Stocks and gold hit new highs with Santa Claus rally: Weekly Market Recap

By Gerald Wong, CFA • 28 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

US and Singapore stocks reached record highs, while gold and silver rallied

As I look back on 2025, I realised that what I value most in this season of life is stability, clarity, and the ability to sleep well at night.

On paper, my portfolio might look a little conservative for someone my age. But with so much of my time and energy going into building Beansprout, I’ve come to see that my investments don’t need to be another source of volatility. They’re there to give me emotional headroom and help me make better decisions for the long term.

And 2025 tested this approach. Between tariff headlines, policy U-turns, and market swings, it became clear that resilience comes from having a plan that feels aligned with what we value in life.

As we approach the final days of the year, we’ve put together a few useful resources if you’re also reviewing your finances before 2026. We share some ways to enjoy tax savings before year end, and walk through the key CPF changes coming up in 2026 and what they could mean for your retirement plans.

This year, I also spent more time building up my passive income streams. In this week’s update, we look at what to expect from the final T-bill auction of 2025, and do a quick recap of the top-performing blue-chip REITs this year.

Interestingly, many of the stronger performers were retail REITs, including some that were active in acquisitions such as CapitaLand Integrated Commercial Trust. We explore four Singapore REITs that are expanding their portfolios, and take a closer look at Starhill Global REIT too.

As I look ahead to 2026, my goal is to continue building financial resilience. For me, that means prioritising stability and income over chasing returns, and building a portfolio that supports the life I want to live.

If you’re spending the last few days of the year reflecting too, it may be a nice moment to ask yourself: what’s your financial priority for 2026?

Thank you for being part of our Beansprout community this past year. Wishing you happy holidays and continued growth in the year ahead!

Gerald, Founder of Beansprout

⏰ This Week In Markets

🚀 Santa Claus Rally

What happened?

The U.S. economy grew at an annualised pace of 4.3% in the third quarter, faster than the 3.8% growth recorded in the previous quarter and well above market expectations of around 3%.

The stronger performance was largely driven by a pickup in consumer spending, which continued to support overall economic activity.

This marks the fastest quarterly growth in two years.

What does this mean?

The stronger-than-expected economic growth helped ease worries about a sharp slowdown for the U.S. economy.

Market sentiment was also boosted by renewed optimism around artificial intelligence stocks, after Nvidia announced that it would license chip technology from start-up Groq and hire its chief executive.

Why should I care?

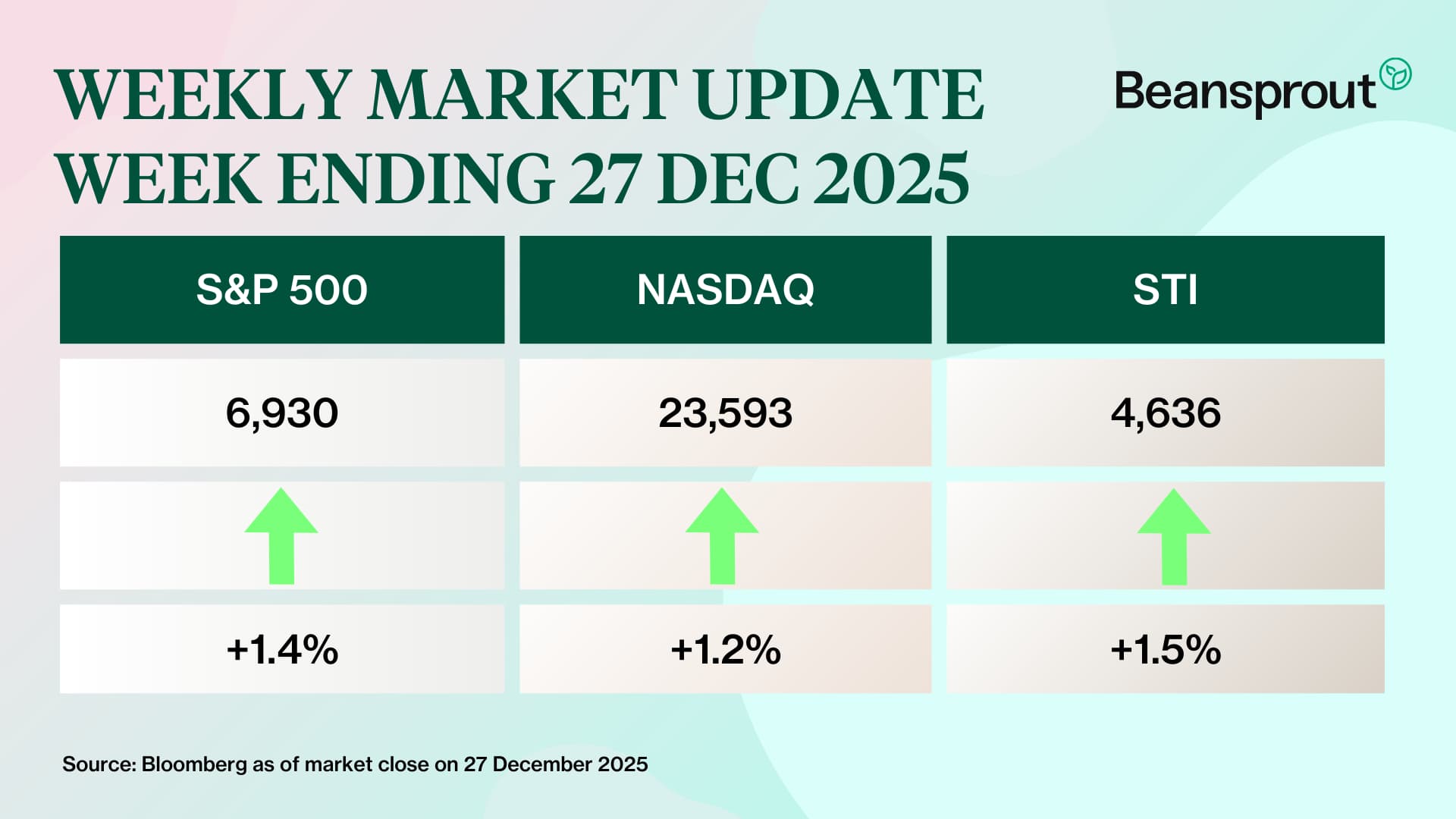

The S&P 500 climbed to a new record high this week, lifted by stronger-than-expected economic data and renewed optimism in the market.

Precious metals continued their strong run as well, with both gold and silver extending their year-to-date rally. Learn more about how to buy gold and how to buy silver in Singapore.

Back home, Singapore’s Straits Times Index (STI) also hit fresh records, closing at 4,639 on Tuesday and touching an intra-day high of 4,647 on Friday.

The local banks were among the key drivers of the gains, with DBS reaching a new all-time high of S$56.37 and OCBC also setting a record at S$19.95.

🚗 Moving This Week

- Seatrium has reached an agreement with buyer Maersk Offshore Wind’s affiliate Phoenix II to pay the balance of the contract price – valued at US$360 million – upon delivery of a wind turbine installation vessel. Earlier, the company received a termination notice for the vessel which was scheduled to be completed in the early part of of 2025. Separately, Seatrium said it is closely monitoring a Trump administration stop-work order affecting the end-customer of its US$475 million wind vessel project, noting that the vessel can be redeployed outside the US market if needed. Read more here.

- A Malaysian unit of CNMC Goldmine has been hit with additional income tax and penalties totalling RM29.6 million (S$9.4 million) for the years of assessment from 2019 to 2024. The Catalist-listed gold miner said it plans to appeal the assessments, which were issued by Malaysia’s Inland Revenue Board to CMNM Mining, its 81%-owned subsidiary.

- Catalist-listed Ever Glory United will transfer to the SGX mainboard on Dec 29, with trading set to begin at 9 am. The move follows shareholder approval at an extraordinary general meeting, where about 99.8% of votes supported the proposed listing transfer.

- Grab will be increasing its platform fee by S$0.30 on Jan 1, 2026. Passengers will then pay S$1.20, up from the current S$0.90. The hike in “platform and partner fees” will support upcoming updates to drivers’ CPF contribution rates under the Platform Workers Act, said Grab.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

6 CPF changes in 2026. How will they affect you?

Here are six key CPF changes in 2026, including higher wage ceilings, updated retirement sums, and new matched schemes. Find out how they will affect you.

🤓 What we're looking out for next week

- Wednesday, 31 December 2025: 6 month Singapore T-Bill Auction

- Thursday, 1 January 2026: New Year’s Day

- Friday, 2 January 2026: Singapore Savings Bond (SSB) application open

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments