Stocks rise and bond yields decline on rate cut hopes: Weekly Market Recap

By Gerald Wong, CFA • 07 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

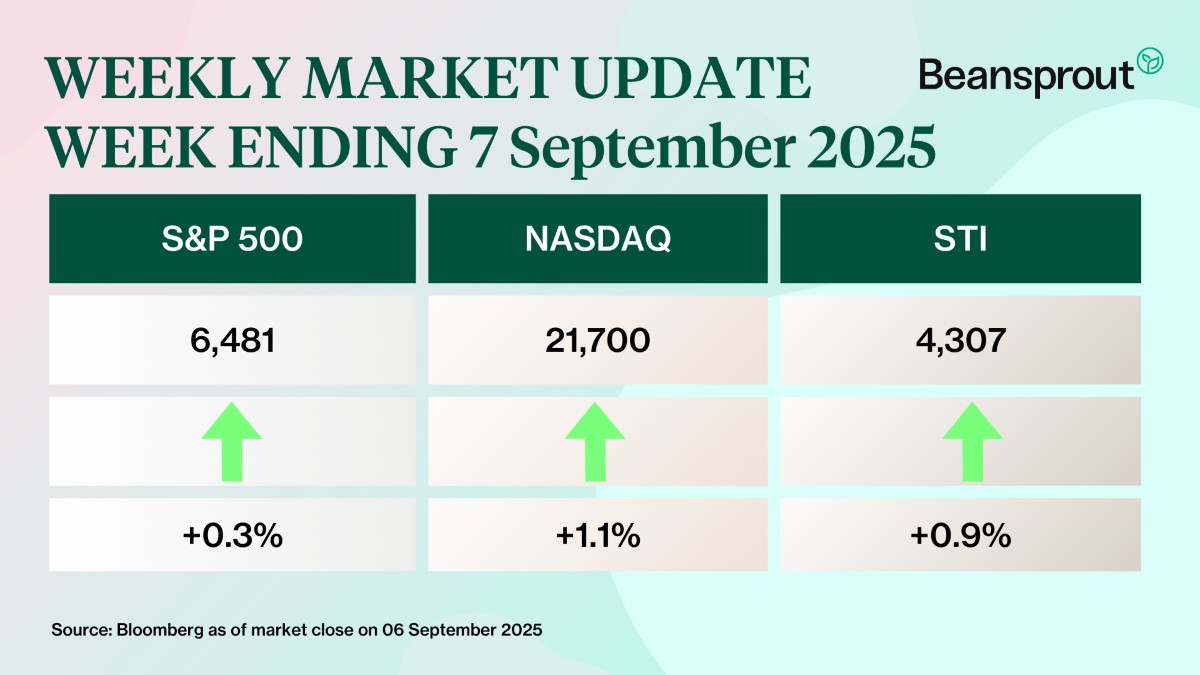

US and Singapore stocks rose while bond yields fell on increasing rate cut hopes

Over coffee this week, one of our readers told me he’s walking away from his full-time job of nearly 20 years.

Instead of slowing down, he’s gearing up for his next big adventure and starting his own company. And to prepare, he’s building a passive income portfolio that will give him the freedom to take this leap.

What inspired me was his mindset. He sees endless possibilities ahead, is learning new things (he was the oldest participant at a recent startup pitch event!), and is taking steps to be financially ready for whatever comes next.

It reminded me of what was shared in this week’s feature – that retirement is about doing it on your own terms. It’s about having purpose, and also making sure your finances are in order.

The last thing anyone wants is to be worrying about money. And with the latest fixed deposit interest rates, savings account interest rates, and even the 6-month Singapore T-bill yield coming down, it’s timely to think about we can take put our money to work.

If you’re wondering where to start, we’ve put together a few ideas, including making the most of your CPF, building your retirement savings through the Supplementary Retirement Scheme (SRS), and creating passive income streams.

With the right planning, you can get closer to living life on your own terms.

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

🏛 Weakening jobs market leads to rising rate cut hopes

What happened?

The latest US jobs report came in much weaker than expected. Only 22,000 jobs were added in August, a big drop from July’s revised figure of 79,000 and far below the forecast of around 77,000.

June’s numbers were also revised down, showing a loss of 13,000 jobs instead of the earlier estimate of a 14,000 gain. This marked the first negative monthly reading since December 2020.

At the same time, the unemployment rate in the US inched higher to 4.3%, the highest level since 2021.

What does this mean?

With the weaker jobs data, expectations are building that the Fed will start cutting rates soon.

Based on the CME FedWatch tool, markets are now pricing in a 100% probability of at least a 25 basis points (0.25%) rate cut at the next Federal Reserve meeting.

The probability of a 50 basis point (0.50%) cut also rose to 8%.

Why should I care?

US markets regained momentum this week, led by technology stocks. Apple and Google’s parent company Alphabet both moved higher after an antitrust ruling was seen by investors as less severe than feared.

Closer to home, the Straits Times Index (STI) reached a new all-time high during the week. The advance was driven by Yangzijiang Shipbuilding, which jumped +6.5% on news of fresh order wins.

🚗 Moving This Week

- Yangzijiang Shipbuilding secured additional shipbuilding contracts for 22 vessels worth US$920 million (S$1.18 billion), since its order book update for the 1HFY2025 ended June 30. The contacts comprise 18 units of containerships, two units of gas carriers and two units of bulk carriers. Read more here.

- Olam Group and Yangzijiang Financial will be added to the Straits Times Index’s (STI) reserve list, replacing CapitaLand Ascott Trust and ComfortDelGro, following the index’s latest quarterly review. There will be no changes to the constituents of the STI following the September 2025 review. Learn more about the STI here.

- ST Engineering is investing S$250 million over the next five years into a programme that will drive physical artificial intelligence (AI) applications such as robotics, with an initial focus on human-machine collaboration. Read more here.

- ComfortDelGro acquired all the remaining shares it does not already own in CityCab for $116.3 million on Sept 1 from ST Engineering's wholly-owned subsidiary. Prior to the acquisition, CDG owned 53.5% of CityCab. According to the company, the acquisition is expected to be earnings accretive. Read more here.

- Sembcorp Industries has won a bid to build an approximately 86 megawatt-peak (MWp) floating solar photovoltaic (PV) system on Pandan Reservoir. The project, awarded by national water agency PUB to Sembcorp’s wholly-owned subsidiary Sembcorp Solar Singapore, marks Sembcorp’s third floating solar project in Singapore. Read more here.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

Best Fixed Deposit Rates in Singapore [September 2025]

Compare the best fixed deposit rates from DBS, UOB, OCBC and Bank of China in September 2025. Find out where you can still earn a decent interest rate on your savings in Singapore.

🤓 What we're looking out for next week

- Monday, 8 September 2025: CapitaLand India Trust Ex-Dividend

- Tuesday, 9 September 2025: OUE Ex-Dividend

- Wednesday, 10 September 2025: US CPI Data

- Thursday, 11 September 2025: Singapore 6-month T-bill Auction

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Join the Beansprout Telegram group and Facebook group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments