Beyond Blue Chips: Where are Singapore’s next big investment opportunities?

Mutual Funds

By Gerald Wong, CFA • 26 Nov 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Amova Asset Management’s portfolio managers explain how structural changes are opening new investment opportunities in Singapore beyond traditional blue chips.

What happened?

Singapore's market has performed very well this year.

We have seen several blue chip stocks reaching new highs, while some companies have also announced special dividends to boost their payouts.

This has led to questions about what is driving the share price gains, and if the strong performance can be sustained.

I recently attended a briefing by Amova Asset Management (formerly Nikko Asset Management), where Kenneth Tang, Senior Portfolio Manager and Lai Yeu Huan, Head of Asian Equity, shared their outlook for Singapore equities heading into 2026.

The session took place shortly after Amova Asset Management was appointed by the Monetary Authority of Singapore (MAS) to manage a Singapore equity portfolio under the Equity Market Development Programme (EQDP).

The EQDP is a strategic initiative to strengthen Singapore’s asset management and research ecosystem and boost investor confidence in the local equities market.

With more than two decades of experience managing Singapore equities, the Amova Asset Management team provided a clear view of how the market is evolving and where they see the next phase of opportunity.

Their main message was simple. Singapore is changing.

Beneath the steady headline numbers, a new generation of companies, sectors and structural drivers is taking shape.

Here are my key takeaways from the briefing.

Singapore offers a rare mix of stability, yield and regional growth

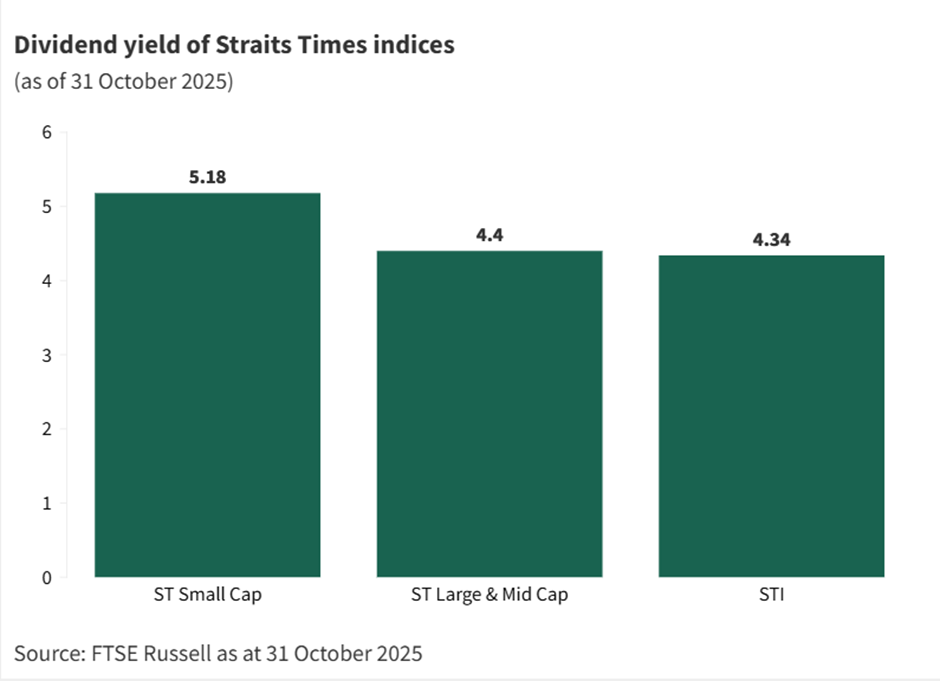

Many investors still see Singapore as a slow moving, dividend heavy market. But over the past three years Singapore equities have matched 80% of the S&P500 return in US dollar terms. Kenneth highlighted that this strong performance has been supported by three pillars.

The first is stability. Singapore is one of the nine countries with a triple A credit rating from all major agencies. The government has deep fiscal buffers and a proven ability to manage shocks. This has helped the market stay resilient through volatile periods.

The second is dividends. More than one third of Singapore’s market returns come from reinvested dividends. Companies here tend to return excess capital, and over time this creates a powerful compounding effect.

The third is regional growth. As supply chains shift from China to ASEAN, Singapore is benefiting from being the region’s financial, technology and logistics hub. Unlike some other developed markets, Singapore offers stability while still being closely connected to the growth of Southeast Asia.

This combination of income, resilience and exposure to regional transformation makes Singapore more dynamic than many investors assume.

The real driver of returns is change

A recurring theme at the briefing was that change, not stability, is the key characteristic of Asian markets. Yeu Huan and Kenneth explained that the most attractive investment opportunities often come from companies undergoing meaningful structural change that the market has not yet been fully recognised.

Their focus is on companies that are undervalued because the impact of change has not been priced in. These changes include

- shifting from legacy businesses to higher growth segments

- divesting non core assets

- improving return on equity through better capital allocation

- restructuring operations or leadership teams

- repositioning for new industry trends

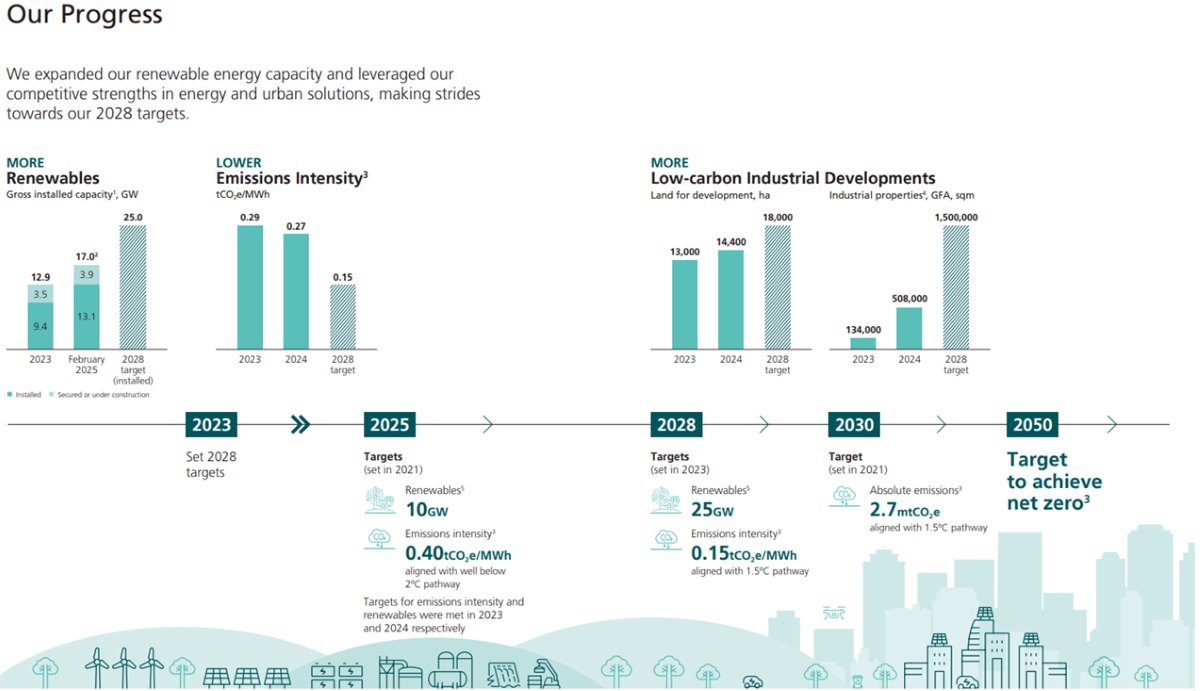

One example they shared is Sembcorp Industries. Years ago the company was weighed down by brown energy assets. Many investors were sceptical that these assets could be divested.

However, the portfolio managers from Amova Asset Management saw conviction in the company’s plan to transition into green energy.

Over time Sembcorp executed this plan, built a pipeline of renewable assets and tripled its market capitalisation. The market eventually rewarded the change.

Sembcorp Industries’ transition towards a sustainable and low-carbon future

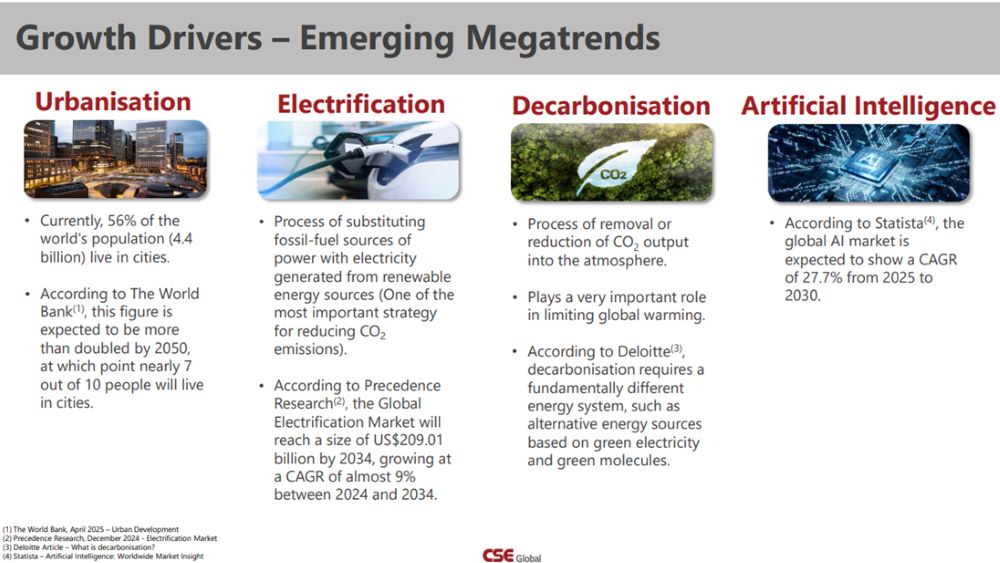

Another example is CSE Global, a mid-sized company focused on industrial automation, data centre infrastructure and mission critical communication systems.

In recent years, CSE Global has deepened its digital footprint through its partnership with Amazon Web Services (AWS) to deliver cloud-based monitoring, analytics, and remote operations solutions.

CSE Global benefits from the long term growth of digitalisation and rising data centre capacity not only regionally, but globally.

While less visible than the STI names, CSE Global reflects the type of specialised company that may shape the future of Singapore’s market.

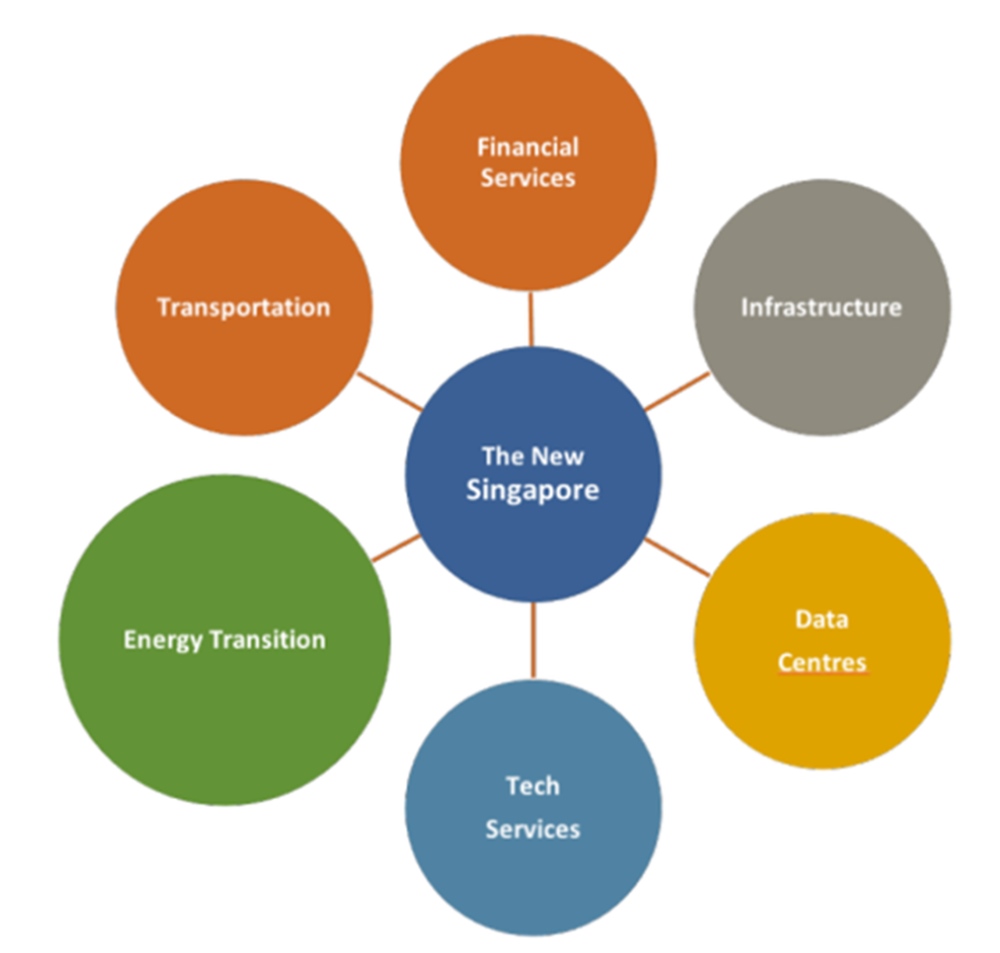

These are the types of companies Amova describes as the “new Singapore” – firms that sit outside the traditional blue chips but have the potential to become tomorrow’s leaders.

Read also: Will Singapore stocks hit new highs? Insights from a top fund manager

CSE Global’s 4 key growth drivers

Growth is happening outside the STI

Singapore Banks and REITs remain important anchors of the Singapore market, but Amova Asset Management believes the next decade of growth will come from sectors linked to the service economy and innovation driven industries.

These include

- renewable energy and energy transition players

- semiconductor equipment companies and technology suppliers

- data infrastructure companies supporting AI and cloud growth

- healthcare and life sciences

- logistics and supply chain enablers

- food innovation and specialised manufacturing

Many of these companies sit within the mid and small cap universe. They are less well covered by analysts and often misunderstood.

Yet they play important roles in global supply chains and tend to have longer structural runways than some larger blue chip names.

Amova Asset Management believes these companies stand to benefit most from EQDP, which aims to improve liquidity, deepen research coverage and attract more institutional participation.

Early signs are encouraging, with recent listings such as Centurion Accommodation REIT showing that more companies are starting to come to market.

Valuations in Singapore remain reasonable

Despite the strong performance of segments like the iEdge Next 50 Index, Amova Asset Management believes that valuations across the market are not expensive.

The STI trades around its long term average valuation. Mid and small cap valuations may appear higher on headline numbers, but bottom up analysis reveals many companies with unrecognised assets, improving business quality or significant catalysts ahead.

For investors willing to do deeper work, the gap between intrinsic value and market value remains meaningful.

The portfolio managers from Amova Asset Management believe this creates a favourable environment for active managers.

But investors must avoid value traps

Even with attractive opportunities, the managers cautioned that not all cheap stocks are worth buying.

Some companies remain undervalued for years due to weak management execution, lack of catalysts or outdated business models.

The portfolio managers from Amova Asset Management looks for evidence that

- management is committed to unlocking value

- operational improvements are real and measurable

- the company has a clear roadmap toward higher returns

- the catalysts are structural rather than temporary

Their internal scoring framework helps them differentiate between companies experiencing genuine positive change and those that simply look cheap.

Continued reforms will be needed for the next leg of upside

While Amova Asset Management is optimistic, they also emphasised that the long term potential of Singapore’s equity market depends on continued structural reforms.

Demand side support from EQDP is helpful, but sustained momentum requires supply side improvements such as attracting more innovative and high growth companies to list.

The managers believe Singapore is on the right track, but more listings and broader sector representation will be needed to keep the market vibrant.

What would Beansprout do?

Singapore is entering a new phase. For investors willing to look beyond blue chips, the opportunities may be broader than they appear.

Amova Asset Management announced that it will be launching two new funds as part of the Singapore Equity Market Development Programme (EQDP).

The two funds, Singapore All Share Strategy and Singapore Small Mid Cap Strategy, will focus on companies listed on the Singapore Exchange (SGX), with some bias towards small and medium-cap stocks.

Until these new funds are launched, investors who want Singapore exposure can consider

These offer different ways to access Singapore’s stability, dividend profile and emerging structural growth story.

To understand more about how to gain broad based exposure to Singapore, learn about the Straits Times Index (STI) here.

To understand more about opportunities beyond Singapore’s 30 largest listed companies, learn about the iEdge Singapore Next 50 Index here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments