Singapore stocks hit record highs as T-bill yields fall: Weekly Market Recap

By Gerald Wong, CFA • 09 Nov 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Singapore's Straits Times Index (STI) reached a new all-time high, while T-bill yields declined

When I meet friends these days, our conversations often turn to one common topic. “With interest rates falling, what should I do?”

It's a timely concern. This week, the latest T-bill yield dipped again after showing signs of stabilisation last month.

Banks have also been cutting their interest rates. The best fixed deposit rates in Singapore have continued to fall this month, and savings account rates have followed suit. UOB, for instance, announced that it will lower interest rates on its UOB One account and UOB Stash account in December.

My answer usually starts with the basics. Make sure you have enough emergency savings set aside. Once that’s in place, you can consider opportunities that might offer higher potential yields, if you’re comfortable with the risks involved.

For example, many investors turn to Singapore blue chip stocks as a way to generate steady passive income. The Straits Times Index (STI) reached a record high this week, supported by resilient corporate earnings and attractive dividend payouts, even as U.S. markets weakened.

If you’re exploring income options, we find out how you can easily gain exposure to a basket of Singapore REITs through a REIT ETF in our latest podcast.

At the end of the day, the goal is to keep your money working for you while maintaining a safety net and staying focused on your long-term plan.

Happy growing!

Gerald, Founder of Beansprout

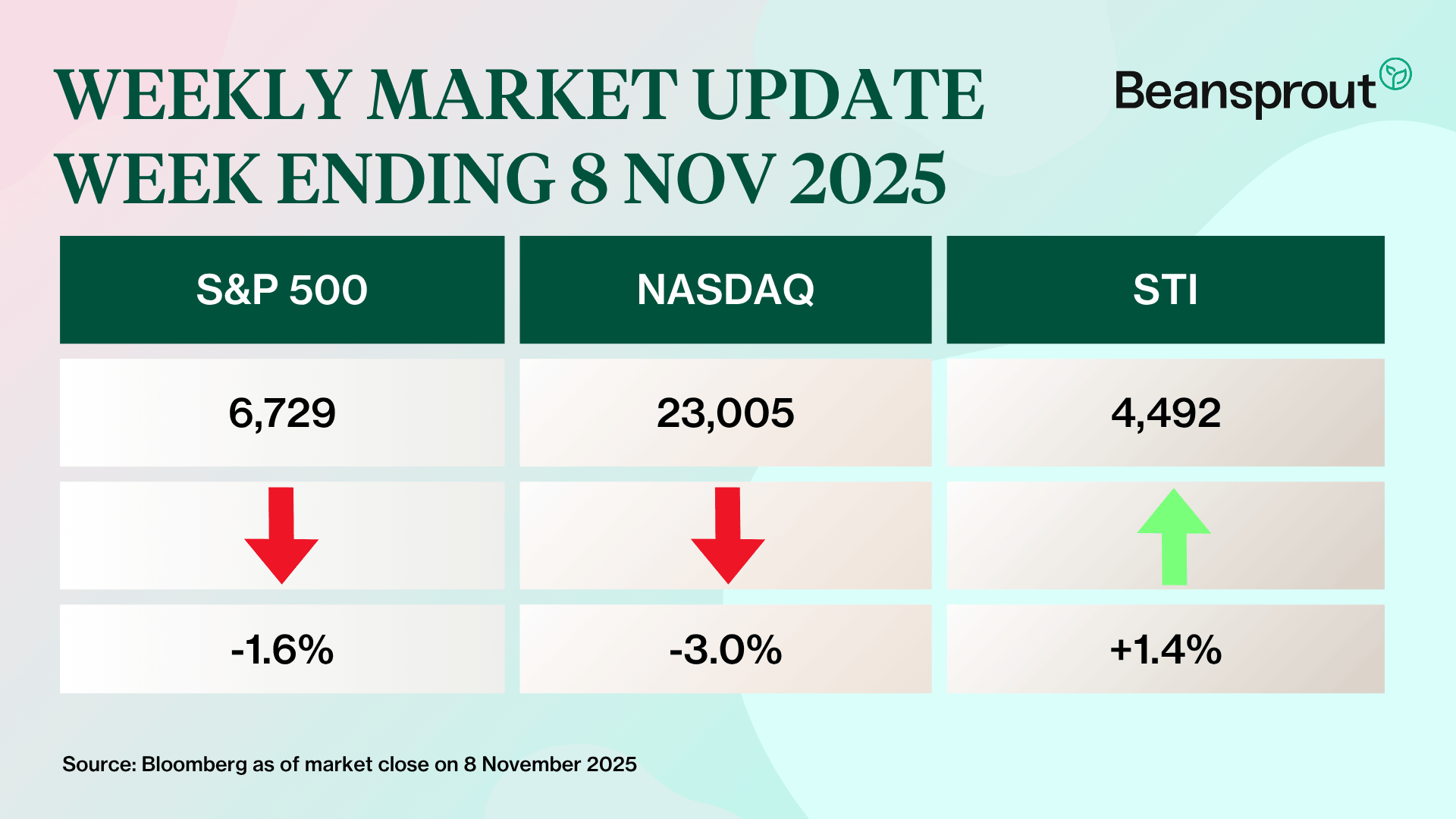

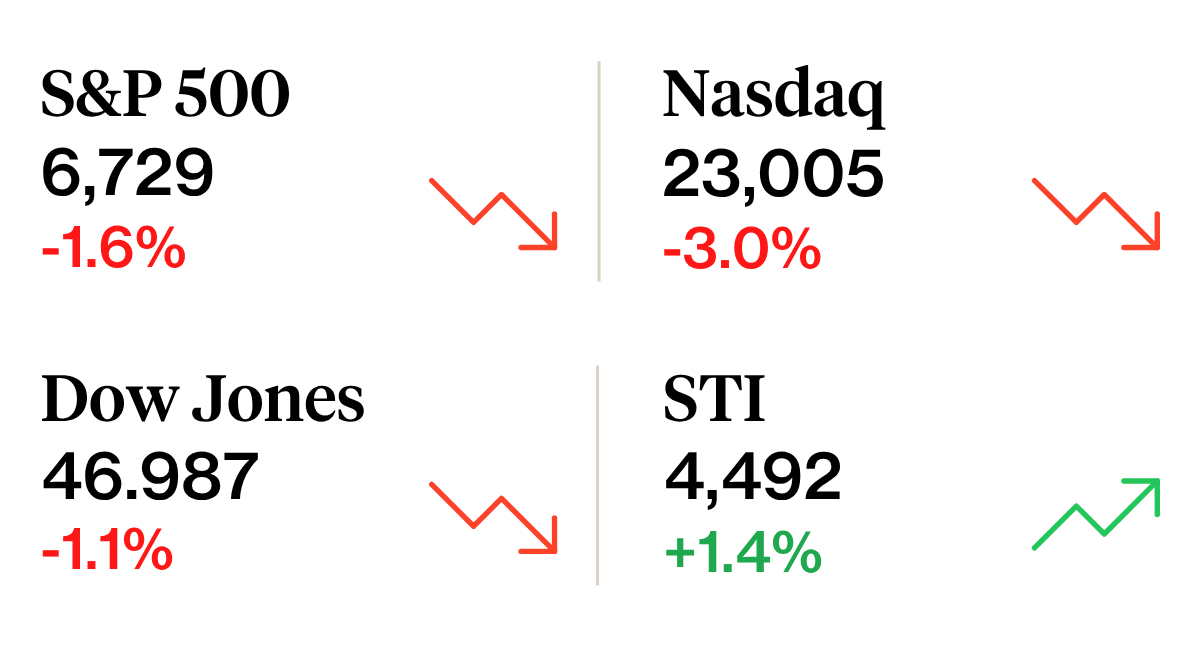

⏰ This Week In Markets

📉 Growth concerns weigh on markets

What happened?

The CEOs of Morgan Stanley and Goldman Sachs cautioned that global equity markets may be due for a pullback, reflecting growing concerns over stretched valuations.

Meanwhile, increased scrutiny on artificial intelligence (AI) spending weighed on many growth-focused stocks, as investors began to question whether the recent surge in AI investments can be sustained.

What does this mean?

The warnings from Wall Street come at a time when concerns about an economic slowdown in the U.S. are growing.

According to a report by consulting firm Challenger, Gray & Christmas, employers have cut nearly 1.1 million jobs this year through October, a 65% increase from the same period last year. October alone saw 153,074 job cuts, the highest for the month since 2003.

Adding to the cautious mood, the University of Michigan’s preliminary reading of its November Consumer Sentiment Index dropped 3.3 points from the previous month to 50.3, its lowest level since the record low in June 2022.

Why should I care?

U.S. stocks fell this week, with losses led by technology shares that have driven much of the market’s rally since early April.

In contrast, Singapore stocks defied the weakness in global markets to post gains. The Straits Times Index (STI) reached a record intra-day high of 4,520 points and closed at a record 4,492 on 7 November.

The rally was led by DBS, which jumped 3.81% after reporting stronger-than-expected earnings. Gains in Singtel and OCBC, both of which also hit record highs, helped lift the benchmark further.

🚗 Moving This Week

- DBS net profit for the third quarter ended Sep 30, 2025, fell 2 per cent to S$2.95 billion, compared with S$3.03 billion in the year-ago period. The company declared an ordinary dividend of S$0.60 per share and a capital return dividend of S$0.15 per share for the period. Read our analysis here.

- UOB’s net profit for the third quarter ended Sep 30, 2025 stood at S$443 million, down 72 per cent from S$1.61 billion a year earlier, due to “pre-emptively set aside” additional allowances. The bank added that the final dividend payment for 2025 will not be impacted by this pre-emptive general allowance set aside. Read our analysis here.

- OCBC reported net profit of S$1.98 billion for the three months ended Sep 30, 2025, flat from the previous year and supported by higher non-interest income and lower allowances. Read more here.

- Genting Singapore reported a 19 per cent year-on-year increase in net profit to S$94.6 million for the third quarter ended Sep 30, with improved VIP rolling volume and win rate contributing a significant rise to its revenue. Read more here.

- CapitaLand Investment (CLI) reported a 25.5 per cent fall in total revenue to about S$1.6 billion for the first nine months of 2025, from S$2.1 billion in the year-ago period, on the back of the deconsolidation of lodging trust CapitaLand Ascott Trust. CLI’s fee-related revenue improved to S$882 million from S$845 million, boosted by higher event-driven fees from listed funds and contributions from new funds. Read more here.

- CapitaLand Ascendas REIT (CLAR) has reported portfolio occupancy of 91.3% for the 3QFY2025 ended Sept 30, 0.5 percentage points lower than the occupancy rate of 91.8% in the quarter before. The REIT’s portfolio rental reversion for the quarter stood at 7.6%, down from 8% in the 2QFY2025. Read more here.

- Yangzijiang (YZJ) Maritime Development, the spin-off from YZJ Financial’s maritime investment segment, is set to raise gross proceeds of at least S$5.2 million through a private placement of about 8.6 million shares at a price of S$0.60 per share. YZJ Maritime is expected to list on the Mainboard of the Singapore Exchange (SGX) at 9am on Nov 18. Read more here.

- SIA Engineering Group (SIAEC) reported a net profit of $83.3 million for the 1HFY2026 ended Sept 30, up 21.1% y-o-y. The company’s revenue rose 26.5% y-o-y in 1HFY2026 due to robust demand for maintenance repair and overhaul services (MRO). Read more here.

- NetLink NBN Trust has reported a distribution per unit of 2.71 cents for the 1HFY2026 ended Sept 30, up 1.1% y-o-y. The slight increase in revenue for the reporting period was primarily driven by higher ancillary project revenue and co-location revenue. Read more here.

- AIMS APAC REIT (AAREIT) reported 1HFY26 Distribution per Unit (DPU) of 4.72 cents, an increase of 1.1% y-o-y. Read our analysis here.

- Parkway Life REIT’s distribution per unit (DPU) grew by 2.3% year-on-year to 11.56 cents in 9M 2025. Read our analysis here.

- CapitaLand China Trust reported stabilised revenue and occupancy rates in 3Q25. Read our analysis here.

- CapitaLand India Trust reported 10% year-on-year increase in total property income to S$76.0 million in 3Q25. Read our analysis here.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

Gold near record highs. How to invest easily in Singapore

With gold trading near record highs, learn how to invest in gold easily in Singapore through SPDR Gold Shares ETF.

🤓 What we're looking out for next week

- Monday, 10 November 2025: SingPost earnings

- Tuesday, 11 November 2025: SIA Engineering ex-dividend

- Wednesday, 12 November 2025: Singtel, NTT DC REIT earnings, Lendlease REIT ex-dividend

- Thursday, 13 November 2025: SIA, SATS earnings, DBS, AIMS APAC REIT ex-dividend, US CPI data

- Friday, 14 November 2025: Frasers Property earnings

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments