Stocks rally while T-bill yields fall further: Weekly Market Recap

By Gerald Wong, CFA • 17 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

US stocks reached record highs while the Singapore T-bill yield declined

At the dinner table, one topic my family often avoids is money.

Sure, we’ll chat about which stocks are moving, or how DBS crossed the S$50 mark last week. But rarely do we go deeper into what our financial goals are, or whether we’re actually on track for retirement.

That’s why I found this week’s Money Diaries conversation with Mr & Mrs Sgfirecouple refreshing. They shared that one of the most valuable lessons for couples is simply this: don’t shy away from talking about money, no matter how uncomfortable it feels.

From my experience, many investors also look for a safe space to ask questions and share perspectives. In our Beansprout Telegram group this week, most of the chatter revolved around the fall in T-bill yields to 1.59%.

It’s no surprise that when rates drop, the first question is: “where else can I earn a higher yield?” We compare between T-bills, fixed deposits and other alternatives, and also do a deep dive into short-term bond funds as an alternative.

Another takeaway from the Sgfirecouple was that each person should invest according to their personality and risk appetite. That might mean having different portfolios within the same household.

If you’d like to invest based on your individual goals, you can start with fuss-free customised portfolios from as little as S$100.

At the end of the day, investing and talking about money don’t have to be complicated. Sometimes, it just starts with one question: what will money make possible for you?

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

🏛 Rate cut hopes remain high

What happened?

The latest US Consumer Price Index (CPI) rose 0.2% month-on-month in July, easing from June’s 0.3% increase.

While cooling CPI numbers boosted hopes of a rate cut in September, higher than expected Producer Price Index (PPI) data tempered some of the earlier optimism.

What does this mean?

Despite the mixed inflation data, investors largely still expect the US Federal Reserve to cut interest rates at its September meeting.

According to the CME FedWatch Tool, markets are now pricing in an 85% probability of a cut, after reaching as high as nearly 100% earlier in the week.

Why should I care?

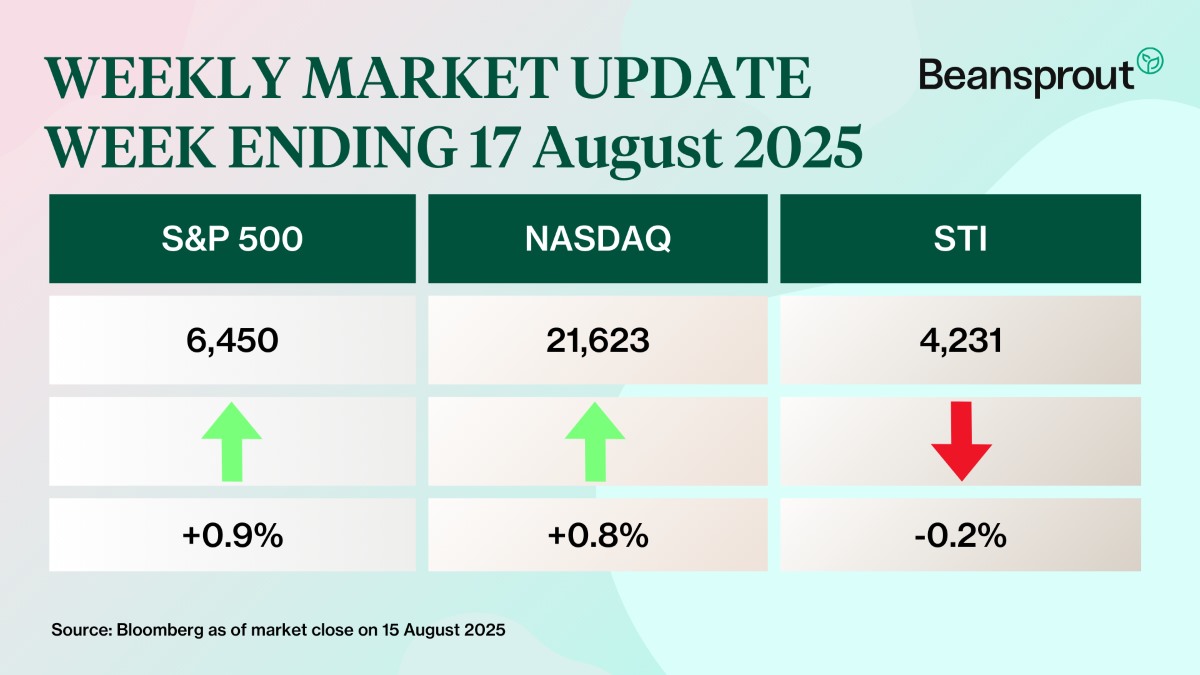

U.S. equities posted modest gains this week as encouraging inflation data lifted sentiment. The S&P 500 rose 0.9%, while the Nasdaq Composite gained 0.8%.

In contrast, Singapore’s Straits Times Index (STI) slipped 0.2%. The decline was led by Sembcorp Industries, which tumbled 8.5% as it extended the previous week’s losses following weaker earnings.

🚗 Moving This Week

- Keppel announced that it is selling its M1 telecom business to rival Simba Telecom. The deal has an enterprise value - which includes cash and debts - of $1.43 billion, subject to post-completion adjustments. Keppel will receive nearly $1 billion in cash for its 83.9 per cent effective stake in M1. Read more here.

- Starhub has acquired the remaining 49.9% stake in MyRepublic’s broadband business that it did not already own for $105.2 million. In March 2022, Starhub received regulatory approval from the Infocomm Media Development Authority (IMDA) to acquire a 50.1% stake in MyRepublic’s broadband unit. Read more here.

- Singtel reported underlying net profit of $686 million for 1QFY2026 ended Jun 30, up 16.7% year on year. Optus, the Australia unit, and NCS, the regional IT services subsidiary, realised further operating profit improvements year on year. Its Thailand and India-based associates AIS and Airtel lifted regional associate contributions. Read more here.

- City Developments (CDL) reported a net profit of $91.2 million for the first half ended Jun 30, an increase of 3.9% year on year, driven by improved performance in the property development segment. For 1H2025, the Board has declared a special interim dividend of 3.0 cents per ordinary share. Read more here.

- CapitaLand Investment (CLI) reported net profit of S$287 million for its first half ended Jun 30, 2025, 13% lower year on year. The declines were partly due to the deconsolidation of CapitaLand Ascott Trust as a CLI subsidiary, alongside the loss of contributions from divested assets in the US and China. Read more here.

- Singapore Technologies Engineering (STE) reported earnings of $402.8 million for its 1HFY2025, up 19.7% year-on-year, as all three of its business segments saw revenue growth. In 1HFY2025, the company won $9.1 billion in new orders, bringing its total order book to $31.2 billion as at June 30. The company plans to pay an interim dividend of 4 cents per share for its 2QFY2025. Read more here.

- ComfortDelgro reported net profit of S$106 million for the first half of 2025, an increase of 11.2% year on year. This was due largely to an increase in its overseas revenue, which contributed more than half of its total revenue for the first time. An interim dividend of S$0.0391 per share was declared. Read more here.

- Wilmar reported a net profit of US$594.9 million for the first half ended Jun 30, up 2.6 per cent year on year. This was attributed to stronger performances in its plantation and sugar milling, which rose on the back of higher palm oil prices and fresh fruit bunch production. Wilmar’s food product segments also turned in a strong performance, due to improved sales in the flour and rice businesses in China. Read more here.

- Sea Ltd reported a 418.3 per cent increase in its second-quarter earnings to US$414.2 million, a jump from the US$79.9 million in the year-ago period. This was driven by revenue growth across its e-commerce and digital financial services arms, respectively, Shopee and Monee.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

Where to park your cash for higher yield? T-bills vs Fixed Deposit vs SSB (August 2025)

We share the best ways to earn a yield on your cash through fixed deposits, Singapore T-bills, SSBs and money market funds.

🤓 What we're looking out for next week

- Tuesday, 19 August 2025: BHG Retail REIT, Prime US REIT, City Developments, Wilmar, YKGI ex-dividend

- Wednesday, 20 August 2025: SATS earnings, ComfortDelgro, CSE Global, Haw Par, Hong Leong Finance, Stoneweg Europe Stapled Trust ex-dividend

- Thursday, 21 August 2025: Olam, Starhub, United Hampshire US REIT ex-dividend

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Join the Beansprout Telegram group and Facebook group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments