Singapore blue chips, REITs and next 50 opportunities: Weekly Market Recap

By Gerald Wong, CFA • 28 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Exploring dividend plays and growth potential in Singapore’s market

In this week’s Money Diaries, our guest Vivienne shared how she builds her portfolio — starting with a diversified base of dividend stocks for stability, while allocating to other asset classes like global ETFs to grow her wealth steadily.

One of the challenges she highlighted was the lack of consistency and knowledge. Indeed, many of us often begin with what feels most familiar, which usually means investing in Singapore.

That’s not a bad place to start. The Singapore market has seen renewed energy over the past year, with the Straits Times Index (STI) hitting all-time highs above 4,300. We take a closer look at three blue-chip stocks still offering dividend yields of more than 5%.

Interest has also been growing in mid-cap stocks beyond the STI, with new measures to revitalise the Singapore market. Just this week, the Singapore “Next 50” indices were launched to shine a spotlight on opportunities outside the STI.

Singapore REITs remain another popular way for investors to build dividend portfolios. With interest rates coming down, we highlight three REITs that continue to offer attractive yields above 5%.

It’s also been a busy time on the SGX — from the listing of Centurion Accommodation REIT, to the dual-listing of cybersecurity firm AvePoint, and the upcoming listing of the LionGlobal Short Duration Bond Fund (Active ETF SGD Class).

If you’ve been held back by not knowing where to start, sometimes the best first step is to focus on what’s familiar, and build up your confidence from there.

Happy growing!

Gerald, Founder of Beansprout

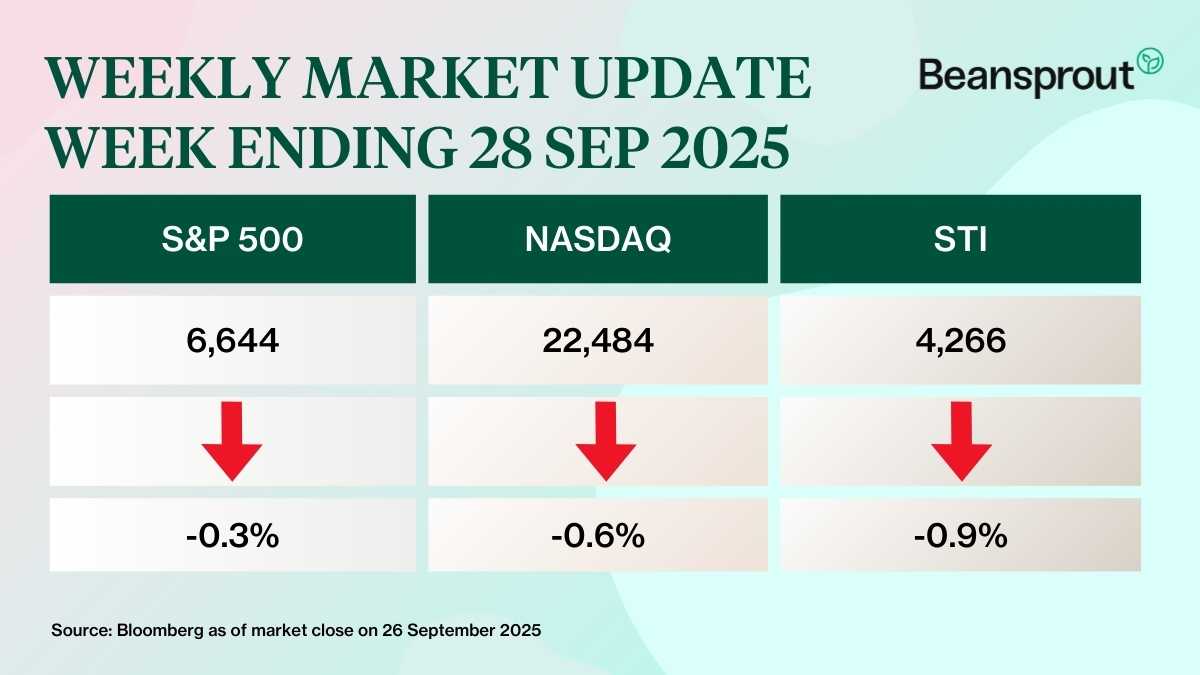

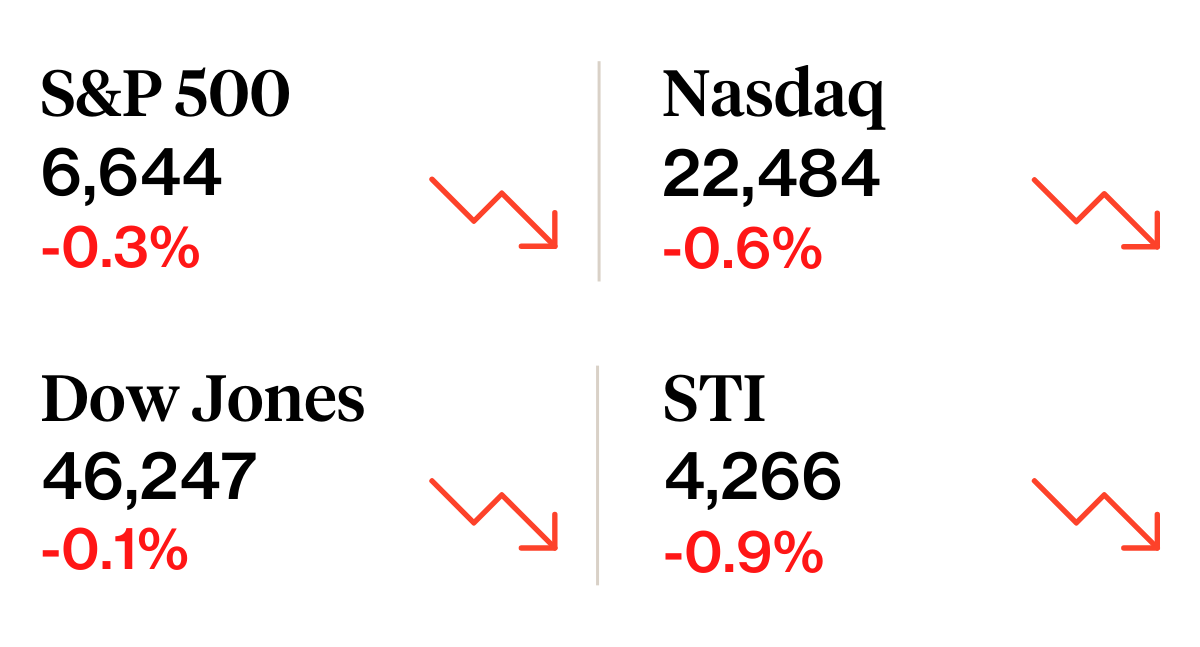

⏰ This Week In Markets

🏛 Rate cut hopes dampened

What happened?

Several US Federal Reserve officials have signaled that they may take a more cautious approach to future rate cuts.

Fed Chairman Jerome Powell described the economy as being in a “challenging situation,” with near-term risks of higher inflation on one hand and a weaker labour market on the other.

He also noted that “equity prices are fairly highly valued,” highlighting concerns about stretched valuations.

What does this mean?

In short, while the Fed has started cutting rates, officials are signalling that they may move more cautiously from here.

Even so, markets are still expecting the Fed to cut rates two more times in 2025.

Why should I care?

The S&P 500 eased slightly after hitting record highs, while short-term bond yields ticked up.

Singapore’s benchmark Straits Times Index (STI) slipped 0.9%, led by profit-taking in Hongkong Land and Singtel.

🚗 Moving This Week

- SGX has launched the iEdge Singapore Next 50 Indices that track the next tier of large and liquid mainboard companies beyond the 30 constituents of the Straits Times Index (STI). Learn more about the new indices here.

- Keppel DC REIT and sponsor Keppel are buying the Tokyo Data Centre 3 for 82.1 billion yen (S$707 million). This freehold, newly-built hyperscale data centre is located in Inzai City, Greater Tokyo and will be the REIT's second data centre asset in Japan. On a pro forma basis, if the acquisition was completed on Jan 1 2024, distribution per unit for FY 2024 would increase by 2.8% from 9.451 cents to 9.712 cents. To fund the acquisition, Keppel DC REIT has launched a pro rata non-renounceable preferential offering where entitled unitholders of Keppel DC REIT will be offered 80 new units at $2.24 each for every 1,000 existing units held. Read more here.

- Wilmar International has been found guilty of corruption after Indonesia’s Supreme Court overturned the company’s previous acquittal in a graft case involving cooking oil export permits during the 2021-2022 shortage crisis. Specifics of the Supreme Court’s grounds of judgment and any financial awards have not been released. The Indonesian Attorney-General’s Office (AGO) has sought 11.8 trillion rupiah (S$907 million) in compensation and a billion rupiah fine from Wilmar. Read more here.

- SingPost has appointed Mark Chong as its group chief executive officer, effective Nov 1. Chong, 62, is currently group chief corporate officer at SingTel, a role to which he was appointed in January 2025. He joined Singtel in 1997 and has held various executive positions including executive vice-president of networks in Singapore and vice-president of the telco’s global accounts. Read more here.

- Singtel’s Optus was served a A$100 million (S$85.1 million) fine by Australia’s country’s federal court for selling phones and contracts to disadvantaged consumers. Read more here.

- Centurion REIT rose 9.1% on Thursday (Sep 25) at its debut on the Singapore Exchange (SGX). This was the second-biggest mainboard listing on the SGX this year, following NTT DC REIT’s listing in July. Read more here.

- Seatrium has divested its asset AmFELS Yard in Brownsville, Texas, for $65 million. Seatrium says that the accretive divestment will allow it to enhance capital and operational efficiencies, while unlocking value from one of its surplus facilities. Read more here.

- Alibaba’s shares surged to their highest in nearly four years after revealing plans to ramp up AI spending past an original US$50 billion-plus target.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

3 Singapore blue chip stocks with dividend yields of above 5%

Here’s 3 stocks listed in Singapore with a high level of dividends to help boost your passive income with falling interest rates.

🤓 What we're looking out for next week

- Mon, 29 Sep 2025: LionGlobal Short Duration Bond Fund (Active ETF SGD Class) listing

- Wed, 1 Oct 2025: Singapore Savings Bond (SSB) application open

- Friday, 3 Oct 2025: US nonfarm payrolls data

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments