Mapletree REITs in focus: Weekly Review with SIAS

Stocks

Powered by

By Gerald Wong, CFA • 02 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We share about Mapletree Industrial Trust, Mapletree Logistics Trust and Mapletree Pan Asia Commercial Trust in the latest Weekly Market Review.

What happened?

In this week's Weekly Market Review in partnership with Securities Investors Association Singapore (SIAS), we discuss key developments in the global equity market alongside Mapletree REITs.

Watch the video to learn more about what we are looking out for this week.

Weekly Market Review

1:33 - Macro Update

- The Straits Times Index (STI) extended its winning streak to four weeks, rising 0.3% to touch a new all-time high of 4,933 points before closing around 4,908, defying volatility in the US where the S&P 500 rose marginally by 0.3% and the Nasdaq dipped 0.2% affected by US big tech earnings.

- The Federal Reserve kept interest rates unchanged, but market attention shifted to the nomination of former Fed governor Kevin Warsh as the next Fed Chair, sparking expectations of a stronger US Dollar and a firmer stance on inflation.

- US 10-year Treasury yields remained elevated at 4.24%. Meanwhile, precious metals saw a sharp sell-off, with Gold falling below the $5,000 level and Silver plunging more than 30% in a single day.

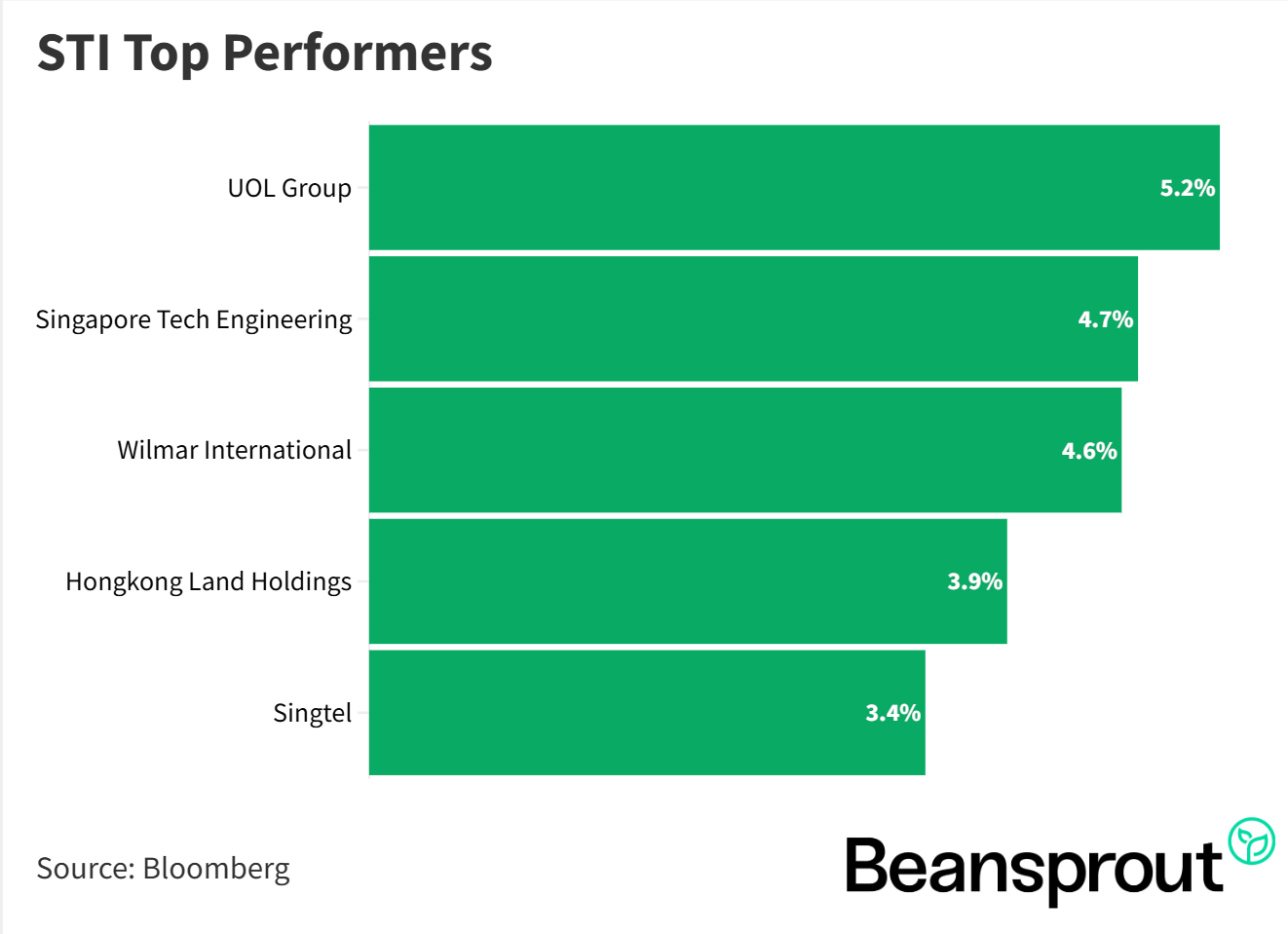

- Singapore property developers continued their rally, with UOL Group gaining 5% and Hongkong Land rising 3.9%; ST Engineering also performed well as a play on global defense spending.

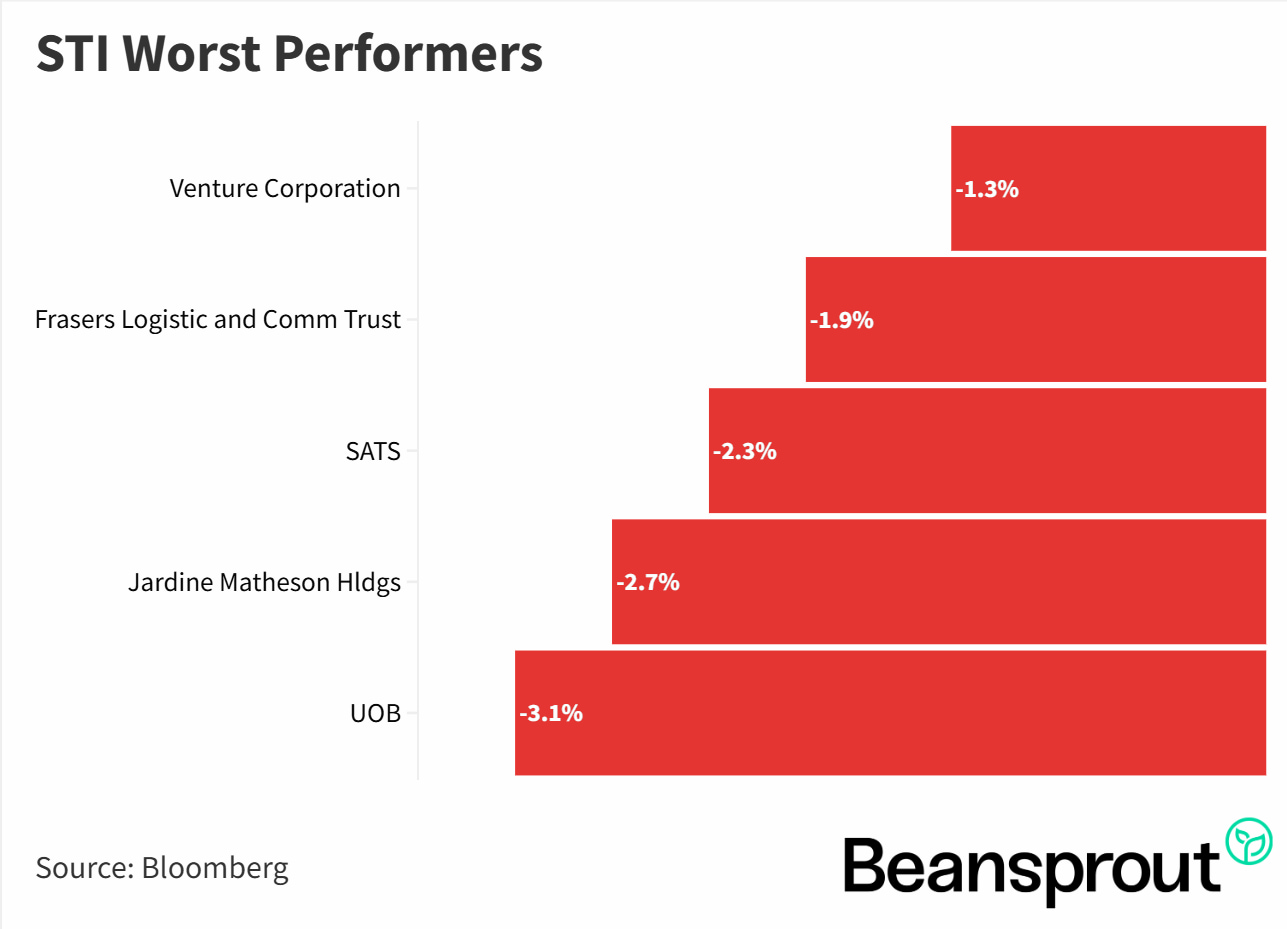

- Profit-taking weighed on UOB following its recent run-up, while Jardine Matheson fell due to negative news flow regarding the Indonesian market.

STI Top Performers:

STI Worst Performers:

Mapletree Industrial Trust (MINT) - SGX: ME8U

- MINT reported a DPU of 3.17 cents for the quarter ending December 2025, a 7% YoY decline largely due to the divestment of Singapore properties and non-renewal of leases in North America.

- Portfolio occupancy remained stable at 91.4%, with Singapore rental reversions showing a positive 7.1%, while the leverage ratio stands at 37.2%.

Mapletree Logistics Trust (MLT) - SGX: M44U

- MLT saw its DPU fall 9.3% YoY to 1.816 cents, dragged down by a weaker Japanese Yen, Korean Won, and Chinese Renminbi against the Singapore Dollar, alongside the absence of income from 12 divested properties.

- The REIT continues its portfolio rejuvenation strategy, achieving a portfolio occupancy of 96.4% supported by strong Singapore occupancy (95.9%), though China occupancy remains softer at 93.8%.

Mapletree Pan Asia Commercial Trust (MPACT) - SGX: N2IU

- In contrast to its peers, MPACT reported a YoY increase in DPU to 2.05 cents, driven primarily by a sharp 10% decline in finance expenses.

- VivoCity remains the crown jewel with 100% occupancy and a robust 14.7% positive rental reversion, helping to offset weaknesses in the China and Japan portfolios where occupancy lagged at 83.6% and 73.1% respectively.

Related Links:

- Mapletree Industrial Trust share price and share price target

- Mapletree Industrial Trust forecast and dividend history

- Mapletree Logistic Trust share price and share price target

- Mapletree Logistic Trust forecast and dividend history

- Mapletree Pan Asia Commercial Trust share price and share price target

- Mapletree Pan Asia Commercial Trust dividend history

Straits Times Index (STI)

- The index touched a new all-time high of 4,933 points last Thursday before closing lower, signaling that the recent strong uptrend may have peaked.

- Momentum indicators suggest a potential pullback is imminent as the MACD converges toward a negative crossover and the RSI has cooled significantly from 86 to 70 despite the index remaining high.

- Traders should watch the pivot level at 4,850 points while immediate support is likely to be found at the January 21 low of 4,800 points.

- The medium term target remains the psychological 5,000 mark which could be tested in the coming months if support holds.

Dow Jones Industrial Average

- Index remains capped by resistance at its all-time high of 49,633 points set in mid January and has been unable to break through despite multiple attempts.

- Bearish momentum is building as the MACD has turned red to indicate a downtrend and the RSI is trending downwards near the neutral 50 point level.

- A further pullback is expected towards firm support around the 48,000 level where the RSI would likely approach oversold territory near 30 to invite renewed buying interest.

S&P 500

- The index briefly crossed the 7,000 barrier to reach a high of 7,002 points last Wednesday before pulling back to sit near a pivot point of 6,939 points.

- Sideways movement is expected as the MACD remains flat and the RSI at 53 indicates a lack of clear directional momentum.

- A dip toward the buy zone between 6,820 to 6,850 points could provide a stable base for the index to launch its next leg up.

Nasdaq Composite Index

- The index failed to test the 24,000 resistance level amid underwhelming tech earnings and remains stuck in a neutral zone.

- Both the MACD and the RSI at 49 are flat, indicating that the market lacks a clear trend and is waiting for a fresh catalyst to determine its direction.

- Without a major spark such as Nvidia earnings in late February, the index risks drifting downward to test key support at the 23,000 handle.

What to look out for this week

Monday, 2 February: CapitaLand India Trust, Parkway Life REIT earnings

Tuesday, 3 February: Keppel Pacific Oak US REIT earnings

Wednesday. 4 February: ESR REIT, Keppel REIT, Digital Core REIT earnings, Alphabet earnings

Thursday, 5 February: Keppel, SGX, CapitaLand Ascendas REIT, CapitaLand China Trust, AIMS APAC REIT, First REIT earnings, Amazon earnings

Friday, 6 February: CapitaLand Integrated Commercial Trust FY2025 Earnings, US nonfarm payroll data

Get the full list of stocks with upcoming dividends here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments