Singapore stocks hold firm as US markets turn volatile: Weekly Market Recap

By Gerald Wong, CFA • 08 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Singapore stocks climbed while US tech stocks slid amid rising AI concerns and market volatility.

I had my first lo hei of 2026 this week.

At the Chinese restaurant, the room quickly filled with loud cries of “Huat ah” as table after table kicked off their meal with a toss of yusheng.

Since a few of my lunch kakis couldn’t speak Chinese, I somehow ended up with the honour of translating every greeting into English.

That’s when it struck me. Almost every line was about the same thing. Prosperity.

And I think that’s a pretty universal wish. Whether it’s abundance in wealth, good health, or simply good things coming our way.

For me, wishing is only one part of the equation. The other part is taking small, practical steps to turn those wishes into reality, with a little help from good timing and discipline.

When comes to building wealth through investing, it usually comes down to three things:

- Having enough emergency cash and liquidity

- Investing in a way that’s aligned with your own needs and risk appetite

- Staying diversified

This week, we take a look at the best fixed deposit rates in Singapore and latest savings account promotions for February, and explore where you can park your cash to earn a higher yield. We also break down what to expect for the upcoming T-bill auction on 12 February.

Personally, a big part of my own investment goal is to build a passive income portfolio. This week, we look at three Singapore REITs offering dividend yields above 5% and find out how they performed in the latest earnings. We also review the latest results from Parkway Life REIT, CapitaLand India Trust, Digital Core REIT, AIMS APAC REIT, and consider whether these REITs are worth a closer look.

If you’re thinking about diversifying across markets, we also share what we learnt from FSM Invest Expo 2026 about investing in the US, Singapore, and China, especially in light of recent market volatility.

As you get ready for Chinese New Year and your first lo hei, it might be a good time to pause and think about how you’d like to build your own sense of abundance in the year ahead.

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

📉 US tech stocks selloff

What happened?

Software stocks sold off sharply this week, extending a period of underperformance.

The move was partly triggered by the release of a new AI tool from startup Anthropic that automates legal work, which reignited concerns about how artificial intelligence could disrupt traditional software business models.

What does this mean?

The weakness in software stocks followed a steep decline in Microsoft’s share price after its latest earnings report, which saw the stock fall more than 10% in a single day and erase about US$357 billion in market value.

While Microsoft reported record spending on artificial intelligence, growth at its core cloud business slowed, raising fresh questions about whether the massive investments being made across Big Tech will deliver adequate returns.

Overall, the selloff reflected growing unease about the pace of AI-driven change and its implications for software companies’ long-term earnings.

Why should I care?

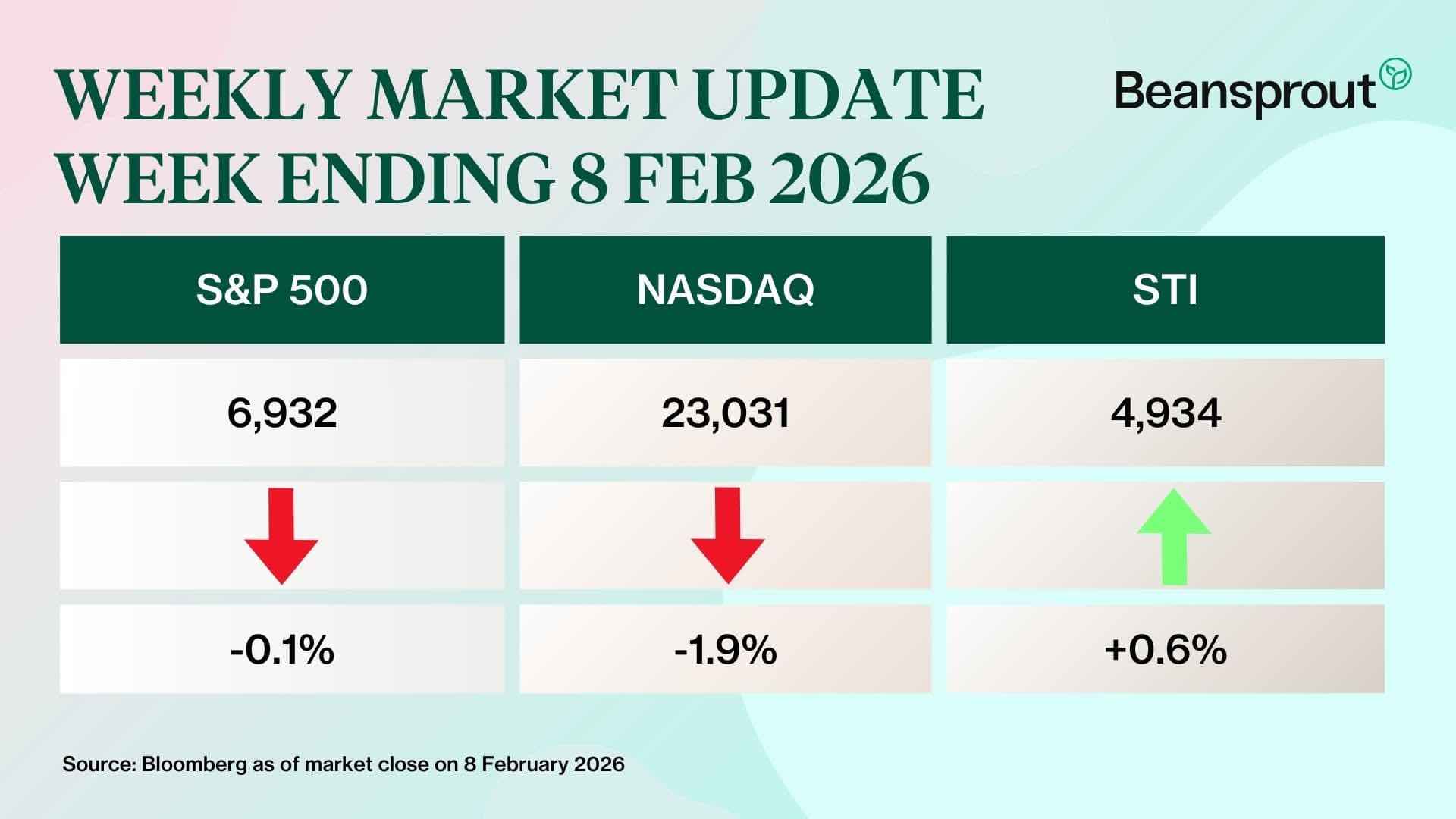

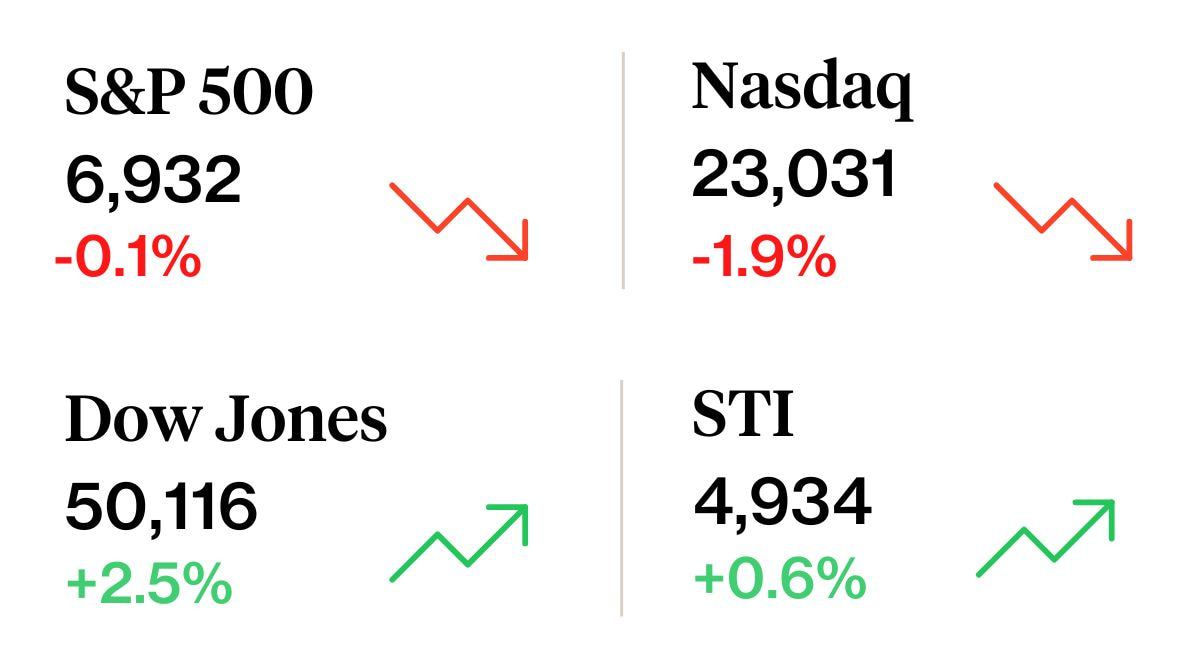

Major US equity indexes ended a volatile week unevenly. Large-cap technology stocks had their worst week since November, dragging the Nasdaq Composite down 1.9%, while the Dow Jones Industrial Average posted solid gains, reflecting a rotation away from tech.

Gold also saw sharp swings. Prices fell from a high of US$5,355 per ounce last week to a low of US$4,653 early this week, before recovering to around US$5,000 by Friday.

Back home, Singapore stocks continued to outperform amid safe-haven demand, with the Straits Times Index (STI) edging closer to the 5,000 level. Gains were led by Keppel (+6.5%), while Singtel also edged up after announcing one of Asia’s largest data-centre deals.

🚗 Moving This Week

Keppel’s net profit rose 27.2% to S$645.4 million in 2H 2025 from S$507.5 million in the same period the year before. This brought its FY2025 net profit to S$1.1 billion, a 39% increase from S$793 million in FY2024. The improvements were attributed to profit growth across all its three business segments of infrastructure, real estate and connectivity. Separately, Keppel named former DBS chief executive officer Piyush Gupta as chairman-designate. Read more here.

- Singtel and KKR will acquire ST Telemedia Global Data Centres for S$6.6 billion, marking one of Asia’s largest data-centre deals. The transaction, driven by surging AI-related data-centre demand, will leave KKR with a 75 per cent stake and Singtel with 25 per cent after conversion of existing preference shares. Read more here.

- SGX’s H1 net profit edged up 0.8% to S$342.7 million, while EBITDA jumped 9.6% and adjusted net profit rose a stronger 11.6%. The bourse also raised its interim quarterly dividend to S$0.11 per share, lifting total H1 dividends to S$0.2175. Read more here.

- CDL’s Newport Residences sold 140 of its 246 units, or 57 per cent, at its launch weekend, marking a strong debut for a District 2 project. Excluding the super penthouse, units were sold at an average price of S$3,370 psf. Read more here.

- CapitaLand Integrated Commercial Trust reported a 16.4% year-on-year rise in distributable income to S$449.0 million for 2H 2025, driven by contributions from ION Orchard, the CapitaSpring commercial acquisition, stronger property performance and lower interest expenses, partly offset by the divestment of 21 Collyer Quay. Distribution per unit grew 9.4% to 5.96 cents despite an enlarged unit base, bringing full-year DPU to 11.58 cents, up 6.4% year on year. Unitholders will receive the remaining 2H DPU of 4.61 cents on Mar 24, 2026. Read more here.

- CapitaLand Ascendas Reit posted a 2 per cent decline in H2 FY2025 DPU to S$0.07528, even as revenue rose 4.1 per cent to S$783.8 million, driven mainly by new acquisitions in the US and Singapore. Read more here.

- Frasers Logistics & Commercial Trust recorded positive Q1 rental reversions, driven by strong logistics and industrial performance, though this was partly offset by weaker commercial assets in Singapore. Read more here.

- Keppel Reit’s H2 FY2025 DPU fell 10.4 per cent year on year to S$0.0251, with distributions payable on Mar 25. Despite the lower payout, net property income rose 2.4 per cent to S$107.7 million, reflecting stable underlying property performance. Read more here.

- Parkway Life Reit’s H2 DPU rose 3.5% to S$0.0764, supported by a 7.1% increase in gross revenue to S$78 million. The growth was driven by contributions from newly acquired nursing homes in Japan and France, as well as organic rental growth from its Singapore hospital portfolio. Read more here.

- CapitaLand China Trust’s H2 DPU fell 11.7% to S$0.0233, weighed down by weaker operating performance. Revenue declined to S$144.5 million and net property income slipped to S$94.4 million, while distributable income dropped to S$40.5 million for the half-year. Read more here.

- Elite UK Reit has secured new UK government leases worth £24.3 million a year for properties occupied by the Department for Work and Pensions, significantly extending its lease profile. The early renewals slash 2028 lease expiries from 95.7% to 32% of gross rental income and lift the portfolio’s weighted average lease to expiry from 2.4 years to 7.2 years. Read more here.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

Where to park your cash for higher yield? T-bills vs Fixed Deposit vs SSB (Feb 2026)

We share the best ways to earn a yield on your cash through fixed deposits, Singapore T-bills, SSBs and money market funds in February 2026.

🤓 What we're looking out for next week

- Monday, 9 February: DBS, Elite UK REIT earnings

- Tuesday, 10 February: CapitaLand Investment earnings

- Wednesday. 11 February: Prime US Reit earnings

- Thursday, 12 February: Starhub, iFast earnings, Singapore 6 month T-bill Auction

- Friday, 13 February: Lendlease REIT earnings, US consumer price index (CPI) data

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments