Stocks soar on rising rate cut hopes: Weekly Market Recap

By Gerald Wong, CFA • 30 Nov 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

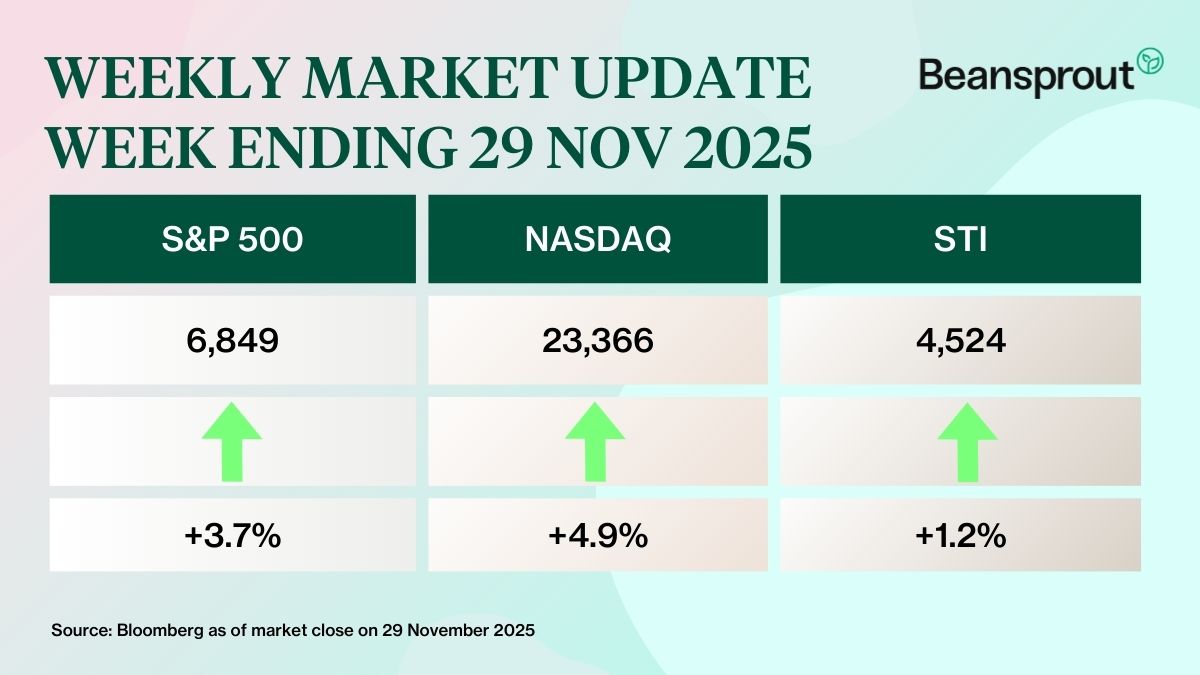

Stocks surged as rising expectations of interest rate cuts boosted market sentiment.

We’re nearing the end of the year, and many investors are already asking: What’s next for 2026?

At two events this week, I shared my market outlook and heard many of the same questions repeated.

🔍 Are we in an AI or property bubble?

📉 With interest rates falling, are REITs still attractive?

📈 What does Singapore’s new Equity Market Development Programme (EQDP) mean for investors?

With so much interest in Singapore REITs, we revisit the fundamentals this week to understand whether they continue to remain attractive, especially with T-bill yields expected to stay low in the upcoming auction on 4 December.

We also spotlight 4 REITs with yields above 5%, from stable names to those with global exposure.

And if you're watching the property market, we’ve reviewed the latest data to see if falling interest rates could support the sector.

When things feel uncertain, I always go back to the fundamentals. That’s what helps me invest with confidence, and I hope it helps you too.

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

🚀 Rising rate cut hopes

What happened?

Several U.S. Federal Reserve officials signalled support for a rate cut at the Central Bank’s upcoming December 2025 meeting.

This marked a reversal from the more cautious tone earlier, when many Fed officials suggested that a rate cut was far from certain.

What does this mean?

Support for rate cuts came as a series of weaker economic reports reinforced the view that a December cut remains likely.

U.S. retail sales rose just 0.2% in September, slowing from 0.6% in August and missing market expectations.

At the same time, consumer confidence dropped sharply in November to its lowest level since April, according to the Conference Board.

With the softer data, investors are now pricing in more than an 80% chance of a December rate cut, based on the CME FedWatch Tool. This is a sharp increase from below 50% just two weeks ago.

Why should I care?

U.S. stocks ended the week higher, led by a rebound in tech shares as worries about stretched valuations and heavy AI spending eased.

Singapore markets also saw a lift, with Singapore REITs leading the gains on rising expectations of rate cuts.

Strong performers included Frasers Logistics & Commercial Trust, Frasers Centrepoint Trust, and Mapletree Logistics Trust.

🚗 Moving This Week

- Seatrium has been awarded a contract from BP Exploration and Production Inc for the engineering, procurement, construction and onshore commissioning of the Tiber Floating Production Unit project in the Gulf of America. The Tiber FPU marks Seatrium’s second consecutive deepwater project for BP. Read more here.

- SATS’ subsidiary TFK Corporation announced that it has secured a three-year inflight catering contract with Turkish Airlines which started in October. Under the agreement, SATS TFK will provide daily inflight meal services for Turkish Airlines' flights from Narita International Airport-Istanbul and Tokyo Haneda Airport-Istanbul. Read more here.

- Jardine Matheson Holdings announced that the company’s portfolio in the third quarter was in line with expectations at the half year, with profit guidance for the full year remaining unchanged. Read more here.

- Thai Beverage (ThaiBev) has reported earnings of 25.4 billion baht ($1.02 billion) for the FY2025 ended Sept 30, down 6.8% y-o-y. For the full year, the group has declared a final dividend of 0.47 baht per share, the same as the period a year ago. Read more here.

- BRC Asia has reported revenue of $837.4 million for its 2HFY2025, up 16% y-o-y. However, earnings in the same period was down 5% y-o-y to $52.2 million with lower net margins. The company plans to pay a final dividend of 7 cents plus a special dividend of 7 cents.

- Medical imaging and surgery technology firm UltraGreen.ai is seeking a listing on the mainboard of the Singapore Exchange (SGX). The company is offering 112.1 million shares at US$1.45 or S$1.892 apiece, comprising 103.4 million new shares and 8.6 million vendor shares, with the aim of raising net proceeds of US$141.8 million or gross proceeds of US$150 million. Together with the cornerstone shares, the IPO offering will raise about US$377.1 million.

- Chinese e-commerce giant Alibaba beat analysts’ estimates for quarterly revenue, as investments in one-hour delivery helped drive more users to its shopping apps, while its cloud division reported strong growth.

- Chinese electric vehicle (EV) maker Nio recorded a net loss of 3.5 billion yuan (S$638 million) for its third quarter ended Jun 30, 2025, narrowing its losses from 5.1 billion yuan in the corresponding year-ago period. Q3 vehicle deliveries stood at 87,071, a 40.8 per cent jump from the year before.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

4 Singapore REITs with dividend yields of above 5% (November 2025)

We look at four Singapore REITs with dividend yields above 5% in November 2025.

🤓 What we're looking out for next week

- Monday, 1 December 2025: Singapore Savings Bonds (SSB) application opening date

- Thursday, 4 December 2025: Singapore 6-month T-bill auction

- Friday, 5 December 2025: US PCE Price Index data, SIA ex-dividend

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments