4 Singapore REITs buying assets. Are their dividends still attractive?

REITs

By Gerald Wong, CFA • 22 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We look at 4 Singapore REITs making acquisitions and find out whether their dividend yields are still attractive for income investors.

What happened?

Singapore REITs are back in buying mode.

Interest rates trended lower in 2025 which provided an opportunity for Singapore REITs to pursue growth opportunities through asset acquisition.

In the past few months, we have seen CapitaLand Ascendas REIT expanding its Singapore portfolio, CapitaLand Integrated Commercial Trust (CICT) buying CapitaSpring, and Keppel DC REIT acquiring a Japan data centre.

The latest headline came from Keppel REIT, which is acquiring an additional one-third stake in Marina Bay Financial Centre Tower 3. It has also acquired a retail mall in Australia in October 2025.

With many key acquisitions happening this year, many income investors in the Beansprout Community have been discussing the impact of these deals on their distributions and yields.

In this article, I look at four Singapore REITs that have made headlines with their latest deals and what it means for their distribution per unit (DPU) and dividend yields.

4 Singapore REITs buying assets. Are their dividends still attractive?

#1 – Keppel REIT (SGX: K71U)

Keppel REIT has been very active recently, announcing two major acquisitions in the second half of 2025.

The most recent deal involves Marina Bay Financial Centre Tower 3.

The REIT is buying an additional one-third stake of MBFC Tower 3 for S$1,453 million. This raises its total ownership in the premium office tower to two-thirds. The property is anchored by DBS Bank and has a high occupancy of 99.5%.

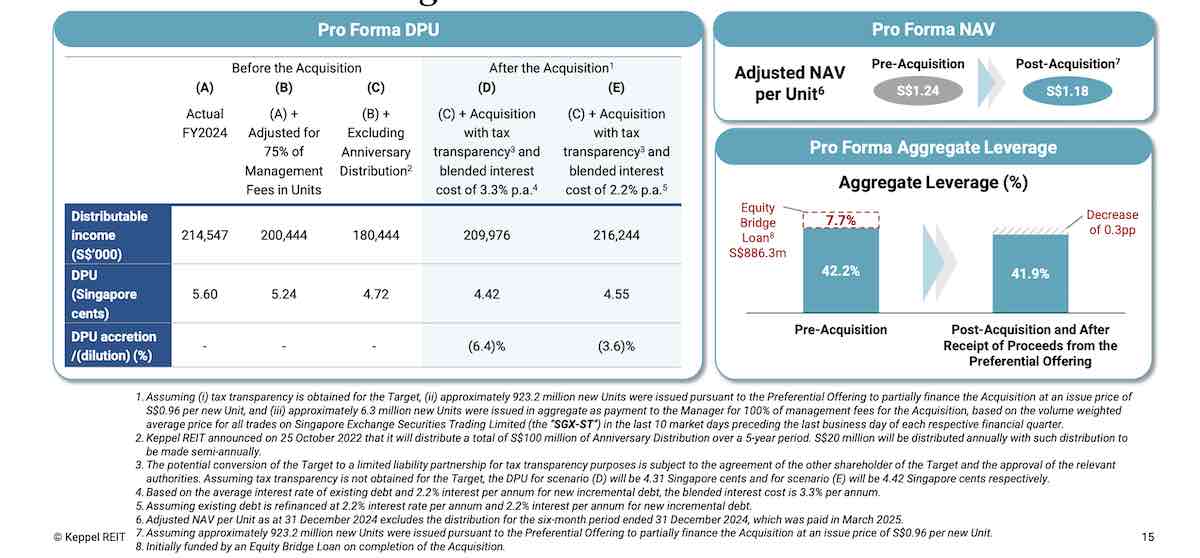

Post-transaction, Keppel REIT’s exposure to Singapore assets will increase from 75.8% to 79.0%, while aggregate leverage is expected to edge down slightly to 41.9%.

While the acquisition deepens Keppel REIT’s presence in the Marina Bay financial district, it comes at a short-term cost to unitholders.

Due to the funding structure, the MBFC deal is expected to be DPU-dilutive by 3.6% to 6.4%. Adjusted Net Asset Value (NAV) per unit is also projected to decline from S$1.24 to S$1.18.

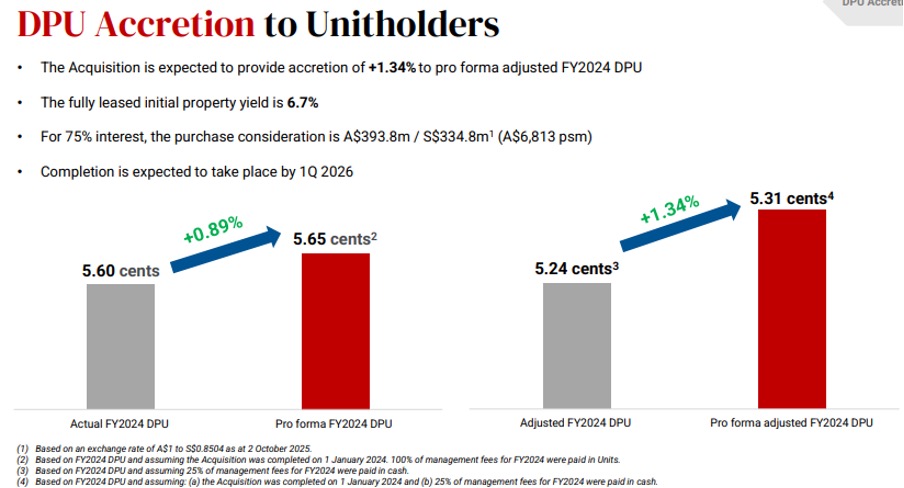

Earlier in October, Keppel REIT made its first move into the retail sector in Australia. It bought a 75% stake in Top Ryde City Shopping Centre in Sydney for A$393.8 million. This freehold suburban mall offers a defensive income stream.

Unlike the MBFC acquisition, the Sydney transaction was DPU-accretive, introducing a new income stream from suburban retail in Australia.

Taking into consideration the impact of both acquisitions on unitholders, the expected dilution from the MBFC deal may reduce

Based on the Keppel REIT's 1H25 DPU of 2.72 cents and a unit price of S$0.975 (as of 16 December 2025), Keppel REIT offers an annualised dividend yield of approximately 5.6%.

Related Links:

- Keppel REIT share price history and share price target

- Keppel REIT dividend forecast and dividend history

#2 – Keppel DC REIT (SGX: AJBU)

Keppel DC REIT continued to execute its strategy of acquiring high-quality data centres in key hubs.

In October, Keppel DC REIT expanded its presence in Japan by acquiring Tokyo Data Centre 3 for JPY 82.1 billion (approximately S$707.0 million).

Located in Inzai City, a major data centre cluster in Greater Tokyo, this freehold facility is fully leased to a global hyperscaler on a long-term 15-year contract.

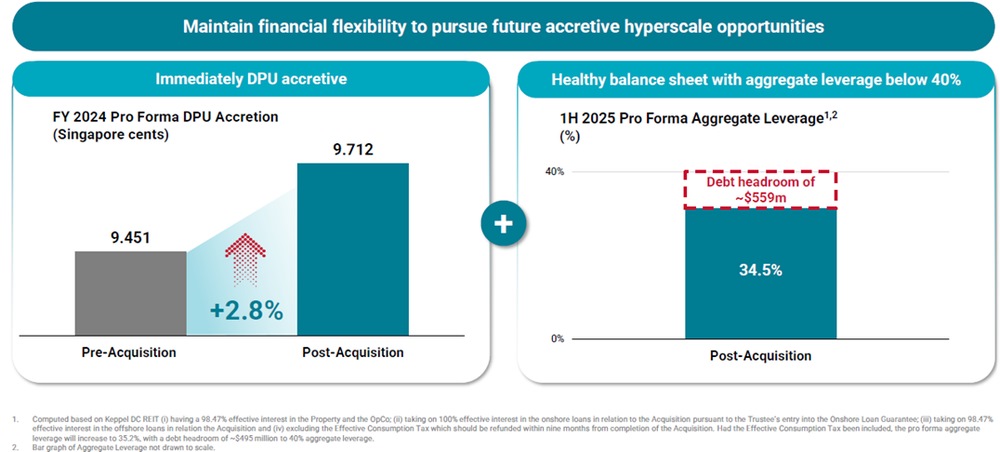

The deal was expected to be immediately positive for unitholders. Management projected the FY2024 pro forma Distribution Per Unit to rise by 2.8%.

While the acquisition increased the REIT’s aggregate leverage from 30.0% to 34.5%, this remains a healthy level that leaves roughly S$559 million in debt headroom for future opportunities.

To fund the purchase, Keppel DC REIT raised approximately S$404.5 million via a preferential offering, giving entitled unitholders the right to subscribe to 80 new units for every 1,000 existing units at S$2.24 per unit

The acquisition strengthened Keppel DC REIT’s portfolio by increasing its assets under management to around S$5.7 billion across 25 data centres in Asia Pacific and Europe, and extending its weighted average lease expiry (WALE).

Keppel DC REIT trades at a price-to-book valuation of 1.42x as of 16 December 2025, based on its pro forma book value of S$1.56 (as of 31 December 2024).

Based on the Keppel REIT's 1H25 DPU of 5.133 cents and a unit price of S$2.21 (as of 16 December 2025), Keppel DC REIT offers an annualised dividend yield of approximately 4.6%.

Related links:

- Keppel DC REIT share price history and share price target

- Keppel DC REIT dividend history and dividend forecast

#3 – CapitaLand Integrated Commercial Trust (SGX: C38U)

CapitaLand Integrated Commercial Trust (CICT) deepened its presence in its home market by consolidating ownership of a flagship asset.

CICT completed its acquisition of the remaining 55% stake in CapitaSpring for S$1,045 million.

This purchase gives CICT 100% ownership of the office and retail components of the 51-storey integrated development in Raffles Place.

CapitaSpring has been nearly fully occupied, supported by a strong tenant mix, and the acquisition deepened CICT’s exposure to Singapore’s core commercial property market.

Upon completion, 95% of CICT's portfolio value is derived from Singapore, solidifying its status as a proxy for the local commercial property market.

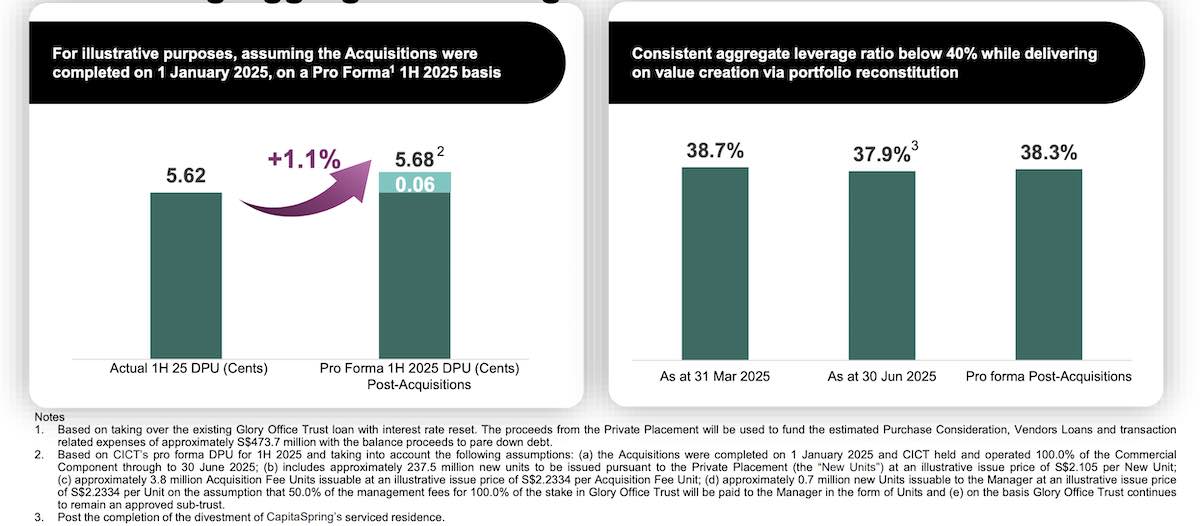

While the acquisition increased the total portfolio value to a massive S$27.0 billion, the impact on the balance sheet was managed carefully, with aggregate leverage rising only marginally from 37.9% to 38.3%.

The acquisition was expected to be DPU-accretive, with forecasted annualised distribution per unit increasing by about 1.1%.

The purchase was partially funded by a private placement that raised S$600 million from investors.

CICT trades at a price-to-book valuation of 1.09x as of 16 December 2025.

Based on the 1H 2025 DPU of 5.62 cents declared on 5 August 2025, and its unit price of S$2.32 as of 16 December 2025, CICT offers an annualised dividend yield of approximately 4.8%.

Related links:

- CapitaLand Integrated Commercial Trust (CICT) share price history and share price target

- CapitaLand Integrated Commercial Trust (CICT) dividend history and dividend forecast

#4 – CapitaLand Ascendas REIT (SGX: A17U)

CapitaLand Ascendas REIT (CLAR) continued to reposition its portfolio towards new economy assets.

CLAR completed the acquisitions of 9 Tai Seng Drive and 5 Science Park Drive in mid-2025, after unitholders approved the purchases at the Extraordinary General Meeting on 30 July 2025.

9 Tai Seng Drive is a data centre with potential for higher rental rates, whereas 5 Science Park Drive currently serves as the regional headquarters for Shopee.

These Singapore properties are fully leased and align with CLAR’s strategy to grow its holdings in data centres and high-growth business space assets.

The transactions were expected to be DPU-accretive, helping expand CLAR’s income base and increase its Singapore exposure to around 67% of total assets.

The acquisitions were funded via a private placement that raised roughly S$500 million.

CapitaLand Ascendas REIT trades at a price-to-book valuation of 1.27x as of 16 December 2025.

Based on the CapitaLand's Ascendas REIT's FY2024 DPU of 15.205 cents and a unit price of S$2.76 (as of 16 December 2025), CapitaLand Ascendas REIT offers a dividend yield of approximately 5.5%.

Related links:

- CapitaLand Ascendas REIT (CLAR) share price history and share price target

- CapitaLand Ascendas REIT (CLAR) dividend history and dividend forecast

What would Beansprout do?

With Singapore REITs returning to acquisition mode and interest rates trending lower, income‑focused investors are asking whether these portfolio expansions still translate into attractive dividend returns.

After all, acquisitions can either boost distributable income or weigh on short‑term yields, depending on the deal structure.

Among the four REITs we’ve highlighted, we see a mix of outcomes.

Keppel REIT's higher stake in MBFC Tower 3 would increase their Singapore asset exposure but is expected to be dilutive to DPU, which may lower its dividend yield from about 5.6% currently.

In contrast, Keppel DC REIT’s acquisition of a Tokyo data centre is expected to be accretive, reinforcing its global expansion strategy. However, Keppel DC REIT offers a more modest yield of roughly 4.6% at its unit price of S$2.21.

CapitaLand Integrated Commercial Trust’s (CICT) consolidation of CapitaSpring is accretive and strengthens its exposure to Singapore core commercial assets, supporting a dividend yield of about 4.8%.

Meanwhile, CapitaLand Ascendas REIT (CLAR) continues to increase its exposure towards segments such as data centres and specialised assets. while offering a dividend yield of 5.5%

Across these four REITs making major acquisitions, Keppel DC REIT’s acquisition of the Japan data centre is expected to be most accretive to distribution per unit. Keppel REIT’s acquisition of MBFC Tower 3 is the only transaction expected to be dilutive to distribution per unit.

For the REITs that have made accretive acquisitions, CapitaLand Ascendas REIT offers the highest dividend yield of 5.5%, followed by CICT with a dividend yield of 4.8%. Keppel DC REIT offers a more modest dividend yield of 4.6%.

For investors looking for REITs offering dividend yields of close to 5% and making acquisitions to grow their distributions, it might be worth CapitaLand Ascendas REIT and CICT to your watchlist.

To screen for Singapore REITs with lowest price-to-book valuation or highest dividend yield, check out our best Singapore REIT screener.

If you are new to investing in Singapore REITs, you can start to learn more about Singapore REITs here.

If you prefer diversification without picking individual REITs, you can also gain exposure through Singapore REIT ETFs.

Lastly, you can also check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in REITs.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments