Top 10 ETFs bought by SRS investors. Which one should you consider?

ETFs

Powered by

By Gerald Wong, CFA • 27 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Many Singapore investors leave their SRS funds idle, earning minimal interest. Here’s how SGX-listed ETFs can help grow your SRS for retirement in 2026 and beyond.

This post was created in partnership with SGX. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

A new year often comes with fresh financial resolutions.

Many of us may have topped up our SRS accounts to enjoy tax relief. But after making the contribution, those funds are often left sitting in cash.

Left uninvested, SRS balances typically earn just 0.05% p.a., which barely keeps up with inflation.

Instead, more investors are putting their SRS funds to work by investing in SGX-listed ETFs.

According to SGX, the combined value of ETF holdings in SRS accounts grew by 380% from December 2019 to October 2025, reaching S$827 million.

Used thoughtfully, SRS can be more than just a tax-saving tool. It can also support the building of long-term retirement savings.

In this article, we explore how SRS investing via SGX-listed ETFs works, look at the ETFs SRS investors are buying today, what the newly added ETFs are, and how to invest your SRS funds in ETFs.

What is SRS and why invest it?

The Supplementary Retirement Scheme (SRS) is a voluntary savings scheme designed to complement CPF.

When left in cash, SRS balances earn interest, but the rate is typically very low.

Over time, inflation can erode the real value of idle SRS savings.

This is why many investors choose to invest their SRS funds in instruments such as unit trusts, shares, bonds and ETFs.

Among these options, ETFs stand out for their simplicity, diversification and cost efficiency.

Why consider ETFs for SRS investing?

ETFs are investment funds that trade on the stock exchange and aim to track the performance of a specific index, such as a stock market, bond market or sector.

For SRS investors, ETFs offer several advantages:

- Diversification: A single ETF can provide exposure to dozens or even hundreds of securities

- Lower costs: Passive ETFs generally have lower expense ratios than actively managed funds like unit trusts.

- Accessibility: ETFs offer instant access to different markets, sectors, and assets, such as domestic or regional REITs, commodities and bond markets

- Transparency: As ETFs are publicly traded, you can view real-time prices, fund details, and index information at any time

- Flexibility: ETFs can be bought and sold through a brokerage account, just like shares. The wide range of ETFs on SGX also allows you to access multiple markets on a single platform.

Because SRS is meant for long-term retirement savings, ETFs can be an accessible way to stay invested without needing to actively manage individual stocks.

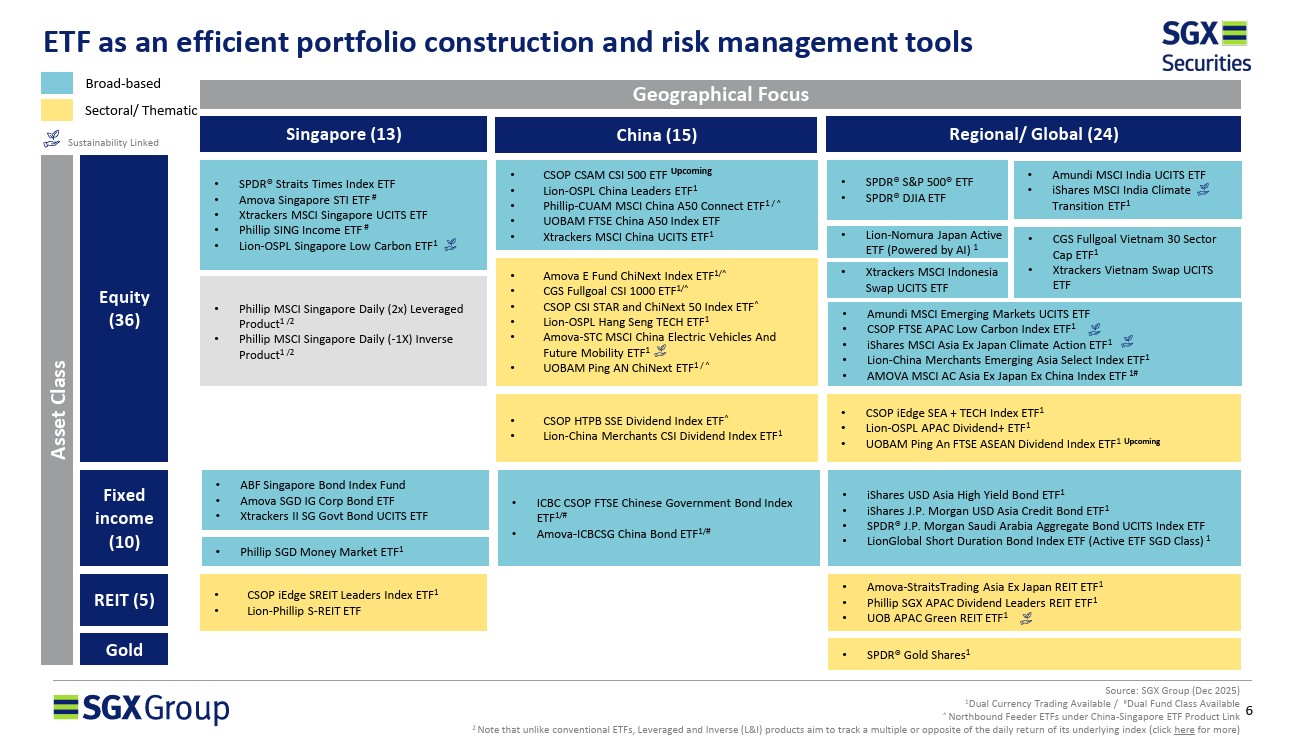

What SRS-Eligible ETFs can you buy on SGX?

SRS account holders can invest in SGX-listed ETFs that are approved under the SRS framework.

In practice, most SGD-denominated ETFs listed on SGX are SRS-eligible, although investors should always verify eligibility with their SRS operator or broker.

According to SGX, SRS investors can invest directly in SGX-listed ETFs through a straightforward process.

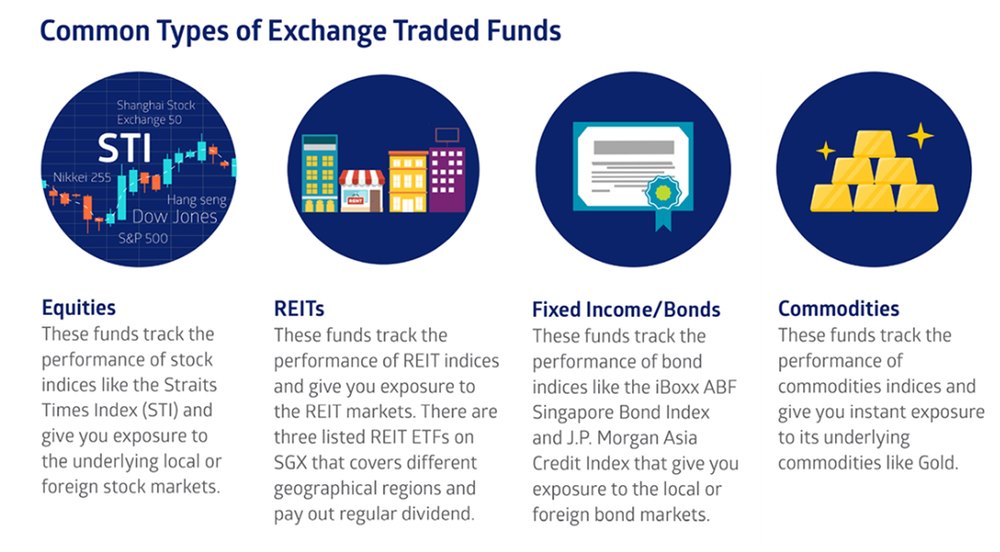

Broadly, these ETFs fall into several categories:

Equity ETFs

- Global equity ETFs track major international markets

- Regional or country-specific ETFs, such as the US, China or Asia

- Singapore-focused ETFs tracking the Straits Times Index (STI)

Fixed income ETFs

- Bond ETFs provide exposure to government or corporate bonds

- ETFs designed to reduce volatility relative to equities

REIT ETFs

- REIT ETFs provide exposure to domestic or regional property markets and offer regular dividend payouts.

Commodity ETFs

- These funds track commodity indices to provide instant exposure to underlying assets such as gold.

This wide range allows SRS investors to build portfolios that match their risk tolerance and time horizon.

Top 10 ETFs bought by SRS investors

We recently came across a list of the most actively held ETFs by SRS investors.

It provides a useful snapshot of how investors are deploying their SRS funds in practice.

ETFs held in SRS accounts do not incur additional custodian or management fees.

The main ongoing cost is simply the ETF’s total expense ratio (TER).

Top 10 ETFs Held by SRS investors (as of October 2025)

| ETF Name | Total Expense Ratio % | Type of ETFs | SGD ticker | USD ticker |

| SPDR® Straits Times Index ETF | 0.28% | STI ETF | ES3 | |

| SPDR® S&P 500 ETF | 0.09% | S&P 500 ETF | S27 | |

| Amova Singapore STI ETF | 0.24% | STI ETF | G3B | |

| Lion-OCBC Securities Hang Seng Tech ETF | 0.68% | China ETF | HST | HSS |

| SPDR® Gold Shares | 0.40% | Gold ETF | GSD | O87 |

| Lion-Phillip S-REIT ETF | 0.60% | REIT ETF | CLR | |

| Amova-StraitsTrading Asia ex Japan REIT Index ETF | 0.55% | REIT ETF | CFA | COI |

| Amova SGD Investment Grade Corp Bond Index ETF | 0.26% | Bond ETF | MBH | |

| Lion-OCBC Securities China Leaders ETF | 0.62% | China ETF | YYY | |

| ABF Singapore Bond Index Fund | 0.24% | Bond ETF | A35 | |

| Source: SGX. All figures as of 30 September 2025. | ||||

#1 - Singapore blue chip (STI ETFs)

The Straits Times Index (STI) remains a core holding for many SRS investors seeking stability and dividends from Singapore’s top 30 companies.

Both the SPDR STI ETF (ES3) and Amova Singapore STI ETF (G3B) track the same index, though they differ in size and liquidity.

Both ETFs delivered strong double-digit returns over the past year, supported by favourable market conditions.

While the SPDR Straits Times Index ETF (ES3) retains the larger asset base (S$2.46 billion), it also recorded a marginally higher 1-year total return of 28.1%, compared to 28.0% for the Amova Singapore STI ETF (G3B) as of 31 December 2025.

Find out more about the ETFs that track the Straits Times Index (STI) here.

| Ticker | ETF Name | AUM (S$ mil) | 12M Gross Dividend Yield (%) | 1-Year Return (%) |

| ES3 | SPDR® Straits Times Index ETF | 2,459 | 3.81 | 28.1 |

| G3B | Amova Singapore STI ETF | 1,210 | 3.72 | 28 |

| Source: SGX ETF Market Highlights Q4 2025. All figures as of 31 December 2025. | ||||

2 - REIT ETFs

For income-focused investors, REIT ETFs offer diversified exposure to real estate without the need to pick individual trusts.

As of 31 December 2025, the Lion-Phillip S-REIT ETF (CLR) offers a higher dividend yield of 5.49% along with a 1-year return of 15.6%.

Meanwhile, the regionally diversified Amova Asia ex Japan REIT ETF (CFA) delivered a 1-year total return of 14.6% with a yield of 5.36%.

Explore and understand the different REIT ETFS here.

| Ticker | ETF Name | AUM (S$ mil) | 12M Gross Dividend Yield (%) | 1-Year Return (%) |

| CLR | Lion-Phillip S-REIT ETF | 811 | 5.49 | 15.60% |

| CFA | Amova-Straits Trading Asia ex Japan REIT ETF | 675 | 5.36 | 14.60% |

| Source: SGX ETF Market Highlights Q4 2025. All figures as of 31 December 2025. | ||||

3 - Bond ETFs

Bond ETFs often serve as the defensive anchor in an SRS portfolio.

While the Amova SGD Investment Grade Corporate Bond ETF (MBH) offers a higher yield of 3.19%, the ABF Singapore Bond Index Fund (A35) delivered a higher one-year return of 7.6%.

Learn more about Singapore Bond ETFs here.

| Ticker | ETF Name | AUM (S$ mil) | 12M Gross Dividend Yield (%) | 1-Year Return (%) |

| MBH | Amova SGD Investment Grade Corp Bond ETF | 772 | 3.19 | 6 |

| A35 | ABF Singapore Bond Index Fund | 1,161 | 2.28 | 7.6 |

| Source: SGX ETF Market Highlights Q4 2025. All figures as of 31 December 2025. | ||||

4 - China ETFs

For investors seeking growth exposure to China, SRS investors are split between technology-focused and broader market ETFs.

The tech-heavy Hang Seng TECH ETF (HST) has a higher AUM and rebounded strongly, posting a 16.7% one-year return as of 31 December 2025.

The China Leaders ETF (YYY) offers a more balanced approach, combining income with capital growth.

If you are looking to invest in China, discover and learn more about China ETFs here.

| Ticker | ETF Name | AUM (S$ mil) | 12M Gross Dividend Yield (%) | 1-Year Return (%) |

| HST | Lion-OCBC Securities Hang Seng TECH ETF | 443 | N.A. | 16.7 |

| YYY | Lion-OCBC Securities China Leaders ETF | 96 | 2.92 | 13.6 |

| Source: SGX ETF Market Highlights Q4 2025. All figures as of 31 December 2025. | ||||

#5 - Gold ETF

Gold was a standout performer in 2025, supported by currency weakness and geopolitical uncertainty.

SPDR Gold Shares (GSD) delivered the highest one-year return on this list at 57% as of 31 December 2025

With local assets under management exceeding S$4.2 billion, it remains a highly liquid option for SRS investors seeking diversification.

Learn more about gold etfs here.

| Ticker | ETF Name | Local AUM (S$ mil) | 12M Gross Dividend Yield (%) | 1-Year Return (%) |

| GSD | SPDR® Gold Shares | 4,220 | N.A. | 57% |

| Source: SGX ETF Market Highlights Q4 2025. All figures as of 31 December 2025. | ||||

#6 - S&P 500 ETF

For exposure to the US market, the SPDR S&P 500 ETF (S27) remains a popular choice.

It provides access to 500 of the largest US companies and delivered a steady 10.6% return over the past year, complementing the more income-focused Singapore ETFs in an SRS portfolio.

Find out more about the ETFs that track the S&P 500 index here.

| Ticker | ETF Name | Local AUM (S$ mil) | 12M Gross Dividend Yield (%) | 1-Year Return (%) |

| S27 | SPDR® S&P 500 ETF | 915,774 | 1.06 | 10.6 |

| Source: SGX ETF Market Highlights Q4 2025. All figures as of 31 December 2025. | ||||

What are the newly added ETFs on the Singapore Exchange for SRS Investors?

The number of ETFs listed on SGX has also been increasing over the past years, giving SRS investors a growing number of ways to diversify their portfolios.

Here are a few themes that the newly added ETFs allow investors to gain access to.

Active bond exposure

The LionGlobal Short Duration Bond Fund (Active ETF SGD Class) stands out as the largest new listing by AUM. It is Singapore’s first active bond ETF and the listed share class of an established S$2.2 billion fund as of 31 December 2025.

The fund is actively managed with the aim of delivering both capital growth and income over the medium to long term.

The portfolio of LionGlobal Short Duration Bond Fund (Active ETF SGD Class) consists mainly of high-quality, short-duration bonds, exposure to Singapore issuers and global bonds.

Read here to learn how to earn regular income with the LionGlobal Short Duration Bond Fund here.

China and regional growth strategies

Beyond established China ETFs, several newer listings offer different angles on growth and income:

Amova E Fund ChiNext Index ETF (CXT) targets growth by providing exposure to the top 100 largest and most liquid innovative A-share stocks on the Shenzhen ChiNext board.

As of 23 January 2025, it has recorded a return of 45.81% since its inception in April 2025, driven by strong momentum in Chinese growth stocks.

For those prioritizing yield, Lion-China Merchants CSI Dividend Index ETF (INC) focuses on income by tracking the CSI Dividend Index to capture high-dividend-paying companies within the Chinese market.

Lion-China Merchants Emerging Asia Select Index ETF (EAA) offers targeted exposure to the broader growth potential of developing Asia by tracking the top 50 companies across the region's emerging markets.

Specialized regional and fixed income exposure

Investors looking for precise regional allocation can also consider the Amova MSCI AC Asia Ex Japan Ex China Index ETF (A93). This ETF tracks large-cap Asian companies while excluding the heavyweights of Japan and China, allowing for more granular portfolio construction.

Finally, within the fixed income space, the SPDR® J.P. Morgan Saudi Arabia Aggregate Bond UCITS ETF (KSB) offers direct access to Saudi Arabia’s fast-growing market by tracking liquid sovereign, quasi-sovereign, and Sukuk bonds.

Notably, KSB offered the highest yield-to-maturity among the new listings, standing at 5.03% as of 30 September 2025.

| No. | ETF Name | Underlying Index | Total Expense Ratio (%) | SGD ticker | USD ticker |

| 1 | LionGlobal Short Duration Bond Fund (Active ETF SGD Class) | 3-month Singapore Overnight Rate Average (SORA) plus 0.35% | 0.25 ~ 1.00 | SBO | SBV |

| 2 | SPDR® J.P. Morgan Saudi Arabia Aggregate Bond UCITS ETF | J.P. Morgan Saudi Arabia Aggregate Index | 0.37 | KSB | |

| 3 | Amova E Fund ChiNext Index ETF | ChiNext Index | 0.3 | CXT | CXO |

| 4 | Amova MSCI AC Asia Ex Japan Ex China Index ETF | MSCI AC Asia ex Japan ex China Index | 0.6 | A93 | A94 |

| 5 | Lion-China Merchants CSI Dividend Index ETF | CSI Dividend Index | 0.50 ~ 0.99 | INC | ICH |

| 6 | Lion-China Merchants Emerging Asia Select Index ETF | iEdge Emerging Asia Select 50 Index | 0.80 ~ 0.99 | EAA | EAU |

| Source: SGX Screener and Respective fund factsheet as of 31 October 2025 | |||||

How do I invest in ETFs using SRS?

Before you start investing using your SRS funds, you’ll need to satisfy the following criteria:

- At least 18 years old,

- Not an undischarged bankrupt, and

- Not mentally disordered and therefore capable of managing yourself and your affairs

Thereafter, investing your SRS funds in ETFs is relatively straightforward with just a few steps:

- Open and fund an SRS account with an approved SRS operator (such as DBS, UOB or OCBC).

- Link your SRS account to a brokerage account that supports SRS trading.

- Choose an SRS-eligible ETF listed on SGX.

- Place your trade using SRS funds during SGX market hours.

Once purchased, the ETF units are held within your SRS account.

Any dividends or proceeds from selling the ETF are credited back into the same SRS account.

Are there any ongoing broker promotions when I invest in ETFs using SRS?

Several brokers and platforms offer promotions to incentivize SRS ETF investments.

| Broker | Promotion Description |

| iFast FSMOne |

|

| Phillip Securities |

|

| *Terms and conditions of participating brokers apply. Please refer to their website for more details. | |

What would Beansprout do?

ETFs offer a simple and cost-effective way to put your SRS funds to work for long-term growth.

Instead of leaving SRS balances idle in cash, investing through SGX-listed ETFs allows investors to stay diversified, keep costs low, and gain exposure to both local and global markets.

The wide range of SGX-listed, SRS-eligible ETFs also means investors can access different asset classes, regions and income profiles without needing to manage individual securities.

That said, there is no single “right” way to invest SRS funds. The mix of ETFs an investor is comfortable with will naturally differ based on time horizon, risk tolerance and personal financial goals.

For investors more comfortable starting with the Singapore market, STI ETFs such as the SPDR Straits Times Index ETF (ES3) or Amova Singapore STI ETF (G3B) offer exposure to Singapore’s largest blue-chip companies and their dividend streams.

Those seeking regular income with diversification across properties may look to REIT ETFs like the Lion-Phillip S-REIT ETF (CLR) or the Amova Asia ex Japan REIT ETF (CFA), which provide access to multiple REITs through a single investment.

To add a more defensive or stabilising element to a portfolio, Bond ETFs such as the ABF Singapore Bond Index Fund (A35) or Amova SGD Investment Grade Corporate Bond ETF (MBH) can help moderate volatility while generating income.

For broad exposure to the US equity market without selecting individual stocks, the SPDR S&P 500 ETF (S27) tracks 500 of the largest US companies across a wide range of sectors.

China-focused ETFs like HST and YYY offer different ways to gain exposure to the Chinese market, from technology-driven growth to more dividend-oriented companies.

Investors who prefer active management within fixed income may consider the LionGlobal Short Duration Bond Fund, which is managed with a focus on short-duration bonds.

Finally, for diversification beyond traditional equities and bonds, SPDR Gold Shares (GSD) provides exposure to gold, which some investors view as a hedge against currency weakness or geopolitical uncertainty.

For retirement planning, consistency matters more than timing. Staying invested, focusing on the long term and choosing ETFs that align with your risk tolerance and financial goals can make a meaningful difference over time.

For beginners, keeping things simple is often the best approach.

Starting with a small, diversified ETF portfolio that balances growth and income, and gradually adding to it, can help your SRS work harder and generate both passive income and retirement savings.

Ultimately, SRS works best when it is treated not just as a tax-saving tool, but as part of a broader retirement plan.

Learn more on how to build your SRS account with SGX-listed ETFs to help generate passive income for your retirement here.

Whether you choose to keep things simple with a few broad ETFs or build a more diversified portfolio over time, the key is to make intentional choices that you can stay comfortable with through different market conditions.

You can find out more about these ETFs on the SGX ETF screener page, or read our guide on how to choose the best ETF as a SRS investor.

New to SRS? Learn how to open an account and start investing for your retirement here.

Don’t have a brokerage account yet? Check out our guide to the best online brokers in Singapore to get started.

Once again, here are some resources to help you familiarize yourself with the world of ETFs:

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments