Chinese New Year 2026 - 5 ways to grow your children’s ang bao money

Investing, ETFs

By Gerald Wong, CFA • 16 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Wondering what to do with your child’s ang bao money for Chinese New Year 2026? Here are 5 practical ways parents can grow and compound it over 10 years, from savings accounts and SSBs to CPF and ETFs.

What happened?

Chinese New Year is here again.

This is one of my favourite times of the year because of the reunion with family and friends.

For many, this is also a time where they are receiving ang bao from parents, grandparents, and relatives.

While each ang bao may seem small, the total often adds up to a meaningful amount each year.

We've shared often about blue chip stocks, Singapore REITs, T-bills and fixed deposits.

That led me to revisit a simple question: how can we help our children’s ang bao money grow steadily over time?

In this article, we will explore five practical ways parents can invest their children’s ang bao money, ranging from safer options to those with stronger long-term growth potential, and see how the outcomes may differ over time.

Why children’s ang bao money is different

Ang bao money is usually not meant for immediate spending.

Unlike emergency funds or monthly savings, this money often has a long runway.

For example, you may start investing when your child turns 10 and plan to use the funds when they turn 20 for university or early adulthood expenses.

That long time horizon allows the power of compounding to get to work.

Even modest annual amounts, when added consistently and given enough time, can grow into a meaningful sum by the time a child reaches adulthood.

To make this more concrete, let’s assume a simple scenario throughout this article:

- A child receives S$500 a year

- This continues for 10 years from age 10 to age 20

- The money is invested once annually after Chinese New Year

Across all options, the total contribution remains S$5,000. What changes is how effectively it compounds.

Chinese New Year 2026 - 6 ways to grow your ang pow money

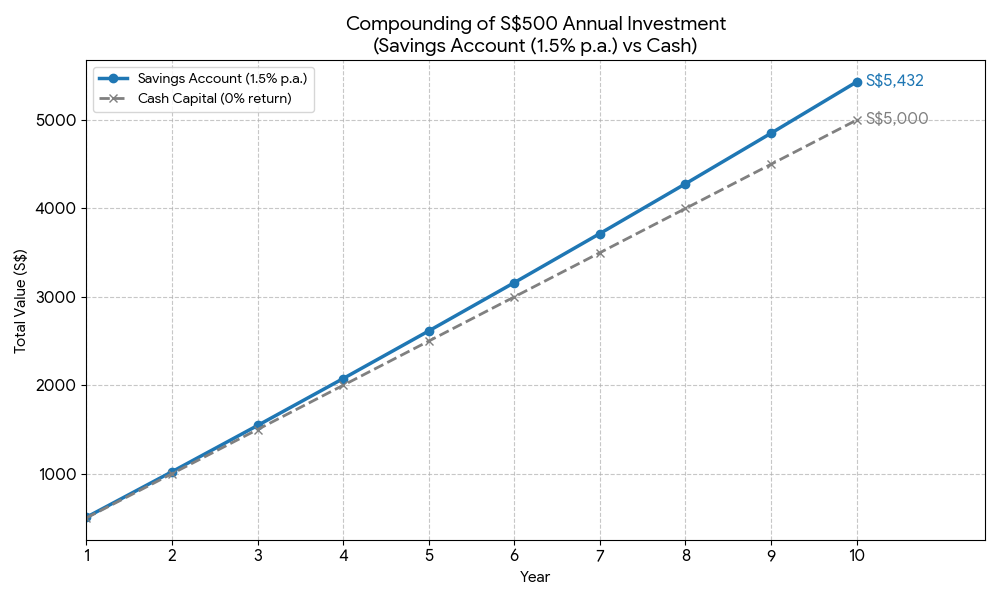

#1 - Savings account: Safe and liquid, but limited growth

For many families, the default option is to keep children’s ang bao money in a savings account.

It feels safe, simple, and easily accessible, especially when parents are unsure when the money might be needed.

At current rates, most savings accounts offer around 1% to 2% p.a. in interest, depending on conditions.

While this provides capital protection, the compounding effect is relatively modest over long periods.

Using our earlier assumption of S$500 a year invested over 10 years, a savings account earning 1.5% per annum would grow to roughly $5,432.

This approach prioritises liquidity and certainty, but over time, inflation can quietly erode the purchasing power of the money.

Savings accounts can still play a role, particularly for short-term needs or as a temporary holding place, but they may not fully capture the potential of long-term compounding.

If you are comparing options, you can refer to our guide on the best fixed deposit accounts in Singapore and best savings accounts in Singapore to see which accounts currently offer the most competitive interest rates.

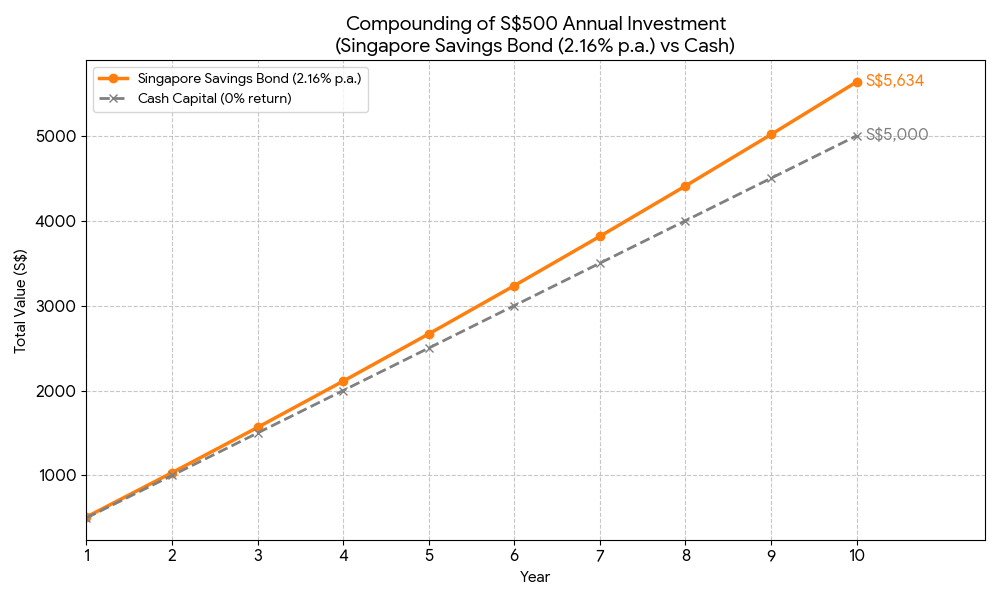

#2 - Singapore Savings Bonds (SSB): Government-backed stability with slightly higher returns

Singapore Savings Bonds offer a balance between safety and better long term returns.

Backed by the Singapore government, the latest 10-year average return for SSB is about 2.16%, however is projected to dip to 2.00%.

They can also be redeemed monthly without capital loss, which provides flexibility that fixed deposits do not.

Using our assumption of S$500 invested each year for 10 years, a 2.16% annual return would grow the total to approximately S$5,634.

This provides modest compounding while preserving capital.

For parents who prioritise stability and flexibility, SSBs can serve as a low risk foundation within a child’s ang bao portfolio.

You can find out more about how Singapore Savings Bonds work and whether they fit your situation in our detailed guide here.

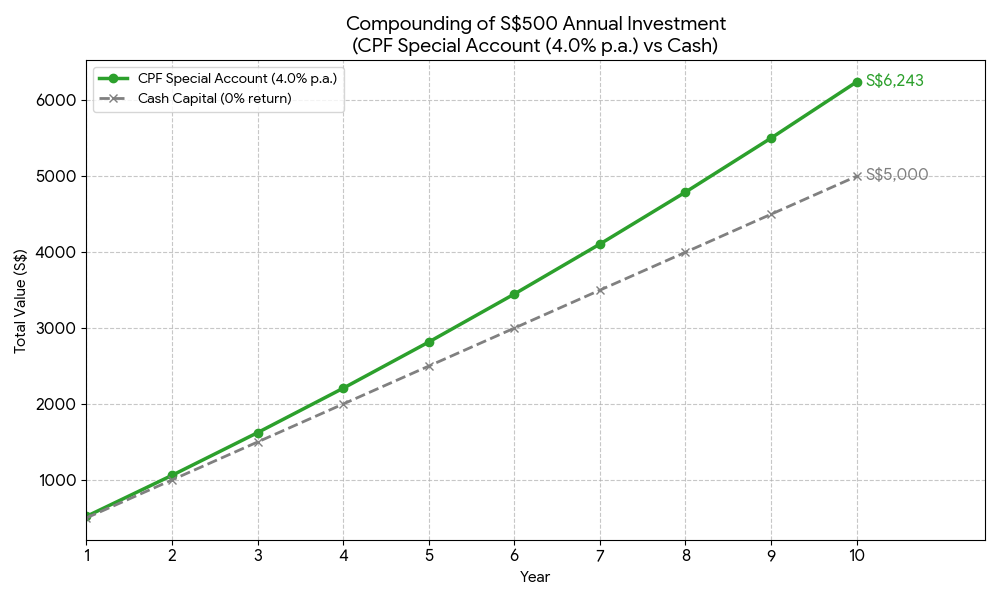

#3 - CPF Special Account (SA): 4% p.a. interest rate for long-term compounding

Every Singaporean has a CPF account from birth.

Parents can voluntarily top up their child’s Special Account under the Retirement Sum Topping-Up Scheme.

The CPF Ordinary Account currently earns 2.5% p.a., while the Special Account earns a higher base interest rate of 4% p.a., with additional interest on the first portion of balances.

At 4% annually, S$500 invested each year for 10 years would grow to approximately S$6,243.

Funds in the Special Account are set aside primarily for retirement and are subject to CPF withdrawal rules.

This means the money is intended for long-term use rather than short-term education or early adulthood expenses.

Once eligibility conditions are met, CPF savings may also be invested under the CPF Investment Scheme, subject to CPF’s rules and investment limits. This provides flexibility for those who wish to seek potentially higher returns within the CPF framework.

For parents who view ang bao money as a long-term head start for their child’s retirement savings, CPF can be a disciplined and structured option.

#4 - Robo-advisors: Digital wealth platforms with income portfolios

For parents who want market exposure but do not have the time or energy to manage investments themselves, digital wealth platforms also known as robo-advisors offer a hands-off way to invest ang bao money across multiple asset classes.

Income-focused portfolios typically invest in a mix of bonds, dividend-paying equities, and REITs, aiming to generate regular income while still allowing for growth.

Portfolios are automatically rebalanced, and income can be reinvested to enhance compounding.

As investments come with risks, you will have to be able to take volatility in your portfolio, which may vary according. to the portfolio you choose. Also, this is also means that your capital and returns are not guaranteed.

However robo-advisors allow you to gain access to a diversified portfolio in a simply way.

You can compare and find the best robo-advisor in Singapore here.

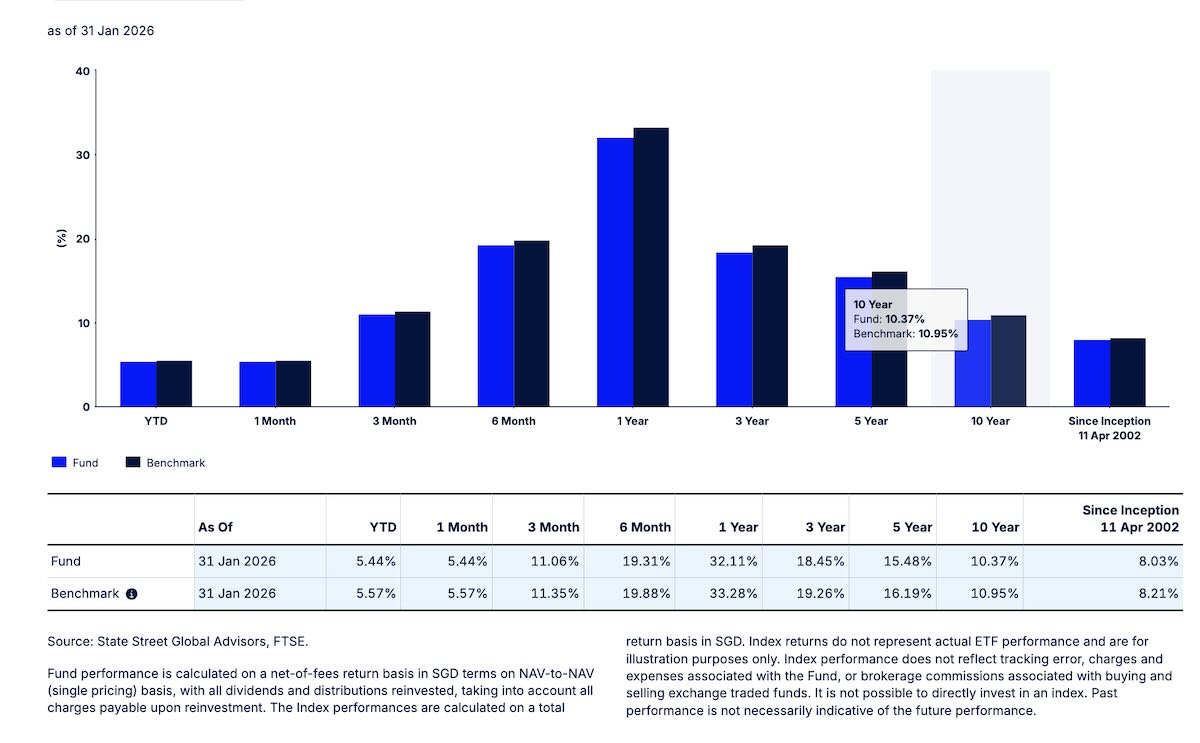

#5 - Straits Times Index (STI) ETF: Dividend-focused market growth

An STI ETF provides exposure to Singapore’s largest listed companies, many of which are mature businesses with a strong track record of paying dividends.

This includes familiar household names such as DBS, Singapore Airlines, and Singtel — companies that many parents already recognise and interact with in daily life.

As many of these blue chip stocks offer attractive dividend yields, the STI ETF offers a distribution yield of 5.36% as of 13 February 2026.

The Straits Times Index (STI) generated a 10-year average return of 10.95% per annum, as of 31 January 2026.

However, it is worth noting that past performance is not an indication of future performance.

Also, an ETF that tracks the Straits Times Index (STI) presents various risks, such as the loss of value when there is a market downturn.

Read our guide to learn more about the STI ETF.

How much will the ang pow money grow over time?

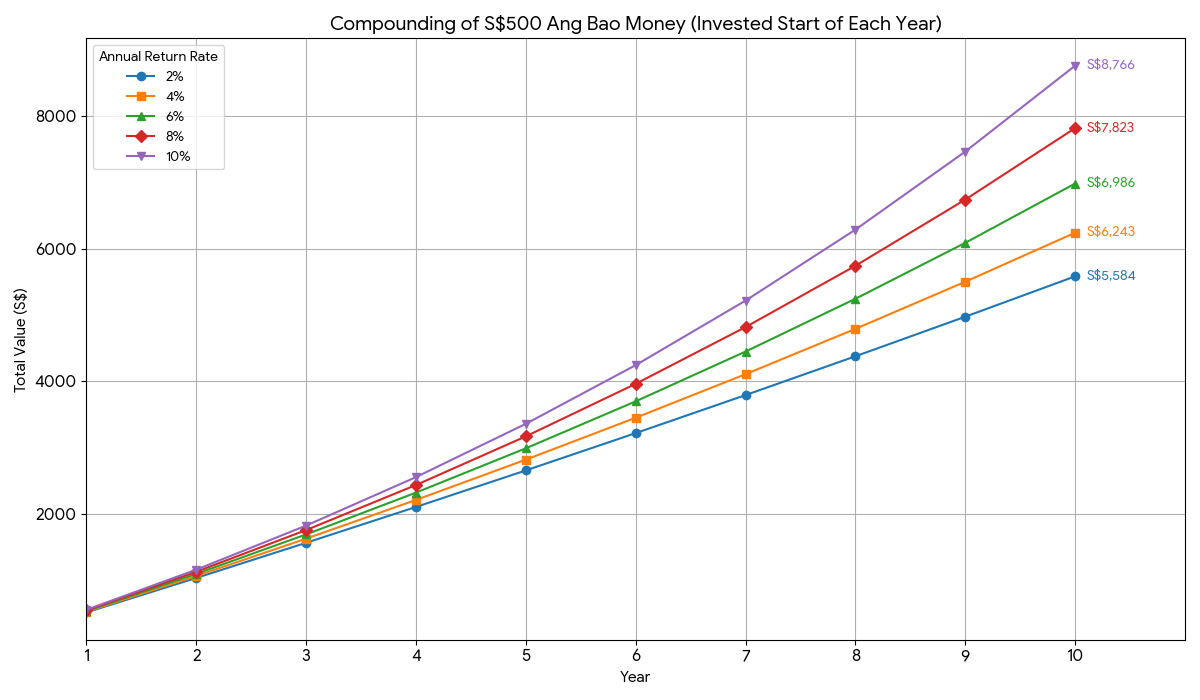

For illustrative purposes, if S$500 is invested at the start of each year for 10 years (a total contribution of S$5,000) compounded over time, the final value would look like this:

- 2% p.a. return: S$5,584

- 4% p.a. return: S$6,243

- 6% p.a. return: S$6,986

- 8% p.a. return: S$7,823

- 10% p.a. return: S$8,766

| Annual Return (p.a.) | Final Value | Gain vs S$5,000 (No Interest) |

|---|---|---|

| 0.00% (Cash) | S$5,000 | S$0 |

| 2.00% | S$5,584 | + S$584 |

| 4.00% | S$6,243 | + S$1,243 |

| 6.00% | S$6,986 | + S$1,986 |

| 8.00% | S$7,823 | + S$2,823 |

| 10.00% | S$8,766 | + S$3,766 |

At a modest 2% return, investing the Ang Bao money immediately earns an extra S$584 over 10 years compared to leaving it idle. At higher rates like 8%, the gain is over S$2,800—more than half of the initial capital.

The amount invested stays the same in every case.

What changes is the rate of return — and over time, even a few percentage points can make a meaningful difference.

What would Beansprout do?

There isn’t a single best place to invest children’s ang bao money.

What tends to matter more is finding a mix that fits your family’s comfort level, time horizon, and how soon the money might be needed.

If safety and liquidity matter most, a savings account keeps things simple but offers limited growth. You can find out the best savings account in Singapore with the highest interest rates here.

The latest issuance of the Singapore Savings Bonds offer a higher 10-year average return compared to savings account interest rates, while offering the flexibility to redeem any time.

If you view ang bao money as a true long-term gift for retirement, CPF Special Account top-ups offer an interest rate of 4% p.a.

For busy parents who prefer diversification without stock picking, robo-advisors offer automated portfolio management with moderate growth potential.

And for those comfortable with market volatility, investing in a broad STI ETF allows exposure to top Singapore blue-chip companies, many of which pay attractive dividends.

Lower-risk options provide stability and peace of mind, while market-based investments introduce volatility, but historically provide stronger long-term growth.

Ultimately, the biggest decision isn’t which product to choose.

It’s whether to leave ang bao money idle — or to give it time to compound.

Over 10 years, even modest sums can grow meaningfully. Over 20 years, the difference becomes even more powerful.

In 2026, one of the most meaningful gifts parents can give their children may not be a bigger ang bao, but a longer runway for compounding to work quietly in the background.

Learn how to start investing in Singapore here.

Read more about Chinese New Year promotions to leap into prosperity in 2026 here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments