3 Singapore REITs with dividend yields of above 5%

REITs

By Gerald Wong, CFA • 27 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We highlight three Singapore REITs that offer dividend yields of above 5%.

What happened?

Singapore REITs have come back into focus with the Fed’s recent rate cuts.

We recently shared that while the sector has been under pressure from elevated financing costs in the past two years, the lower interest rate environment could ease some of these headwinds.

What I noticed for Singapore REITs is that some of them continue to offer dividend yields of above 5%.

Just like the Singapore blue-chip stocks that offer dividend yields of above 5%, this makes them potential options for investors seeking passive income in Singapore from regular distributions.

Let’s take a closer look at three Singapore REITs that have dividend yields above 5% that may be worth adding to your watchlist.

Three Singapore REITs with dividend yields above 5%

#1 – CapitaLand Ascendas REIT (SGX: A17U)

CapitaLand Ascendas REIT (CLAR) is Singapore’s largest industrial REIT with a portfolio spanning business parks, life sciences, logistics and industrial properties across Singapore, Australia, the US and the UK/Europe.

Its total AUM stood at about S$16.8 billion as of June 2025.

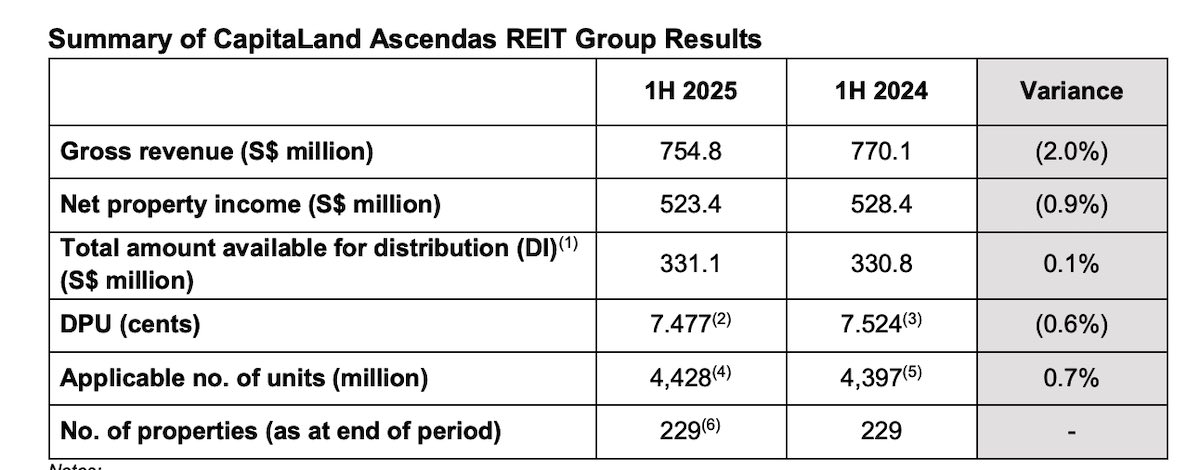

For 1H 2025, CapitaLand Ascendas REIT recorded gross revenue of S$754.8 million and net property income of S$523.4 million, both slightly lower than the year before due to earlier divestments.

Portfolio occupancy was 91.8%, and rental reversion remained positive at 9.5%, which helped to support CapitaLand Ascendas REIT's net property income.

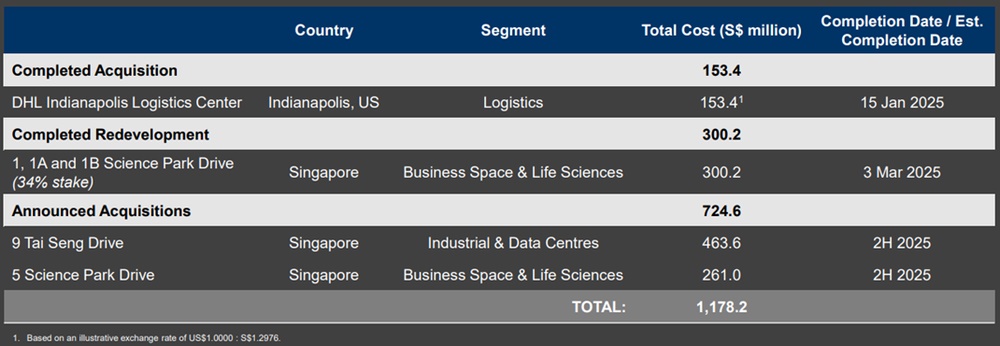

The REIT remained active in reshaping its portfolio by refreshing its portfolio with new acquisitions and redevelopments, including two Science Park Drive properties in Singapore and a logistics centre in the US.

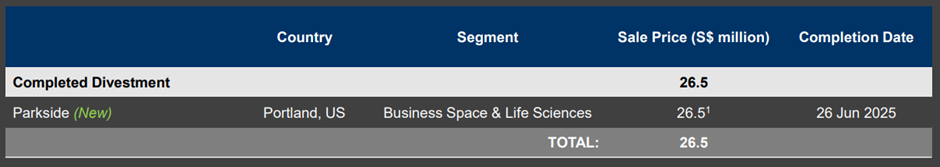

It sold one US property at a 45% premium to valuation, unlocking capital for reinvestment.

Aggregate leverage stood at 37.4%, with 76% of borrowings on fixed rates and an average debt cost of 3.7%.

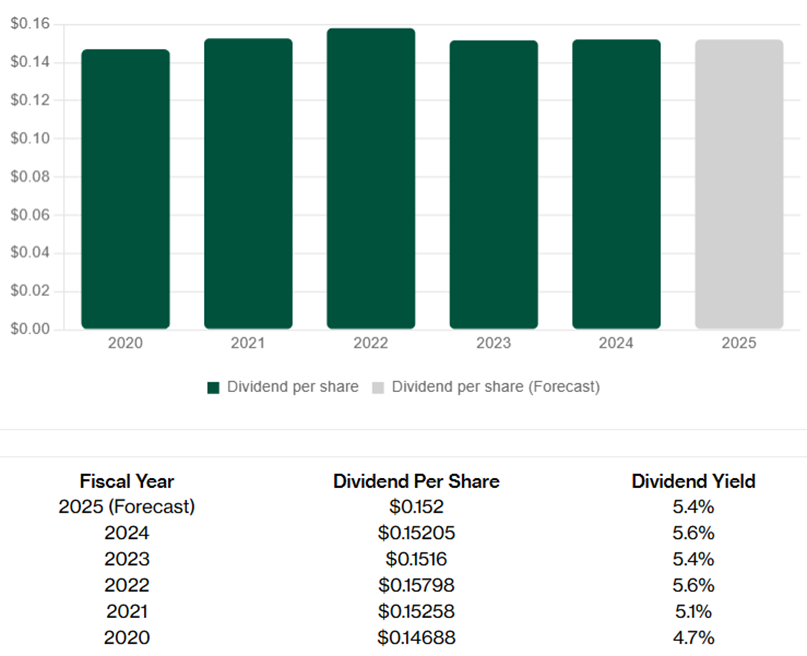

Distribution per unit (DPU) for 2Q 2025 was 0.998 cents, bringing 1H 2025 DPU to 7.477 cents. This was just 0.6% lower than the previous year, mainly because of a larger unit base after fundraising.

Based on its closing price of S$2.79 as of 25 September 2025, CLAR offers an annualised dividend yield of about 5.4%.

Find out how much dividends you may receive as a shareholder of CapitaLand Ascendas REIT with the calculator below.

Related links:

- CapitaLand Ascendas REIT (CLAR) share price history and share price target

- CapitaLand Ascendas REIT (CLAR) dividend history and dividend forecast

#2 – Frasers Centrepoint Trust (SGX: J69U)

Frasers Centrepoint Trust (FCT) is Singapore’s largest prime suburban retail space owner, with nine malls including Causeway Point, Northpoint City, and Tampines 1. Its portfolio was valued at about S$8.3 billion as of June 2025.

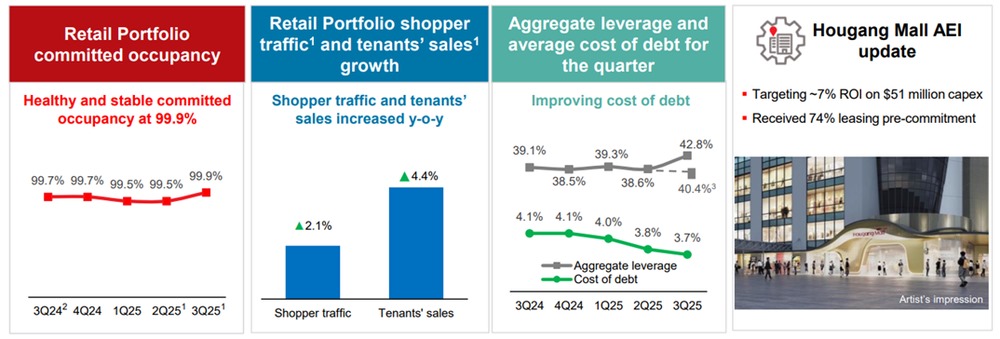

Operationally, the portfolio continued to perform well as of the third quarter of fiscal year 2025 (3Q FY25) for the quarter ending June 2025).

Occupancy was 99.9%, while shopper traffic rose 2.1% and tenant sales increased 4.4% year-on-year.

Hougang Mall’s asset enhancement works are ongoing, with about 74% of space pre-committed and targeted ROI of ~7% when completed in 2026.

Frasers Centrepoint Trust recently completed the acquisition of Northpoint City South Wing, giving it full ownership of the largest mall in northern Singapore.

The acquisition was funded through a S$421.3 million equity fundraising and S$200 million perpetual securities, which enlarged the unit base and diluted DPU.

Following these moves, aggregate leverage was 42.8%, but would be reduced to 40.4% after including the perpetual securities. The average cost of debt declined slightly to 3.7% in 3Q25, compared to 3.8% in the previous quarter.

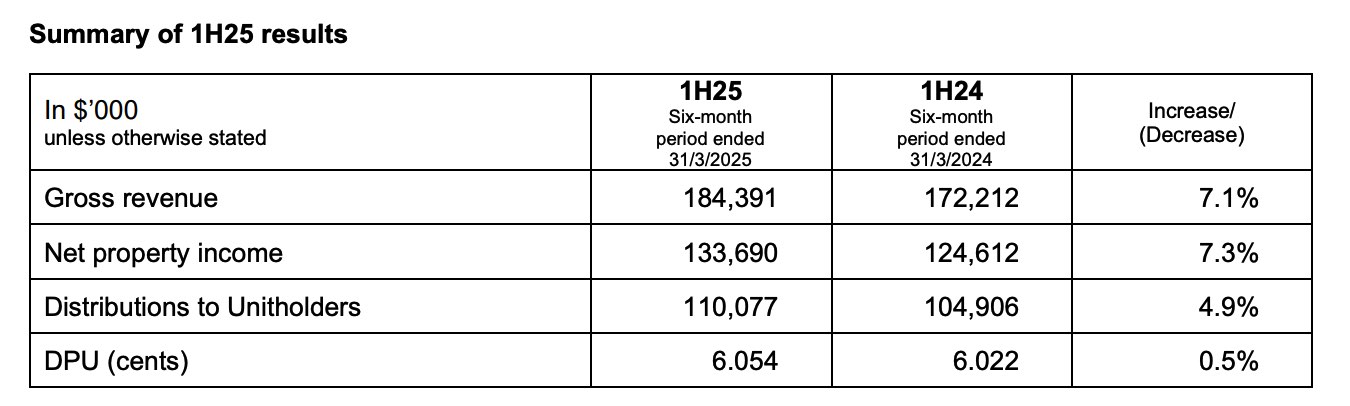

FCT reported a distribution per unit of 6.054 cents for 1H FY25, 0.5% higher than the same period in the previous year.

Based on its closing price of S$2.34 as of 25 September 2025, FCT offers a dividend yield of around 5.3%.

Find out how much dividends you may receive as a shareholder of Frasers Centrepoint Trust with the calculator below.

Related links:

- Frasers Centrepoint Trust share price history and share price target

- Frasers Centrepoint Trust history and dividend forecasts

#3 – Lendlease Global Commercial REIT (SGX: JYEU)

Lendlease REIT owns Jem mall in Jurong East, one of Singapore’s largest suburban malls and a key contributor to its rental income.

Lendlease REIT's other properties include 313@somerset along Orchard Road and the Sky Complex in Milan, Italy.

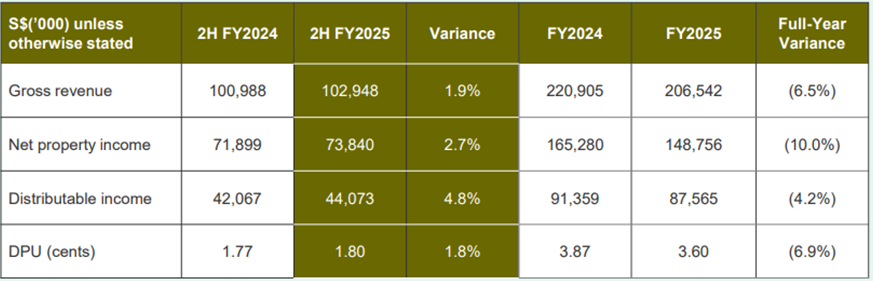

For FY2025, gross revenue was S$206.5 million and net property income was S$148.8 million.

Both were lower than the previous year due to the upfront recognition of supplementary rent received from the lease restructuring for Sky Complex in 1H FY2024.

After adjusting for this item, revenue and NPI were broadly stable.

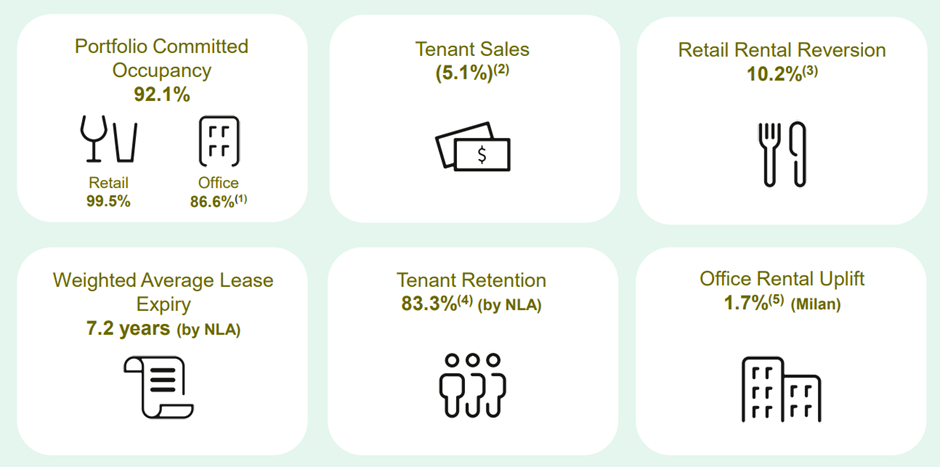

Lendlease REIT’s retail assets continued to perform, while the office portfolio showed more mixed results.

Within retail, Lendlease REIT maintained a high occupancy of 99.9% at Jem and 98.8% at 313@somerset, with positive rental reversion of 10.2%.

Tenant sales, however, declined 5.1% year-on-year due to softer inbound tourism and the transition from Cathay Cineplexes to Shaw Theatres.

The office portfolio saw some changes during the year. Lendlease REIT entered into an agreement in August to divest Jem’s office component for S$462 million, with proceeds mainly used to repay borrowings and reduce leverage.

This is expected to reduce aggregate leverage from 42.6% to about 35% on a pro-forma basis.

This divestment is part of Lendlease REIT's capital recycling strategy and will leave more than 85% of its portfolio value in Singapore retail properties.

Meanwhile, Lendlease REIT achieved a positive rental uplift of 1.7% for the Sky Complex Commercial Buildings 1 and 2 in Milan, while committed occupancy at Building 3 stood at about 31%.

The overall portfolio valuation rose 2.2% year-on-year to S$3.9 billion as of June 2025, supporting an increase in net asset value (NAV) per unit to S$0.84 from S$0.82 a year earlier.

On the funding side, the weighted average cost of debt was 3.46% with 68% of borrowings on fixed rates, and the interest coverage ratio improved to 1.6 times.

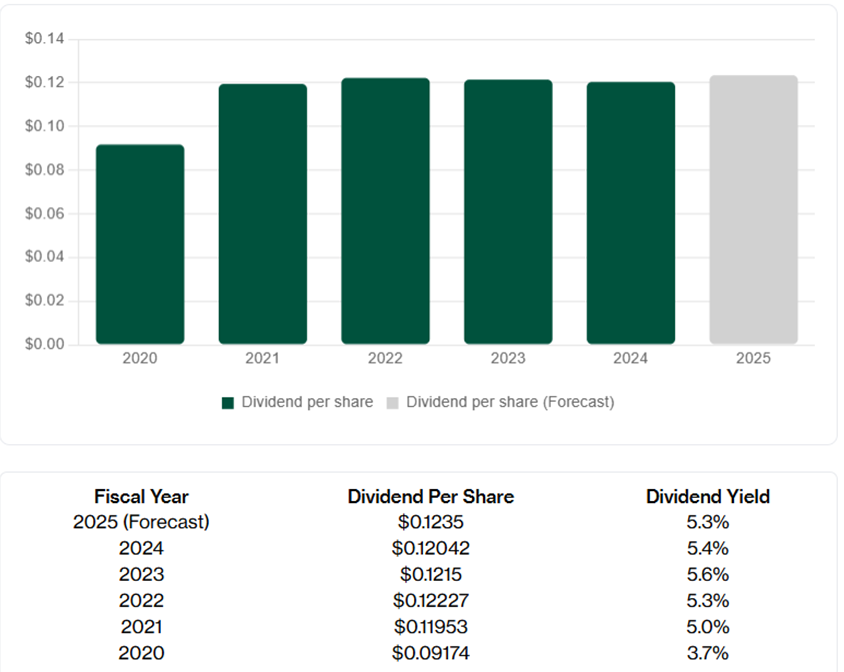

Distribution per unit (DPU) for 2H FY2025 was 1.80 cents, up 1.8% year-on-year, bringing full-year DPU to 3.60 cents.

Based on its closing price of S$0.615 as of 25 September 2025, LREIT offers a historical divdiend yield of 5.9%.

Find out how much dividends you may receive as a shareholder of Lendlease Global Commercial REIT with the calculator below.

Related links:

- Lendlease Global Commercial REIT share price history and share price target

- Lendlease Global Commercial REIT dividend history and dividend forecast

What would Beansprout do?

With Fed rate cuts, dividend yields offered by Singapore REITs are looking more attractive.

Several continue to offer a dividend yield of 5% and above, which is higher than the latest 10-year Singapore government bond yield.

Amongst the three REITs above, CapitaLand Ascendas REIT (CLAR) and Frasers Centrepoint Trust (FCT) have demonstrated more resilient DPU.

Both of these REITs have also been active in making acquisitions in Singapore to enhance their distributions.

Lendlease REIT stands out with the highest yield and potential interest from renewed investor focus on mid-cap stocks with the launch of the SGX Next 50 index.

To screen for Singapore REITs with lowest price-to-book valuation or highest dividend yield, check out our best Singapore REIT screener.

If you are new to investing in Singapore REITs, you can start to learn more about Singapore REITs here.

If you prefer diversification without picking individual REITs, you can also gain exposure through Singapore REIT ETFs.

[Beansprout Exclusive Longbridge Promotion] Get bonus S$50 FairPrice voucher, S$18 cash voucher, plus 2x6% p.a. interest boost on S$2,000 with Longbridge Cash Plus for 90 days (worth up to S$60) when you sign up for a Longbridge account via Beansprout and fund S$2,000. T&Cs apply. Learn more about the Longbridge promotion here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments