US-China tensions return. Can the market rally hold?

Stocks

By Gerald Wong, CFA • 13 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

US markets just saw their sharpest one-day drop since April. Could this be a healthy reset or signs of more volatility ahead?

What happened?

Last Friday, U.S. equities suffered their sharpest drop in months after fears of a renewed trade war flared up.

U.S. President Trump announced 100% tariffs on Chinese imports, sparking worries over supply chains and company earnings.

The S&P 500 fell 2.7%, the worst single-day drop since April’s Liberation Day. The Nasdaq Composite declined 3.6%, while Dow Jones lost 1.9%.

Despite the sell-off, the S&P 500 is still up 14% year-to-date, while the Nasdaq remains up 18% year-to-date.

The sell-off was most pronounced in semiconductors and large-cap tech, as well as Chinese ADRs, which have been outperforming this year.

I saw questions in the Beansprout community wondering if this is a healthy correction or the start of a deeper pullback.

Let us dive deeper to find out.

A number of global markets have been breaking all-time highs recently

S&P 500 and Nasdaq Composite have both been setting new all-time highs, driven largely by excitement around the artificial intelligence (AI) sector, supported by earnings revision as well as valuation expansion.

The rally has been rather extended and markets have been trading at stretched valuations. The S&P 500 sits around 22.8x forward P/E, well above long-term averages.

Friday’s drop was steep, but smaller than earlier 2025 episodes, when the S&P fell nearly 10% in March and dropped ~6% in a single day in April.

The VIX (fear index) jumped back above 16, signalling heightened uncertainty but far from crisis levels.

The 3Q earnings season is expected to start the week of October 13

The recent rally has been supported by strong 2Q earnings reported as well as positive guidance.

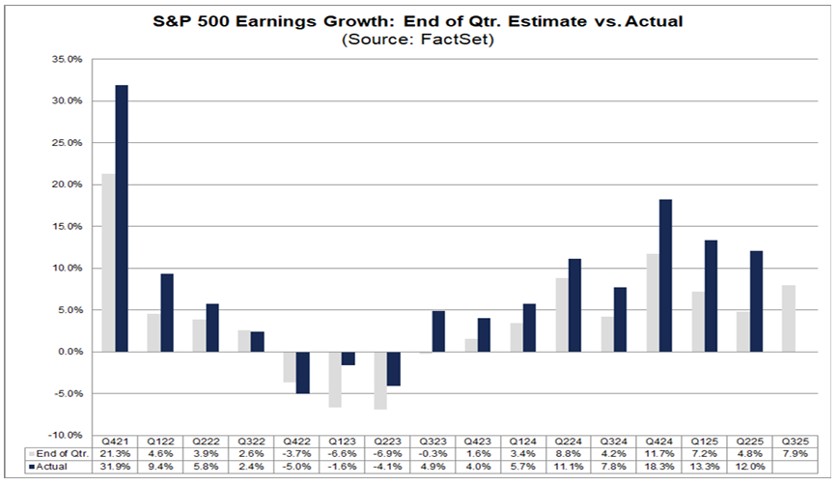

Consensus is now expecting about 8% Year on Year earnings per share (EPS) growth and about 6% revenue growth in Q3 for S&P500.

This would mark the 9th consecutive quarter of year-over-year earnings growth for the index.

In the last earning season, nearly half (49%) of companies providing updates have been positive. This is better than the 5-year average of 43% and well above the 10-year average of 39%.

In the preceding four quarters (Q3 2024 through Q2 2025), actual earnings reported by S&P 500 companies have exceeded estimated earnings by 7.3% on average.

During these four quarters, 77% of companies in the S&P 500 reported actual earnings per share above the mean earnings per share estimate on average.

With the number and magnitude of positive earnings surprises. the earnings growth rate has increased by 5.9% on average from the end of the quarter through the end of the earnings season.

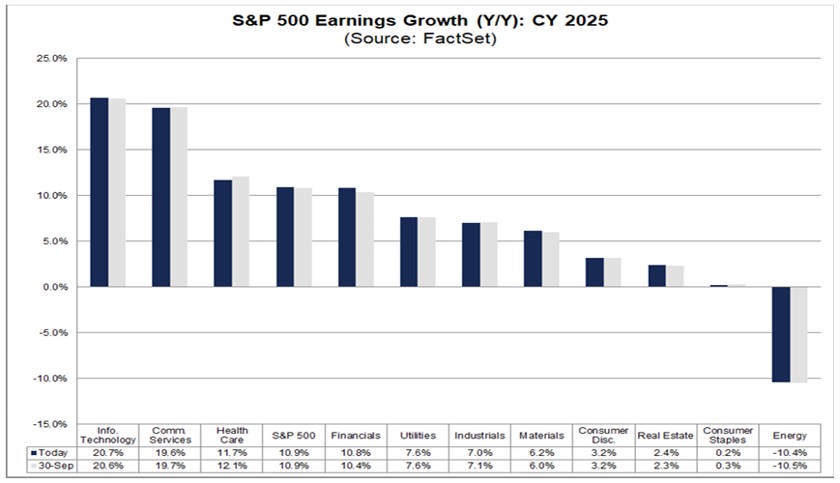

Seven of the eleven sectors are projected to report year-over-year growth, led by the Information Technology, Utilities, Materials, and Financials sectors.

On the other hand, four sectors are predicted to report a year-over-year decline in earnings, led by the Energy and Consumer Staples sectors.

Sell-side analysts have also raised their revenue estimates during the quarter, expecting S&P 500 to report year-over-year revenue growth of 6.3%, versus revenue growth of 4.8% on June 30.

For the calendar year 2025, analysts are projecting earnings growth of 10.9% and revenue growth of 6.1%. For calendar year 2026, analysts are projecting earnings growth of 13.8% and revenue growth of 6.6%.

Market volatility expected into APEC summit

Both China and the US appear to be escalating rhetoric ahead of the APEC summit on 31 October to 1 November 2025. This may be done using tariffs, sanctions, and export controls as tools to strengthen their negotiating positions.

By raising the stakes now, the U.S. may hope to extract concessions, while China has signalled it can retaliate in sensitive areas like rare earths and U.S. tech firms.

There may be more headline-driven swings in the weeks leading up to APEC, as each new statement or countermeasure could spark volatility.

A partial truce or symbolic agreement at APEC could calm markets, but if talks stall, the risk of further escalation remains high.

What would Beansprout do?

We may see more volatility through the APEC Summit, and investors should be prepared for swings as tariffs and countermeasures are used as negotiation leverage.

As a result, we prefer not to put all our eggs in one basket. It’s better to stay diversified and avoid being too concentrated in the U.S. market or the U.S. tech sector, where valuations remain stretched.

For traders looking to hedge their portfolios and guard against market pullbacks, you can learn more about using futures here.

Also, catch our weekly market review for insights on the latest technical trends and trading signals.

For investors looking to diversify their equity portfolios, Singapore could be a good option, offering stable yields and added defensiveness.

The Straits Times Index (STI) is dominated by Singapore’s three local banks - DBS, UOB and OCBC, along with defensive sectors such as Singapore REITs and telcos like Singtel.

These names typically offer attractive dividend yields of around 4–6%, providing a steady income stream for global investors, especially at a time when valuations in overseas markets look stretched.

Learn more about 3 Singapore blue chip stocks with dividend yields of above 5%, and 3 Singapore REITs with dividend yields of above 5%.

For investors looking to diversify across asset classes, bond funds can help reduce portfolio volatility and provide more stability. Learn more about bond funds here.

Lastly, gold’s strong run is a timely reminder that it still deserves a spot in a diversified portfolio. Learn more about investing in gold here.

If you are looking to make use of the market dip to start investing, check out our guide of the best stock trading and brokerage account in Singapore.

As we shared earlier, it’s never easy when markets swing. However, staying calm and focused on the long term always pays off.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments