I care?

U.S. stocks ended the week mixed as hopes for a December rate cut faded.

Concerns about stretched valuations and growing scrutiny over artificial intelligence spending also contributed to a rotation out of many growth stocks that had driven major indices to record highs in recent months.

In contrast, Singapore stocks defied the weakness in U.S. markets to notch new highs, supported by positive earnings surprises from companies such as Singtel.

🚗 Moving This Week

- Singapore Airlines (SIA) reported a 82.1% drop in net profit to S$52 million for the second quarter of FY2026 ended September, due largely to the share of results of associated companies and lower interest income. SIA plans to return capital to shareholders via a special dividend package of S$0.10 per share yearly over three financial years. As the first payment from this package, the board has declared an interim special dividend of S$0.03 per share, which will be paid on Dec 23. Read more here.

- Singtel reported a 176.4 per cent increase in net profit to S$3.4 billion for the first half-year ended September. This was boosted by a net exceptional gain of S$2.05 billion mainly from the sale of a partial stake in Airtel in May and the Intouch-Gulf merger. Excluding these one-off items, underlying net profit climbed 13.7 per cent to S$1.4 billion. Read more here.

- ST Engineering reported a 9 per cent year-on-year rise in revenue to S$9.1 billion for the nine months ended Sep 30, on the back of strong performances across all its three business segments. Separately, ST Engineering reported a non-cash impairment of S$667 million for its iDirect Group, its satellite communications technology subsidiary. The group is also proposing a special dividend of S$0.05 per share to shareholders in view of the cash proceeds from recent divestments. Read more here.

- ComfortDelGro reported a PATMI of $70.4 million for the 3QFY2025 ended Sept 30, 22.4% higher y-o-y. Revenue rose by 12.9% y-o-y to $1.3 billion as revenues rose largely across the board. According to the group, the higher profit was driven by its UK public transport arm, as its Metroline London bus contract margins continued to improve. Read more here.

- Seatrium reported that its net order book stood at S$16.6 billion as at end-September, comprising 24 projects with deliveries extending through 2031. Seatrium said it is pursuing a “robust pipeline of opportunities” and is making “steady progress” toward achieving its 2028 financial targets. Read more here.

- SATS reported a Q2 FY2026 net profit of S$78.9 million, up 13.3 per cent from S$69.7 million in the corresponding year-ago period. The group attributed this to the strong performance of its cargo handling business as well as steady contributions from its ground handling and food services segment. Read more here.

- Sembcorp Industries has been awarded a 150MW firm and dispatchable renewable energy (FDRE) power project by SJVN Limited. The latest win brings Sembcorp’s gross renewables capacity in India to over 7.6GW. Read more here.

- CapitaLand Ascendas REIT (Clar) is divesting a logistics property in Australia for S$90 million. The sale consideration is a 17.2 per cent premium to the original purchase price of S$76.8 million, when the property was acquired in October 2015. It also represents a premium of 9.5 per cent over the independent market valuation of around S$82.2 million as at Sep 30, 2025. Read more here.

- SingPost reported a 12.8 per cent drop in net profit to S$19.7 million for its first half year ended Sep 30, from S$22.6 million in the previous corresponding period. This was mainly due to the lack of contributions from the divested Australia business, which had offset the exceptional gains from other divestments in the half year. An interim dividend of S$0.0008 per share was declared for the half year. Read our analysis here.

- Riverstone Holdings has reported a net profit of RM52 million ($16.31 million) for the 3QFY2025 ended Sept 30, down 28% y-o-y. The board has declared an interim dividend of 2.5 sens per share. Read more here.

- AEM Holdings reported a S$4 million profit for the nine months ended Sept 30, reversing its year-ago loss. This was due to a more favourable product mix, with higher contributions from advanced test solutions. Read more here.

- Sea reported a 144.6 per cent increase in its third-quarter earnings to US$375 million, from US$153.3 million for the year-ago period. Garena, Sea’s digital entertainment arm, had its best quarter for bookings since 2021. They grew 51.1 per cent to US$840.7 million in Q3 2025.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

Where to park your cash for higher yield? T-bills vs Fixed Deposit vs SSB (November 2025)

We share the best ways to earn a yield on your cash through fixed deposits, Singapore T-bills, SSBs and money market funds.

🤓 What we're looking out for next week

- Tuesday 18 November 2025: Frasers Logs & Comm Trust ex-dividend

- Wednesday, 19 November 2025: NVIDIA Earnings

- Thursday, 20 November 2025: 6 Month T-Bill Auction, US FOMC Meeting Minutes, SATS, Singtel ex-dividend

- Friday, 21 November 2025: SIngpost, ST Engineering ex-dividend

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments