Stocks and gold rally to record highs: Weekly Market Recap

By Gerald Wong, CFA • 05 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

US and Singapore stocks hit new highs, while gold prices continue to rally

During our podcast recording this week, our intern asked me a simple but thought-provoking question “Do you not regret the investment opportunities you missed out on?”

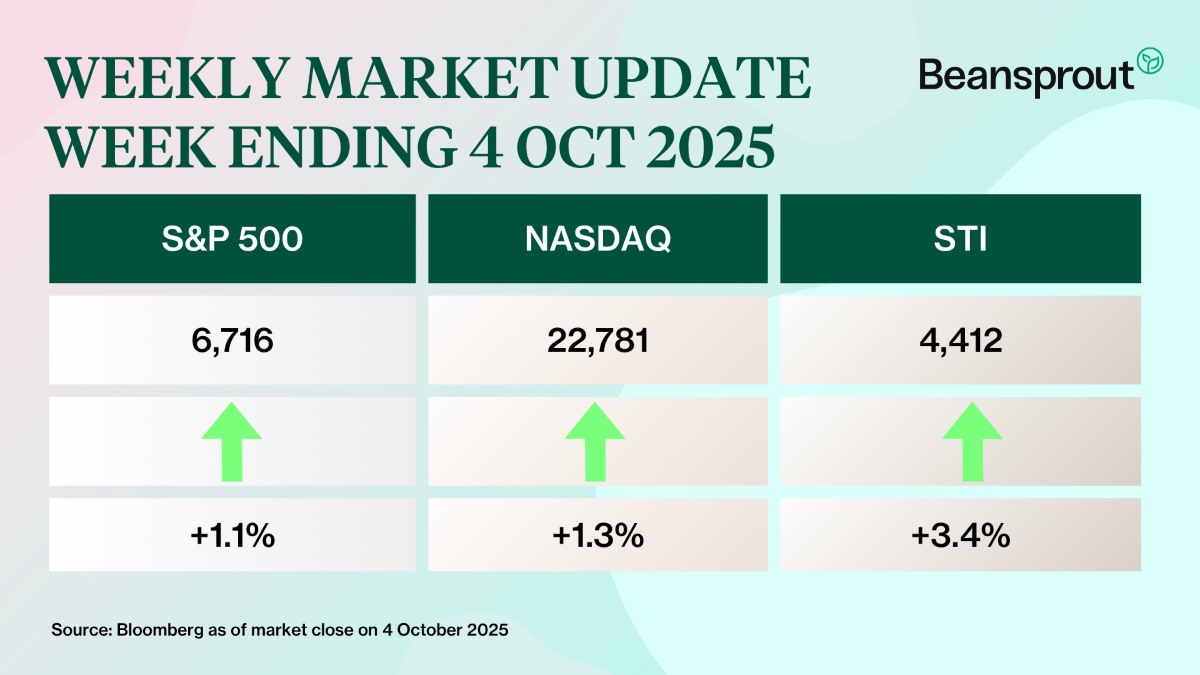

It’s a fair question, especially this week, with both US and Singapore stocks hitting record highs. The sharp V-shaped recovery since the “Liberation Day” tariffs in April has caught many investors off guard.

As the Senior Investment Strategist from the DBS Chief Investment Office (CIO) team shared in our discussion on navigating volatile markets, it’s a reminder of how difficult it is to time the market.

That’s why dollar-cost averaging remains one of the simplest yet most powerful strategies. By investing consistently over time, it helps smooth out market ups and downs, and it’s something we often encourage beginner investors to start with.

If you’re still building up your portfolio, it may also help to keep your spare cash working for you. This week, we round up the best fixed deposit rates and savings accounts in October 2025, and take a look at whether T-bill yields might rebound.

Going back to my intern’s question, I would say I have no regrets. Markets will always rise and fall. What matters most is staying true to my financial plan, and remembering why I’m investing in the first place.

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

🚀 The rally goes on

What happened?

Investors shrugged off the US government shutdown that began on Thursday after legislators were unable to reach a funding agreement to keep nonessential government functions open.

Reflecting sentiment that “bad news is good news”, weak labour market data reinforced investor expectations for interest rate cuts.

What does this mean?

If the shutdown continues, other vital economic indicators provided by the government could be delayed, including the September consumer price index (CPI) report scheduled for October 15.

This could create more uncertainty ahead of the Fed’s next policy meeting in late October.

Why should I care?

US markets reached new record highs, with gains led by tech stocks as investors remain hopeful about growth from artificial intelligence. Learn more about S&P 500 ETFs here.

Gold prices also hit a new high of US$3,895 per ounce, lifted by safe-haven demand amid the US government shutdown. Learn more about investing in gold here.

In Singapore, the Straits Times Index (STI) also reached a record high of above 3,400 points. Learn more about the Straits Times Index (STI) here.

🚗 Moving This Week

- SGX's share price rose on increased trading activity on the exchange and a growing listing pipeline. Since 29 Sep, four companies have lodged preliminary IPO documents with the exchange, following the listings of two other companies in September, including US cyber-security firm AvePoint and Centurion Accommodation REIT, the second-largest mainboard listing in 2025 after NTT DC REIT.

- Yangzijiang Financial Holding and two other investors are aiming to control 23.36% of Ningbo Shanshan Co, a listed producer of lithium battery anode materials, which is undergoing restructuring. Yangzijiang Financial Holding's investment of RMB 1.02 billion represents around 4.79% of its NAV as at 30 June 2025. Read more here.

- UOL, SingLand and CapitaLand has completed the S$810 million Thomson View en bloc deal, the largest in Singapore since Chuan Park’s S$890 million sale in May 2023. The development on Bright Hill Drive houses 200 apartments, 54 townhouses and a shop unit on a 5-hectare site.

- Lendlease REIT announced that it has signed a US technology company as a new tenant in its Milan building 3. This brings its committed occupancy at building 3 to 49%, up from 31% in February 2025.

- GuocoLand will start previews for its Clementi project, Faber Residence, on Friday (Oct 3), with prices starting at S$1,995 per square foot (psf). Jointly developed with TID and Hong Leong Holdings, the project comprises 399 units of two to five-bedroom apartments across nine five-storey residential blocks.

- Property management services group LHN’s co-living business Coliwoo has lodged a preliminary prospectus for a listing on the Singapore Exchange. Coliwoo’s property portfolio comprises 25 properties across Singapore. Of this, 11 are owned by the group, 10 are leased, and four are managed by the group.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

Keppel DC REIT Preferential Offering – What should unitholders do?

The Keppel DC REIT preferential offering opened on 3 October 2025.

🤓 What we're looking out for next week

- Thursday, 9 October 2025: Singapore 6-month T-bill auction

- Friday, 10 October 2025: University of Michigan Consumer Sentiment

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments