Singapore stocks hit record highs with Budget support: Weekly Market Recap

By Gerald Wong, CFA • 15 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

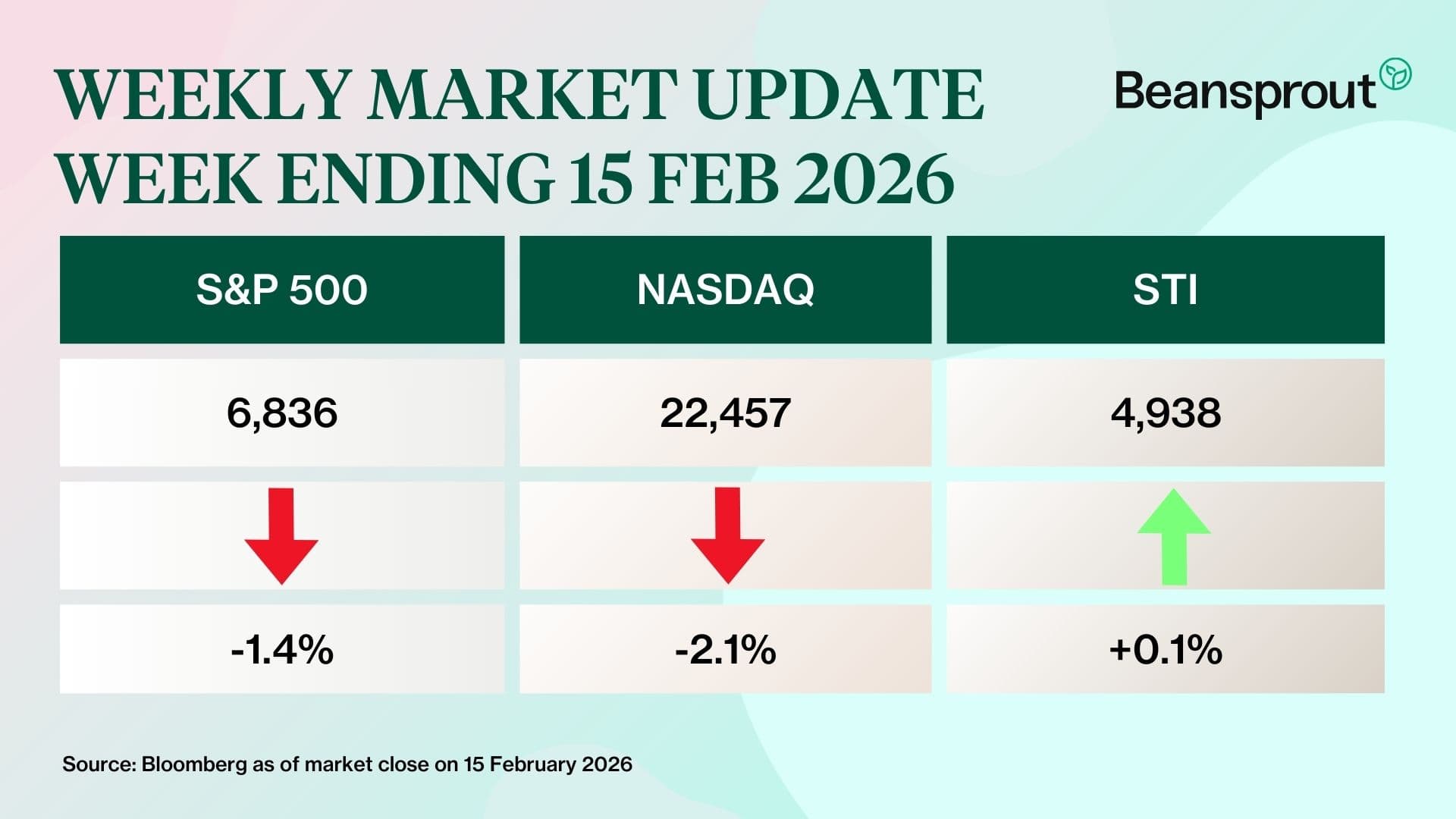

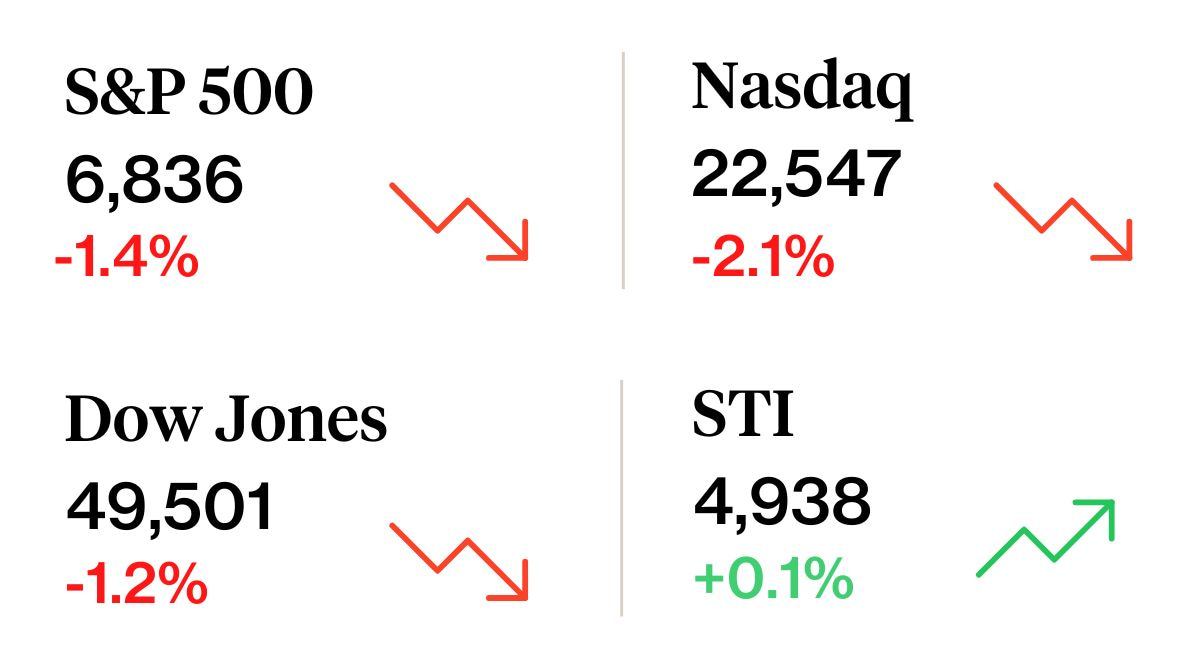

Singapore stocks climbed with measures to strengthen the local market, while US stocks fell amid AI concerns

I used to tune in to the Budget with a pen in hand, ready to jot down anything that might move markets.

This year, I caught myself listening to Budget 2026 with a slightly different question in mind. “How is all this going to affect us as AI keeps getting smarter?”

Somewhere during the week, I read a viral post by an AI startup founder who warned that AI could be something “much, much bigger than Covid.” Not exactly light bedtime reading, but definitely thought provoking.

Whether one agrees or not, one thing is clear. AI is reshaping industries faster than most of us can refresh our news feeds.

So what am I doing about it? I try to keep learning, and most importantly, make sure my financial safety net is in place, especially if the future is unpredictable.

That is also why I keep coming back to income. With Singapore T bill yields drifting lower in the T-bill auction this week, we revisit dividend ideas and look at three Singapore blue chip stocks that recently raised their dividends.

Singapore property stocks have had a strong run in January too. We dig into the fundamentals and ask whether income opportunities still look attractive after the rally.

CDC vouchers from the Budget are always appreciated, and they also serve as a helpful reminder to think about longer term financial resilience. And to me, that is to build income streams that support us year after year.

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

🏛 Further boost to Singapore stocks

What happened?

Prime Minister and Finance Minister Lawrence Wong’s Budget speech highlighted plans to accelerate AI adoption and act on the recommendations of the Economic Strategy Review (ESR) committee.

Singapore will inject an additional S$1.5 billion into the Financial Sector Development Fund to support initiatives aimed at strengthening the local equities market, with the Equity Market Development Programme (EQDP) expanding from S$5 billion to S$6.5 billion. To date, MAS has allocated S$3.95 billion across nine appointed asset managers.

What does this mean?

The expanded EQDP is expected to channel more capital into Singapore equities by supporting additional asset managers with a strong focus on local stocks.

This could help deepen liquidity, and strengthen funding support for Singapore-listed companies with solid fundamentals. The next batch of EQDP managers is expected to be appointed around mid-2026.

Why should I care?

Singapore stocks remained supported by positive momentum this week, with the Straits Times Index (STI) climbing above the 5,000 level.

Gains were led by companies reporting strong earnings, including Keppel and Singtel.

In contrast, US stocks weakened as investors continued to assess the potential impact of AI across sectors. Losses extended beyond software stocks to areas such as financial services and real estate.

🚗 Moving This Week

- DBS reported a 10% drop in profit but raised its 4Q25 ordinary dividend by 10% to S$0.66, alongside a S$0.15 capital return, bringing total dividends to S$0.81. Read more here.

- Keppel reported net profit of S$1.1 billion for FY2025, representing a 39% year-on-year increase. Keppel proposed a final cash dividend of S$0.19 per share, and a special dividend of S$0.13 per share, comprising $0.02 cash and a dividend in-specie of 1 Keppel REIT unit for every 9 Keppel shares held. With an interim dividend per share of S$0.15, this would bring total FY2025 dividends to S$0.47 per share, 38% higher than $0.34 in FY2024. Read more here.

- Singtel reported underlying net profit up 9.5% YoY to S$744m (from S$680m), driven mainly by stronger earnings from key regional associates. Contributions from associates’ post-tax profits rose over 15% to S$529m, led by India’s Bharti Airtel and Thailand’s AIS, helping to offset a softer domestic showing. Read more here.

- StarHub’s 2H FY2025 net profit fell 50.9% year on year to S$38.5 million with prolonged pricing pressure in Singapore’s consumer telco market continued to weigh on returns.The company declared a final dividend of S$0.03, bringing total FY2025 dividend to S$0.06 per share. Read more here.

- iFast posted a 70.4% jump in 4Q2025 net profit to S$32.9 million, alongside a 45.7% rise in revenue to S$151.7 million. The stronger quarter was driven by higher contributions from ePension, improved performance across its core wealth platform, and a bigger lift from its banking operations. Read more here.

- Frasers Property reported S$1.4 billion in pre-sold residential revenue across Singapore, Australia, Thailand and China as at Dec 31, 2025. China contributed S$500 million, up from S$400 million in September, with 1,580 contracts on hand. The increase was driven mainly by the launch of the first phase of the Fang Song Community project in Shanghai, alongside continued sales at Juyuan Upview and Xuhang Upland. Read more here.

- NTT DC Reit reported distributable income of US$36.3 million for the nine months ended Dec 31, 2025, 0.4% above its forecast of US$36.1 million. Net property income was lower due to softer power revenue and a 0.5 percentage-point drop in occupancy to 94.6%, partly offset by higher tenant fit-out revenue and favourable foreign exchange effects. Read more here.

- Grab turned profitable for the first time in FY2025, reporting net profit of US$268m versus a US$105m loss in FY2024, largely driven by a strong 4Q profit of US$171m (up more than 6x YoY) on higher operating profit and net finance income. It also announced a newly authorised US$500m share buyback programme.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

3 Singapore blue chip stocks that raised dividends in February 2026

Here are three Singapore blue chip stocks that recently raised their dividends in February 2026. We find out if their dividend yields remain attractive.

🤓 What we're looking out for next week

- Monday, 16 February 2026: US market closed

- Tuesday, 17 February 2026: Chinese New Year Holiday

- Wednesday. 18 February 2026: Chinese New Year Holiday

- Friday, 20 February 2026: US GDP data

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments