4 Singapore REITs with dividend yields of above 5% (November 2025)

REITs

By Gerald Wong, CFA • 27 Nov 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We look at four Singapore REITs with dividend yields above 5% in November 2025.

What happened?

Singapore REITs are gaining traction.

Last month, we shared 3 Singapore REITs with dividend yields above 5%, which included CapitaLand Ascendas REIT and Lendlease Global Commercial REIT.

With the latest earnings season concluded, we also covered 3 Singapore blue-chip stocks paying special dividends and a comparison between DBS, OCBC and UOB’s dividend yield.

Several other REITs have also reported their latest financial results and have announced higher distributions in their most recent quarter.

Let’s take a closer look at four Singapore REITs that offer dividend yields of above 5% in November 2025 to see if they are worth adding to your watchlist.

4 Singapore REITs with dividend yields of above 5%

#1 – Mapletree Pan Asia Commercial Trust (SGX: N2IU)

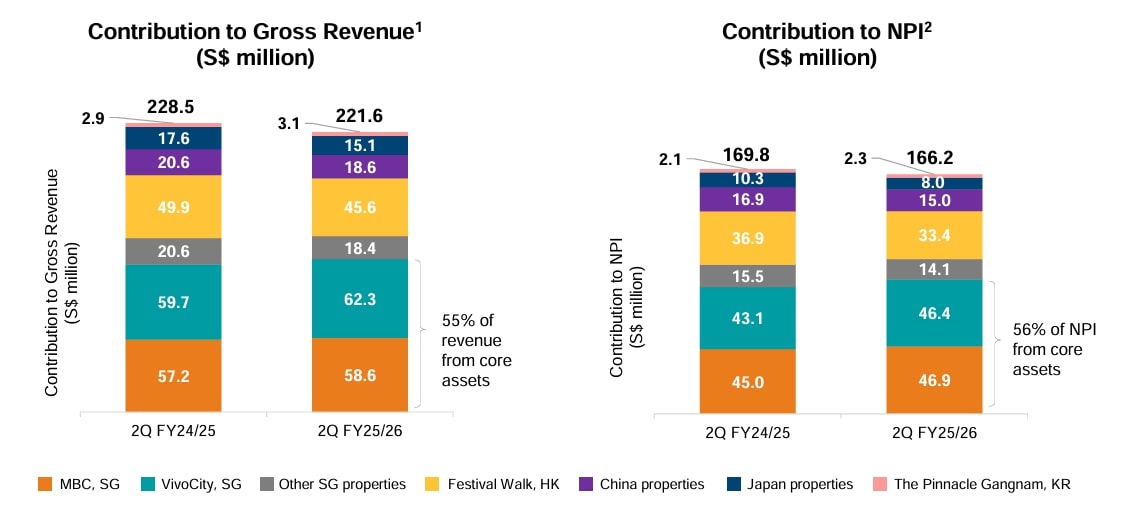

Mapletree Pan Asia Commercial Trust (MPACT) is a diversified commercial REIT with assets across Singapore, Hong Kong, China, Japan, and South Korea.

Its portfolio includes VivoCity in Singapore and Festival Walk in Hong Kong.

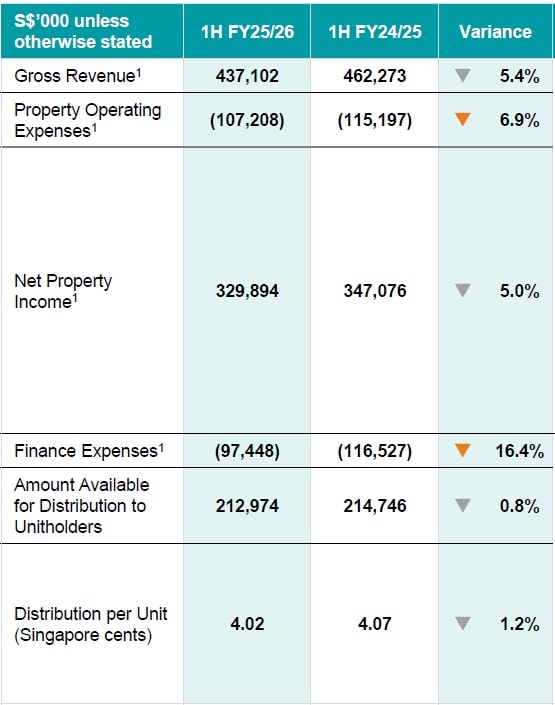

For the first half of the financial year 2025/26 (1H FY25/26) ended 30 September 2025, MPACT reported that its gross revenue declined by 5.4% year-on-year to S$437.1 million.

This led to a drop of 5.0% in net property income to S$329.8 million for 1H FY25/26.

The decline was mainly due to the divestment of Mapletree Anson and properties in Japan, as well as weaker currencies against the Singapore Dollar.

In 2Q FY25/26, MPACT delivered resilient results, driven by strong Singapore performance, strategic cost and debt optimisation, and support from a favourable interest rate environment.

Its net property income (NPI) for its Singapore portfolio rose 6.1% yoy, driven by a strong performance from VivoCity, which achieved a positive rental reversion of 14.1%.

With a better 2Q performance, MPACT’s distribution per unit (DPU) for 2Q FY25/26 rose 1.5% year-on-year to 2.01 cents.

MPACT estimates that every 50 bps change in benchmark rates would impact DPU by 0.11 cents per annum, translating to 1.4% impact based on FY2025’s DPU of 8.02 cents.

Based on its annualised DPU and a unit price of S$1.44 (as of 26 November 2025), MPACT offers a dividend yield of approximately 5.6%.

Find out how much dividends you may receive as a shareholder of Mapletree Pan Asia Commercial Trust with the calculator below.

Related links:

- Mapletree Pan Asia Commercial Trust (N2IU) share price history and share price target

- Mapletree Pan Asia Commercial Trust (N2IU) dividend history and dividend forecasts

#2 – Frasers Centrepoint Trust (SGX: J69U)

Frasers Centrepoint Trust (FCT) is a leading suburban retail REIT with a portfolio of malls located near MRT stations and bus interchanges in Singapore.

Key assets include Causeway Point, Northpoint City (North Wing), and the newly acquired stake in Northpoint City (South Wing).

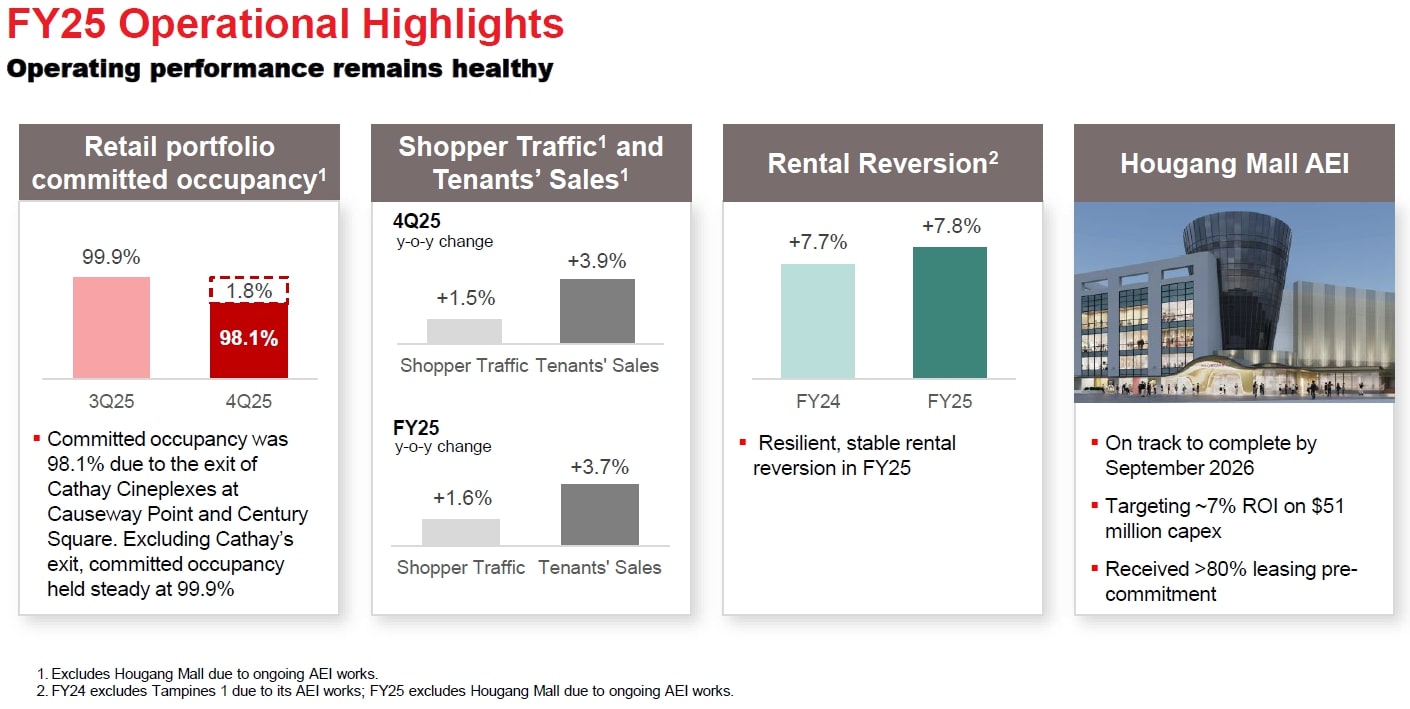

FCT reported a strong set of results for its full financial year ended 30 September 2025 (FY2025) as its net property income increased 9.7% year-on-year to S$277.9 million.

The growth was driven by contributions from the acquisition of an additional interest in Northpoint City South Wing and higher rental income from Tampines 1 following the completion of its Asset Enhancement Initiative (AEI).

The REIT’s committed occupancy remained healthy at 98.1%, although it dipped slightly due to the exit of a cinema operator.

Shopper traffic and tenants’ sales show positive growth.

The portfolio also achieved a strong rental reversion of 7.8%, signaling robust retailer demand for suburban mall space.

Looking ahead, FCT is driving value creation through the S$51 million asset enhancement of Hougang Mall, which is on track for completion in September 2026 having already secured over 80% leasing pre-commitment.

FCT’s DPU in FY25 rose 0.6% year-on-year to 12.113 cents, reaching a new high.

Based on its annualised DPU and a unit price of S$2.25 (as of 26 November 2025), FCT offers a current dividend yield of approximately 5.4%.

Find out how much dividends you may receive as a shareholder of Frasers Centrepoint Trust with the calculator below.

Related links:

- Frasers Centrepoint Trust share price history and share price target

- Frasers Centrepoint Trust dividend history and forecasts

#3 – AIMS APAC REIT (SGX: O5RU)

AIMS APAC REIT (AA REIT) is an industrial REIT with a portfolio of logistics, warehouse, and light industrial properties across Singapore and Australia.

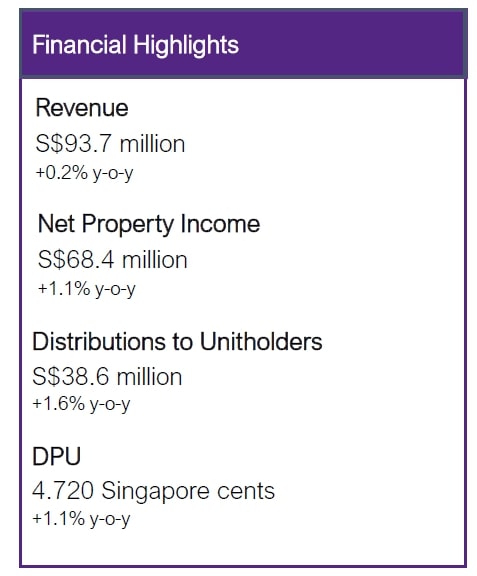

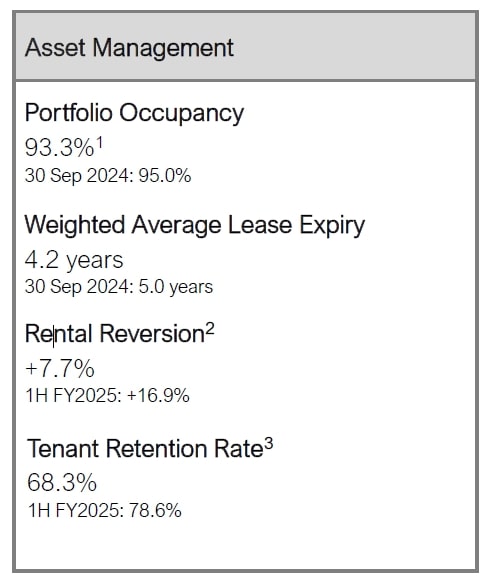

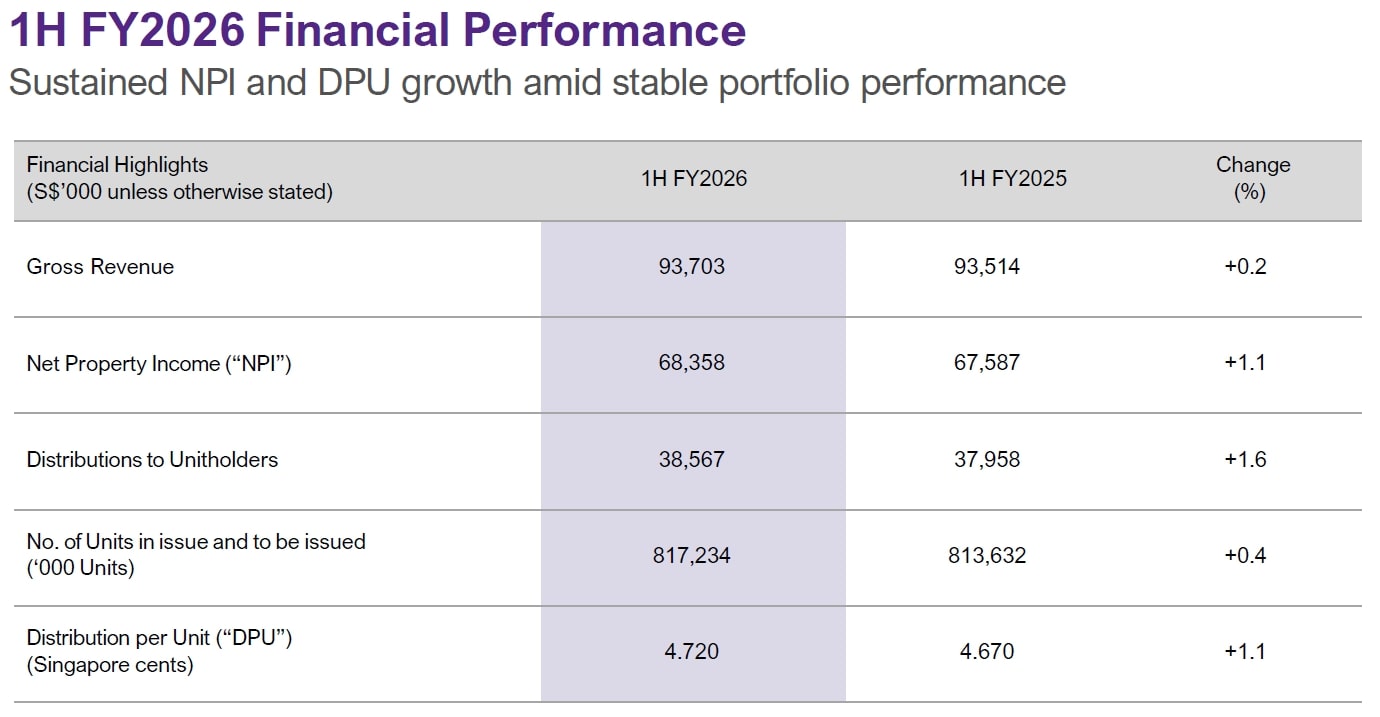

For the first half of its financial year ending 31 March 2026 (1H FY2026), it has recorded a 1.1% yoy increase in net property income to S$68.4 million.

The steady performance was underpinned by high tenant retention and a positive portfolio rental reversion of 7.7%.

The REIT also maintained a high portfolio occupancy rate of 93.3%.

AA REIT has been active in capital recycling and asset enhancement.

It recently completed the refurbishment of 7 Clementi Loop.

In August, it announced a proposed acquisition of Framework Building at 2 Aljunied Avenue 1, Singapore, which is projected to be approximately 2.5% DPU accretive.

The REIT maintains a conservative balance sheet with an aggregate leverage of 35.0%, providing it with ample debt headroom for future growth.

AA REIT reported a 1.1% year-on-year increase in DPU to 4.72 cents for 1H FY2026.

Based on an annualised DPU and a unit price of S$1.45 (as of 26 November 2025), AIMS APAC REIT offers a dividend yield of approximately 6.5%.

AA REIT also shared that for every 25 bps change in interest rates is expected to have a 0.06 Singapore cents DPU impact per annum, translating to 0.6% impact based on FY25’s DPU of 9.6 cents.

Find out how much dividends you may receive as a shareholder of AIMS APAC REIT with the calculator below.

Related links:

- AIMS APAC REIT share price history and share price target

- AIMS APAC REIT dividend history and forecast

#4 – Elite UK REIT (SGX: MXNU)

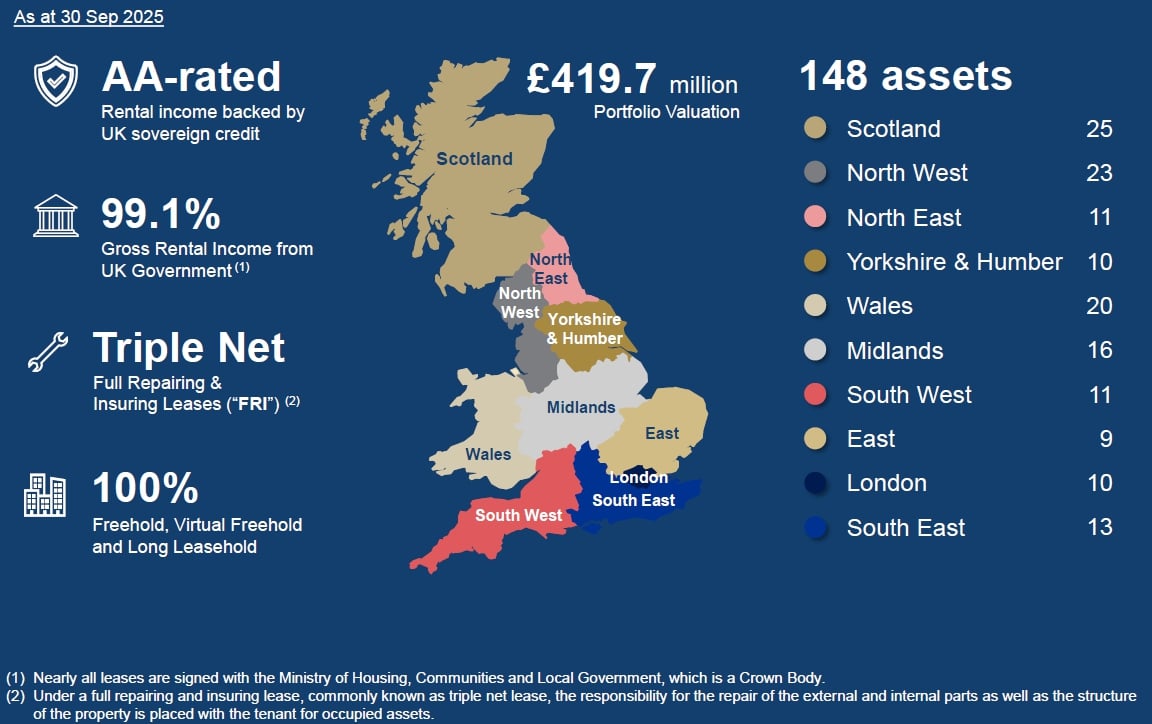

Elite UK REIT is the only Singapore-listed REIT focused on the United Kingdom, with a portfolio primarily leased to the UK government’s Department for Work and Pensions (DWP).

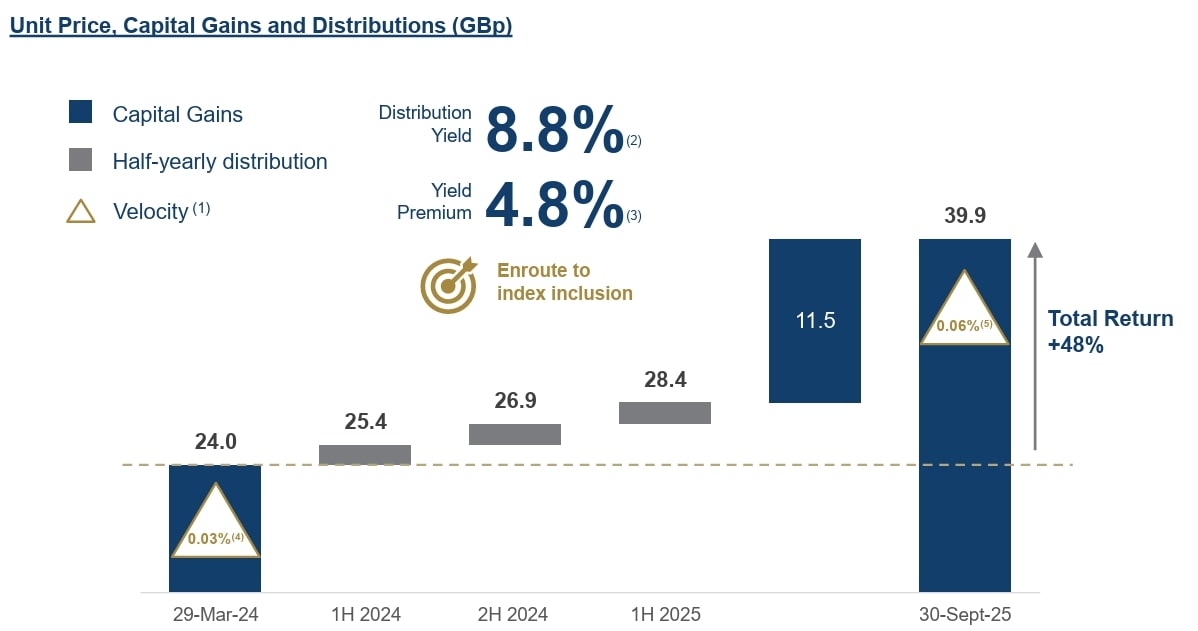

For the nine months ended 30 September 2025 (9M 2025), The REIT increased its revenue by 1.0% year-on-year with higher rental reversions and contributions from new acquisitions.

Also, its distributable income growth of 6.2% year-on-year was attributed to interest cost savings from its debt management strategies.

The portfolio remains resilient with an occupancy rate of 98.6%, providing high income visibility given the credit quality of its main tenant, the UK government.

Elite UK REIT is also diversifying its portfolio, with plans to convert a property in Scotland into student accommodation, as well as potential data centre developments.

9M25 DPU increased 9.4% year-on-year to 2.33 pence as it raised its payout ratio to 95%.

Based on its annualised DPU and a unit price of £0.36 (as of 26 November 2025), Elite UK REIT offers a dividend yield of approximately 8.6%.

Find out how much dividends you may receive as a shareholder of Elite UK REIT with the calculator below.

Related links:

- Elite UK REIT share price history and share price target

- Elite UK REIT dividend history and dividend forecast

What would Beansprout do?

With the recent earnings season coming to a close, we can see that a number of Singapore REITs are still able to offer attractive dividend yields of above 5%.

If you are looking for stability, Frasers Centrepoint Trust’s, the largest suburban retail mall operator in Singapore gives 5.4% dividend yield. Its portfolio is defensive and also benefits from limited new retail supply, rising household incomes, and supportive government policies.

For investors seeking a large-cap REIT showing early signs of turnaround, Mapletree Pan Asia Commercial Trust offers 5.6% dividend yield. It benefits from its resilient Singapore portfolio, particularly VivoCity which is generating solid positive rental reversion and strong tenant sales, despite disruption from ongoing asset enhancement initiatives. That said, the overseas portfolio still faces market and currency headwinds, though management is actively optimising the portfolio with a renewed focus on Singapore as its core market.

If you are looking for mid-cap REITs with attractive yields, Elite UK REIT offers a dividend yield of 8.6%, underpinned by a stable tenant base where 99.1% of gross rental income is secured by the UK government. Despite the high headline yield, it is exposed to the UK economy and may have currency exposure risk.

Another mid-cap REIT is AIMS APAC REIT which provides 6.5% dividend yield and has positive rental reversion. Its overseas properties are currently facing currency and market headwinds, but the REIT has hedged 75% of its forecasted AUD income into SGD on a four-quarter rolling basis, to help stabilise distributions. We can also expect additional contribution from the Framework Building acquisition, which is scheduled to complete by late November 2025..

To screen for Singapore REITs with lowest price-to-book valuation or highest dividend yield, check out our best Singapore REIT screener.

If you are new to investing in Singapore REITs, you can start to learn more about Singapore REITs here.

If you prefer diversification without picking individual REITs, you can also gain exposure through Singapore REIT ETFs.

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in Singapore REITs.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments