Singapore stocks rise while gold pulls back: Weekly Market Recap

By Gerald Wong, CFA • 01 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Singapore stocks hit new highs while gold prices fall amid heightened volatility

This week, I was chatting with the team about who they would like to interview on the Beansprout podcast.

One said Blackpink. One said Obama. One said Lawrence Wong.

My answer? Alex Honnold.

Not because I’m suddenly training to climb a mountain, but because I genuinely want to understand what goes through his mind when he free-solo climbs something like Taipei 101.

If I had to guess, his answer would be simple. It’s about preparation, practice, and managing the risks you can control.

And honestly, investing feels the same way.

Markets are at all-time highs, and volatility and uncertainty are creeping back in. This is when risk management becomes vital.

Firstly, having sufficient emergency cash and liquidity allow us to invest with greater peace of mind. We find out what is driving the cut-off yield for the latest 6-month Singapore T-bill auction to decline to 1.37%, and if there are better options available to earn a higher yield.

For investors in Singapore, investing in the home market can help reduce currency swings, and blue chip stocks can offer some stability to our portfolios. This week, we round up the best-performing blue chip stocks this month, and explore what’s been driving the rally.

Another way I manage risk in my own portfolio is through diversification. If you’re looking to invest your SRS funds in a more diversified way, we’ve rounded up the top 10 ETFs bought by SRS investors.

To me, the lesson here is that being prepared matters. Good investing is often less about chasing the highest returns, and more about managing risk well.

As we make strides in our investing journeys, who would you like to hear on our podcast next? Leave us a comment below and let us know.

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

📉 Volatility returns

What happened?

After three consecutive rate cuts, the Federal Reserve kept its benchmark fed funds rate unchanged at 3.50% to 3.75%, in line with market expectations.

US President Donald Trump also announced that he has nominated Kevin Warsh, a former Fed governor, to lead the US central bank. If confirmed by the Senate, Warsh would succeed Chair Jerome Powell when Powell’s term expires in May.

What does this mean?

The nomination supported a stronger US dollar. Warsh is known for taking a firmer stance on keeping inflation under control during his previous time at the Fed.

He was seen as less likely to support aggressive rate cuts compared to other candidates being considered.

This helped reverse the recent weakness in the US dollar, which had fallen to an 11-year low against the Singapore dollar.

Why should I care?

Gold, which had surged to record highs, reversed sharply on Friday and fell below US$5,000 per ounce, marking its biggest daily decline since the early 1980s.

Silver also sold off heavily, with spot prices dropping more than 30% to below US$85 per ounce.

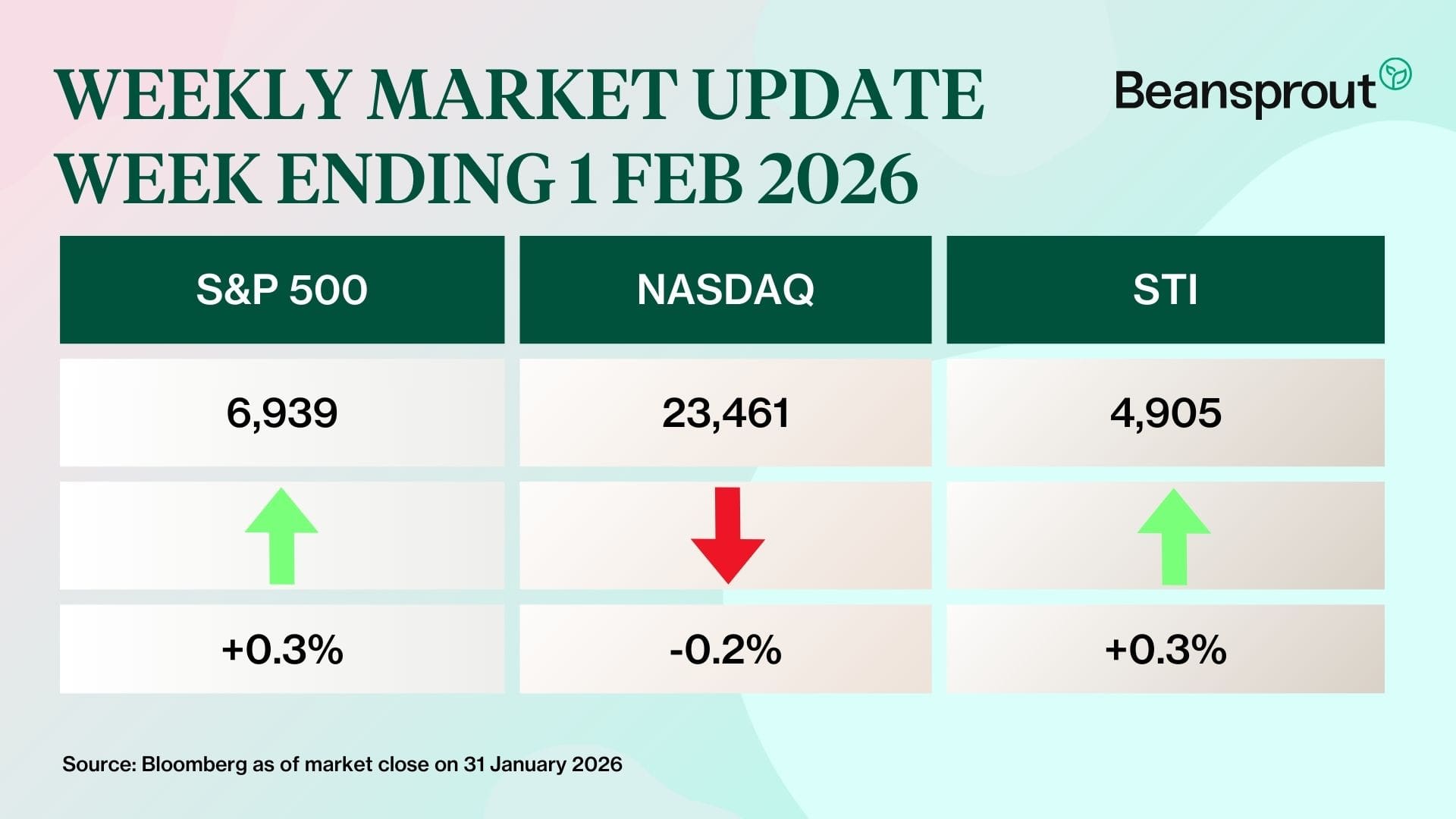

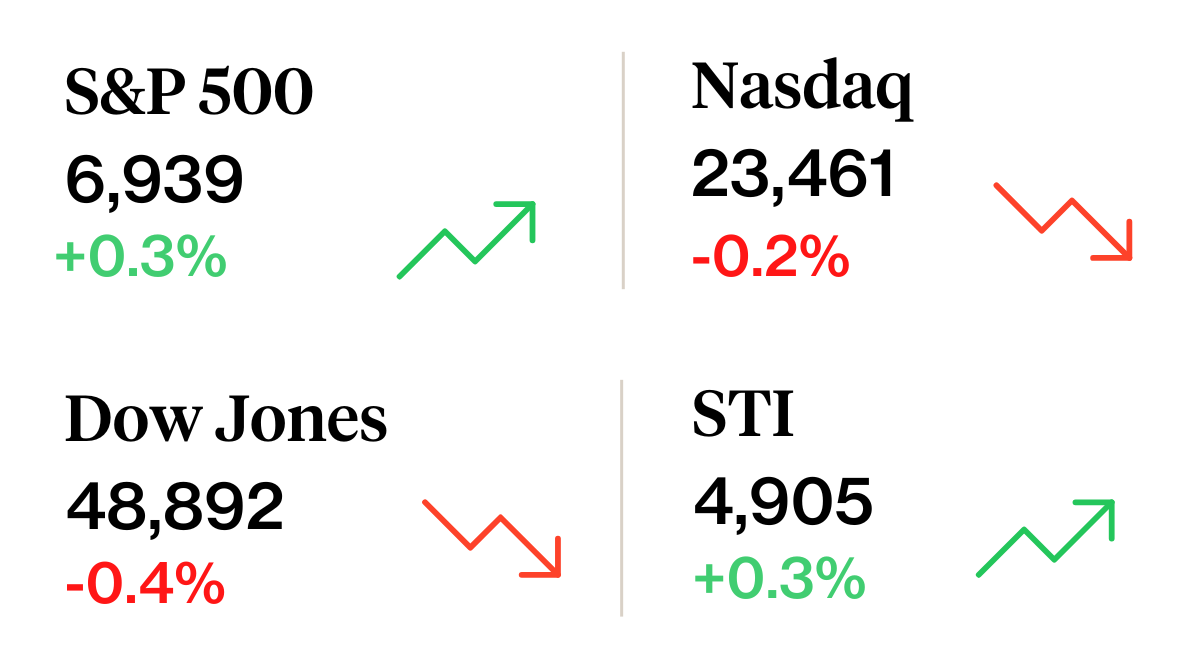

Equities remained volatile. The S&P 500 ended the week slightly higher, after briefly crossing the 7,000 level earlier in the week.

Back home, Singapore stocks continued to outperform with the Straits Times Index (STI) approaching 5,000 as investors looked for safe-haven markets. DBS reached a new all-time intra-day high of S$60, while property stocks such as UOL and Hongkong Land continued to climb.

🚗 Moving This Week

- Mapletree Industrial Trust’s Q3 DPU fell 7 per cent year on year to S$0.0317, as revenue declined 8 per cent to S$163.1 million. Distributable income slipped 6.9 per cent to S$90.5 million, partly offset by an 8.6 per cent drop in property expenses. Despite the weaker quarter, the manager said it remains committed to its North America divestment target of S$500 million to S$600 million. Read more here.

- Mapletree Logistics Trust (MLT) reported a distribution per unit (DPU) of S$0.01816 for the third quarter ended Dec 31, down 9.3 per cent from a year earlier. Revenue fell 3.1 per cent year on year to S$176.8 million, compared with S$182.4 million in the same period last year. Read more here.

- OUE REIT reported a distribution per unit (DPU) of S$0.0125 for the second half ended December, up 10.6 per cent year on year. The manager said the higher DPU was driven by resilient operating performance across the portfolio and a stronger capital structure that enabled the REIT to benefit from a lower interest-rate environment. Read our analysis here

- Starhill Global REIT reported stable revenue and DPU in 1H FY25/26 despite loss of contribution from divested assets. The REIT achieved improved operating metrics and maintained healthy balance sheet. Read our analysis here.

- Frasers Centrepoint Trust (FCT) saw its committed occupancy climb to 99.9% in the first quarter ended Dec 31, 2025, up from 98.1% in the previous quarter, after successfully backfilling cinema spaces at two malls. During the quarter, shopper traffic across FCT’s portfolio rose 1.3%, and tenant sales increased 2.7%. Read more here.

- The Singapore Exchange (SGX) is seeking public feedback on proposals to reduce board lot sizes for certain listed instruments, with potential implementation in mid-2026 if supported. Under the plan, instruments priced between S$10 and S$100 would see board lots cut from 100 units to 10 units, while those above S$100 would drop from 100 units to a single unit. Read more here.

- Sembcorp Industries said its subsidiary Sembcorp Power will supply Micron with an additional 150 MW of electricity to support the chipmaker’s expanding operations, as Micron breaks ground on a new Woodlands facility under a US$24 billion, 10-year investment plan. Read more here.

- Hong Leong Asia said that Guangxi Yuchai Marine and Genset Power, an indirect subsidiary of China Yuchai International (CYI), has applied to list on the mainboard of the Hong Kong Stock Exchange, marking a proposed spin-off by the group. CYI, which is listed on the New York Stock Exchange, is 48.7 per cent owned by Hong Leong Asia. Read more here.

- Netlink NBN Trust posted an 11.8 per cent drop in net profit to S$65.4 million for the nine months ended Dec 31, dragged down by higher depreciation and finance costs. Depreciation and amortisation rose 6 per cent to S$138.9 million as its asset base expanded, while higher net finance costs also weighed on earnings. Read more here.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

3 best-performing Singapore blue chip stocks in January. Can the rally continue?

We look at the top three Singapore blue-chip stocks in January 2026. With gains of 17% or more year to date, we find out if their rally can be sustained.

🤓 What we're looking out for next week

- Monday, 2 February: CapitaLand India Trust, Parkway Life REIT earnings

- Tuesday, 3 February: Keppel Pacific Oak US REIT earnings

- Wednesday. 4 February: ESR REIT, Keppel REIT, Digital Core REIT earnings, Alphabet earnings

- Thursday, 5 February: Keppel, SGX, CapitaLand Ascendas REIT, CapitaLand China Trust, AIMS APAC REIT, First REIT earnings, Amazon earnings

- Friday, 6 February: CapitaLand Integrated Commercial Trust FY2025 Earnings, US nonfarm payroll data

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments