Stocks slip while T-bill yields continue to drop: Weekly Market Recap

By Gerald Wong, CFA • 03 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Stocks decline with weak jobs data while T-bill yields fall further

This week’s Money Diary guest, Daisy Anne Mitchell, shared her goal of having a healthier relationship with money.

Growing up, she believed that money was “bad” and was never taught how to manage it. Now, she’s working towards building a stronger foundation through consistent savings and regular CPF contributions, steps that help her feel more in control of her financial journey.

And that’s something I’ve found to be true as well: The first step to building wealth often starts with having a solid base of savings.

This month, we saw more cuts to fixed deposit rates across Singapore. Even as some banks lowered their savings account rates, we were still able to find a few that offer interest rates above 2% p.a.

The 6-month Singapore T-bill yield also fell further to 1.77% this week.

With falling rates, it's no surprise that there has been more attention on the latest Astrea 9 private equity bonds.

The Class A-1 Bonds offer a fixed interest rate of 3.40% per annum, and the Class A-2 Bonds offer a fixed interest rate of 5.70% per annum. We break down how the bonds work, whether they’re worth considering, and how you can apply.

As Daisy reminded us, there’s no one-size-fits-all approach when it comes to managing money. But cultivating a healthier mindset and shifting from “money controls me” to “I control my money” can be a powerful first step.

Gerald, Founder of Beansprout

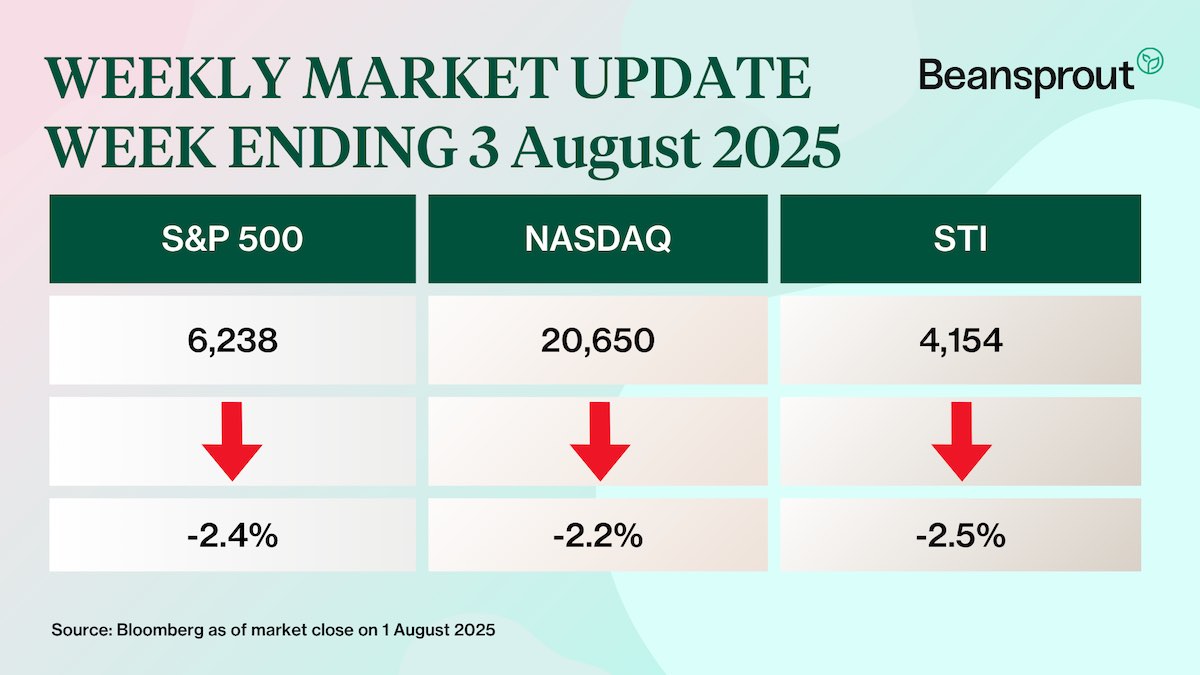

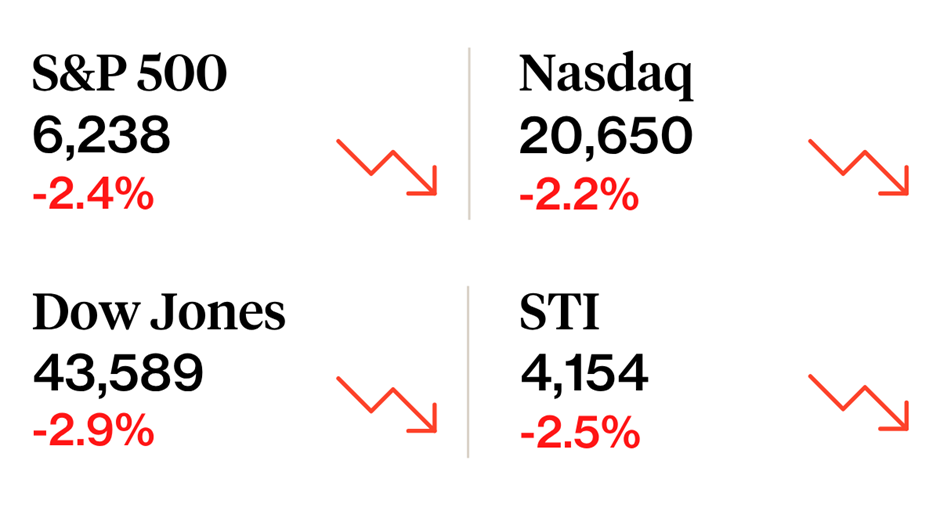

⏰ This Week In Markets

🚀 Stocks decline with poor jobs data

What happened?

The US Federal Reserve held interest rates steady and gave no strong indication that rate cuts are imminent.

However, Friday’s jobs report shifted market expectations. The US economy added only 73,000 jobs in July, and figures from previous months were revised significantly lower.

This brought the three-month average job gain down to just 35,000 per month.

What does this mean?

The weak jobs data raised expectations that the Fed could cut rates in the coming months.

There is now an 80% probability that the US Federal Reserve will cut interest rates at its September meeting, up from 62% just a week earlier, according to the CME FedWatch Tool.

Why should I care?

U.S. government bond yields fell sharply after weaker-than-expected jobs data signaled slowing economic momentum.

The S&P 500 Index pulled back from record highs to end the week lower.

In Singapore, the Straits Times Index (STI) declined 2.5%, dragged down by a sharp drop in Singapore Airlines’ share price following its disappointing earnings report

🚗 Moving This Week

- OCBC’s net profit for the second quarter declined 7 per cent to S$1.82 billion as interest rates fell. The company declared an interim dividend of S$0.41 per share, down from S$0.44 per share a year earlier. Read more here.

- Singapore Airlines’ (SIA) net profit declined 58.8% year-on-year to S$186 million for the first quarter of FY2026 ended Jun 30. This was due to lower interest income with lower cash balances, as well as share of losses of associates from Air India. Read more here.

- Keppel reported a net profit of S$377.7 million for the first half ended Jun 30, a 24.2 per cent rise year on year. This was largely driven by growth in its real estate segment. Keppel announced an interim dividend of S$0.15 per share, unchanged from the year-ago period, as well as a S$500 million share buyback programme. In its earnings statement, Keppel announced that it has identified a S$14.4 billion portfolio of non-core assets for divestment. Read more here.

- Seatrium’s net profit for the six months ended Jun 30 grew 301.3 per cent to S$144.4 million. As at end-June, Seatrium’s net order book stood at S$18.6 billion, of which S$6.3 billion, or 34 per cent, are renewables and cleaner solutions. Read more here.

- Seatrium has signed a leniency agreement with Brazilian prosecutors in relation to Operation Car Wash. Seatrium will incur financial penalties of more than S$240 million to the authorities in Brazil and Singapore, including a final settlement payment of around S$168.4 million under the leniency agreement with Brazil. Read more here.

- Mapletree Industrial Trust’s (MIT) distribution per unit (DPU) fell 4.7 per cent to 3.27 Singapore cents for its first quarter ended Jun 30, 2025. This was partly due to lower cash distribution declared by its joint venture, Mapletree Rosewood Data Centre Trust, due to higher borrowing costs from the repricing of matured interest rate swaps. Read more here.

- Mapletree Pan Asia Commercial Trust reported a 3.8 per cent fall in distribution per unit (DPU) to S$0.0201 for the first quarter of FY2026. Contributions from Singapore assets fell due mainly to the divestment of Mapletree Anson in 2024. MPACT’s properties in overseas markets had lower occupancies and negative rental reversions. Read more here.

- CapitaLand Ascott Trust (CLAS) reported a 1 per cent drop in distribution per stapled security (DPS) to S$0.0253 for its first half ended Jun 30. Revenue and gross profit rose compared to the previous year, supported by stronger operating performance, a portfolio reconstitution strategy and asset enhancement initiatives. Read more here.

- CDL Hospitality Trusts net property income (NPI) fell 11.9 per cent to S$58.6 million for the first half ended June 30, from S$66.5 million in the previous corresponding period. The decline was largely driven by ongoing room renovations at the W Hotel, which are set to be completed by early 2026. Read more here.

- iFAST Corporation has reported a net profit for the 2QFY2025 ended June 30 of $22.11 million, up 37.9% y-o-y. As at June 30, iFast’s group’s asset under administration (AUA) grew to another record high of $27.20 billion, up 21.6% y-o-y, while net inflows stood at an all time high of $1.29 billion in 2QFY2025. The company has proposed an interim dividend of 2 cents per ordinary share. Read more here.

- Sheng Siong reported a 3.5 per cent increase in H1 2025 net profit to S$72.3 million. Revenue grew 7.1 per cent to S$764.7 million with the opening of 11 new stores in the first half of 2025 and in 2024. The company proposed an unchanged interim dividend of S$0.032 per share. Read more here.

- AEM Holding’s CEO Amy Leong has resigned, having served just one year in this role. Samer Kabbani, currently president and chief technology officer of the company, will take over with effect from Monday, July 28. AEM says Leong is leaving her role because of "board-led leadership realignment for growth." Read more here.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

Are Astrea 9 PE bonds worth buying?

The Astrea 9 Class A-1 Bonds offer a fixed interest rate of 3.40% per annum, and the Class A-2 Bonds offer a fixed interest rate of 5.70% per annum.

🤓 What we're looking out for next week

Earnings Announcements

- Monday, 4 August 2025: CapitaLand Ascendas REIT, Lendlease REIT, Frasers Hospitality Trust earnings

- Tuesday, 5 August 2025: CapitaLand Integrated Commercial Trust earnings

- Wednesday, 6 August 2025: Acrophyte Hospitality Trust, Parkway Life REIT, Venture Corporation earnings

- Thursday, 7 August 2025: BHG Retail REIT, IREIT Global, DBS, UOB, Frasers Property, Genting Singapore earnings

- Friday, 8 August 2025: Daiwa House Logistics Trust, Sembcorp, SGX earnings

Dividend Dates

- Monday, 4 August 2025: Mapletree Industrial Trust ex-dividend

- Tuesday, 5 August 2025: CapitaLand Ascott Trust, ESR REIT, Keppel Infrastructure Trust, Starhill Global REIT ex-dividend

- Wednesday, 6 August 2025: CapitaLand China Trust, CDL Hospitality Trusts, Far East Hospitality Trust, Keppel REIT, Mapletree Pan Asia Commercial Trust, UOI ex-dividend

- Thursday, 7 August 2025: Elite UK REIT ex-dividend

- Friday, 8 August 2025: AIMS APAC REIT, OCBC, Singapore Airlines ex-dividend

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Join the Beansprout Telegram group and Facebook group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments