US stocks rebound, gold surges and T-bill yields fall: Weekly Market Recap

By Gerald Wong, CFA • 19 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

US stocks rebounded on rate cut optimism, gold climbed to record highs, and Singapore T-bill yields eased.

Over lunch with the team on Friday, our conversation turned to gold.

With prices climbing to new all-time highs, even some of our younger team members have started paying attention. A few joked about selling the gold jewellery they received when they were younger.

It’s not hard to see why. With the 1-year T-bill yield dipping to 1.35% and the 6-month T-bill yield expected to stay low in the upcoming auction on 23 Oct, investors have been turning their focus to gold. The precious metal has had a remarkable run over the past year, outperforming many other asset classes.

In this week’s feature, we explore what’s driving the rally and whether it can continue. If you’ve been thinking about buying gold, we also share how you can buy gold in Singapore, whether through physical gold from UOB or via a gold ETF.

As we’ve shared in our recent market updates, when assets are hitting record highs, the key is to stay focused on your long-term plan and remain diversified.

This mindset is especially important for retirement planning. Knowing where you stand and how to bridge any gaps matters. We dive into how the CPF Retirement Planner can help you find out if you are on track to achieving your retirement payout goal.

For me, it's a reminder that while gold shines today, it's steady planning that truly shapes our golden years.

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

🏛 Cautious Optimism Returns as Rate-Cut Bets and Strong Earnings Lift Markets

What happened?

US President Donald Trump said the high tariffs on Chinese goods were “not sustainable,” easing fears of further trade tensions between the two countries.

Meanwhile, Fed Chair Jerome Powell reiterated that “downside risks to employment”, leading to heightened investor expectations for more rate cuts later this year.

What does this mean?

Optimism in markets was further lifted as earnings season kicked off on a strong note. JPMorgan, Citigroup, and Wells Fargo all beat expectations, with 86% of early reporters surpassing consensus estimates, according to FactSet.

Fresh deal activity in the AI space also supported risk appetite. OpenAI announced a partnership with Broadcom to produce its first in-house AI processors, the latest move by the ChatGPT maker to secure more computing power for growing demand.

However, sentiment was slightly dampened after several US regional banks revealed issues with certain loans involving allegations of fraud.

Following the recent bankruptcies of a subprime auto lender and an auto parts company, these developments have raised fresh concerns among investors about the overall health of the US regional banking sector.

Why should I care?

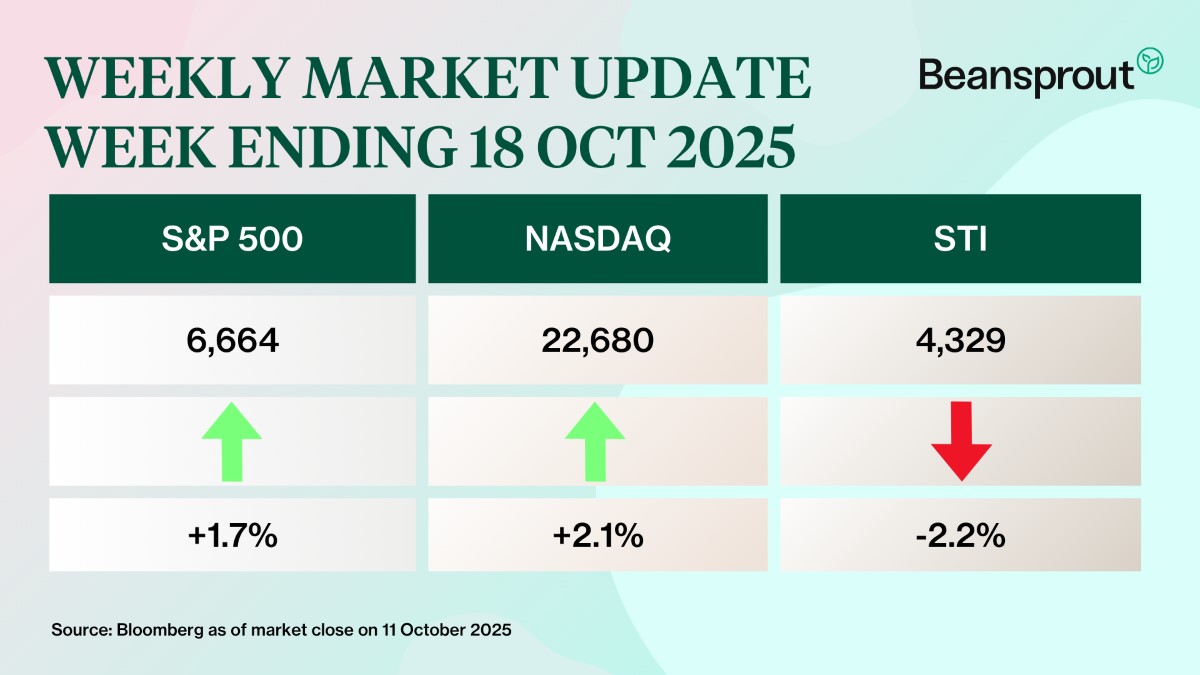

US stocks ended a volatile week higher, rebounding from last Friday’s sharp sell-off that marked the S&P 500’s worst session since April.

Meanwhile, Treasury yields fell sharply, with the 10-year yield dipping below 4% for the first time in 12 months.

In Singapore, the Straits Times Index (STI) pulled back amid profit-taking. Losses were led by Seatrium after news of a contract cancellation, while gains came from REITs benefiting from lower bond yields — with Frasers Centrepoint Trust (FCT) and CapitaLand Integrated Commercial Trust (CICT) among the top performers.

🚗 Moving This Week

- Seatrium announced that its customer Maersk Offshore Wind sent a notice of termination for a US$475 million (S$616.2 million) contract to build a vessel that is already 98.9 per cent completed. Read more here.

- UOL and CapitaLand Development announced that 658 (99%) of the 666 units at Skye at Holland have been sold on the first day of launch. The average price of units sold was $2,953 psf. Read more here.

- Singapore Airlines (SIA) group passenger traffic was 3.7 per cent higher year on year in September, outpacing the 2.5 per cent rise in passenger capacity. As a result, the group’s passenger load factor (PLF) increased by 1 percentage point on year to 87.1 per cent. Read more here.

- With the launch of the Indonesia–Singapore Depository Receipt (DR) Linkage, investors in Singapore will be able to trade Indonesian-listed companies via SDR on SGX. This initiative will provide exposure to leading names such as Bank Central Asia, Telkom Indonesia, and Indofood CBP. Learn more about Telkom Indonesia here.

- Centurion Corp has acquired a land site in central London for £41 million (S$71 million) to develop a purpose-built student accommodation (PBSA). The acquisition marks Centurion’s entry into London, the sixth city in its UK portfolio, and follows its successful listing of Centurion Accommodation REIT in September. Learn more about Centurion Accommodation REIT here.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

Are my CPF savings enough for retirement? Here’s how I found out

Our writer, age 52, shares his experience using CPF Board’s Retirement Payout Planner – from making rough guesses about his future retirement income to discovering a nearly $2,000 shortfall by age 65, and the practical steps he could take to bridge it.

🤓 What we're looking out for next week

- Monday, 20 October 2025: Singapore public holiday

- Wednesday, 22 October 2025: Tesla Earnings, Mapletree Pan Asia Commercial Trust Earnings

- Thursday, 23 October 2025: 6-month T-bill Auction, Frasers Centrepoint Trust Earnings

- Friday, 24 October 2025: iFast Earnings, US CPI Data

- Saturday, 25 October 2025: CPF Ready for Life Festival

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments