What's next for gold prices after rally pauses

Commodities

By Ng Hui Min • 19 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Gold prices pulled back after their record-breaking rally paused. We examine what triggered the dip and whether the investment case for gold remains intact.

What happened?

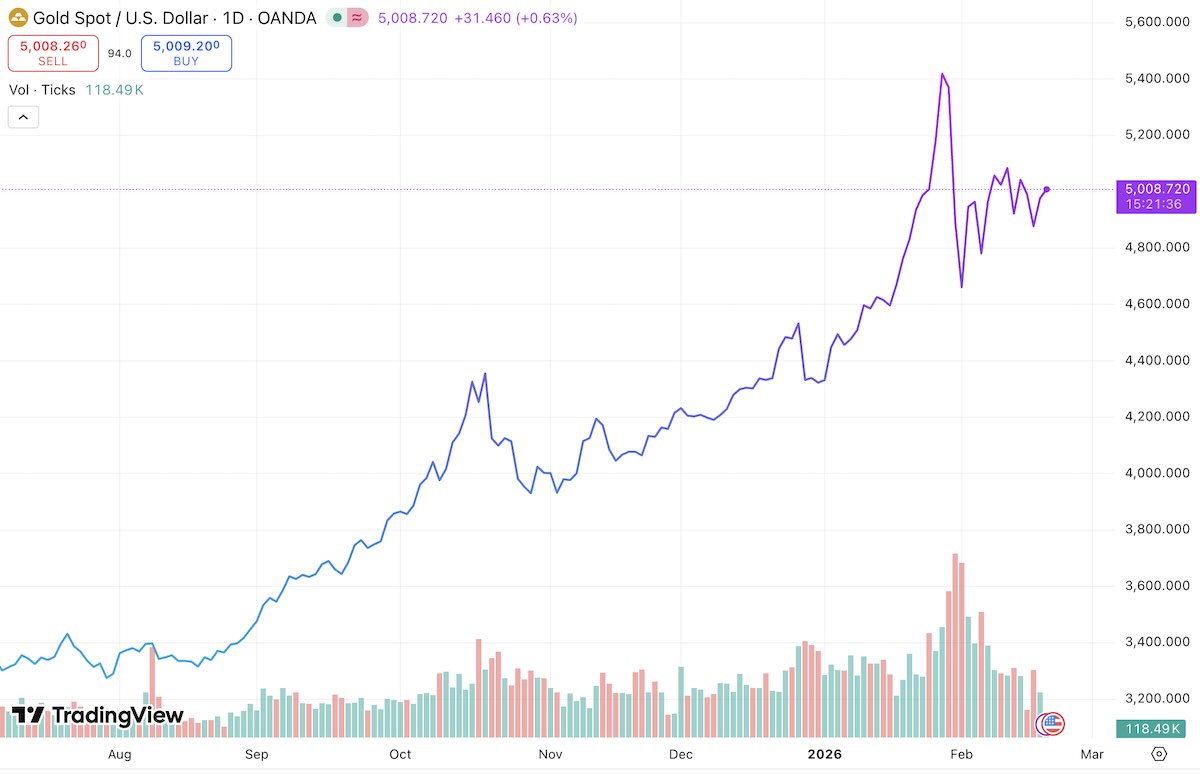

Gold’s powerful rally has come to a halt recently.

After surging to fresh record highs in late January, prices pulled back sharply as markets digested a sudden shift in the US policy and a rebound in the US dollar.

The selloff came after Donald Trump nominated Kevin Warsh as the next Federal Reserve chair, which let to sharp movements in interest rate expectations and the US dollar at a time when precious metals positioning was already stretched.

I saw discussions in the Beansprout community asking if the pullback is a good opportunity to add.

Previously, we have explored what is driving gold's rally and if the momentum can continue.

In this update, we discuss if the investment case is broken after the dip.

What drove the correction in gold prices?

The Warsh nomination shifted expectations on the Fed and the dollar

Kevin Warsh's nomination as Federal Reserve Chair signaled a potential shift toward tighter monetary policy.

Markets interpreted this as hawkish which could suggest higher interest rates for longer and a more conservative approach to Fed policy than previously expected.

Higher expected interest rates strengthen the US dollar (as investors seek higher-yielding dollar assets) and push Treasury yields upward. Both movements create headwinds for gold.

A stronger dollar makes gold more expensive for foreign buyers, reducing demand.

Rising yields increase the opportunity cost of holding gold, which generates no income, making interest-bearing assets relatively more attractive.

These forces combined to pressure gold prices sharply lower.

Ahead of the selloff, gold had become increasingly overextended.

Prices had climbed rapidly without meaningful pullbacks, technical indicators suggested overbought conditions, and positioning data revealed crowded long positions among speculators.

When markets accelerate quickly, even a modest catalyst can trigger forced selling as stop losses get hit and leveraged positions de-risk.

In that context, the pullback was not only about headlines. It was also about how far, and how fast, prices had moved.

Is the investment case for gold broken?

The short answer is no. The more useful framing is that gold can correct sharply in the short term while its medium term foundations remain intact.

#1 - Safe haven status and geopolitical risk

Geopolitical risk remains a persistent source of support for gold.

Renewed US–Iran tensions, alongside earlier flare-ups such as Venezuela, have reinforced safe-haven demand.

At the same time, US policy uncertainty has become a more direct driver, as headlines around Fed independence and the leadership transition have added to investor caution.

Trade policy is another unresolved overhang as the Supreme Court decides whether emergency powers can be used to impose tariffs.

Taken together, the backdrop continues to favour gold not because a single crisis is inevitable, but because the range of plausible outcomes has widened.

#2 — Central bank accumulation is not stopping

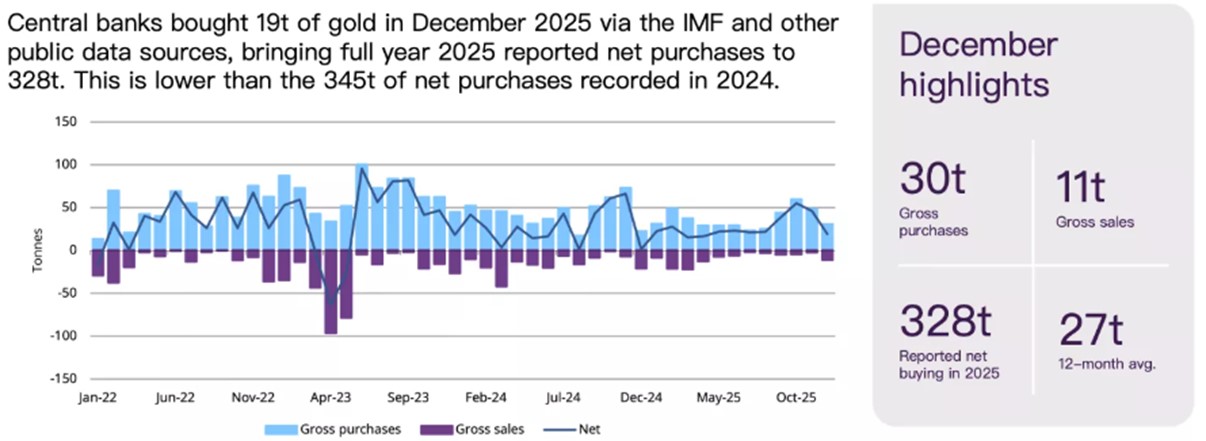

Central bank demand remains a key structural pillar for gold.

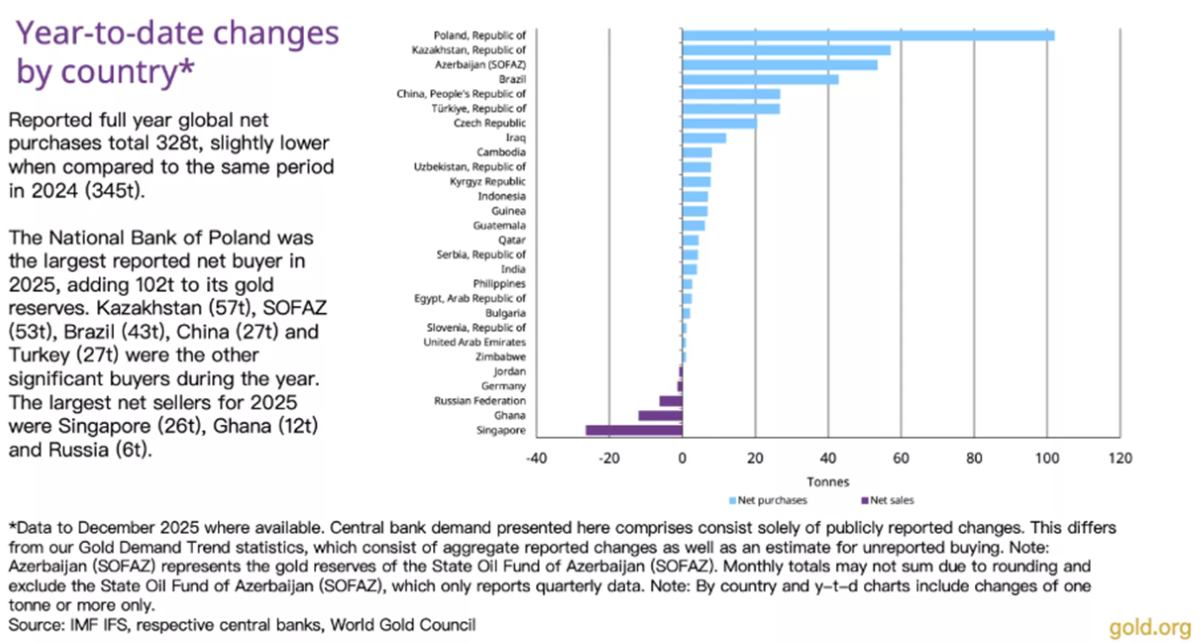

Based on IMF and other public data compiled by the World Gold Council, central banks bought a net 19 tonnes in December 2025, bringing reported full-year 2025 net purchases to 328 tonnes, slightly below 345 tonnes in 2024.

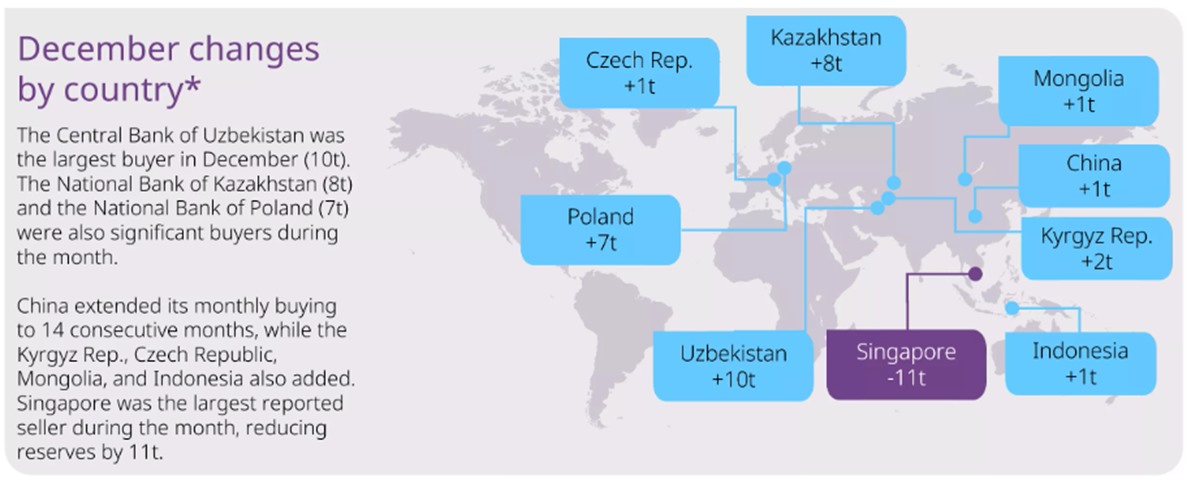

December buying was led by Uzbekistan (+10t), Kazakhstan (+8t) and Poland (+7t), while Singapore was the largest reported seller (-11t).

For 2025 as a whole, Poland (+102t) was the largest reported net buyer, followed by Kazakhstan (+57t) and SOFAZ (+53t). The broader message is unchanged: official-sector diversification into gold remains broadly intact.

#3 — Record investment demand is reinforcing the rally

Investment flows have been a major support for gold, although they can also amplify volatility in both directions.

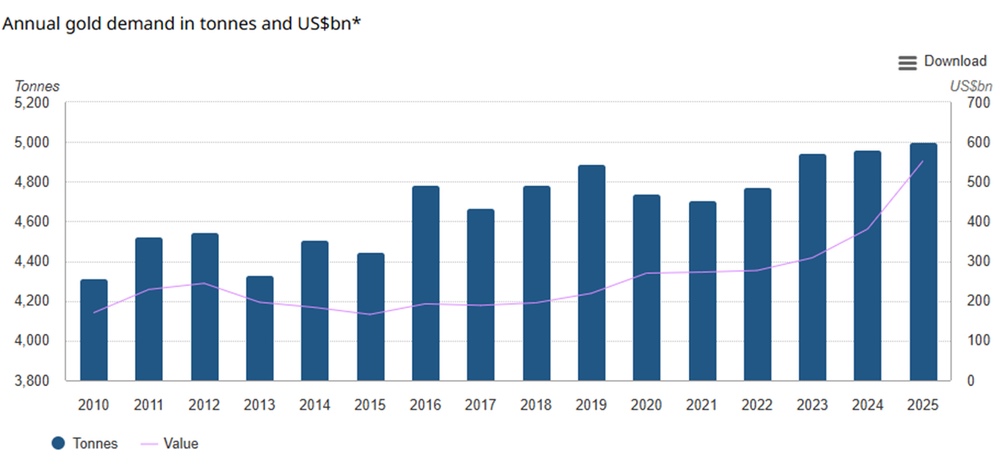

The World Gold Council noted that total gold demand in 2025, including OTC, exceeded 5,000 tonnes for the first time.

Combined with the record run in prices, which set 53 new all-time highs, this pushed the total value of demand to an unprecedented US$555 billion, up 45% year on year.

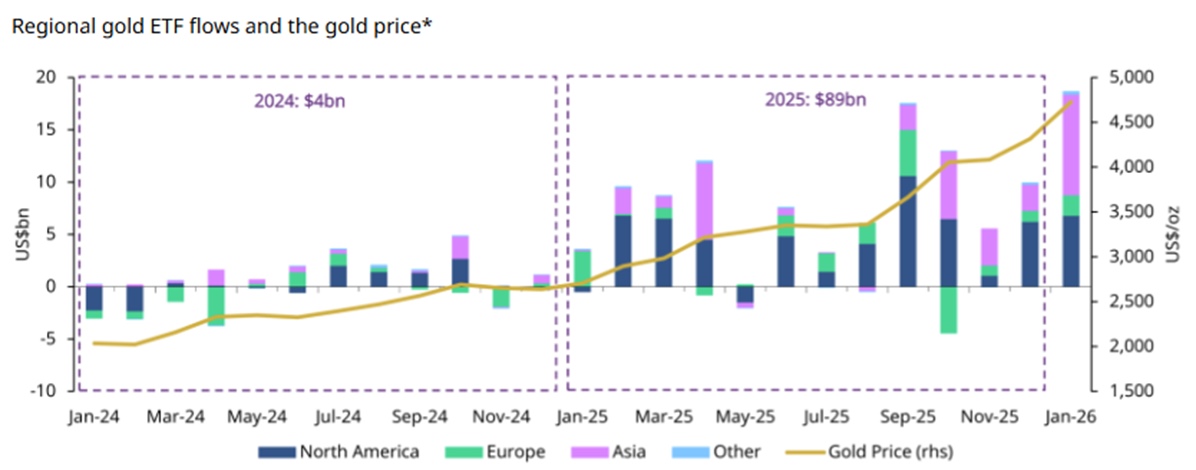

Importantly, the composition of demand has continued to tilt toward investment-led buying, and the latest January 2026 data reinforces this trend.

In 2025, global gold ETFs added 801 tonnes, one of the strongest years on record, while bar and coin buying rose to a 12-year high.

Central bank purchases remained historically elevated at 863 tonnes for the year, even if they slowed from their recent pace, and jewellery volumes softened under successive record prices even as jewellery demand value climbed to a record US$172 billion.

That investment momentum has carried into the new year. The World Gold Council reported that physically-backed gold ETFs attracted US$19 billion of inflows in January 2026, the strongest month on record.

Combined with a 14% rise in the gold price during the month, global gold ETF AUM rose to a record US$669 billion, while collective holdings increased by 120 tonnes to 4,145 tonnes, also an all-time high.

Flows were broad-based, led by North America and Asia, with Europe also recording notable inflows amid heightened geopolitical and trade tensions.

Even after the subsequent price pullback, investors continued to add exposure, suggesting the dip has so far been treated as an opportunity to increase allocations rather than a reason to exit.

Source: Bloomberg, Company Filings, ICE Benchmark Administration, World Gold Council

#4 — Monetary policy and dollar weakness and the debasement trade

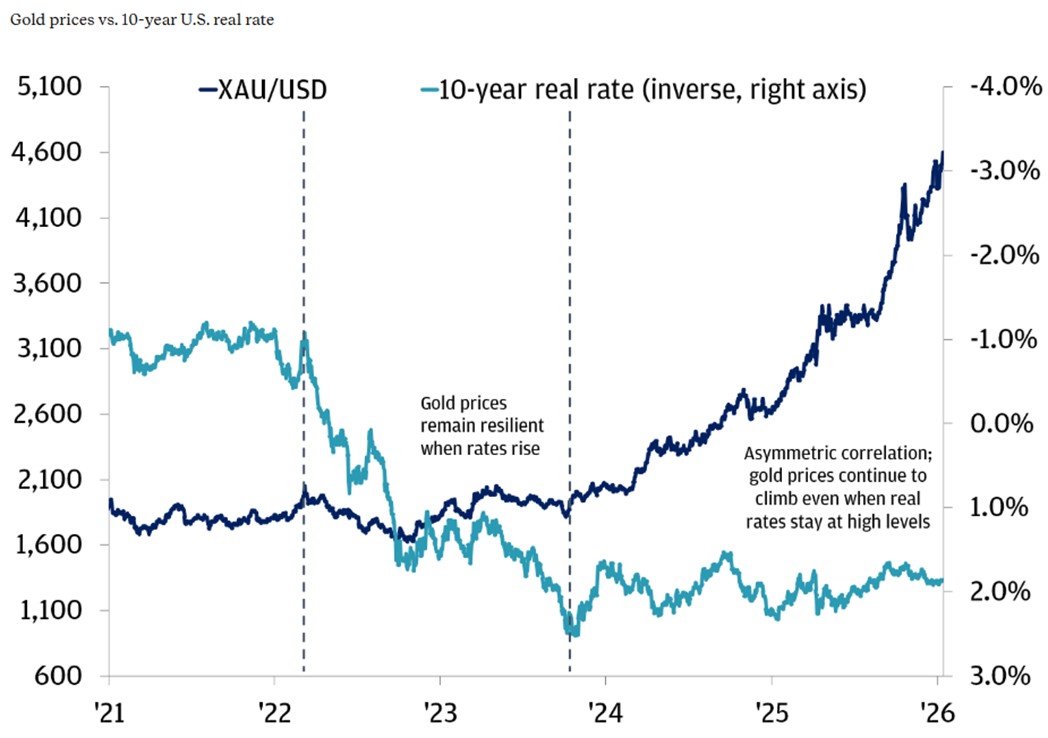

Gold prices are heavily influenced by two main factors: what investors can earn on safer investments after accounting for inflation, and the strength of the US dollar.

Recent weeks demonstrated just how quickly gold can move when these dynamics shift.

In late January, gold rallied as the dollar weakened and investors grew increasingly concerned about the currency's long-term health.

Many feared that government spending and monetary policy might erode the dollar's purchasing power over time, prompting them to buy gold as protection against this potential decline.

However, prices reversed sharply following Kevin Warsh's nomination as Federal Reserve Chair.

Markets suddenly expected a more disciplined approach to monetary policy, one that would likely mean higher interest rates and a stronger dollar.

This shift made holding gold, which pays no interest, less attractive compared to bonds and other income-generating assets. The dollar strengthened on these expectations, and gold tumbled.

What has stood out in 2026 is that the “debasement trade” has increasingly expressed itself through precious metals rather than through bonds or FX alone.

A recent Bank of America fund manager survey described “long gold” as one of the most crowded trades, highlighting how widely gold has been used as a hedge against fiscal concerns and policy uncertainty.

Those same themes have continued to drive allocation behaviour, with reports pointing to strong flows into gold and precious-metals ETFs in January amid geopolitical uncertainty, expectations of further dollar weakness, and growing bets on US rate cuts.

#5 — Portfolio construction is shifting, and gold is still under-allocated

A key tailwind for gold is that portfolio diversification has been less reliable since the inflation shock, pushing allocators to look beyond the traditional stock–bond mix.

In recent years equities and bonds have become more correlated at times.

In September 2025, Bank of America’s latest Global Fund Manager Survey of 165 allocators overseeing US$426bn, reported gold exposure was only 2.4%, and 39% of respondents said they had zero allocation to gold, while only 6% of respondents held 8% or more in gold.

The implication is straightforward: even a gradual move from “no allocation” to a small strategic weight across large portfolios can translate into meaningful incremental demand, especially in a regime where investors are less confident that bonds alone will diversify equity risk.

What would Beansprout do?

A pullback in gold prices can feel unsettling. However, it is often better viewed as a reminder to stay disciplined rather than a sign that gold has lost its relevance in a portfolio.

Gold’s appeal today is driven less by short term supply and demand factors, and more by its broader role.

Many investors see it as a hedge during periods of policy uncertainty, a beneficiary of continued central bank buying, and a way to diversify when stocks and bonds do not move as expected.

That said, the recent decline also shows that gold prices can be sensitive to quick shifts in the US dollar and interest rate expectations. When sentiment becomes too optimistic, price swings can be sharper.

For those considering exposure, it can be sensible to build positions gradually instead of chasing strong rallies. Phasing your investments over time helps you participate while managing near term volatility.

When adding gold, it is best thought of as a diversification tool rather than a speculative trade.

Gold does not produce income like dividends or coupons. Its value lies more in providing balance and protection, particularly during market stress or uncertainty. Because of this, gold often works better as a long term component within a diversified portfolio.

Allocation size is important too. For many investors, a modest exposure is sufficient. Common portfolio guidelines often suggest around 5% to 10%, depending on your risk tolerance and overall asset mix.

If you decide to invest, staggering your purchases over time can help reduce the pressure of trying to time the market perfectly.

By maintaining a steady, long term allocation, it can play a supporting role in helping your portfolio remain more resilient across different market conditions.

If you are interested in buying gold, learn how to buy gold in Singapore here. If you are keen to buy physical gold, find out how to buy physical gold from UOB with our step by step guide here.

To gain access to gold in a simple and low-cost way, find out the best gold ETF in Singapore here.

If you are looking for a simple, low-cost way and regulated exposure, the SPDR Gold Shares ETF is a practical local solution, especially since it is SRS-eligible and CPF-OA approved.

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in gold ETFs.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments